Wise Card Review – Is This Your Next Travel Card?

Disclosure: This post (probably) contains affiliate links. If you click on one, I may make a small commission. Of course, this will come at no extra cost to you and helps keep this site running.

There are some challenges that are pretty much universal when it comes to international travel. One of the most common is finding an easy and inexpensive way to pay for things while overseas. So when it looked like the Wise card could be a good solution, I decided to give it a go on my most recent trips. This Wise card review will take you through my experience traveling with the card.

My reasoning for doing a review is that I know how useful a good travel card can be be. Options for these kinds of things generally depend on which country you’re from, with some countries like the US having more choice than others. Coming from Australia, our options are far fewer, and I’m sure we’re not alone. So hopefully, this review of the Wise card that is widely available across the world can help you see if it’s a useful option for you or not.

Disclaimer: This is not financial advice and I am not a financial advisor. I do not know your financial situation or whether this product will be specifically right for you. This is simply a review of my experience using the Wise Card as a consumer. Please check the Wise website for latest rates/fees and do your own due diligence.

Table of Contents

What is the Wise Card?

Wise, formerly TransferWise, is an online foreign exchange service based in London. I’ve been using Wise for a while now to send/receive money from overseas for work. It’s very useful being able to provide banking details in other countries to receive payments.

They use the mid-market exchange rate for conversions and their transfer fees are considerably lower than alternatives such as Paypal in my experience. There are even tables they provide to show you how they compare to the competition.

The Wise card is simply a Visa debit card associated with your Wise account. It lets you pay for things using the money stored in your Wise account. Like with travel cards, you can store money in different currencies, but it will also auto-convert at the current rate if you don’t have money stored in the necessary currency.

If you’re curious, you can read here about how Wise is regulated according to your country’s laws .

Who is the Wise Card For?

Generally speaking, I believe anyone travelling internationally can get value out of using a Wise card. However, it’s much more useful if you’re already using Wise to receive different currencies from overseas. That’s because it saves you the step of loading funds onto your card’s account and the small associated fee for doing so.

As such, the Wise card is well-suited to digital nomads and freelancers with international clients. If you get paid in USD, Euros, GBP etc., you can get them sent to your Wise bank details and access them easily with your card. At the moment, they support 40 currencies, with information on which come with bank details here .

Wise Cash Withdrawals

Beyond just charging expenses to the card using your funds, you can also use the Wise card to withdraw cash at ATMs. This has turned out to be my favourite use for the Wise card , as cash is still very important when travelling in some countries like Japan and South Korea.

What’s good about the Wise card is the way its fees are done . Each calendar month, you’re given two withdrawals up to a certain threshold without any rates or fees. This is excluding any fees the ATM merchant may charge of course.

But even once you reach three withdrawals or go over the free limit, the fees and rates are minimal (in my opinion). In Australia, for example, the free threshold is AU$350, after which it’s a 1.75% fee, and after the first two withdrawals a $1.50 fee.

The threshold and fee for your withdrawals do depend on where you’re from, but they were favourable compared to my previous go-to travel card. And if you’re able to be strategic with your timing, like I was in Japan and South Korea, you can avoid them.

Benefits of a Wise Card

While using the Wise card these last few trips, I’ve encountered a few scenarios where I’ve been glad to have it with me.

- It’s always helpful having more than one card when you travel, in case you run into a problem on one. Having a Visa card is also useful if your other card is a Mastercard in case of card/vendor problems or restrictions.

- Rather than being strictly a debit card or a currency card, the Wise card feels like a hybrid of both. It lets you take advantage of favourable exchange rates, but doesn’t limit you if you exhaust funds in one currency either.

- I ran into problems with my other credit card in Japan when trying to buy train tickets and at other times in South Korea. Thankfully, my Wise card worked fine and I think it was because it had the local currency stored on it.

- Like other bank cards, you can add your Wise card to your smart phone to pay with Google Pay or Apple Pay.

Flaws of the Wise Card

My one and only small gripe with the Wise card has been when I’ve depleted my funds in the local currency. When that happens, it auto-converts the remaining balance from one of your other stored currencies. Unfortunately, it’s taken from my Euros account in that situation and I wanted to keep my Euros for later to withdraw as cash. I can’t seem to find an option to nominate a default secondary currency to withdraw funds from.

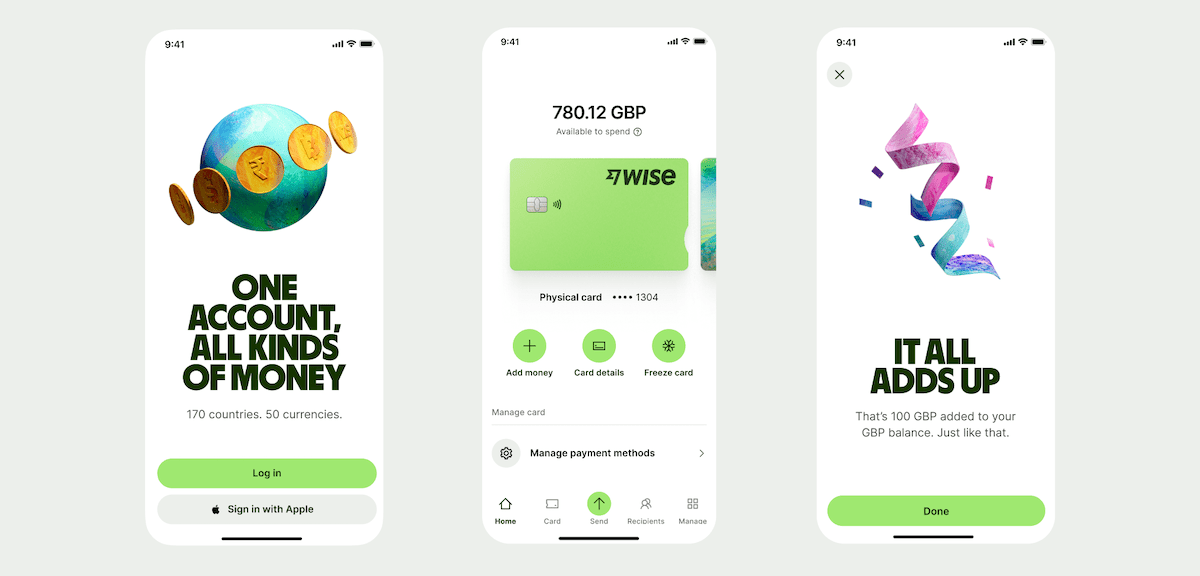

Managing the Card Through the App

Having an app for banking these days isn’t anything new or special. But I will say that the Wise app is especially easy to use and does help you manage your card. Go into the app and you can see for instance how far off the withdrawal threshold you are. You can also easily see your funds, add money, freeze the card, or even change which payment methods you want to allow for it.

With the app, it also makes it very easy to see the details of transactions and cash withdrawals. They clearly break down the fees associated with a withdrawal, so that there’s no confusion where you stand.

Getting a Wise Card

The process for getting a Wise Card couldn’t be simpler. Either log in or create a new account, and then pay a small one-time fee (currently US$9) for the card to be sent to you. They’ll also provide you with a digital card immediately so that you can get started using it online.

Have you tried using the Wise card as a travel card? What more information would you like from this Wise card review? Please share your thoughts in the comments below.

David is the author behind the Travelsewhere travel blog and is always on the search for the quieter, less-visited corners of the world.

You may also like

Loom waterproof shoes – travel footwear review, joojoobs leather wallets review – personalised travel wallets, nere suitcase review – wonda 65cm checked-in luggage, staying connected with the ivideo pocket wifi hotspot, g adventures review – my experience on their laos tour, leave a reply cancel reply.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Wise Travel Card Review: The Multi-Currency Debit Card For Travellers

By: Author Angela Price

Posted on Last updated: March 26, 2024

The Wise Travel Card is a Visa Debit card designed for international travellers and individuals who frequently make multi currency transactions. I was first introduced to the Wise card by another travel blogger who had been using it for a few years and could vouch for its credibility.

At the time, I was looking for a money transfer account that would allow different currencies to be paid into it without incurring the hefty conversion fees my high street bank was charging me. I also wanted an easy-to-use, app-based money card that I could use during my travels to check, top-up and convert balances whenever needed.

The Wise Travel Money Card sounded perfect because it would allow me to have one debit card holding credit balances in USD, EUR, and GBP, all in separate currency wallets. I could then use my Wise Euro credit balance to buy items charged in Euros and likewise for USD. My transactions would be like-for-like, with no hefty currency conversion fees appearing on a statement.

