Top Travel Insurances For Indonesia You Should Know in 2024

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Indonesia is a huge and bustling country that's famous among visitors and expats for its diverse landscapes (including tropical forests and stunning beaches) and fun cultural experiences, including visiting to the famous Borobudur Temple and the resorts of Bali. Although travelling to Indonesia can be an accessible holiday destination for many people, and although healthcare costs in the country aren't outrageously expensive, it's still a very good idea to arrive there with travel insurance anway, as you'll want the highest-quality healthcare you can find.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to Indonesia and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

Indonesia Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for Indonesia:

Best Travel Insurances for Indonesia

- 01. Do I need travel insurance for Indonesia? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to Indonesia scroll down

Heading to Indonesia soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Is Travel Insurance Mandatory in Indonesia?

No, there's currently no legal requirement to take out travel insurance for travel to or through Indonesia.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to Indonesia or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for Indonesia:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to Indonesia, no matter whether you're planning to recline on a sunny Bali beachfront or explore the concrete jungles of Jakarta.

VisitorsCoverage lets you choose between various plans tailored to meet the specific needs of your trip to Indonesia, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies, and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for Indonesia:

- Policy Names: Varies

- Medical Coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip Coverage: Excellent - but only available for US residents.

- Customer Support: FAQ, live chat and phone support

- Pricing Range: USD 25 to USD 150 /traveller /month

- Insurance Underwriter: Lloyd's, Petersen, and others

- Best For: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option for Indonesia, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy Names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical Coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip Coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer Support: FAQ, live chat, phone support

- Pricing Range: USD 80 to USD 420 /traveller /month

- Insurance Underwriter: David Shield Insurance Company Ltd.

- Best For: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads in Indonesia because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy Names: Nomad Insurance, Remote Health

- Medical Coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip Coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing Range: USD 45 to USD 160 /traveller /month

- Insurance Underwriter: Tokyo Marine HCC

- Best For: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to Indonesia? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to Indonesia

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for Indonesia. However, we strongly encourage you to do so anyway, because the cost of healthcare in Indonesia can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Travel Insurance for A Worry-free Trip

Stay protected on your travels!

Enjoy the most of your journey by ensuring that you and your trip are covered against unpredictable events, without the extra hassle.

Now available on Traveloka App

Traveloka Travel Insurance "a journey without worry"

We offer insurance plans that come with extensive coverage and choices of Single-Trip or Annual. Whether you are an occasional or frequent traveller, you can put your mind at ease and minimize any potential worries while you’re on your trip.

Travel Insurance for International Destination

Get quote for Japan Travel Insurance now?

United States

Get quote for US Travel Insurance

Get your Thailand Travel Insurance here

Get your Australia Travel Insurnce here

What You Get

Flight delay protection.

Avoid the stress of dealing with flight delays or even cancelations. Any disruption that happens to your flight plans is covered up to Rp7,5 million.

Personal Accident Coverage

Ensure that you are well-protected should any unwanted events occur before it’s too late! Accidents encountered during your trip are insured up to Rp15 million.

Medical Expenses Coverage

Medical emergencies are no fun, especially when it comes to paying off expensive hospital bills. But no worries, because your medical expenses are covered up to Rp500 million.

Baggage Loss Protection

Arrived safely, but couldn’t find your baggage? No need to panic! Any missing or damaged belongings can be claimed up to Rp15 million.

Get your Insurance now?

Let us protect you and your trip with our travel insurance plans. Now we are available on the latest Traveloka App version.

Find Travel Insurance on Our App

Open Traveloka App and tap All Products

Scroll down to find the Travel Guide & Add-ons section, then tap Travel Insurance

Planning for next destination to other country? Do further check here with Traveloka Travel Insurance for International destination. We have online comprehensive information for you here.

Buy Travel Insurance at Traveloka

Traveling, whether for business, family trip, education, or just walking around, certainly requires careful preparation. This preparation is needed so that we can anticipate various things that might happen so that the trip can take place safely, comfortably, and without significant obstacles.

Although the preparation has been made, there is a chance that problems might happen. There are still a number of things that are beyond our control that might occur. For example, flight delays, damaged or lost baggage, problems with booking rooms, to the worst: accidents.

No need to worry much about this. Moreover, thinking to cancel the trip. Since long ago, there has been a name for a Travel Insurance service that is in charge of providing special protection as long as we travel. This insurance serves to provide protection in the form of financial protection for a number of events beyond our control. Some of the most common, for example: compensation for late or delayed flights, compensation for damaged or lost baggage, and dependents on post-accident maintenance costs.

In modern times like this, you can get the insurance very easily from various sources. No longer having to go to a particular provider, you can even buy travel insurance online with a sophisticated device and a fast internet connection.

This year, Traveloka complements the comfort of your trip with Travel Insurance services. The presence of this service can make you feel more calm and safe to deal with trips because you can buy full protection through a mobile application.

Have a worry-free journey with Traveloka Travel Insurance. Download the Traveloka Application now or update your Traveloka Application to the latest version. This latest feature can be found in the "Travel Guide & Add-on" menu.

There are a lot of reasons to complete your trip with Travel Insurance. This latest service provides comprehensive protection to free you from anxiety because various potential interference effects can be handled as well as possible.

By purchasing Traveloka Travel Insurance, you will get protection for flight delays or cancellations up to Rp. 7.5 million. When an accident occurs, you will get coverage of up to IDR 15 million per person. The cost of medical coverage for emergencies at the hospital is also available up to a maximum of Rp. 500 million per person. Lost or damaged baggage? Traveloka Travel Insurance is ready to compensate up to Rp. 15 millions.

Worry-free trip is now in your own hands. All can be accessed quickly, safely, and so easily with just the touch of a finger. Traveloka Insurance price is of course affordable just as like Traveloka's special treat. Special promos are often available for you to add as a form of more savings when buying travel insurance online from the App.

Frequently Asked Questions

Insurance has a lot of aspects into it. To make it easier for you to find and fully grasp all of the important information, we have compiled a list of short questions that are frequently asked. This page will be updated periodically to give you the most relevant and comprehensive information.

How do we purchase Travel Insurance?

- Download Traveloka App from Google Play Store or iOS App Store.

- Complete the account’s registration process and log in to your account.

- Tap the Insurance icon button on the home page.

- Scroll down to find the Travel Insurance icon.

- Click the Travel Insurance icon.

- Select the Coverage Type , Coverage Area , Destination Country , Coverage Start Date , Coverage End Date , and Travelers .

- Click Search Plans and select an insurance plan that best suits your need.

