The future of tourism: Bridging the labor gap, enhancing customer experience

As travel resumes and builds momentum, it’s becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. —a number made more significant because it was reached without travelers from China, which had the world’s largest outbound travel market before the pandemic. 2 “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Recovery and growth are likely to continue. According to estimates from the World Tourism Organization (UNWTO) for 2023, international tourist arrivals could reach 80 to 95 percent of prepandemic levels depending on the extent of the economic slowdown, travel recovery in Asia–Pacific, and geopolitical tensions, among other factors. 3 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. Similarly, the World Travel & Tourism Council (WTTC) forecasts that by the end of 2023, nearly half of the 185 countries in which the organization conducts research will have either recovered to prepandemic levels or be within 95 percent of full recovery. 4 “Global travel and tourism catapults into 2023 says WTTC,” World Travel & Tourism Council (WTTC), April 26, 2023.

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022 , WTTC, August 2022.

So, is it all systems go for travel and tourism? Not really. The industry continues to face a prolonged and widespread labor shortage. After losing 62 million travel and tourism jobs in 2020, labor supply and demand remain out of balance. 6 “WTTC research reveals Travel & Tourism’s slow recovery is hitting jobs and growth worldwide,” World Travel & Tourism Council, October 6, 2021. Today, in the European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022.

There has been an exodus of tourism staff, particularly from customer-facing roles, to other sectors, and there is no sign that the industry will be able to bring all these people back. 8 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022. Hotels, restaurants, cruises, airports, and airlines face staff shortages that can translate into operational, reputational, and financial difficulties. If unaddressed, these shortages may constrain the industry’s growth trajectory.

The current labor shortage may have its roots in factors related to the nature of work in the industry. Chronic workplace challenges, coupled with the effects of COVID-19, have culminated in an industry struggling to rebuild its workforce. Generally, tourism-related jobs are largely informal, partly due to high seasonality and weak regulation. And conditions such as excessively long working hours, low wages, a high turnover rate, and a lack of social protection tend to be most pronounced in an informal economy. Additionally, shift work, night work, and temporary or part-time employment are common in tourism.

The industry may need to revisit some fundamentals to build a far more sustainable future: either make the industry more attractive to talent (and put conditions in place to retain staff for longer periods) or improve products, services, and processes so that they complement existing staffing needs or solve existing pain points.

One solution could be to build a workforce with the mix of digital and interpersonal skills needed to keep up with travelers’ fast-changing requirements. The industry could make the most of available technology to provide customers with a digitally enhanced experience, resolve staff shortages, and improve working conditions.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

Complementing concierges with chatbots.

The pace of technological change has redefined customer expectations. Technology-driven services are often at customers’ fingertips, with no queues or waiting times. By contrast, the airport and airline disruption widely reported in the press over the summer of 2022 points to customers not receiving this same level of digital innovation when traveling.

Imagine the following travel experience: it’s 2035 and you start your long-awaited honeymoon to a tropical island. A virtual tour operator and a destination travel specialist booked your trip for you; you connected via videoconference to make your plans. Your itinerary was chosen with the support of generative AI , which analyzed your preferences, recommended personalized travel packages, and made real-time adjustments based on your feedback.

Before leaving home, you check in online and QR code your luggage. You travel to the airport by self-driving cab. After dropping off your luggage at the self-service counter, you pass through security and the biometric check. You access the premier lounge with the QR code on the airline’s loyalty card and help yourself to a glass of wine and a sandwich. After your flight, a prebooked, self-driving cab takes you to the resort. No need to check in—that was completed online ahead of time (including picking your room and making sure that the hotel’s virtual concierge arranged for red roses and a bottle of champagne to be delivered).

While your luggage is brought to the room by a baggage robot, your personal digital concierge presents the honeymoon itinerary with all the requested bookings. For the romantic dinner on the first night, you order your food via the restaurant app on the table and settle the bill likewise. So far, you’ve had very little human interaction. But at dinner, the sommelier chats with you in person about the wine. The next day, your sightseeing is made easier by the hotel app and digital guide—and you don’t get lost! With the aid of holographic technology, the virtual tour guide brings historical figures to life and takes your sightseeing experience to a whole new level. Then, as arranged, a local citizen meets you and takes you to their home to enjoy a local family dinner. The trip is seamless, there are no holdups or snags.