I could also exchange one currency wallet balance for another at any time via the Wise App. The app is easy to use, and with a press of a button, I can auto-convert my USD or EUR balances for GBP, which appear in my online GBP currency wallet immediately. Simple!

Wise also allows me to send, add, or request money at any time and even set up direct debits through the app.

In the time I have been using my Wise Travel Card, I have been very pleased with its functionality and am happy to let other travellers (and non-travellers) know about it. For transparency, please see the Wise Card Fees and Pricing.

This travel guide may contain affiliate links – please read my disclaimer and privacy policy for more information.

Table of Contents

What Is The Benefit Of Using Wise?

- The Wise Debit Visa is linked to a Wise multi-currency account, allowing you to manage money in multiple currencies.

- One of the key features of Wise is its use of the real exchange rate, providing users with rates close to the mid-market rate without additional markups. This can result in cost savings compared to traditional banks.

- The card offers interest on your multi-currency balances, which is great if you don’t intend to withdraw your funds immediately.

- Wise typically offers transparent and competitive fees for international money transactions and currency conversions. Users may benefit from lower fees compared to traditional banks.

- The card supports contactless payments, allowing for quick and convenient transactions at merchants that accept contactless payments.

- The Wise Debit Card is a Visa, which means it’s an international debit card widely accepted globally. Users can use the card for online, in-person, and ATM withdrawals worldwide. It’s all you need in one card.

- Wise provides a mobile app that allows users to manage their multi-currency accounts, monitor transactions, and receive notifications. The Wise app also features such as spending analytics and budgeting tools.

- The card can be used to withdraw cash from ATMs around the world. Wise has partnerships with specific ATMs to offer fee-free or reduced-fee withdrawals up to a specific limit.

- Visa provides standard security features, and Wise offers additional security measures through its app, such as the ability to lock/unlock the card and receive instant transaction notifications.

- Users can activate and manage their Wise Debit Visa through the Wise mobile app.

Wise Card For International Travel

I recently used my Wise travel card while on holiday in Lanzarote, Spain . I paid for entrance fees and food and drink in Euros, which was debited from the Euro currency wallet in my Wise account. The debit card was so easy to use, and I knew I wasn’t going to be charged any additional fees as the transaction was made in EUR rather than being converted from GBP.

I also just purchased a flight online and paid in USD. This came from my Wise USD currency wallet, which was straightforward with no added foreign transaction fees.

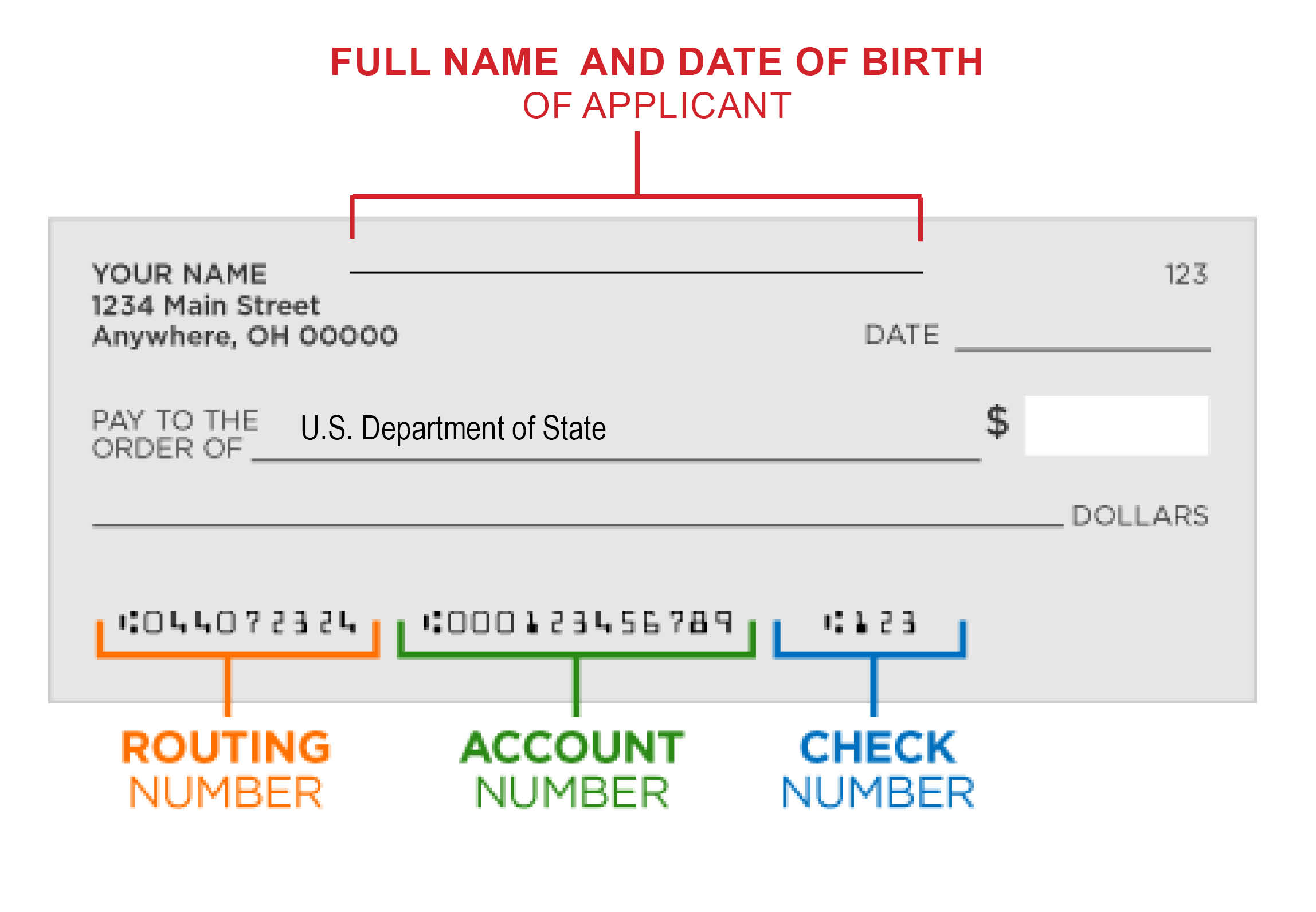

How To Get Your Wise Card

I hope this post has helped outline the benefits of getting a Wise Travel Card. The details I have provided are a brief overview, so please visit the official Wise website for more in-depth details before signing up.

You can access a digital card in your app as soon as Wise accepts your application, but if you prefer a physical card like me, you can apply for one below.

The physical Wise card costs a one-off fee of £7. And yes, the card really is the same colour as Kermit the Frog from The Muppet Show!

APPLY FOR YOUR WISE TRAVEL DEBIT CARD

I am not a financial expert, nor did Wise pay me to write this article; however, I am now part of their affiliate scheme, and I will receive a small commission if you sign up through my link. This is at no extra cost to you and helps me keep this travel blog running.

The opinions in this review are based entirely on my own experiences using my Wise Debit Card. Before you sign up for a Wise Card, please be sure to do your own due diligence.

I would like to receive occasional updates and new travel posts.

Notify me of follow-up comments by email.

- Search Search Search …

- Search Search …

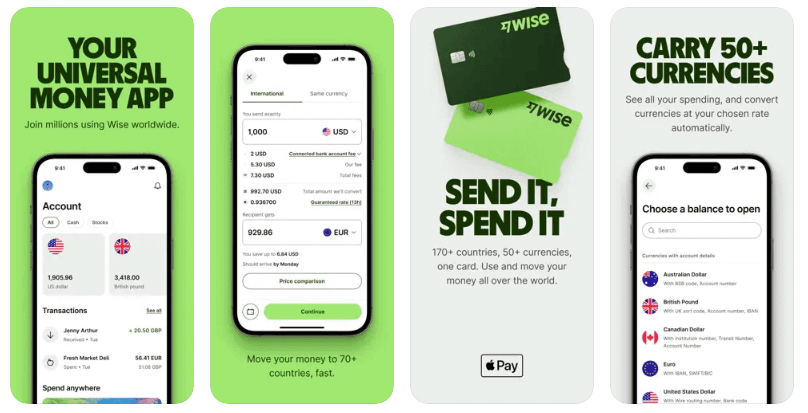

How to use Wise for CHEAPER Travel Money & Spending

One of the key considerations for taking a trip is money. Especially if you’re traveling to a location where the currency is different from your home country. Getting hold of cash can be a costly exercise – from fluctuations in exchange rates to poor exchange rates and the dreaded currency commission rates. One of the best ways to pay the least to obtain currency while traveling is to use the Wise debit card for travel. Wise, is a great way to move money between currencies – and using the Wise debit card is one of the cheapest ways to use money while traveling.