Pro-tip : Make sure that you have read and understood the applicable Terms & Conditions including the details of the insurance before you make a purchase.

How do we make a claim?

- Download and fill in your claim form, and prepare the required documents as listed there.

- Make sure that you attach ALL the required supporting documents that are related to your claim onto your claim form.

- Submit your claim request and the required documents within 30 days from the date of the incident to one of the following options:

- 021-550-7777 (24-jam)

- [email protected] (Email)

- +6288-1109-0888 (WhatsApp)

- Pusat layanan Klaim simas Insurtech , coHive Menara Tekno, Jl.KH fachrudin No. 19, Jakarta Pusat, 10250 (Post)

- Your claim will be processed within 7 working days and Simasnet will notify you in case of insufficient or incomplete documents.

- Payment will be settled in 2 working days to your bank account after the claim is approved by Simasnet.

Claim Inquiries

- [email protected]

- Pusat layanan Klaim simas Insurtech , coHive Menara Tekno, Jl.KH fachrudin No. 19, Jakarta Pusat, 10250

What are the Terms & Conditions?

- Insurance purchase is non-refundable.

- Only valid for Indonesian residents or foreigners holding a valid identification document such as KTP, KITAS, or KITAP.

- The insurance is only valid for trips departing from or to Indonesia.

- When purchasing the insurance, you must be fit to travel and are not aware of any circumstances that might disrupt it.

- Simas Insurtech is entitled to withdraw the funds that have been paid to you if any evidence of fraud or data manipulation is found.

- Coverage lasts from the start date to the end date of the insurance policy unless the trip is cancelled.

- For one-way flights, the coverage ends when you have safely landed at your destination’s airport.

- In case that you’re entitled to a refund from other parties, Simas Insurtech will only pay the remaining amount up to the maximum amount of your policy limit (not the total amount of loss).

What are the things that are not covered?

- Pre-existing medical conditions and chronic illnesses (e.g. asthma, heart attack, stroke, epilepsy, diabetes, appendicitis, kidney stones).

- Outbreak of disease, epidemic, and pandemic. Although some plans cover COVID-19, please check your policy to make sure.

- Pregnancy and childbirth (including the associated injuries or sickness), and venereal disease.

- Medical treatments or surgeries that can be postponed until you return to Indonesia.

- Additional medicines that are not medically prescribed (e.g. balm, ointment, insect repellent, Counterpain and its equivalent, and Betadine and its equivalent).

International Travel Insurance Destinations

Using the latest version of Traveloka App, you can purchase travel insurance for almost all destinations worldwide. To make it easier for you to find the necessary information on the travel insurance that we provide for each destination, you can click on one of the following pages:

- Travel Insurance to United States

- Travel Insurance to Japan

- Travel Insurance to China

- Travel Insurance to Germany

- Travel Insurance to France

- Travel Insurance to Netherlands

- Travel Insurance to Russia

- Travel Insurance to Poland

- Travel Insurance to Canada

- Travel Insurance to Spain

- Travel Insurance to Australia

- Travel Insurance to Thailand

- Travel Insurance to Malaysia

- Travel Insurance to Great Britain

- Travel Insurance to Turkey

- Travel Insurance to New Zealand

- Travel Insurance to Vietnam

- Travel Insurance to Mexico

- Travel Insurance to South Korea

Disclaimer : The destinations shown above are only the most popular. We will periodically add other destinations to this page.

Payment Partners

About Traveloka

- How to Book

- Help Center

- Installment

- Download App

Follow us on

- Bus & Travel

- Airport Transfer

- ProductItems.cruises-search

- International Data Plans

- Gift Voucher

- Traveloka for Corporates

- Traveloka Affiliate

- Privacy Notice

- Terms & Conditions

- Register Your Accommodation

- Register Your Experience Business

- Traveloka Press Room

- Traveloka Ads

- Vulnerability Disclosure Program

Download Traveloka App

- Heart Attack

- Big 3 Critical Illness

Flight Delay

- Motor Vehicle Insurance

- All Products

Make a Claim

- How To Claim

- Distribution Portal

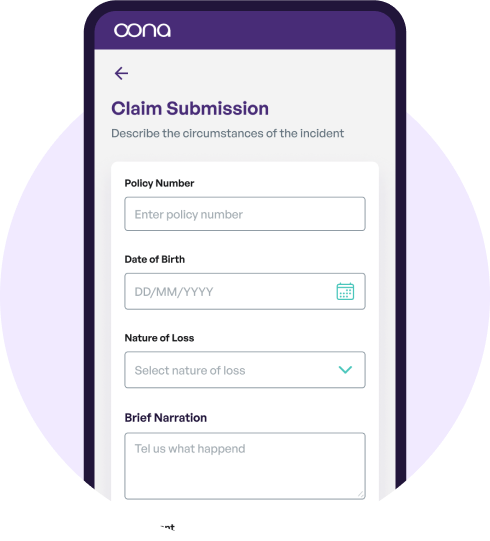

Oona Travel Insurance

Coverage for International and Domestic Travels.

Medical cover up to 2.5 Billion, Flight Delay, Covid-19 cover and more.

Scroll down to check your price!

25% Discount

Use code LIBURTELAHTIBA

Popular Countries You can select more than one

- Iran (Islamic Republic of)

- Lao People's Democratic Republic

- Micronesia (Federated States of)

Annual multi-trip?

I agree to the Terms & Conditions and Privacy Policy

Just one more thing...

Travel with peace of mind with Oona Travel Insurance

Embark on your journeys with confidence, thanks to Oona Travel Insurance. Our diverse coverage plans cater to every adventure, from international voyages requiring Schengen visas to domestic tourism. Stay a step ahead with our inclusive policies, including essential Covid-19 protection, flight delay coverage (check), baggage lost and delay. With Oona, you're not just insured; you're prepared for the world.

Explore a variety of travel insurance plans tailored to meet your travel plans

International Travel

Starts From

IDR 110.000

Domestic Travel

Why choose Oona?

Buy online. policy issued within minutes, covid-19 extension, medical expenses for illness and accidents, with cashless coverage up to idr 2.5 billion, got a question.

Explore our FAQ page to find all the information you need.

What does travel insurance cover?

Travel insurance coverage varies depending on the terms of the specific product or policy. Generally, common coverages include:

Trip Cancellation: Compensation for travel expenses already paid if canceled due to illness, accident, or unexpected events.

Emergency Medical Evacuation: Costs of evacuation to medical facilities or repatriation to the home country if necessary.