This scenario features less human interaction than a traditional trip—but it flows smoothly due to the underlying technology. The human interactions that do take place are authentic, meaningful, and add a special touch to the experience. This may be a far-fetched example, but the essence of the scenario is clear: use technology to ease typical travel pain points such as queues, misunderstandings, or misinformation, and elevate the quality of human interaction.

Travel with less human interaction may be considered a disruptive idea, as many travelers rely on and enjoy the human connection, the “service with a smile.” This will always be the case, but perhaps the time is right to think about bringing a digital experience into the mix. The industry may not need to depend exclusively on human beings to serve its customers. Perhaps the future of travel is physical, but digitally enhanced (and with a smile!).

Digital solutions are on the rise and can help bridge the labor gap

Digital innovation is improving customer experience across multiple industries. Car-sharing apps have overcome service-counter waiting times and endless paperwork that travelers traditionally had to cope with when renting a car. The same applies to time-consuming hotel check-in, check-out, and payment processes that can annoy weary customers. These pain points can be removed. For instance, in China, the Huazhu Hotels Group installed self-check-in kiosks that enable guests to check in or out in under 30 seconds. 9 “Huazhu Group targets lifestyle market opportunities,” ChinaTravelNews, May 27, 2021.

Technology meets hospitality

In 2019, Alibaba opened its FlyZoo Hotel in Huangzhou, described as a “290-room ultra-modern boutique, where technology meets hospitality.” 1 “Chinese e-commerce giant Alibaba has a hotel run almost entirely by robots that can serve food and fetch toiletries—take a look inside,” Business Insider, October 21, 2019; “FlyZoo Hotel: The hotel of the future or just more technology hype?,” Hotel Technology News, March 2019. The hotel was the first of its kind that instead of relying on traditional check-in and key card processes, allowed guests to manage reservations and make payments entirely from a mobile app, to check-in using self-service kiosks, and enter their rooms using facial-recognition technology.

The hotel is run almost entirely by robots that serve food and fetch toiletries and other sundries as needed. Each guest room has a voice-activated smart assistant to help guests with a variety of tasks, from adjusting the temperature, lights, curtains, and the TV to playing music and answering simple questions about the hotel and surroundings.

The hotel was developed by the company’s online travel platform, Fliggy, in tandem with Alibaba’s AI Labs and Alibaba Cloud technology with the goal of “leveraging cutting-edge tech to help transform the hospitality industry, one that keeps the sector current with the digital era we’re living in,” according to the company.

Adoption of some digitally enhanced services was accelerated during the pandemic in the quest for safer, contactless solutions. During the Winter Olympics in Beijing, a restaurant designed to keep physical contact to a minimum used a track system on the ceiling to deliver meals directly from the kitchen to the table. 10 “This Beijing Winter Games restaurant uses ceiling-based tracks,” Trendhunter, January 26, 2022. Customers around the world have become familiar with restaurants using apps to display menus, take orders, and accept payment, as well as hotels using robots to deliver luggage and room service (see sidebar “Technology meets hospitality”). Similarly, theme parks, cinemas, stadiums, and concert halls are deploying digital solutions such as facial recognition to optimize entrance control. Shanghai Disneyland, for example, offers annual pass holders the option to choose facial recognition to facilitate park entry. 11 “Facial recognition park entry,” Shanghai Disney Resort website.

Automation and digitization can also free up staff from attending to repetitive functions that could be handled more efficiently via an app and instead reserve the human touch for roles where staff can add the most value. For instance, technology can help customer-facing staff to provide a more personalized service. By accessing data analytics, frontline staff can have guests’ details and preferences at their fingertips. A trainee can become an experienced concierge in a short time, with the help of technology.

Apps and in-room tech: Unused market potential

According to Skift Research calculations, total revenue generated by guest apps and in-room technology in 2019 was approximately $293 million, including proprietary apps by hotel brands as well as third-party vendors. 1 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. The relatively low market penetration rate of this kind of tech points to around $2.4 billion in untapped revenue potential (exhibit).

Even though guest-facing technology is available—the kind that can facilitate contactless interactions and offer travelers convenience and personalized service—the industry is only beginning to explore its potential. A report by Skift Research shows that the hotel industry, in particular, has not tapped into tech’s potential. Only 11 percent of hotels and 25 percent of hotel rooms worldwide are supported by a hotel app or use in-room technology, and only 3 percent of hotels offer keyless entry. 12 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. Of the five types of technology examined (guest apps and in-room tech; virtual concierge; guest messaging and chatbots; digital check-in and kiosks; and keyless entry), all have relatively low market-penetration rates (see sidebar “Apps and in-room tech: Unused market potential”).