THIS POST MAY CONTAIN COMPENSATED AND AFFILIATE LINKS MORE INFORMATION IN OUR DISCLAIMER

#1 TIP FOR CASH & CARDS

Get a Fee Free Card to Use

Get a WISE Card to take to on your travels. Two free ATM withdrawals per month, plus free to use to pay by card with zero foreign transaction fees.

Wise is now Wise

Wise changed its name to Wise in February 2021. However, name changes take a long time, especially in the web world, so the name change from Wise to Wise is a long-term process and the names are used interchangeably – and not just by me!

Using Wise for Lowest Travel Money Costs

There are a couple of elements to Wise and Wise that make it one of the best ways to obtain and spend money abroad.

The Wise Multi-Currency Account.

First, you can create what’s called a Wise“ borderless or multi-currency account ”. All that really means is that you can open bank accounts in multiple countries via Wise and hold different currencies in those accounts. So if I’m traveling to the USA for vacation it would make sense to have some money that I can use in US dollars. The Wise Multi-Currency Account lets me open an account, not just in my native British Pounds, but also in US dollars. (And Euros, and Australian dollars – and a whole lot of other currencies). But, you don’t HAVE to hold money in those currencies until you actually want it there. (Keep it where you’re earning interest if you’re lucky enough to be doing that!).

And the borderless accounts from Wise are Free. There are no account charges with Wise.

Do it now. See how easy it is. Open your Wise multi-currency account now!

These different currency accounts mean that you can move money from your home currency account to the currency in which you’re going to be spending. And the reason you want to use Wise to do this is that it offers some of the best currency exchange rates – WAY better than your bank, or the bureau exchange.

The Wise Currency Exchange Charging Rates

Wise uses the mid-market rate (like all the banks do when they move money between each other) when it is moving your money between currencies. It is completely transparent about this. The way that it makes money is that it charges a small percentage on the commission- and this is ALWAYS displayed and VERY CLEARLY, so you can see exactly how much your currency exchange is costing. Check out Wise currency rates here.

When you move money, say between Euros and US Dollars Wise clearly shows how much it costs, and what their commission is (it’s never hidden like some other providers) and it explains how much you have saved based on average rates for high street banks. You can also run through the process and see what it’s going to cost without committing. Check out the Wise exchange rate here now

The Wise Travel Card

There is a small charge for the Wise debit card – the cost of a Wise debit card depends on where you sign up (for instance in Portugal it’s 8 euros) – check the cost of a Wise debit card here. There’s no minimum balance you have to pay and there are no ongoing charges to pay for the card. The huge benefit of the Wise debit card is that you get TWO FREE ATM withdrawals up to the equivalent of GBP200 a month. After that, there’s a small fee per transaction and a 1.75 percent fee for withdrawals made in a 30-day period.

As of December 2021, Wise debit cards are also available to Canadian residents > Get yours here

There are zero foreign transaction fees with the Wise debit card. Convinced? Get your Wise Debit card here.

You can use the Wise debit card just like any other debit card, in more than 200 countries. Use it to pay for food, in bars, restaurants, shops – there’s no charge – just use it exactly the same as you would any other card, except you’ll be paying in the currency of where you’re traveling, with the money that you’re holding in your multi-currency account, and so getting some of the best exchanges rates around.

So what happens if you don’t have any money left in your Wise currency account? Don’t worry, your card will still work. When you set up your Wise multi-currency account you link it to a bank account in your home country. So if you aren’t holding any money in a particular currency but are spending that currency Wise will automatically do the conversion at the standard exchange rate and charge their regular fees.

You can spend in ANY currency on your Wise debit card and it will be converted using the lowest possible fee.

What are the Wise Fees?

I’m not going to type out what all those fees are, as they make it very clear on their website – you can check them here

Our Guides to Lower ATM Fees When Traveling

If you’re traveling, then our guides to ATMs and ATM fees are here

- Guide to lowest Guatemala ATM fees

- The Ultimate Guide to the lowest Colombia ATM fees

- How to reduce Laos ATM fees

- Understanding Japan ATM fees

- The cheapest Chile ATM fees

Why Use Wise? Reasons for Using Wise

We use Wise for the following reasons

- Because they provide cheap currency exchange rates

- Because it Wise provides us with the ability to hold local accounts in US dollars, GB Pounds, Euros, Australian dollars, Japanese.

- We can receive money for free in GB pounds, US dollars, Australian dollars and Euros – and other currencies – check which currencies you can use Wise with here .

- Because it is all online and you don’t need to go into a branch or find someone to deal with if there is a problem (we haven’t had a problem, but doing it online is seriously important to us). – We ALWAYS login to our VPN before connecting to ANY financial services provider – as we tend to use publicly available wifi networks. Our guide to using VPNs for travel is here.

- They’re transparent about their pricing.

Get the best VPN that we’ve found that works in ANY country we’ve been to including Turkmenistan, China, Myanmar &Cuba. This link gives you a coupon for THREE MONTHS for free as a reader of ASocialNomad

You can’t pop into a branch of Wise, they have a different model to other banks, so their overheads are lower. And those savings are passed onto you and me. Wise is fully regulated – and yes your money is safe – there’s more on regulation and your money at the end of the article.

What is Wise?

Wise is a financial services company with more than 6 million active customers who move more than US$4billion dollars EVERY MONTH, saving on average US$4 million a DAY in bank fees. Wise is an Authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the UK. They are required by law to keep money safe by storing it in low-risk financial institutions. In Europe, they do this with Barclays. In the USA they do this with Wells Fargo.

These accounts are reserved for customer money, this means your money is kept in a separate account from the money they use to run the business.

Wise has more than 1,300 employees in 11 offices and 4 continents. This is a serious operation. Wise is also now a public company, listed on the London Stock Exchange.

How Much Can You Save with Wise?

Wise operates a really simple pricing structure . You get charged what it costs them to send your money plus a small fee. You will always know what that fee is before you send any money. You’ll also always know how long your money is likely to take to transfer between currencies. You can save up to 15 x what your local bank would charge for currency exchanges.

Wise collects data from other financial services providers that are publicly available – to show you how much you can save. They’ll show you this on each transaction you want to make, but you can also take a look for example here where they show how much transfers cost and also how long they take to go through. Some providers take as many as FOUR business days to transfer money, while Wise takes hours, which means you get the benefit of your own money for longer with Wise.

How to Use Wise for Travel

It’s really easy to use Wise for traveling. If you want to use the benefit of a Trnasferwise debit card then you’ll need to set up a Wise account and get hold of the Wise debit card before you leave home. If you don’t want the card, then you can set up a Wise multi-currency account from anywhere. Here’s how to set up Wise for travel .

Set up a Wise Account

The Wise multi-currency account is free to set up and free to maintain. There are no ongoing account costs for Wise accounts. All you need to do to set up a Wise account is to complete your profile , upload ID documents to verify your account for security and then you’re good to start!

Get local bank details with your Wise Account

British Pounds, Euros, Polish Zloty, Australian Dollars, US Dollars, and New Zealand Dollars all come with local bank details. That’s right, you get your own bank account details – IBANs, account numbers – the whole nine yards, just like your regular account.

Download the Wise App

Move money from an app, from your laptop, just as and when you need it. Confirm the rates.

Apply for a Wise card

Simply apply for your Wise debit card here , which gives you

- No foreign transactions fees

- No annual fees

- Low currency conversion rates

- Free ATM withdrawals worldwide – up to the equivalent of GBP200 every 30 days

- Lowest possible fees with auto-convert for any currency

- Manage with the Wise App – get instant notifications, freeze your card, unfreeze it any anytime

How to Use a Wise Card when travelling

Using Wise when traveling is a fabulous to save money.

You can hold balances in your Wise account in different currencies. (like US dollars, British Pounds, Euros, Australian dollars, Japanese Yen.. and so on). But equally, you don’t have to have money in those currencies to spend in those currencies. If you spend in say Japanese Yen but don’t have Yen in your currency account, then Wise will auto-convert to give you the lowest possible rates.

Once you’ve got a Wise account you can apply for a debit card. I don’t know of anyone who’s been turned down. This is a debit card, not a credit card. It is a Mastercard.