Emergency Medical Expenses: Protection for emergency medical treatment costs, including hospitalization and medication.

Baggage Insurance: Compensation for loss or damage to personal belongings during the trip.For example, lost luggage.

Flight Delay: Compensation for additional costs arising from flight delays, such as accommodation or transportation tickets.

Personal Accident Insurance: Protection against the risk of accidents leading to injury or death.

Legal Protection: Assistance and legal consultation during the trip.

Travel insurance is available for a single trip or as an annual policy for multiple trips. Make sure you understand the terms of the policy to ensure it meets your needs.

What is meant by travel insurance?

Travel insurance is one form of insurance that offers financial protection from various risks when you are travelling. This includes trip cancellation, baggage issues, flight delays, to medical evacuation while you are traveling.

Do you need to buy travel insurance?

The decision to buy travel insurance depends on various factors, including the destination of your trip, the type of activities you will be doing, your health and a number of other personal considerations.

Every trip is unique and so are your needs. Take time to reflect on the risks and personal needs before departing.

Travel insurance from Oona is ready to be a faithful companion that ensures your journey is safer and more comfortable.

Purchase Oona Travel Insurance Online for peace of mind on every trip.

Is travel insurance mandatory?

There is no global requirement that makes travel insurance mandatory.In Indonesia, there is also no regulation that requires domestic or international travelers to have travel insurance when travelling.

However, there are some situations where travel insurance can be a mandatory requirement.

For example, when applying for a Schengen Visa to travel to countries in Europe. In this case, you will need international travel insurance to meet the terms and conditions of the visa application. Travel insurance can provide protection against financial loses and emergency assistance, especially when you are abroad.

It is advised to consider having a travel insurance to protect yourself from potential risks that may occur during the trip.

Does the flight ticket price include insurance?

The price of a plane ticket generally does not include travel insurance and only covers the cost of the flight and some standard services.

You have the option to add insurance when booking a ticket or choose a separate policy according to your travel needs.

If you do not choose this option, insurance can be purchased separately from insurance companies like Oona to get a policy that best suits your travel needs.

Click here to buy Oona travel insurance to make sure you are protected during your trip.

How to file a claim?

How to file a claim for your travel insurance

Before you claim.

Prepare and collate all the required documents and claim details for submission. Click here to see the required documents.

Submitting the claim online

Fill out the online claim form and upload the required documents online.

Other Ways to File a Claim

Track your claim

Claim result will be informed within 5 business days upon submissions of all required documents to Oona.

Other Ways to File a Claim

Alternately, you may reach out to our Claim Operation team through the following channels:

24 Hours Customer Support General Insurance & Roadside Assistance

WhatsApp Business

Customer Service & Claim Report

Providing quality insurance services with leading partners

Plaza Asia Lt. 27 Jl. Jend Sudirman Kav. 59 Jakarta Selatan DKI Jakarta, 12190

Follow us on social

Don’t miss out on any updates

- Car Insurance

- Travel Insurance

- Flight Delay Insurance

- Personal Accident

Legal & Compliance

- Privacy Policy

- General Terms & Conditions

Useful Links

- Branch Locators

- Corporate Governance

- Kahoona (Distribution Portal)

PT Asuransi Bina Dana Arta Tbk is licensed and supervised by the Financial Services Authority (OJK).

Copyright © 2023

OONA Insurance. All Rights Reserved.

I agree to the Terms & Conditions and Privacy Policy

Thank you for providing your details!

One of our sales experts will contact you during working hours.

Best Travel Insurance for Indonesia – Price & Requirements

Home | Travel | Asia | Indonesia | Best Travel Insurance for Indonesia – Price & Requirements

When traveling abroad, get a policy from one of the best travel insurance companies . Y ou can get a 5% discount on Heymondo , the only insurance that pays medical bills upfront for you, HERE!

Purchasing travel insurance for Indonesia should be at the top of your list of things to do before you travel. Baggage delays, flight cancellations, and illnesses are actually fairly common occurrences while traveling, so it’s smart to be prepared by having Indonesian travel insurance .

Best Travel Insurance for Indonesia – Price & Requirements

Personally, we use Heymondo insurance for all of our trips. They’ve provided our travel insurance coverage for years, and we’ve had nothing but great experiences with their team. (You can read our review of Heymondo to find out more.) Best of all, you can even get a discount on their insurance just for being a Capture the Atlas reader.

5% OFF your travel insurance

Of course, there are plenty of other great Indonesia travel insurance plans , which I’ll cover below. Most importantly, all the plans I’ll talk about are travel insurance plans with COVID-19 coverage . This guide to the best travel insurance for Indonesia contains everything you need to know, including:

Is travel insurance mandatory for Indonesia?

Indonesia travel insurance cost

- Best travel insurance for Indonesia

Do I need travel insurance for Indonesia?

Ready to learn more about Indonesia travel insurance ? Just keep reading !

Having travel insurance for Indonesia is not currently a requirement to enter the country. However, just because Indonesian travel insurance isn’t mandatory doesn’t mean purchasing some isn’t a good idea.

In fact, buying Indonesia travel insurance ensures that you’ll have coverage if you fall ill, miss a flight, lose your luggage, and more. Having travel health insurance coverage is especially important, since receiving medical treatment in Indonesia without insurance can leave you with a hefty bill to pay out of pocket (I learned this from personal experience, as you’ll find out). That’s why, ultimately, travel insurance is worth having .

Your age, nationality, and the length and cost of your trip will all affect the price of your Indonesian travel insurance . As such, if you’re interested in getting cheap travel insurance , taking a shorter trip and spending less on trip costs will save you some money.

To give you an idea of how much Indonesia travel insurance costs, I’ve used the example of a 30-year-old American from Pennsylvania who is traveling to Indonesia for a week and whose trip costs $2,500 to generate quotes from four companies.

*price used for example

As you can see from the chart above, Heymondo is the best overall option for travel insurance to Indonesia . On the other hand, if you want to save money or just need travel health insurance, SafetyWing is another fantastic choice. Of course, all four of these Indonesian travel insurance plans have their merits, so you can’t go wrong with any of them .

1. Heymondo , the best Indonesia travel insurance

Heymondo has emerged as one of the best travel insurance companies for good reason. Their travel insurance for Indonesia boasts the best travel- and medical-related coverage of all the plans I compared. Moreover, even with this high amount of coverage across all categories, the Top plan is still extremely affordable.

Best of all, you’ll never have to file a claim to get reimbursed for medical expenses. Instead, the Heymondo team will arrange payments directly with the medical center, so you won’t have to pay anything out of pocket. On top of that, the Top plan’s $0 deductible means 100% of your medical costs will be covered by Heymondo.