While apps, digitization, and new technology may be the answer to offering better customer experience, there is also the possibility that tourism may face competition from technological advances, particularly virtual experiences. Museums, attractions, and historical sites can be made interactive and, in some cases, more lifelike, through AR/VR technology that can enhance the physical travel experience by reconstructing historical places or events.

Up until now, tourism, arguably, was one of a few sectors that could not easily be replaced by tech. It was not possible to replicate the physical experience of traveling to another place. With the emerging metaverse , this might change. Travelers could potentially enjoy an event or experience from their sofa without any logistical snags, and without the commitment to traveling to another country for any length of time. For example, Google offers virtual tours of the Pyramids of Meroë in Sudan via an immersive online experience available in a range of languages. 13 Mariam Khaled Dabboussi, “Step into the Meroë pyramids with Google,” Google, May 17, 2022. And a crypto banking group, The BCB Group, has created a metaverse city that includes representations of some of the most visited destinations in the world, such as the Great Wall of China and the Statue of Liberty. According to BCB, the total cost of flights, transfers, and entry for all these landmarks would come to $7,600—while a virtual trip would cost just over $2. 14 “What impact can the Metaverse have on the travel industry?,” Middle East Economy, July 29, 2022.

The metaverse holds potential for business travel, too—the meeting, incentives, conferences, and exhibitions (MICE) sector in particular. Participants could take part in activities in the same immersive space while connecting from anywhere, dramatically reducing travel, venue, catering, and other costs. 15 “ Tourism in the metaverse: Can travel go virtual? ,” McKinsey, May 4, 2023.

The allure and convenience of such digital experiences make offering seamless, customer-centric travel and tourism in the real world all the more pressing.

Three innovations to solve hotel staffing shortages

Is the future contactless.

Given the advances in technology, and the many digital innovations and applications that already exist, there is potential for businesses across the travel and tourism spectrum to cope with labor shortages while improving customer experience. Process automation and digitization can also add to process efficiency. Taken together, a combination of outsourcing, remote work, and digital solutions can help to retain existing staff and reduce dependency on roles that employers are struggling to fill (exhibit).

Depending on the customer service approach and direct contact need, we estimate that the travel and tourism industry would be able to cope with a structural labor shortage of around 10 to 15 percent in the long run by operating more flexibly and increasing digital and automated efficiency—while offering the remaining staff an improved total work package.

Outsourcing and remote work could also help resolve the labor shortage

While COVID-19 pushed organizations in a wide variety of sectors to embrace remote work, there are many hospitality roles that rely on direct physical services that cannot be performed remotely, such as laundry, cleaning, maintenance, and facility management. If faced with staff shortages, these roles could be outsourced to third-party professional service providers, and existing staff could be reskilled to take up new positions.

In McKinsey’s experience, the total service cost of this type of work in a typical hotel can make up 10 percent of total operating costs. Most often, these roles are not guest facing. A professional and digital-based solution might become an integrated part of a third-party service for hotels looking to outsource this type of work.

One of the lessons learned in the aftermath of COVID-19 is that many tourism employees moved to similar positions in other sectors because they were disillusioned by working conditions in the industry . Specialist multisector companies have been able to shuffle their staff away from tourism to other sectors that offer steady employment or more regular working hours compared with the long hours and seasonal nature of work in tourism.

The remaining travel and tourism staff may be looking for more flexibility or the option to work from home. This can be an effective solution for retaining employees. For example, a travel agent with specific destination expertise could work from home or be consulted on an needs basis.

In instances where remote work or outsourcing is not viable, there are other solutions that the hospitality industry can explore to improve operational effectiveness as well as employee satisfaction. A more agile staffing model can better match available labor with peaks and troughs in daily, or even hourly, demand. This could involve combining similar roles or cross-training staff so that they can switch roles. Redesigned roles could potentially improve employee satisfaction by empowering staff to explore new career paths within the hotel’s operations. Combined roles build skills across disciplines—for example, supporting a housekeeper to train and become proficient in other maintenance areas, or a front-desk associate to build managerial skills.