Your Wise card lets you take money out of an ATM for FREE – if you hold that currency in your Wise account. It lets you take out up to 200 GBP/250 USD/350 AUD/350 NZD/350 SGD (or your currency’s equivalent) in total per 30 days. After that, a 1.75% withdrawal fee will be charged. After two ATM transactions per 30 days, there’s also a 50p fee. These fees are charged in the currency of your account.

When using your Wise debit card always select to get charged by the ATM in the local currency – NOT your home rate – this means that Wise and not the bank whose ATM you are using will set the exchange rate. ALL ATMs will try and convince you to take their conversion rate – it’s called Dynamic Currency Conversion. You should NOT take their offer. Wise will ALWAYS offer you a better rate. Always.

Using Wise for Currency Transfer Payments

If you need to pay bills in another currency to your home account, then using your Wise account for this is really simple. You can do it ALL online. There’s no waiting period. No hassles and you’ll know exactly how much it is going to cost. And for me, it’s ALWAYS been cheaper than alternatives. Always. Read independent comparisons here.

Simply add your recipient to your recipient’s list – and then transfer the money. You don’t even have to be holding the foreign currency in your Wise account, you can make the exchange on the fly from your connected bank account, the fees are exactly the same as if you move money from say Euros to Dollars, and then pay them as if you just do it all as one transaction.

I love how transparent Wise is about showing me what the cost of the money is, and what their commission charge is for providing the service.

And I really love how quickly it all happens, as well as their humorous comments about how quick the service is compared to other things in the world ( check it out when you do your transfers! )

Using Wise for Holiday Travel Money

We are traveling most of the year, so most of our expenditure is in foreign currency, but even if you’re looking at a one or two-week holiday Wise can save you money. There’s no need to be using the seriously expensive currency exchanges at airports or border crossings. All you need is a Wise account, a Wise debit card, and an ATM.

Pop the card into the ATM, take the cash out and you’re off and running.

Don’t forget you can also use the Wise debit card like a normal debit card, – paying for restaurant meals, trips, tours, car rental, and so on. I don’t know why I keep saying “like a normal debit card”, I really should say, it’s a super-normal debit card – because it doesn’t charge huge fees for spending in a foreign currency!

Using Wise to Receive Foreign Currency Payments

If you get paid in foreign currencies then getting that payment into your home bank account can cost a HUGE amount in fees. Even if the person paying you wants to use, say PayPal, then your fees are high.

Wise lets you open accounts in multiple currencies, so you can give local bank details to the people wanting to pay you, or put them on your invoices. And this is all for free. Check out a multi-currency account here and now. Wise also lets you convert more than 40 currencies! So your billpayers will be paying in their currency, then you can use the low exchange rates that Wise offers to convert to whichever currency you want it in.

Is Your Money Safe with Wise?

In a word. Yes. Here’s how and why.

Wise FCA (Financial Conduct Authority)

Wise is regulated by the Financial Conduct Authority in the UK – they’re required by law to keep money safe. They do this by storing it in low-risk financial institutions – in Europe, it’s Barclays in the UK, in the USA it’s Wells Fargo. All monies are held in a specific customer account, separate from their business operating monies.

Wise FCSC (Financial Services Compensation Scheme)

If Wise were to cease to exist, then your money would be paid back from the accounts referenced above. Wise, is, however, not covered by the Financial Services Compensation Scheme (FSCS) as it is not a bank. Your money is protected by safeguarding.

FAQs on Why Use Wise

Got questions about what is Wise? About how to use Wise to transfer money? Or even what is Wise? Check out our frequently asked questions about Wise money transfers below, or ask us yours in the comments.

What is Wise? What is Wise?

Wise is an Authorised Electronic Money Institution. They are independently regulated by the FCA in the UK.

Wise is a financial services company with more than 6 million active customers who move more than US$ 4 billion dollars EVERY MONTH, saving on average US$4 million a DAY in bank fees. Wise is an Authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the UK. They are required by law to keep money safe by storing it in low-risk financial institutions. In Europe, they do this with Barclays. In the USA they do this with Wells Fargo.

Which countries can get a Wise Account? Can I use Wise in Canada?

As of December 2021 as a resident or citizen of the following countries, you can get a Wise account and Wise debit card: Canada, UK, US, Australia, New Zealand, Singapore, Japan, Switzerland, and EEA. As of December 2021, Canadian residents can get access to Wise cards too. > Get your Wise Account here

What is Transfer Wise borderless?

The Wise borderless account is the old name of the Wise Multi-Currency Account. It’s the same thing. A Wise borderless account is simply a way of holding multiple currencies.

Does Wise work in Cuba?

No. The Wise card will not currently work in Cuba.

How to Use Wise Debit Cards?

You use a Wise card / Wise debit card in the same way that you do any other debit card. Pay in restaurants, pay at tolls, pay in supermarkets. Use it online. There’s no charge for using a Wise debit card to pay for goods and services. As of December 2021 the Wise debit card is also available to Canadian residents > more here

Can You Link Wise to Paypal?

Yes. You can link a Wise account to Paypal easily. Usually, you can link a bank account from your primary Paypal currency online. (So my UK bank account is linked to Paypal online). Then to add a second account in a different currency (say US dollars), you might need to call Paypal. If you are not able to link Wise to Paypal online, then you can phone Paypal and they can add it manually for you. I did this to link my Wise account to Paypal for dollars and they were incredibly helpful and it only took 5 minutes.

Can you use a Credit Card on Wise?

Yes. You can link a credit card to Wise and use it to transfer money to your Wise multi-currency account. You can easily use a credit card on Wise. However, you will be charged a CASH advance fee if you use a credit card attached to Wise. And therefore it is usually cheaper to use a debit card. You should check with your card provider what charges they will make as payments made via Wise using a credit card may be interpreted by your bank as being a cash withdrawal and therefore may incur additional charges.

How do I use Wise?

How you use Wise depends on what type of transactions you want to use it for. You can set up a Wise account for free. You can then add different currency accounts to your wise account for free. There is no charge for this. You do not need to hold money in these currency accounts to have them open.

You link your Wise / Wise account to a “bricks and mortar” bank account or even a credit card. This then means that you can make transfers using Wise as the mechanism. So if you hold your money in Pounds sterling, but want to pay someone in US Dollars, the Wise currency conversion rates tend to be LOTS cheaper than regular bank transfers.

You can also use the Wise debit card. You can receive money in your Wise multi-currency account. Wise lets you hold and convert 40 currencies. Then you can use your Wise Debit card to spend in the local currency of the country that you are in. Or that you want to pay in. You can use the Wise debit card as an ATM card as well.

Is Wise covered by FCSC?

No. Wise is NOT covered by the FCSC. Wise doesn’t provide financial protection through the FSCS (Financial Services Compensation Scheme (FSCS), which is a scheme used by traditional bricks and mortar banks. That’s because Wise is not a bank. But they are very clear about how they safeguard your money.

Wise safeguards your money. Safeguarding is a legal requirement that means your money is kept in separate accounts from those which are used to run the business of Wise. If anything ever happened to Wise then your money will be safe in the accounts of the banks in which it is stored.

Final Words on Using Wise to Save Money

Whether you are a frequent or infrequent traveler getting access to cash and paying for items in currencies outside your home currency is usually always expensive – regular banks charge a fortune to pay in different currencies. The Wise multi-currency account and Wise debit card change all of that. You can pay in multiple currencies, you can transfer money into multiple currencies and you can get paid in multiple currencies too. Wise operates a transparent method of charging – you can ALWAYS see how much something will cost to convert before you convert it. It makes traveling and using your own money a lot cheaper and easier.

We receive a fee when you get a quote from World Nomads using our affiliate links. We do not represent World Nomads. This is not a recommendation to buy travel insurance.

ASocialNomad is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com, amazon.co.uk, and amazon.ca. Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates. As an Amazon Associate, I earn from qualifying purchases .

Sarah Carter

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

One thought on “ How to use Wise for CHEAPER Travel Money & Spending ”

- 1 comment

Thanks for the great review. You explained everything very simply.

Privacy Overview

Wise Travel Card Review: Is It Worth Getting a Wise Card?

The Wise Travel Card Review is an in-depth examination of the Wise Card’s features and benefits. This includes paying quickly, safely, and at a lower cost in different currencies and its easy-to-use app for keeping track of funds and transparent price structure. It is ideal for international spending and travel because it allows for real-time top-ups, low currency translation fees, and fee-free ATM withdrawals up to a set amount.