If you’d prefer to save a little money or just want travel health insurance for Indonesia , SafetyWing is your best bet. Otherwise, Heymondo is by far the best overall option for Indonesia travel insurance .

We have used Heymondo for years and they always provide the best customer service. You can get a discount for one of their policies just for being our reader.

2. SafetyWing , a great travel health insurance for Indonesia

If you’re looking for travel medical insurance for Indonesia , there’s no better option than SafetyWing . Not only will you benefit from an extremely affordable plan with top medical coverage, but you’ll also enjoy worldwide coverage.

Even better, if you decide to keep traveling, you can easily extend your plan and choose to have it automatically renew every month while you’re abroad. You’ll also have some limited travel-related coverage, including trip interruption and travel delay coverage, but the coverage won’t be as comprehensive as it is with an Indonesian travel insurance plan like Heymondo ’s.

Additionally, SafetyWing’s Nomad Insurance plan has a $250 deductible for medical expenses. This means you’ll have to pay $250 toward any medical bills you incur before SafetyWing covers the remaining balance. As such, it may be worth paying a little more upfront for Indonesian travel insurance so you can have a $0 deductible.

3. World Nomads , a top Indonesian travel insurance for adventurers

While World Nomads ’ Standard plan offers solid Indonesian travel insurance coverage, its main appeal is its adventure activities and sports coverage. If you’re planning on having an active trip filled with diving, surfing, and more, this travel insurance to Indonesia is a must-buy.

The Standard plan also provides good coverage in all medical- and travel-related coverage categories. It even offers a $0 deductible for medical expenses. However, you can get higher amounts of coverage in all categories for a lower price with Heymondo .

Because of this, I only recommend purchasing World Nomads’ travel insurance for Indonesia if you know you’ll be doing lots of sports and activities.

4. IMG , a reliable travel insurance to enter Indonesia

IMG is a travel insurance company that many travelers trust for everything from Cancel for Any Reason travel insurance and travel insurance for pre-existing conditions to trip cancellation insurance . As you might expect, their travel insurance for Indonesia is just as reliable as their other plans and provides a more-than-sufficient amount of coverage in all categories.

The $0 deductible for medical expenses is also a plus. Still, the IMG iTravelInsured SE plan is the most expensive of all the plans I compared, so it’s not the best choice for travelers who are trying to save money. However, the good news is that you can get even a higher amount of coverage for a lower price with Heymondo .

Indonesia travel insurance requirements

If you’re planning to purchase travel insurance for Indonesia , there are a few types of coverage your plan should include.

Emergency medical expense coverage is the most important type of coverage for any insurance plan. Of course, no one wants to get injured or fall ill while they’re traveling, but that doesn’t mean it can’t happen. Similarly, having COVID-19 coverage is key since quarantine meal and accommodation costs can add up quickly.

You should also ensure that you have evacuation and repatriation coverage. That way, your transportation fees will be covered if you need to be sent back to your home country for medical treatment or for political reasons.

Trip cancellation, trip interruption, trip delay, and baggage coverage are less crucial insurance features overall. Still, if they’re important to you, look for Indonesian travel insurance with a high amount of travel-related coverage .

As I’ve already mentioned, there’s no entry requirement to have travel insurance for Indonesia . Even so, it’s always a good idea to have travel insurance – I know from firsthand experience!

I was on a 7-day trip to Bali and visited the Sacred Monkey Forest in Ubud. There, I let one of the monkeys climb on me, and unfortunately, it bit me! Luckily, I had travel insurance for Bali , so all of my medical bills were covered. Otherwise, my medical treatment would have cost me a pretty penny.

Now, I’m not saying that you’ll also get bitten by a monkey when you visit Indonesia (I really hope not!), but my story is a great reminder that unexpected things can happen anytime while you’re traveling. That’s why it’s safest (and smartest for your wallet!) to purchase Indonesia travel insurance .

Heymondo is the best choice for most travelers since it’s affordable and offers fantastic travel- and medical-related coverage.

Another excellent option, particularly if you just need medical coverage, is SafetyWing . Either way, as long as medical expenses, COVID-19, and repatriation are covered by your Indonesian travel insurance , you’ll be all set for an amazing trip.

Don't miss a 5% discount on your HeyMondo travel insurance

and the only one that pays all your medical bills upfront for you!

Ascen Aynat

4 replies on “ Best Travel Insurance for Indonesia – Price & Requirements ”

Hi , I’m Indonesia citizen but now I follow my husband traveling for a while. So I’m looking for insurance for medical and travel included. The question is do u HV insurance who can cover medical and travel for Asia ,thx u

Yes, You can get the Heymondo insurance if you’re Indonesian and it will cover medical and travel expenses while you’re traveling abroad.

I’m Shernell Marie Horne and would like to go over my travel insurance to Spain with you. However; have just one more stop to make before of going back to the United States. I would like to add another country plus get an extension on my insurance going to Jerusalem looking moore over there for my families.!

Hi Shernell,

We’re not an insurance company but a travel blog comparing different options. Please make sure you select global coverage when booking your insurance so you make sure you’re covered in Spain and Jerusalem.

Let me know if you have any questions, Ascen

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Medical Insurance Plans

- Trip Cancellation Insurance

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Best Travel Insurance for Seniors

- Evacuation Insurance Plans

- International Life Insurance for US Citizens Living Abroad

- The Importance of a Life Insurance Review for Expats

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Health Insurance Plan

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- Trawick Safe Travels USA

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

Indonesia Travel Insurance and Safety Advice

Indonesia travel safety for visitors.

Do I Need Travel Insurance for Indonesia?

Visitors to Indonesia should have comprehensive travel insurance , with both trip and medical coverage. This applies to all trips to Indonesia, from a week at a resort to a six-month stint as a digital nomad. Visitors may need medical care after vehicle accidents, serious sunburn and heatstroke, and tropical and gastro diseases. While as of December 2022, Indonesia does not require visitors to hold health insurance or travel insurance, it is still a good idea for many reasons.

Indonesia’s healthcare system ranks 45th out of 195 countries, according to the Global Health Security Index . This means that for more complex medical issues, travelers may need to be transported back to their home country for care. Make sure that your travel health insurance includes repatriation, which means transport back to your home country for advanced care.

Indonesia is also home to several active volcanoes and regularly experiences earthquakes and tsunamis. Volcanic eruptions shut down or delayed air travel to Indonesia in 2015, 2017, and 2019. Further travel disruptions can come from political unrest within Indonesia, too. Travel insurance can help with these issues.