Where management or ownership is shared across properties, roles could be staffed to cover a network of sites, rather than individual hotels. By applying a combination of these approaches, hotels could reduce the number of staff hours needed to keep operations running at the same standard. 16 “ Three innovations to solve hotel staffing shortages ,” McKinsey, April 3, 2023.

Taken together, operational adjustments combined with greater use of technology could provide the tourism industry with a way of overcoming staffing challenges and giving customers the seamless digitally enhanced experiences they expect in other aspects of daily life.

In an industry facing a labor shortage, there are opportunities for tech innovations that can help travel and tourism businesses do more with less, while ensuring that remaining staff are engaged and motivated to stay in the industry. For travelers, this could mean fewer friendly faces, but more meaningful experiences and interactions.

Urs Binggeli is a senior expert in McKinsey’s Zurich office, Zi Chen is a capabilities and insights specialist in the Shanghai office, Steffen Köpke is a capabilities and insights expert in the Düsseldorf office, and Jackey Yu is a partner in the Hong Kong office.

Explore a career with us

Travel & Tourism - Worldwide

- The Travel & Tourism market is projected to experience a significant increase in revenue in the coming years worldwide.

- By 2024, revenue is estimated to reach US$927.30bn and is projected to grow annually at a rate of 3.47%, resulting in a market volume of US$1,063.00bn by 2028.

- The largest market within Travel & Tourism is the Hotels market, which is projected to reach a market volume of US$446.50bn in 2024.

- Looking ahead, the number of users in the Hotels market is expected to increase to 1,397.00m users by 2028.

- In 2024, the user penetration rate was 25.9%, and it is expected to reach 28.1% by 2028.

- The average revenue per user (ARPU) is projected to reach US$0.46k.

- Online sales are expected to account for 76% of total revenue in the Travel & Tourism market by 2028.

- It is worth noting that United States is expected to generate the most revenue in this market, reaching US$199bn in 2024.

- Following the profound ramifications of the COVID-19 pandemic, the travel and tourism sector demonstrates robust indications of resurgence.

Key regions: Malaysia , Europe , Singapore , Vietnam , United States

Definition:

The Travel & Tourism market encompasses a diverse range of accommodation services catering to the needs and preferences of travelers. This dynamic market includes package holidays, hotel accommodations, private vacation rentals, camping experiences, and cruises.

The market consists of five further markets.

- The Cruises market covers multi-day vacation trips on a cruise ship. The Cruises market encompasses exclusively passenger ticket revenues.

- The Vacation Rentals market comprises of private accommodation bookings which includes private holiday homes and houses as well as short-term rental of private rooms or flats.

- The Hotels market includes stays in hotels and professionally run guest houses.

- The Package Holidays market comprises of travel deals that normally contain travel and accommodation sold for one price, although optional further provisions can be included such as catering and tourist services.

- The Camping market includes bookings at camping sites for pitches using tents, campervans, or trailers. These can be associated with big chains or privately managed campsites.

Additional Information:

The main performance indicators of the Travel & Tourism market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues and users for the above-mentioned markets. Users represent the aggregated number of guests. Each user is only counted once per year. Additional definitions for each market can be found within the respective market pages.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

Prominent players in this sector include online travel agencies (OTAs) like Expedia and Opodo, as well as tour operators such as TUI. Specialized platforms like Hotels.com, Booking.com, and Airbnb facilitate the online booking of hotels and private accommodations, contributing significantly to the market's vibrancy.

For further information on the data displayed, refer to the info button right next to each box.

- Bookings directly via the website of the service provider, travel agencies, online travel agencies (OTAs) or telephone

out-of-scope

- Business trips

- Other forms of trips (e.g. excursions, etc.)