Table of Contents

What is the Wise Travel Card?

If you’re anything like me and have dabbled in the realm of foreign transactions, you’ve probably heard of the Wise card or Wise travel card. Wise, formerly known as TransferWise, is a terrific online foreign exchange firm based in the heart of London that I’ve been using for quite some time. Personally, I’ve found it really convenient to transfer and receive money from abroad for my work. It’s game-changing to supply banking information in nations like the United States or the United Kingdom and receive payments as if you had a local account there.

Let’s take a look at Wise card review. This isn’t your average credit card; it’s a prepaid debit card linked to your multi-currency Wise account. It’s a traveller’s dream, whether you get it as a Mastercard or a Visa of wise travel card. You can do the following with this card in your wallet:

- You can shop from 175 different nations.

- Transfer funds to overseas bank accounts with ease.

- Get money from overseas directly into your currency, with no costs.

- Load this card with several currencies and shop like a local wherever your excursions lead you.

The Wise debit card is linked to your Wise account, making overseas shopping and payments as simple as a Bondi Beach morning. So, whether you’re a world traveller or simply want to get the most out of foreign shopping, the Wise card is a friend you’d want in your pocket!

Who is the Wise Card for?

The Wise debit card, available in Australia, caters to personal and business customers, offering a convenient way to manage finances while reducing transaction expenses. Travellers can benefit from its contactless or mobile payment features, making it a preferred choice for those wanting to withdraw cash from local ATMs during their holidays. For avid online shoppers, especially those frequently purchasing from international retailers, the Wise debit card is a cost-effective option. The card is not only designed for individuals, but also for businesspeople. Entrepreneurs with frequent foreign currency transactions will find it invaluable, and business owners can offer these international debit cards to their team, streamlining the management of spending and expenses.

Wise Card Review ⭐4.3/5

Pros & cons of wise travel card, pros of the wise card.

- Affordable and Transparent: Wise aims to provide cost-effective solutions, such as the Wise card, which emphasises low costs and employs mid-market currency rates for conversions.

- Multi-currency Support: While travelling in 170+ destinations, users can load up and spend in over 50 currencies.

- Convenience for Travellers and Shoppers: For its global reach and contactless payment features, the card is perfect for travellers and online buyers.

- Fast & Secure: Wise is known for its rapid transfers and dependable security safeguards. It offers real-time alerts, safe fraud detection tools, and multilingual customer service.

- User-friendly: The desktop and mobile apps are simple, and the card is available globally.

Cons of the Wise Card

- Fees: Although the overall cost is reasonable, there are certain fees to consider. For example, there is a one-time price to receive the wise debit card and ATM withdrawal fees after a set limit.

- Lack of Rewards: Unlike typical credit cards, the Wise Travel card does not provide rewards or credit possibilities.

- Account Freezes: Some Trustpilot reviews noted account freezes during verification checks, indicating possible, albeit infrequent, problems in their service.

Statistic Note

Wise has a commendable Trustpilot rating of 4.3 stars based on an independent evaluation. While the majority of users (84%) gave it 5 stars, there were some complaints about delays in receiving the wise card and several references of inadequate customer service. Recognising that these unfavourable evaluations represent a small percentage of users is critical.

It is usually essential to undertake personal research before making financial decisions, whether you are looking for a wise travel card review or detailed facts regarding the wise card fees. Individual needs and experiences differ, but the wise debit card has proven to be a game changer for many.

How to use Wise Card?

Imagine you’re an Australian resident named Alex who has recently discovered the allure of online shopping from international stores. You’ve heard about the wise travel card from a friend and read a glowing wise card review online. Intrigued by the idea of saving on hefty currency conversion fees and the convenience it offers, you decide to dive in. Here’s Alex’s journey, which will help you understand how to use the Wise Card seamlessly.

Alex’s International Shopping Journey

It started with Alex stumbling upon a UK-based online store selling unique antique watches. The price was in pounds, and he remembered the extra charges his bank levied the last time he made an international purchase. That’s when the wise card he had recently acquired came to mind.

1. Setting Up the Wise Account

Before Alex could use his Wise Card, he had to set up a Wise multi-currency account. The registration was simple, requiring some personal details and identity verification.

2. Topping Up the Wise Account

To make his purchase, Alex needed to ensure he had sufficient funds. He added Australian dollars into his account using his local bank. There might be a small wise card fee for certain transactions, but it’s generally more affordable than most banks’ conversion rates.

3. Making the Purchase

Alex bought the antique watch with his account topped up. At checkout, he used his Wise Debit Card like any other card. The watch’s price was in pounds, but Wise automatically converted the required amount from his AUD balance at a real exchange rate. The process was transparent, and he didn’t have to worry about hidden fees or poor conversion rates, a point highlighted in this wise travel card review.

4. Checking His Account

After purchasing, Alex was curious about how much he had spent in AUD. He quickly logged into his Wise account and could easily see the transaction, the conversion rate applied, and his remaining balance.

5. Converting Money Between Currencies

A week later, Alex found another enticing product, but this time from a US-based store priced in dollars. He used his Wise account to hold both AUD and USD, allowing him to avoid conversion fees for future USD transactions. Converting some of his AUD to USD was straightforward, and he was ready for his next international shopping spree.

6. Using the Wise Card Locally

Alex’s journey with his wise debit card wasn’t just limited to international transactions. He also used the card for local Australian purchases, benefiting from the ease of tracking his expenses through the Wise app.

Wise spending limits

The Wise debit card has features that increase security against fraudulent activity. The adoption of expenditure constraints is one of these aspects. These limits are not rigid; they are determined by the location in which the card was issued. Default limits are imposed if you received your card in Australia, New Zealand, or Singapore. Wise, on the other hand, provides flexibility by allowing consumers to alter these default limitations to match their spending habits using their mobile app or web platform.

The table below shows the most a user in Australia, New Zealand, or Singapore can spend. It should be noted that the values are given in AUD, NZD, and SGD, respectively:

Wise card fees

The Wise card is becoming a popular option for travellers and global spenders, with a variety of features aimed at streamlining foreign purchases. This card was created with ease and cost savings for customers in Australia, Europe, the United Kingdom, New Zealand, Japan, Singapore, and Canada. Here to discuss the charges for different situations to wise card fees.

- Issuance Fee: A fee of $10 is involved in the initial issuance of the card, but free to open the account.

- Replacement Fee: A fee will be applied if you lose your Wise card and need a replacement. For example, $6 will be charged.

- Conversion Fee: While the Wise travel card prides itself on offering optimal currency conversion with over 50+ options and reducing fees, there still exists a fee for currency conversion. Mostly, it will be starting from 0.41%. However, if a local currency is lacking when a transaction is made, the card will automatically utilise the currency with the lowest fee, ensuring savings for the user. Further, mid-market exchange rates are typically offered, amplifying its advantages.

- ATM Withdrawal Fee: The Wise card, when used at ATMs, provides two free withdrawals of up to $350 each month. Beyond these two, fees will apply to $1.50 for each withdrawal. Only when the free and amounts limits are surpassed do fees for 1.75% of amounts withdrawn over $350.

- No Annual Fees: The card does not come with annual maintenance fees, ensuring continual user savings throughout the year.

- Other Fees: If there’s an excess beyond the set currency allowances, additional fees will be incurred. It’s also worth noting that using the Wise card abroad, especially for ATM withdrawals, might incur minimal fees after consuming the free limits.

Wise card exchange rates

The Wise travel card makes currency conversion easier while purchasing abroad. The card uses mid-market exchange rates, which are often better than those offered by traditional banks. Users can avoid unnecessary fees by using the correct payment currency.

Furthermore, when a local currency is not accessible during a transaction, the Wise card selects the most cost-effective currency conversion option from the available currencies in the user’s account, assuring cost-effective currency conversions.

Wise card vs traditional bank

Here’s a table that compares Wise card spending to using a traditional bank credit or debit card when you’re overseas:

How to get started with Wise Card

To use Wise Card in Australia, users must first open a Wise multi-currency account. This card, which can be a Mastercard or a Visa, is made for foreign transactions. It works like a traditional debit card and can be used in several different currencies. The Wise app allows users to manage their money.

Steps to apply for a Wise Card: A Handy Guide

1. Signup on Wise Platform: To begin, create an account on the Wise website or app.

2. Open a Multi-Currency Account: Set up a multi-currency account linked to your Wise Travel Card once enrolled. You can hold, trade, and spend money in different currencies with this account.