Many tourists visit Indonesia for an international experience that is both fun and affordable. But even budget backpackers can and should protect themselves with travel insurance for Indonesia. Australia’s official SmartTraveller site says frankly, “If you can’t afford travel insurance, you can’t afford to travel. This applies to everyone, no matter how healthy and fit you are. If you’re not insured, you may have to pay many 1000s of dollars up-front for medical care.”

Best Travel Insurance for Visitors to Indonesia

Here are options for international health and travel insurance for Indonesia. When you contact an insurer, tell them how long your trip or stay will be and what types of activities you plan to do. Someone spending a week in Balinese spas will have different insurance needs than a hiker exploring Indonesia’s national parks.

- Emergency medical, evacuation, repatriation benefits

- Choose between the basic and more extensive coverage

- Meets Schengen visa insurance requirements

- 24/7 worldwide travel and emergency medical assistance

Best Insurance for Adventure Travel in Indonesia

SafeTreker Adventure Sports Coverage

- Valid for US residents

- Coverage for over 450+ sports and activities

- Emergency medical coverage

Related: Health Insurance in Indonesia

Medical Preparation for Travel to Indonesia

If you have medical needs or prescriptions, here’s how to prepare for travel to Indonesia.

What Vaccinations Do I Need for Travel to Indonesia?

To go to Indonesia from September 2022, you must provide proof of COVID-19 vaccination , preferably as a certificate. Indonesia has released a new mobile app called SatuSehat, which replaces the previous mandatory app PeduliLindungi; however it is not clear at this time that tourists will need to download the app. The Ministry of Health in Indonesia uses this app to accelerate sharing treatment and more for COVID-19.

Starting on June 9, 2023, the Indonesian Government no longer requires proof of vaccination. However, the U.S. Centers for Disease Control recommends important vaccinations if you’re visiting Indonesia, including tetanus, Hepatitis A and B, and typhoid.

How to Bring Medications to Indonesia

You can bring over-the-counter medications to Indonesia without filling out any forms. However, to bring prescription medications to Indonesia, you must document them in detail.

Indonesia wants you to provide evidence that your medication is prescribed to you and that you need it. This is especially important for painkillers and for psychiatric drugs. Common medications that Indonesia prohibits include Tramadol, oxycodone, codeine, morphine and anything containing amphetamines (ADHD medication is in this category).

What do you need to do to bring prescribed medications with you to Indonesia?

- Before your trip, get a letter from your doctor and copies of your prescriptions. This is to confirm that your medication is prescribed to you and that you need it. You may also need to provide a travel itinerary. This letter and your travel boarding pass should have the same name on them. The letter should make it clear that this medication will be used only by you.

- You will then be asked to declare your medication with a customs declaration supported by your letter from your doctor.

- If you are traveling from some countries, such as Australia, or if your medication is complicated, your Indonesian consulate may want you to provide this documentation before you travel. In return, you will get a Certified Letter of Approved Medicines, written in Indonesian, that grants you permission to bring and carry your medications.

- Travel with copies of your letter from your doctor and of your prescriptions. Bring your medications in their original packaging, and bring only the amount that you need for your trip.

Indonesian Customs has the power to make a final decision about whether your medication is or is not allowed. Importantly, don’t bring medical THC or marijuana. They are not considered medications and are not legal in Indonesia.

Also Read: Checklist for Traveling with Prescription Medication Overseas

How to Access Medical Care in Indonesia for Visitors

Indonesia’s health care system is split between basic government health care and private health care supported by health insurance. Government health care is limited and may not provide the most current or thorough care. Visitors to major centers can expect to use private health care.

In Indonesia, a doctor’s visit at a private clinic or hospital ranges from $30 to $70 USD. Seek a healthcare provider who speaks your language. Major cities and tourist areas usually have an English-speaking healthcare clinic or hospital. These providers are often used to working with international health insurers, too.

If you need emergency care in Indonesia, be prepared. You can expect to pay fees for ambulance service from a private ambulance service. Seek a 24-hour clinic or hospital that speaks your language.

Major cities have some foreign pharmacies. In Indonesian, a pharmacy is called an apotik . A good apotik will have a doctor on site who can issue prescriptions. You may see medications for sale at roadside stalls – these are usually counterfeit and not recommended.

Traveling in rural or wilderness areas of Indonesia? Follow your usual medical precautions and bring everything you might need in case of an emergency. There is a shortage of medical care and emergency medical transport in rural areas. If you need medical care often, stick to major centers in Indonesia instead.

Related: Understanding Indonesia’s Health Care System

Travel Warnings and Alerts for Indonesia

International travelers need to be aware of travel warnings and alerts. Good news sources for Indonesia include the BBC, Al-Jazeera, and the Jakarta Post.

U.S. travelers can sign up for the US Smart Traveler Enrollment Program . Enroll your trip and get alerts during your time in Indonesia.

Websites with important alerts for Indonesia include:

- Australian government Smartraveller Indonesia page

- US Department of State Indonesia page

- UK Foreign Travel Advice Indonesia section

- Government of Canada travel advisory page for Indonesia

- Singapore Ministry of Foreign Affairs page

Emergency Contact Information for Indonesia

Here’s a quick guide to emergency phone numbers for Indonesia.

Emergency Assistance Numbers in Indonesia

These phone numbers will help you in cities, small towns, and national parks in Indonesia.

- Fast Medical Assistance – 118 or 119

- Search and Rescue – 115

- Police Department – 110

- Fire Department – 113

- Tourism Information – 116

Also, see the Indonesian government’s site for visitors and their “How do I make calls in Indonesia” page .

Embassy Phone Numbers in Indonesia

This list has phone numbers and links for English-language embassies in Jakarta, Indonesia’s capital city. Links also include information about consulates in other parts of Indonesia, especially Bali.

- United States: +62-21-5083-1000, press 1 for assistance, see U.S. Embassy page for consulate contacts

- Australia: +62-21-2550-5555; see Australian Embassy page for consulate contacts.

- New Zealand: +62-21-299-55800; for after-hours or consulate contacts, see the related NZ diplomatic web page .

- Canada: + 62-21-2550-7800; for consular contacts, see the Canada Travel Destinations page.

- United Kingdom: +62 (21) 2356 5200 for urgent help from the U.K.; for more, see the UK help and services in Indonesia page .