Travel & Tourism

- Vacation Rentals

- Package Holidays

- Analyst Opinion

The Travel & Tourism market has been experiencing significant growth worldwide, driven by various factors such as increasing disposable income, ease of travel, and desire for unique experiences. Customer preferences: Travelers are increasingly seeking authentic and unique experiences, moving away from traditional tourist attractions to more off-the-beaten-path destinations. This shift in preferences has led to the rise of experiential travel, where immersive cultural experiences and interactions with locals are highly valued. Trends in the market: In the United States, there has been a noticeable trend towards sustainable and eco-friendly travel practices. Travelers are becoming more conscious of their environmental impact and are actively seeking out destinations and accommodations that prioritize sustainability. This has led to the growth of eco-tourism initiatives and the popularity of destinations known for their conservation efforts. Local special circumstances: In Europe, the rise of budget airlines and the Schengen Area agreement have made travel within the region more affordable and convenient. This has resulted in a significant increase in intra-European tourism, with travelers exploring multiple countries in a single trip. The diverse cultural offerings and close proximity of European countries make it an attractive destination for those seeking a mix of history, art, and culinary experiences. Underlying macroeconomic factors: The Asia-Pacific region has seen a surge in outbound tourism, driven by a growing middle class with higher disposable incomes. Countries like China and India have witnessed a significant increase in international travel, with travelers from these markets exploring destinations beyond their borders. This rise in outbound tourism has also led to an influx of international visitors to Asia-Pacific countries, boosting the tourism industry in the region.

- Methodology

Data coverage:

Modeling approach:

Additional notes:

- Sales Channels

- Global Comparison

- Key Market Indicators

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Unlimited access to our Market Insights

- Statistics and reports

- Usage and publication rights

Global Market Size of Travel and Tourism (2017-2021, $ Billion) Share Share on Twitter Share on LinkedIn Industry: Travel services Current: Market Sizing & Shares The market size of the travel and tourism sector globally reached a value of $631 billion in 2021 The travel and tourism market globally grew by 43% in 2021 as the sector witnessed a recovery in the demand Key travel destinations among travelers globally include Machu Picchu, Galapagos Islands, Cusco City, Dubai, Thailand, Vietnam, Hong Kong, France, Italy, Istanbul, and Easter Island !function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r Global Market Size of Travel and Tourism: Industry Overview

Travel and Tourism is one of the key sectors that play a pivotal role in any Country’s Economy and make a significant contribution to the country’s GDP. This growth in travel and tourism activities globally has led to the rise of travel intermediaries and forms an important part of selling travel products to customers.

The market size of the travel and tourism sector globally reached a value of $631 billion in 2021. In recent years, the rise in the number of online travel intermediaries was aided by the growth in the number of internet users along with the demand for convenience among travelers further supported the rise in the market for online travel Intermediaries.

The travel and tourism market globally grew by 43% in 2021 as the sector witnessed a recovery in the demand after easing the restrictions which were placed on account of the Outbreak of the pandemic COVID-19 and online travel intermediaries’ sharp rise in travel products as the consumers planned their travel activities after the gap of close to two years.

Meanwhile, the growth which the travel and tourism sector was going to see was reversed as the Outbreak of the COVID-19 pandemic completely devastated the industry in 2020. During the year 2020, the market value of travel and tourism globally saw a de-growth of a whopping 62%, and the sectors allied with the industry were severely impacted.

Key travel destinations among travelers globally include Machu Picchu, Galapagos Islands, Cusco City, Dubai, Thailand, Vietnam, Hong Kong, France, Italy, Istanbul, and Easter Island.

The travel and tourism market across global grew at a compound annual growth rate of negative 13% during the period 2017-2021. The global travel industry along with its allied sectors saw a slump in market value with the pandemic in 2020. Prior, to 2020, the industry was also witnessing slow growth due to low economic growth.

The major companies that have a strong presence in the travel and tourism global market include BCD Travel, Expedia , and Booking.com.