3. Fund Your Account: Fund your account before card issuance and future transactions.

4. Order the Wise Card: You can choose between a real and a virtual card, depending on your needs. The virtual card option is ideal for fast online purchases, whereas the real card will be delivered to your home address.

5. Activate Your Card: This is a way how to activate the Wise card, upon receiving your physical card, make a purchase or an ATM transaction using the given PIN to activate it. The virtual card is available for use immediately after purchase.

6. Using the Card Abroad: To understand how to use the Wise card abroad, you must ensure you transact in the local currency to avoid conversion charges when spending globally. The card will automatically convert your funds to the required currency using the best available conversion rates if you do not have the local currency. When prompted at ATMs or merchant terminals, always choose transactions in the local currency.

Wise Virtual Card & App

The Wise Virtual Card, an essential component of the Wise financial ecosystem, provides users with a convenient option to conduct online transactions without the physicality of a traditional card. As part of Wise’s dedication to worldwide ease, the virtual card works with the company’s multi-currency account, allowing for transactions in over 53 currencies. This digital application intends to provide customers with more flexible and safe methods of managing their international spending, which is especially important for Australians wanting to purchase or transact overseas.

Wise also provides a digital app to enhance the user experience in addition to the virtual card. This software has a virtual card and includes features such as customisable spending restrictions, encryption for extra security, and transaction monitoring. This programme allows Australians to manage up to three virtual cards, promoting better budgeting and a stronger security foundation for online purchases.

Final thoughts on the Wise Card’s value

For Australians engaging in international transactions or travel, the Wise Card offers convenience, competitive currency conversion rates, and security features. Given its benefits and minimal fees, it’s a worthy consideration for those seeking global financial flexibility.

**Disclaimer

Information provided here is for general guidance only. Always consult the official Wise website or relevant authorities for up-to-date and accurate details. Use at your own discretion.

Frequently Asked Questions

Is wise card trusted.

Yes, the Wise card is licenced and regulated by financial authorities. It also provides encryption, transaction monitoring, and 3D Secure verification.

What are the Wise debit card withdrawal limits?

There are no ATM withdrawal limitations, but there are free withdrawal limits followed by fees for withdrawals exceeding $350.

Is the Wise Card contactless?

Yes, the Wise Card supports contactless.

What happens if you lose your Wise debit card?

If you misplace your Wise debit card, you can use the Wise app to freeze it to prevent unauthorised use.

How do I get my Wise virtual card?

A Wise virtual card can be obtained by using the digital Wise app. The virtual card is immediately useable after it is ordered.

Samantha Lim

Samantha Lim, a finance writer from Malaysia, combines her Finance degree and industry experience to offer expert insights on personal...

Girl Eat World

A girl's adventure in food and travel around the world, wise debit card for travel: spend like a local when abroad.

I have been a regular Wise customer ever since it was still called TransferWise many years ago. I became a fan as soon as I started using their services – I even wrote some articles raving about them on my (other) personal blog.

For a while, I used Wise for its fair foreign exchange rate, so that I can receive any currency and convert it to Singapore Dollars without paying the unfair rate that banks usually give us.

When Wise released its debit card to the Singapore market in 2019, I was among the first batch to sign up for it. However, thanks to the pandemic which locked all of us in Singapore for two years, it wasn’t until my recent visit to the US that I was able to use the Wise Debit Card for its intended purpose. And it was then that I realized the true potential of it – the card truly allowed me to spend like I was a local! What a game changer in travel.

What is Wise?

OK, first of all – what is Wise ? Wise is not a bank. It is an international money transfer service. They were originally known as TransferWise, recently rebranded to just Wise in 2021. The main feature of Wise is that it lets you create multi-currency accounts, which lets you hold a balance in currencies that are not your home currency.

For example, I live in Singapore and my home currency is Singapore Dollars. With Wise, I am able to create a multi-currency account that let me receive transfers in US Dollars, British Pounds, Euro, and Japanese Yen – just to name a few – with practically no fees. Then, I am able to convert those currencies to Singapore Dollars at a very fair mid-market rate, also with minimal fees.

It saves me money and that makes me a very very happy camper.

What is the benefit of using Wise?

You might be wondering – why should I use Wise ? What is the difference between receiving a payment with PayPal or bank direct deposit vs using Wise? Well, the difference lies in conversion fees and foreign exchange rate , which PayPal and traditional bank charge an exorbitant amount for.

For example – I recently received a payment in PayPal for 1,942.31 Thailand Baht, which PayPal converted to $84.67 Singapore Dollars. If I had received the payment in Wise, it would have been converted to $87.39 Singapore Dollars.

This example is just a small amount, so the difference isn’t much – But if you are doing larger transactions and often, this could translate to a lot more difference!

On the other hand, if you accept payment via direct deposit to your bank account, then you’ll have no choice but to use your bank’s conversion rate which tends to not be the best rate in town.

How does the Wise Debit Card work?

In 2018, Wise released a debit card that lets you spend the balance you have in your Wise multi-currency account. It works just like any other debit card – except for one small difference: Wise Debit Card lets you spend in the 40+ currencies that Wise supports.

And that, coupled with the very fair rate Wise charges for currency exchange, is a very powerful thing when you use this card for your spending abroad! Especially in countries like US , Australia , and Singapore , where contactless payment is widely accepted.

For example, during my recent visit to NYC , I bought a US $100 pair of pants from my favorite brand. If I had charged this to my regular Singapore credit card, I would have been charged a 2.25% foreign currency fee, and it would be converted using the bank’s FX rate (and banks never give you a fair rate), which would translate to SG $136. But using the Wise Card, the US $100 spending converted to only SG $132!

Now $4 is not much savings, but repeat this for every single transaction I made during my entire stay in the US, and it translated to hundreds of dollars saved!

Unless your bank gives you a mid-market rate and no foreign transaction fees, you’ll stand to benefit from using the Wise Card. Overall, I find using the Wise card translated to be the same conversion rate as using cash converted at the best money changer, but without the hassle of converting, carrying and managing cash throughout your trip.

Another feature is that Wise Debit Card also lets you withdraw cash from ATMs using that same card, though I have yet to try this myself.

➡️ To start spending like a local, simply create a Wise account and apply for the Wise Card!

How can I use Wise Debit Card when I travel?

If everything I’ve written seems confusing to you, don’t worry! I’ve created a step-by-step how you can use the Wise card for your travel. Here goes:

Step 1: Create a Wise account

First of all, you do need to have a Wise account to be able to use the Wise card. So, register for an account right on their website! Do this about a month before you are due to travel , because you do need to provide some ID and go through verification before they can approve you for an account. It didn’t take too long for me in Singapore, but it might take some time for other countries.

Step 2: Apply for the Wise card

Once your Wise account has been approved, you can apply for the Wise card through the mobile app. Again, do this ahead of your travel as it may take them some time to send you the physical card.

You don’t actually need to get a physical card if you’re traveling to countries where mobile or contactless payment is accepted, like US , Australia , and Singapore . The Wise mobile app would have already let you create digital cards, which you can add to your smartphone wallet and use with contactless payments. But, I recommend getting the physical card anyway in case the merchant still lives in the stone age and needs to swipe your actual physical card. And we did actually encounter such a merchant in San Francisco!

Or, the physical card could also come in handy should you need to withdraw cash from the ATM at your destination country.

Step 3: Fund your Wise account

Before you travel, you’ll need to fund the Wise account so that you can spend the balance while you’re abroad. To do this, simply open a balance in your home currency, and use the details to send some funds. For security purposes, I suggest sending only what you plan to spend per trip so that you don’t have too much money in the Wise account.

For example, my home currency is Singapore Dollars. So in the Wise mobile app, I opened a Singapore Dollar (SGD) balance which gives me Singapore bank account details. Then, I simply transferred some Singapore Dollars to the Singapore bank account that Wise gave me. The transfer time varies per country and bank, but in Singapore, it is almost instant.

Step 4: Open a balance in the currency of the destination you are traveling to

You don’t actually have to do this because Wise will automatically convert your balance to whatever currency you’re spending, and it will choose the currency with the least conversion fee.

But if you want to have more control over how the balance is spent (like when you spot a really good fx rate), then I suggest you create a balance in the currency of the destination you’re going to. Then, you can convert some balance to that currency using the mobile app.

For example, suppose I am traveling to Australia. In my Wise app, I would open both a Singapore Dollar balance and an Australian Dollar balance. I would then transfer some Singapore Dollar to the balance. Then, whenever I notice Australian Dollar is getting weaker against Singapore Dollar, I would convert some amount to fund the trip.