Tips for Safe Travel in Indonesia

Seven Safety Tips for All of Indonesia

- Only drink bottled water. Don’t drink tap water in Indonesia in any form. Ice in drinks, fruit or vegetables washed in tap water, or even water in your mouth in the shower can introduce gastro bugs to your system.

- Avoid food poisoning; be careful about what and where you eat. Food poisoning happens so often in Indonesia that Australian travelers call it “Bali belly.”

- Watch your valuables. Bag snatching and pickpocketing are common in tourist areas – the most common crime is the theft of mobile phones. Do not leave belongings on a beach to swim or wade and expect to find them there when you return!

- Indonesia has a hot, tropical climate. Protect yourself with sunscreen, hats, insect repellent, and water bottles with safe water. If you are not sleeping in a closed or screened room, do your best to sleep protected by a mosquito net. Mosquito bites here can transmit malaria and dengue fever.

- Be aware of Indonesia’s laws and social beliefs, especially if traveling alone. While Indonesia is hot and tropical, it is a predominantly Muslim country. Modest, covered dress and good manners help travelers blend in. Indonesia has very strict laws against recreational drugs of any kind, including marijuana, CBD and THC products. Some provinces in Indonesia criminalize consensual same-sex activity . There is also much prejudice against LGBTQIA people, which can lead to harassment.

- Be careful around animals. Stray dogs and wild monkeys may beg for food or follow you, but they can be rabid or carry flea and tick diseases.

- Women traveling solo should take extra precautions. Women travelers on their own report problems with sexual harassment from locals and other visitors. Women can support their personal security with a door stopper or lock, an attention-grabbing whistle, and a budget for more upscale lodging and transport.

Is Bali Safe? Yes, But Watch Out for Scams

Bali is one of the safest places in Indonesia for visitors. English speakers can find most essential services, including medical care, from English-speaking providers. Bali is also one of the world’s top tourist destinations. And if there’s a tourist scam going on, you will find it in Bali. See what SmartTraveller.gov.au has to say about tourist scams and how to protect yourself .

For more Bali safety, be aware that tourists also get into trouble with accidents and thefts while riding rental scooters. It’s easy to have a bag snatched while you are on a scooter. Also, be careful in Bali’s party district, Kuta, especially with mobile phones.

Use Urban Precautions for Safety in Jakarta

Visiting Jakarta? Use all your precautions for visiting a risky urban area. Jakarta has a low safety rating among Asian cities . Distracted or tired visitors are at risk of pickpockets, scams, and long travel delays. Avoid taxis that don’t use meters. Be careful around traffic, especially when crossing busy streets. Foreigners should avoid certain neighborhoods, such as West Jakarta and Blok M in southern Jakarta.

Another risk in Jakarta is ATM crime, where your account is skimmed after using an ATM card. Only use ATM machines directly located at and supervised by banks.

Safe Travel Around Volcanoes and Quakes in Indonesia

Over the past decade, volcanic eruptions have often interfered with travel to and from Indonesia. Be wary about visiting or hiking near any volcanoes that have been showing signs of activity. Prepare in advance by buying travel insurance for Indonesia to cover any disruptions.

Quakes happen too in Indonesia, and they can cause tsunami flooding along the coastline. Indonesia was impacted by the Boxing Day Tsunami of 2004, and other tsunamis have caused damage and death in visitor areas as recently as 2018.

Basic quake safety is to drop, cover, and hold on. If you are near the beach or a coastline, if the quake is “long or strong, get gone” to avoid being in a tsunami zone. The United States Geological Survey provides good quake and tsunami safety guidelines .

Related: What To Do If You Experience a Natural Disaster Abroad

Indonesia Adventure Travel: Get Serious About Safety

Indonesia’s rural areas hold treasures of culture and nature. UNESCO World Heritage sites and national parks beckon adventurers. You may also travel to rural Indonesia as a volunteer, a researcher, or for work. Be prepared and research what your venture needs. If you are traveling for fun or wilderness challenges, seriously consider a tour or traveling with a group.

Be diligent about safety in the ocean, when traveling by boat or on dirt roads, and in the wilderness, where you can encounter wildlife, including poisonous snakes. Crime and terrorism happen in remote areas here. Bring any medications you need, a first aid kit, and spare supplies for tropical conditions. A satellite tracker is a great item for hikers or kayakers to have. Learning essential Indonesian will help you in emergencies.

Enjoy Indonesia and Stay Savvy

In 2019, over 16 million people visited Indonesia. Almost all of them had a safe and positive experience – and many of them want to return. With changes to travel after 2020, including new digital nomad visas, savvy voyagers know that travel insurance for Indonesia will protect them, whatever adventures they choose.

- Best Hospitals in Indonesia for Expats and Visitors

- Adventure Travel: Does My Health Insurance Cover Me For That?

- Health Insurance Plans in Asia

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

AIG Travel Insurance Indonesia

A complete travel protection that covers flight delay, trip cancellation, 24/7 worldwide assistance & more.

Travel Insurance for Indonesia

With an astounding number of more than 17,000 islands and over 300 languages spoken across the country, Indonesia offers a diverse and dramatic landscape that attracts visitors with its white sandy beaches and coral reefs in the islands of Pulau Banyak, remote jungle trekking with volcanic vistas in the Kerinci Seblat National Park, lush green rice terraces in Tegalalang and the oldest and largest ancient shrines in Gunung Kawi. A trip to Indonesia is not complete without a visit to the Komodo National Park, declared as one of the new seven wonders of nature, a sprawling natural preserve that protects the world’s only living dragons from extinction.

Public transportation is the cheapest way to get around and local food is extremely cheap compared to western food, so you can lepak and enjoy a new variety of Asian cuisine on your trip. Don’t be afraid to say ‘mahal’ (expensive) as most prices offered by sellers here can be bargained or haggled for lower price. If you intend to hop around using local airlines, book flights through local travel agents as non-Indonesian credit cards are not accepted online. If you’re one of many that has made a beeline to Bali for an island holiday, do consider getting travel insurance to Bali, especially if you are volcano trekking to Mount Batur for stunning views and sceneries!

Why do you need Travel Insurance to Indonesia?

By covering yourself with AIG travel insurance, all your concerns during travel will be taken care of, for example, if you met with an unexpected accident, your trip had to be canceled due to unforeseen circumstances, or your personal belongings stolen when you’re there; you can be rest assured that we’ll take care of you by reimbursing the expenses and by ensuring that you won’t need to worry about these inconveniences.

Buy Travel Insurance for Indonesia with AIG

Purchase AIG travel insurance for Indonesia online and you will easily obtain comprehensive protection in just a few clicks. From as low as RM30, AIG travel insurance even covers trip cancellation, so even if you are forced to cancel or cut short your trip for reasons covered under our policy, your expenses will be covered and reimbursed seamlessly for your convenience.