Related Data & Insights

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

By Bastian Herre, Veronika Samborska and Max Roser

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

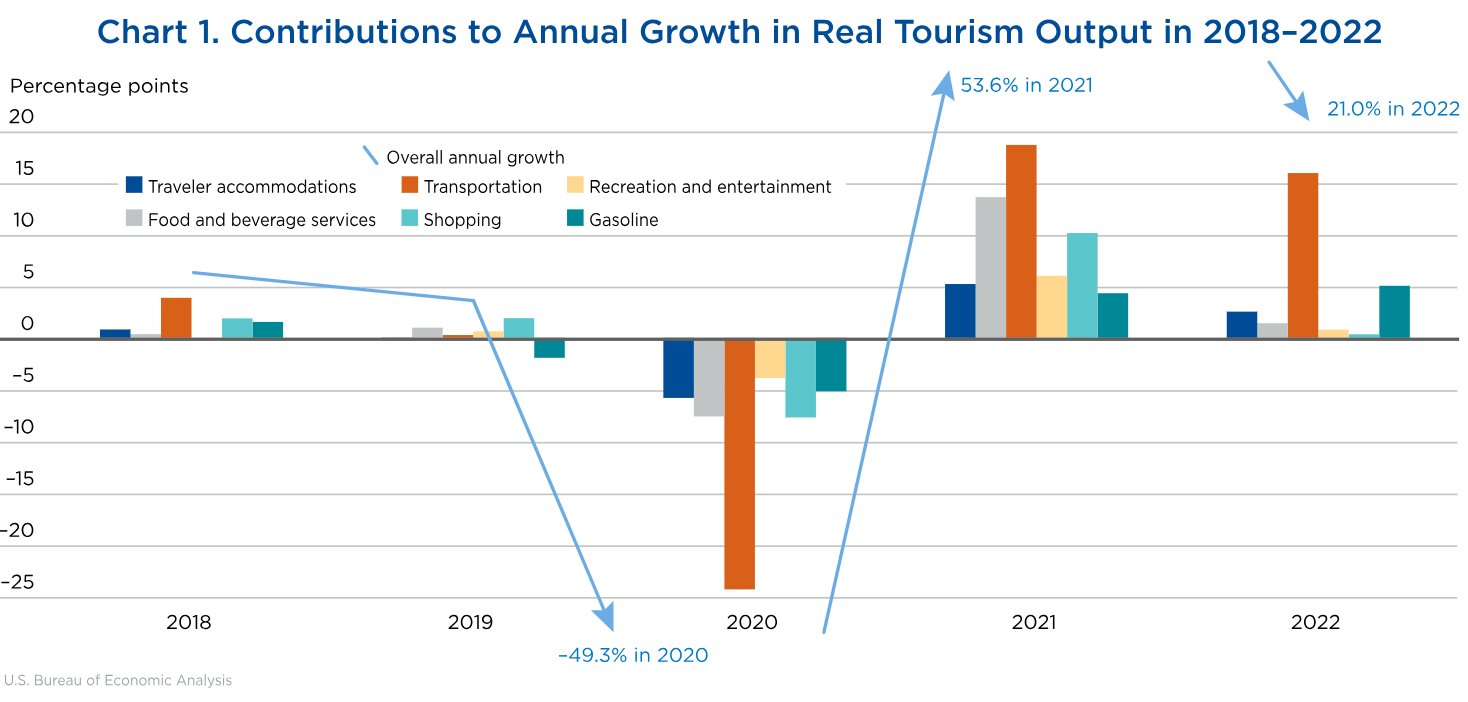

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Hotel Sustainability Basics

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Sustainable Growth

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

Economic Impact Research

- In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level.

- In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level.

- Domestic visitor spending rose by 18.1% in 2023, surpassing the 2019 level.

- International visitor spending registered a 33.1% jump in 2023 but remained 14.4% below the 2019 total.

Click here for links to the different economy/country and regional reports

Why conduct research?

From the outset, our Members realised that hard economic facts were needed to help governments and policymakers truly understand the potential of Travel & Tourism. Measuring the size and growth of Travel & Tourism and its contribution to society, therefore, plays a vital part in underpinning WTTC’s work.

What research does WTTC carry out?

Each year, WTTC and Oxford Economics produce reports covering the economic contribution of our sector in 185 countries, for 26 economic and geographic regions, and for more than 70 cities. We also benchmark Travel & Tourism against other economic sectors and analyse the impact of government policies affecting the sector such as jobs and visa facilitation.

Visit our Research Hub via the button below to find all our Economic Impact Reports, as well as other reports on Travel and Tourism.

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

2020 Travel and Tourism Industry Impact on the U.S. Economy

Total economic output generated by travel and tourism in the united states decreased 50% in 2020 from 2019, decline in travel and tourism gdp accounted for more than half of the decline in u.s. gdp in 2020, decline in total tourism-related employment accounted for more than a third of the total employment decline in the united states in 2020 .

The National Travel and Tourism Office’s (NTTO) Travel & Tourism Satellite Account, produced annually by the Bureau of Economic Analysis, is the official U.S. Government estimate of the economic impact of the travel and tourism industry in the United States. The latest TTSA shows that in Calendar Year 2020:

Total economic output generated by travel and tourism fell $982.5 billion (-50.1%) from 2019 ($1.96 trillion) to 2020 ($978.4 billion).