Step 5: Always pay in the local currency of your travel destination

Let’s say all is well and you have received your Wise card (whether physical or digital) and you’re already in the midst of your travel, ready to spend the money. Sometimes, at point of sale, the cashier will ask which currency you want to spend in – your home currency, or the local currency of the destination you’re traveling in.

If given the option, ALWAYS pay in the local currency of the destination you are visiting . If you choose to pay in your home currency, you will trigger Dynamic Currency Conversion (DCC) – which is a scam, and it means funds will be deducted from the home currency balance, but converted at a conversion rate decided by the bank. This completely defeats the purpose of using a Wise card!

Let me give you an example: if I (as a Singaporean) am traveling in America, I might be asked at the point of sales whether I want to pay in US Dollars or Singapore Dollar. I will ALWAYS choose paying in the local currency (US Dollars – USD) when I’m traveling in the US. If I choose my home currency (Singapore Dollars – SGD), the funds will be taken from my SGD balance at the bank’s rate. The bank will simply tell Wise how much SGD to deduct, and Wise is completely unaware of the original USD transaction.

How can I use a Wise Debit Card safely when I’m abroad?

Wise Debit Card makes money management while traveling super convenient. I no longer needed to convert that much cash when I travel, I only keep some for emergencies. I was even able to use it as my travel card when I was in NYC since the metro now accepts contactless transactions. I simply added my Wise Debit Card to my Apple Wallet and tapped using Apple Pay to pay whenever I boarded the train!

Now, we all know credit card scams are very common. I myself have fallen victim when I used my credit card in Bali and Vietnam , so you definitely want to stay vigilant when you’re using your Wise Debit Card – just like any other card really!

Here are some tips to keep your Wise account and card details safe:

Security Tip #1: Use the digital card feature

As much as possible, limit the use of your physical debit card and never expose the card details by using it as-is when paying online. This is the golden rule because that’s how most card details get stolen – whether someone manually copied the detail, or the card details get stolen when you swiped your card, or the store you’re shopping online gets hacked.

Instead, Wise has a feature that lets you generate digital cards through their mobile app. This is a very handy feature – it gives you a card detail that only exists digitally but behaves like any physical card. You can delete and re-generate digital cards as needed, but you can only hold 3 digital cards at a time. If your digital card details get stolen or leaked, you can just freeze the compromised card through the Wise mobile app.

When traveling, I usually generate a digital card for the trip. Then I use that same digital card throughout the trip, and when the trip is done, I delete the digital card detail. Don’t delete it if you’re expecting a refund though!

Security Tip #2: Pay with your mobile wallet whenever possible

Mobile wallets, like Apple Pay or Google Pay, are one of the most secure ways of transacting in person. It obfuscates your card detail so that even if someone intercepts your card at the point of payment, they can’t know your actual card detail. Paired with the digital card feature and adding a digital card to your mobile wallet, it basically makes your account extra secure. No one will ever know your real card detail!

Security Tip #3: Freeze the cards until you need to use it

You can easily and instantly freeze and unfreeze any card details through the Wise mobile app. I always keep all physical and digital cards frozen until I am about to use them. This greatly reduces the chance of someone compromising my card and taking money from my Wise account.

Security Tip #4: Keep only the balance you need in your Wise account

Only transfer what you need for the trip to your balance. In the event that your card or account is compromised, this will help minimize damage because the thief will only have access to whatever balance is in your Wise account.

And there you have it! Wise Debit Card has definitely become an integral part of my travel. With all the security features around it, I feel confident to use the Wise card abroad at any destination.

As usual, please leave me a comment below if you have any questions!

Until next time 👌🏻

Note: I am just a regular, long-time, happy customer of Wise . I was not paid to write this review. As always, all thoughts and opinions are honest and remain my own.

- May 28, 2024

Hi there! Great review! I was wondering: – if you run out of money on your trip, can you still transfer and convert money while you’re abroad? – if, by the end of your trip, you can get your unused money back? Thank you!

- May 29, 2024

Yes, if you run out of money you should be able to transfer money to your Wise account and use it abroad. But it depends on your bank.

At the end of the trip, you can simply transfer back any money you don’t use to your bank account. However, unless you hold a multi-currency account, you might have to convert back any balance that is in a foreign currency.

- April 2, 2024

Thanks for the helpful info! I’m just wondering, since you are saying you save money on conversion rates compared to the bank – isn’t that outweighed by the debit fee and wise fee for doing the conversion? In one example, if I transfer $1000 CAD to EUR, the fees on that are $8.86 which seems more expensive than using the bank exchange rate and a card with no fees (ie. CIBC prepaid visa card). Could you please let me know what you think? Thanks!

it definitely depends on your bank charge. for me in singapore, we don’t have any card that doesn’t charge forex conversion fee.

- February 4, 2024

Hi Melissa! I came accross your post and it was very useful! I am myself a Wise user, but my doubt is: as a tourist in Singapore, how easy would it be to use my card and get some cash from regular ATMs? Are international Wise cards well accepted everywhere?

It would be wonderful if you could give me these details, as my trip to Singapore will take place within the next few weeks and I’m going on with preparations.

Hope to hear from you soon, many thanks!

Hey Tatiana. Singapore is where Wise has their APAC headquarters! you can use Wise pretty much everywhere here through the touchless function. If you have a smartphone, add a virtual card to your wallet and you are good to go. I haven’t tried withdrawing from ATM myself, but my siblings have and it is smooth process for them.

- March 28, 2024

What other cards should you take as a backup when travelling to Singapore from Australia?

- January 4, 2024

Very informative and useful information. Thank you.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Wise Travel Card Review [2024]

In a Nutshell

A market leader for exchange rates and transparency, the Wise card is one of the best prepaid cards for travel and great for making purchases overseas or online in a foreign currency. Fees apply if you go over the ATM limits. Includes a convenient app and virtual card.

Wise Travel Money Card

- Best Excellent exchange rates

- Worst High ATM fees

- The best exchange rates for a travel card

- No annual fees

- Top up on the go in seconds

- Low conversion fees that are clearly labelled

- Ability to preload up to 53 currencies including USD , CAD , SGD , JPY , EUR and more

- Ability to freeze your card via the app should it get lost or stolen

- Track your spending via the app (great if you've got a travel budget)

- Can use digitally with Apple Pay and Google Pay

- One of the most popular travel cards with over 4 million global users

- Customer support can be slow

- No interest on your balance

- Card delivery may be slow (but you can use the digital card straight away)

- If you withdraw over $350 AUD anytime from an ATM, you will be charged an additional 1.75% of the amount

- After the first two free under $350 AUD ATM withdrawals for the month, a $1.50 fee applies per additional withdrawal

The Wise card (formally TransferWise) removes the money headaches we associate with frequent travelling by making it easy to load and spend a huge range of currencies overseas.

Hands down, it is one of the best cards for overseas travel . No other travel card or debit card offers the same low fees and mid-market exchange rates as Wise. However, charges can add up if you need to withdraw large sums of cash from ATMs.

The average Trustpilot review for Wise is 4.3 stars (from 191,128 users on 14 June 2023).

The most common complaints by users are occasional delays to receive the card, along with poor customer support — although these customers are a minority. 84% of reviewers rate Wise 5 stars.

What is the Wise Travel Card?

The Wise card is a prepaid debit card attached to your Wise multi-currency account . Available as a Mastercard or Visa travel card, it allows you to:

- Makes purchases from 175 different countries

- Transfer money to international bank accounts

- Receive money from overseas in your currency using local bank account details with no fees

- Load up multiple currencies and pay like a local while you’re abroad

Note: Wise is the same company as TransferWise, just with a new name (as of 2021). The Wise multi-currency account used to be called the Borderless account. Nothing else has changed — the debit card remains the same.

How it works

The Wise travel card works just like a normal debit card.

You can use it almost anywhere around the world to withdraw money, make contactless purchases in shops and cafes, pay for accommodation, and shop online.

You can load and hold up to 53 currencies in your Wise account.

If you have the local currency for a payment, the card will use it. If you don’t have the right currency, Wise will convert one of your other currencies for you at the best rate.

Natalie lives in New Zealand and travels to Europe. In her Wise account, she adds euros, British pounds, and New Zealand dollars . She uses her Wise debit card throughout the trip.

In the UK, purchases are automatically deducted from her balance of pounds . In Europe, Wise directly debits purchases from her euros balance.