Our benefits include:

Comprehensive coverage

Besides overseas emergency medical expenses, medical evacuation costs and personal accident coverage, AIG will provide cover if you are forced to cancel or cut short your trip for reasons covered under our policy. Any flight departure delays, baggage delays, baggage damage or loss, personal items damage or loss due to theft or negligence by service providers, AIG will cover for you.

Medical & Personal Accident Cover

Depending on the plan and product purchased, AIG will cover up to unlimited medical expenses and up to RM 500,000 for personal accidents in Indonesia. Our travel assistance team is on call by phone 24/7 to assist you in any emergency situation, ensuring that you receive appropriate medical care in Indonesia.

Trip Cancellation Cover

AIG will reimburse you for non-refundable expenses incurred if your trip to Australia is cancelled due to specific events, within 60 days before your departure date.

Natural Disasters

If natural disasters occur in Indonesia such as earthquakes, floods or volcano eruptions, AIG will pay for expenses caused by these travel inconveniences.

Travel Inconvenience

If you experience travel inconveniences such as delays, loss or damage to your personal belongings, including your checked-in baggage, you will be covered by AIG.

AIG Global Assistance Service

Our 24-hour Emergency Assistance Team delivers fast and efficient aid if you are injured during an accident or if you are ill, requiring hospitalization in Indonesia.

Helplines during emergency in Indonesia

If you are insured with AIG when you travel in Indonesia, keep our 24/7 contact no. 603-27725600 with you at all times to process claims and medical emergencies.

Dial 110 for police, 118 for ambulance and 113 for fire.

Contact details of Embassy of Malaysia in Indonesia: Address : Jl. H.R. Rasuna Said, Kav.X/6, No. 1-3, Kuningan, 12950, Jakarta Selatan Phone: (6221)5224947 Fax: (6221)5224974

Secure your journey to Indonesia with peace of mind. Get your travel insurance now! For more information about our other insurance products, click here

Want to know more about AIG Travel Insurance?

Read in detail about:

- 24/7 Travel Assistance Service

- Download & Claims

Tel: 1800 88 8811

Email: [email protected]

- Travel Insurance

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Travel Insurance For Indonesia: Everything You Need To Know

Updated: Apr 4, 2024, 12:32pm

Table of Contents

Travel insurance for indonesia, what does travel insurance for indonesia cover, does travel for indonesia cover all emergencies, will an insurer cover me if i have a medical condition, cost of travel insurance for indonesia, how do i compare travel insurance for indonesia, frequently asked questions (faqs).

While Indonesia may be most famous for its tourist hub, Bali , the archipelago, as a whole, has grown in popularity in recent months. The Australian Bureau of Statistics (ABS) reported Indonesia replacing New Zealand as the top destination for short-term trips overseas by Australians last year—the first time since the Bureau started collecting travel records nearly 50 years ago.

Roughly 1.37 million Australians visited Indonesia in 2023. While some 86% took a holiday there, 7% visited friends or relatives. Whatever your reason for visiting the country, you’ll want to make sure you’re safeguarded against common mishaps that can arise while away, and even in the lead up to your holiday. Travel insurance for Indonesia can provide this protection, paying out should you fall ill or get injured and need treatment during your stay, if you lose your baggage or belongings or need to cancel your trip. Find out exactly how travel insurance for Indonesia works, what it covers and does not cover below.

If you’re sticking solely to Bali and its associated islands, then you can read more in our guide to travel insurance for the island of the gods.

Featured Partners

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

On Cover-more’s secure website

Unlimited, with a $2000 limit to dental

Yes, amount chosen by customer

Southern Cross Travel Insurance

Medical Cover

Including medical treatment, doctors’ visits, prescribed medication, specialist treatment & medical transport costs

$2,500 with option to increase to unlimited

If you’re planning to visit Indonesia, you’ll need travel insurance specifically for the destination. There are three main types to choose from:

- Single trip: for a one-off trip in the space of 12 months to Indonesia

- Annual multi-trip: for more than one trip in the space of 12 months to Indonesia or various destinations. This type of cover can work out more cost-effective than buying multiple single trip policies but not always so it’s best to compare both types of cover.

- Long-stay/backpacker: for an extended stay in Indonesia, of typically 60 or 90 days, or 12 or 18 months. Cover for 24 months may be available, from certain providers.

Depending on the insurer, and the type of policy you choose, you may have the option to take out cover for Indonesia alone, Asia or worldwide destinations. Note that insurers usually offer worldwide policies that include the US and destinations such as Canada, Greenland Mexico and the Caribbean, and worldwide policies that exclude them, depending on where you’re going, as medical costs are extremely high in this part of the world.

A good travel insurance policy will cover emergency medical costs should you fall ill or injure yourself while away. This may also extend to medical rescue, and repatriation costs, for severe cases where you need transporting to a hospital or back to Australia.

Cover for personal liability should you injure someone or damage another person’s property, and trip cancellation for reasons such as falling ill before the trip or suffering a bereavement should also be included as standard. You should also be able to claim for loss or theft of your luggage and belongings. Note that there’s typically a total limit on the amount you can claim for your possessions, as well as an individual limit for each type of item.

A policy may additionally include a number of other forms of cover, such as:

- Personal money: the amount that can be claimed if your money is lost or stolen

- Missed departure: covers the cost of additional accommodation and travel should an emergency cause the policyholder to miss their journey

- Travel delay: pays out if your scheduled transport is late by typically a least 12 hours

- Company insolvency: compensates you if your airline or hotel goes bust

- Personal accident: pays out if an injury causes permanent disability or death

Insurers usually offer basic policies with few benefits and low cover levels and comprehensive policies that provide their widest range of cover and higher cover levels. They may also have one or more mid-level policies for anything in between.

Shopping around will allow you to find the best policy to suit your needs and budget. For help with finding a comprehensive policy, we’ve conducted in-depth research to find what we believe are the top 10 available .

It may be impossible for travel insurance for Indonesia to cover everything that can go wrong with a holiday, but it can cover a wide range of common scenarios, particularly if you opt for comprehensive cover. A policy’s product disclosure statement (PDS) sets out the specifics of what it does and does not cover. You should be able to access this on the insurer’s website, and read it before making a decision on whether it’s right for you.