- Among those sectors hardest hit, passenger air transportation services output declined by nearly $214.7 billion in 2020, followed by food services and drinking places/restaurants (down $131.1 billion), traveler accommodations (down $124.6 billion), and tourism-related shopping (down $123.5 billion).

- These four sectors accounted for 60.4% of the decline in total tourism-related output in 2020.

Total tourism-related employment declined from 9.5 million in 2019 to 6.3 million in 2020. This decline of 3.2 million in total tourism-related employment accounted for 34.2% of the overall 9.3 million employment decline in the United States from 2019 to 2020.

- Among those sectors hardest hit, employment supported by food services and drinking places declined by 972,000 in 2020, followed by traveler accommodations (down 685,000), air transportation services (down 338,000), and participant sports (down 262,000).

- These four sectors accounted for 70.8% of the decline in total tourism-related employment in 2020.

Travel and tourism value added, or GDP, (in nominal terms, not inflation adjusted) declined from $624.7 billion (2.9% of GDP) in 2019 to $356.8 billion (a historic low of 1.7% of GDP) in 2020 .This $267.9 billion decline in travel and tourism GDP accounted for more than half (56.0%) of the overall $478.8 billion decline in U.S. GDP from 2019 to 2020.

Domestic travel demand by resident households declined by 53.2% from 2019 to 2020. At the same time, domestic business travel demand declined by 40.9%; domestic government travel demand declined by 33.6%; and travel demand by nonresidents (international visitors in the United States) declined 82.4% — accounting for a fifth (20.7%) of the overall decline in total travel demand from 2019 to 2020.

Learn more on NTTO’s Travel and Tourism Satellite Account (TTSA) Program Page .

Travel and Tourism Satellite Accounts (TTSAs) allow the United States to measure the relative size and importance of the travel and tourism industry, along with its contribution to gross domestic product (GDP). Approved by the United Nations in March 2002 and endorsed by the U.N. Statistical Commission, TTSAs have become the international standard by which travel and tourism is measured. In fact, more than 50 countries around the world use travel and tourism satellite accounting.

View BEA’s Travel and Tourism Satellite Account .

Global Tourism - Market Size, Industry Analysis, Trends and Forecasts (2024-2029)

Instant access to hundreds of data points and trends.

- Market estimates from

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

100% money back guarantee

Industry statistics and trends.

Access all data and statistics with purchase. View purchase options.

Global Tourism

Industry Revenue

Total value and annual change from . Includes 5-year outlook.

Access the 5-year outlook with purchase. View purchase options

Trends and Insights

Market size is projected to over the next five years.

Market share concentration for the Global Tourism industry is , which means the top four companies generate of industry revenue.

The average concentration in the sector in Global is .

Products & Services Segmentation

Industry revenue broken down by key product and services lines.

Ready to keep reading?

Unlock the full report for instant access to 30+ charts and tables paired with detailed analysis..

Or contact us for multi-user and corporate license options

Table of Contents

About this industry, industry definition, what's included in this industry, industry code, related industries, domestic industries, competitors, complementors, international industries, performance, key takeaways, revenue highlights, employment highlights, business highlights, profit highlights, current performance.

What's driving current industry performance in the Global Tourism industry?

What's driving the Global Tourism industry outlook?

What influences volatility in the Global Tourism industry?

- Industry Volatility vs. Revenue Growth Matrix

What determines the industry life cycle stage in the Global Tourism industry?

- Industry Life Cycle Matrix

Products and Markets

Products and services.

- Products and Services Segmentation

How are the Global Tourism industry's products and services performing?

What are innovations in the Global Tourism industry's products and services?

Major Markets

- Major Market Segmentation

What influences demand in the Global Tourism industry?

International Trade

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

- Industry Trade Balance by Country

What are the import trends in the Global Tourism industry?

What are the export trends in the Global Tourism industry?

Geographic Breakdown

Business locations.

- Share of Total Industry Establishments by Region ( )

Data Tables

- Number of Establishments by Region ( )

- Share of Establishments vs. Population of Each Region

What regions are businesses in the Global Tourism industry located?

Competitive Forces

Concentration.

- Combined Market Share of the Four Largest Companies in This Industry ( )

- Share of Total Enterprises by Employment Size

What impacts market share in the Global Tourism industry?

Barriers to Entry

What challenges do potential entrants in the Global Tourism industry?

Substitutes

What are substitutes in the Global Tourism industry?