Towards the end of the trip, Natalie wants to buy a handbag for 500€ but she only has 200€ left in her euros balance, alongside £400, and NZ$1,000.

She can still make the purchase. In this case, Wise deducts the final 200€, then finds the best conversion rate into euros from British pounds or New Zealand dollars. It then converts that currency into euros to complete the purchase.

Adding money to your Wise debit card

The Wise app makes it easy to add money to your debit travel card . Just open the app, choose the currency and amount you want to add, and select your payment method (such as a bank transfer or by card).

You can hold and convert money in 53 currencies:

Wise spending limits

For fraud prevention and extra security, spending limits apply to the Wise debit card. These limits depend on where you got your card.

The card has default limits but you can adjust them to your own spending habits in the app or online. a

The table below lists the maximum limits allowed for Australian, New Zealand, and Singapore cardholders (in AUD, NZD, and SGD respectively).

Wise debit card fees

The Wise website declares that their travel card can help you save up to 85% when you spend internationally thanks to a better exchange rate and lower fees compared to banks.

Of course, fees are unavoidable but Wise makes sure to keep them competitively low.

While it’s free to create a multi-currency account with Wise (formerly TransferWise), other charges will be associated with the card, including:

- Card issue and replacement fees

- Currency conversion fees

- ATM withdrawals fees (beyond 2 withdrawals per month)

Currency allowances

Australian customers can hold a large amount of money per currency for free in their Wise balances. The allowance varies depending on the currency but is roughly equivalent to A$23,000 per currency.

If you exceed the maximum allowance per currency for more than 3 days, you’ll be charged an annual fee of 0.4% for Euros and 1.6% for all other currencies. This is charged as a daily fee for every day in the month you hold over the allowance.

For example, if you hold A$24,000 in your account for a month, you will be charged approximately A$1.30 at the end of the month for the excess A$1,000.

Wise card exchange rates

The beauty of the Wise travel card is that it can hold more than 50 currencies so you don’t have to worry about high conversion fees for every purchase.

If you don’t hold the local currency for a purchase, Wise will use whichever currency you have that has the lowest conversion fee.

Here’s where it gets good.

Wise gives you the mid-market exchange rate for any currency conversions — a rate that is typically better than the exchange rates provided by banks or other travel card companies.

If you have the right currency for a payment, you avoid the conversion fee altogether.

Card Provider

Exchange rate.

A$ → GBP (11 am 09 December 2022)

Conversion Fee

Loading A$1000

$4.38 (0.44%)

No fee on weekdays

How it compares

Get your card

You can apply for a Wise card if you live in one of the eligible countries (including Australia and New Zealand). View eligible countries here.

To get your Wise card, it takes just a few simple steps:

Get a Wise multi-currency account for free online or via the Wise (formerly Transferwise) app. You’ll need ID.

Add money to your account

To be eligible for the card, you’ll need to add a minimum of US$20 to the account. This will cover card issuing fees.

Order your card

Apply for your card on the website’s Card tab or the Wise app’s Account tab.

Activate your Wise card

There are different ways to activate your Wise card depending on whether it’s a Visa or Mastercard.

If it’s a Visa card, you can activate it by entering your PIN in the first transaction you make in a physical store or ATM. If it’s a Mastercard, you will need to go online and enter the 6-digit code provided to activate it.

Wise virtual card & app

Wise has fully embraced the digital age with an easy-to-use smartphone app and access to virtual cards — all designed to banish money and currency confusion in an increasingly connected world.

The app (available on Apple and Android) has everything you need to create an account, get your Wise card, and manage it while you’re globe-trotting.

Once you sign up for a Wise multi-currency account and place an order for the physical card, you can have up to 3 Wise virtual cards connected to your account at the same time.

These free digital cards only exist on your phone and are easy to get through the Wise app or website. They’ll have different details to your physical card and are a great backup option.

Wise virtual cards work with Apple Pay, Google Pay, and Samsung Pay and can be used to make payments online, in-store, and overseas.

The best bit? You can start using your virtual cards immediately — no need to wait for your physical card to arrive.

Importantly, the Wise card is not a travel credit card . You must have money in your account to make a purchase. If you don’t have enough funds, the transaction will be declined.

Your Wise card could take anywhere from 3 working days to 3 weeks to arrive, depending on where you live. However, you can set up your digital card on your phone to use immediately.

The Wise card offers 2 withdrawals of up to A$350 each month for free and A$1.50 per withdrawal after that.

If you need to withdraw more than A$350, you will incur a 1.75% fee on the amount withdrawn — plus the A$1.50 withdrawal charge if you’ve already made 2 ATM transactions that month.

The maximum amount you can withdraw in a single transaction is A$1,750. The maximum daily withdrawal is A$2,700 while the monthly maximum is A$7,000 (the default monthly maximum is set at A$5,250 but you can change this in-app).

Contactless is a common form of payment across Australia, Europe, the UK, New Zealand, Japan, Singapore, and Canada.

Wise enables contactless payments with both your physical Wise card and your Wise virtual card (accessible on Google Pay, Apple Pay, Samsung Pay, and more).

There are different payment limits for cardholders in different countries. In Australia, the limit for single contactless payments is A$900. The daily limit is A$1,750 (set at a default of A$900) and the monthly limit is A$7,000.

As an extra security measure, you may be asked to enter your PIN if you’ve made a lot of contactless payments in one day or you’re making a purchase over a certain amount.

You can also pay with a chip and PIN or with the magnetic stripe where possible — different payment limits apply to these payment methods. View payment limits here .

When it comes to your money, safety is paramount. Wise knows this, which is why it has several safety guarantees.

To start, Wise encrypts any information you give them to protect sensitive data and follows strict guidelines for international money transfers.

Safety measures include the ability to freeze and unfreeze your card any time — helpful if you misplace it — and the option to receive instant transaction notifications to track purchases.

The Wise debit card also allows for 3D Secure (3DS) payments, where some transactions require verification through the Wise app, SMS, or a phone call.

As a company, Wise has an Australian Financial Services Licence and is regulated by the Australian Securities and Investment Commission (ASIC). It is also registered overseas with the UK Financial Conduct Authority and the Financial Crimes Enforcement Network (US), among other financial institutions.

It’s worth remembering that the Wise multi-currency account isn’t like a bank account and safeguards your money differently — the company is completely transparent in how it does this .

The Wise card is designed to be used just like a debit card, which means you can use it to withdraw money from any ATM that accepts Visa or Mastercard — with some exceptions.

You can make 2 free monthly withdrawals (up to A$350) each month. After that, there is a withdrawal fee of A$1.50, plus a 1.75% fee on withdrawals over A$350.

Wise cards issued in Singapore or Canada cannot be used for ATM withdrawals in the country of issue. But you can still use them for ATM withdrawals overseas.

For Wise debit cards issued in Japan, you can only withdraw from certain Japanese ATMs (including AEON, Family Mart, Viewcard, and Daily Yamazaki).

If your Wise card is lost or stolen, the first step is to freeze your card temporarily via the Wise website or app.

Freezing the card means it can’t be used for purchases or withdrawals so you can protect your balance. If you find your card, you can unfreeze it online.

If you can’t retrieve your old card, you can order a replacement card through the Wise app or website. There’s a small fee of A$6 for card replacements.

Wise will block and cancel your old card and ship the new one to you. It will take anywhere from 3 working days to 3 weeks for your card to arrive, depending on your location.

While you’re waiting for your replacement card to arrive, you can use a virtual card. Wise allows you to have up to 3 virtual cards at any given time.

Learn more about the best travel money, debit and prepaid cards for travel

Prepaid Travel Card

Best Travel Money Cards

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

Travel Technology: Should I Use a Prepaid Travel Credit Card Like Wise?

by Carolyn Ray | Apr 9, 2024

- Toggle High Contrast

- Toggle Font size

Last updated on April 19th, 2024

How to save money and convert multiple currencies while travelling

by Carolyn Ray

Welcome to our Travel Technology column, where I attempt to answer your questions about the mystifying, ever-changing and evolving world of technology. Having spent years working in the technology industry with IBM and other notable firms, I have always been an early adopter and feel qualified to share my personal experiences or find those who know more than me, which often includes our readers. I always encourage you to review other sources and consult with experts.

Topic of the week: Prepaid travel credit cards

One of the most frequent questions on our private Solo Travel Wisdom group is about prepaid travel credit cards.

Question: “Does anyone have experience with a Wise card? How are the exchange rates going from Canadian dollars to other currencies? Thank you for any guidance you can give me.” — Cheryl T.