Bear in mind that most insurers won’t cover a holiday where you’ve travelled to parts of Indonesia that the government’s Smartraveller website has on its “do not travel” list. To avoid this type of problem, it’s best to check the website for updates on Indonesia before purchasing a policy, and before departure. Smarttraveller will also advise if you should travel with caution, warning of risks, such as acts of terrorism, civil and political unrest and natural disasters.

Insurers will also likely reject claims resulting from intoxication from alcohol or drugs, and disorderly behaviour. If you’ve partaken in any sports and activities while away, it’s likely an insurer will only accept related injury claims if you wore the appropriate safety gear, such as a helmet, or harness.

Having a medical condition won’t necessarily hinder your chances of finding suitable cover for Indonesia, but you may find you’ll have to shop around a little more.

Only some insurers provide cover for what they term “pre-existing medical conditions”. These are conditions that you had before taking out the policy. Those that do provide this type of cover usually raise their premiums to do so, owing to the heightened risk that you’ll make a medical-related claim while away. The policy premium—the price of the policy—will often rise with the severity of a condition. This means cover for a heart condition will be more expensive than for diabetes, for example.

When running quotes on the sites of insurers that provide pre-existing medical cover, you’ll be taken to a medical screening section of the application. Make sure to state what conditions you have and answer the questions about them. This ranges from whether, and how often you take medication, to when you last saw a practitioner concerning your condition. If you later make a claim relating to a condition that you did not declare or detailed inaccurately, an insurer could refuse it.

Insurers refer to a number of factors when calculating how much you must pay for cover. This includes the number of people travelling, and the holiday destination and duration.

More mature travellers and those with pre-existing conditions will likely be charged more than younger travellers and those without conditions, as insurers deem them as high-risk travellers that will likely need to claim while away.

We used the profile of a family of four, aged 42, 40, 14 and 12, spending 13 to 26 May in Indonesia, and assumed they have no pre-existing conditions, (although these providers do offer cover for pre-existing conditions should you need it).

We found basic cover ranged from around $106 to $241, while comprehensive cover started at around $226, with the most expensive policy costing just under $324.

Running quotes on travel insurer websites will allow you to make side-by-side comparisons of their policies based on the types of cover they offer, the various cover levels and prices. Looking through the offerings of a number of insurers can help with finding a deal on the cover you need.

When running a quote you will need to enter details about yourself, anyone else travelling with you and your trip. This includes your name, the age of all travellers, your holiday destination and duration. If pre-existing cover is available, you will also be taken through a medical screening, so the insurer can build a medical profile on each traveller.

Is travel insurance mandatory for Indonesia?

Travel insurance is not a legal requirement for travelling to Indonesia. However, it is recommended by Smartraveller, which advises taking out a comprehensive policy that covers all emergency medical costs, including emergency treatment and medical evacuation. Without it, you could be faced with bills for thousands of dollars, which the Australian government will not pay.

What is required to enter Indonesia from Australia?

Australians visiting or transiting through Indonesia should apply for an e-Visa on arrival , at least 48 hours before travelling. You can alternatively get a Visa on Arrival at some international airports, seaports or land crossings.

To apply for an e-Visa on arrival or the Visa on arrival, you need to have an ordinary (non-emergency) passport that will remain valid at least six months after your arrival in Indonesia. Smarttraveller also advises ensuring your passport has a minimum six months validity from your departure from Indonesia, to avoid any issues with leaving the country or with an onward or return flight. You’ll also need to complete an e-customs declaration within three days of departure to Indonesia.

The Bali Provincial Government has introduced a tourist levy of IDR 150,000 ($14.56 AUD) per person for foreign tourists visiting Bali. The levy is separate from the e-Visa on Arrival or the Visa on Arrival. You can pay the levy online before you travel or on arrival at a designated payment counter at Bali’s airport and seaport. Further detail can be found on the Bali Provincial Government’s website .

What is ‘excess’ in travel insurance?

An excess is a set amount you’ll be expected to pay on each approved claim. It’s usually levied per person on the policy, per event, per claim, but you can check the PDS for the specifics concerning your insurer. You usually can pick from a range of excess amounts, from $50 – $250 on average, when taking out a policy.

The more you choose to pay in excess, the lower your policy premium typically will be, while paying less in excess will raise the cost. An excess is usually deducted from a claim amount, so you won’t need to pay for it out of pocket. However, it’s still crucial that you ensure you can afford it. Some insurers may also offer an excess waiver if you pay an extra premium.

- Best Comprehensive Travel Insurance

- Best Seniors Travel Insurance

- Best Domestic Travel Insurance

- Best Cruise Travel Insurance

- Best Family Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance Cancellation Cover

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance For Japan

- Travel Insurance For Europe

- Travel Insurance For Singapore

- Travel Insurance For Vietnam

- Travel Insurance For Canada

- Travel Insurance For South Africa

- Cover-More Travel Insurance Review

- Fast Cover Travel Insurance Review

- Travel Insurance Saver Review

- Allianz Comprehensive Travel Insurance Review

- 1Cover Comprehensive Travel Insurance Review

- Australia Post Comprehensive Travel Insurance Review

- Tick Travel Insurance Review

More from

Travel insurance for the usa: a guide, best student travel insurance, travel insurance and covid: are you covered, top travel insurance tips for australians, our pick of the best comprehensive travel insurance providers in australia, do frequent flyer points expire.

I have been writing for newspapers, magazines and online publications for over 10 years. My passion is providing, in a way that is easily accessible and digestible to all, the knowledge needed for readers to not only manage their finances, but financially flourish.

The World’s Trusted Company

Rating based on more than 1,000 reviews from around the world

Call, we're online

- Water Skiing

- Kitesurfing

- Wakeboarding

- Windsurfing

- Snowboarding

- Ice Climbing

- Snowmobiling

- Hang Gliding

- Paragliding

- Hot Air Balloon

- Mountain Hiking

- Rock Climbing

- Mountain Biking

- Cycling Travel

- Bungee Jumping

- Base Jumping

- Horse Riding

- Motorsports

- American Football

- Dominican Republic

- Czech Republic

- Switzerland

- Netherlands

- United Kingdom

- South Africa

- Philippines

- Saudi Arabia

- South Korea

- New Zealand

- Multi trip insurance

- Single trip insurance

- Annual travel insurance

- Group travel insurance

- Schengen travel insurance

- Travel insurance for visas

- Worldwide insurance

- Top Up Travel Insurance

- Legal information

- Validate insurance policy

Cooperate with us

- --> --> -->

#1.6 crore+.

Happy Customers

Cashless Hospitals

24x7 In-house

Claim Assistance

Travel Insurance for Indonesia