Buyer and Supplier Power

- Upstream Buyers and Downstream Suppliers in the Global Tourism industry

What power do buyers and suppliers have over the Global Tourism industry?

Market Share

Top companies by market share:

- Market share

- Profit Margin

Company Snapshots

Company details, summary, charts and analysis available for

Company Details

- Total revenue

- Total operating income

- Total employees

- Industry market share

Company Summary

- Description

- Brands and trading names

- Other industries

What's influencing the company's performance?

External Environment

External drivers.

What demographic and macroeconomic factors impact the Global Tourism industry?

Regulation and Policy

What regulations impact the Global Tourism industry?

What assistance is available to the Global Tourism industry?

Financial Benchmarks

Cost structure.

- Share of Economy vs. Investment Matrix

- Depreciation

What trends impact cost in the Global Tourism industry?

Financial Ratios

- 3-4 Industry Multiples (2018-2023)

- 15-20 Income Statement Line Items (2018-2023)

- 20-30 Balance Sheet Line Items (2018-2023)

- 7-10 Liquidity Ratios (2018-2023)

- 1-5 Coverage Ratios (2018-2023)

- 3-4 Leverage Ratios (2018-2023)

- 3-5 Operating Ratios (2018-2023)

- 5 Cash Flow and Debt Service Ratios (2018-2023)

- 1 Tax Structure Ratio (2018-2023)

Data tables

- IVA/Revenue ( )

- Imports/Demand ( )

- Exports/Revenue ( )

- Revenue per Employee ( )

- Wages/Revenue ( )

- Employees per Establishment ( )

- Average Wage ( )

Key Statistics

Industry data.

Including values and annual change:

- Revenue ( )

- Establishments ( )

- Enterprises ( )

- Employment ( )

- Exports ( )

- Imports ( )

Frequently Asked Questions

What is the market size of the global tourism industry.

The market size of the Global Tourism industry is measured at in .

How fast is the Global Tourism market projected to grow in the future?

Over the next five years, the Global Tourism market is expected to . See purchase options to view the full report and get access to IBISWorld's forecast for the Global Tourism from up to .

What factors are influencing the Global Tourism industry market trends?

Key drivers of the Global Tourism market include .

What are the main product lines for the Global Tourism market?

The Global Tourism market offers products and services including .

Which companies are the largest players in the Global Tourism industry?

Top companies in the Global Tourism industry, based on the revenue generated within the industry, includes .

How many people are employed in the Global Tourism industry?

The Global Tourism industry has employees in Global in .

How concentrated is the Global Tourism market in Global?

Market share concentration is for the Global Tourism industry, with the top four companies generating of market revenue in Global in . The level of competition is overall, but is highest among smaller industry players.

Methodology

Where does ibisworld source its data.

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

Deeper industry insights drive better business outcomes. See for yourself with your report or membership purchase.

Discover how 30+ pages of industry data and analysis can give you the edge you need..

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

- Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Tourism Market

Tourism Market: Global Industry Analysis and Opportunity Assessment 2022 - 2032

Market Insights on Tourism covering sales outlook, demand forecast and up-to-date key trends

- Report Preview

- Request ToC

- Request Methodology

Tourism Market Overview

Valued at US$ 10.5 Trillion in 2022, the global tourism market is expected to develop at a CAGR of 5% over the next ten years. By the end of this forecast year in 2032, analysts anticipate the tourism market size would be worth US$ 17.1 Trillion.

Countries such as the United States, France, and other European countries are traditionally famous tourist destinations across the world with an established tourism market. However, in recent years, several lesser-known Asian and African countries have come to the fore as destinations of appeal to foreign tourists. As a result, global tourism service providers are realigning their offerings to capitalize on the potential economic benefits of this shift.

The emergence of new trends such as adventure tourism, art tourism, and so on is projected to boost the global tourism market growth. Rock climbing, mountaineering, excavating, kayaking, and other pursuits are examples of adventure tourism significantly contributing to the tourism market share in recent years. Secondly, the adoption of tourism websites plays a significant role in the management and monetization of all types of tourism. The expanding tendency of social networking sites is also projected to give a promising possibility for tourism market advancement.

In accordance with a travel market analysis report, cultural and pilgrimage tourism are the sectors with the highest exponential growth in Asia, Africa, and South America, while adventure and ecological tourism are the fastest-growing sectors in North America and Europe. Unfortunately, outbreaks of diseases such as Ebola, SARS, and COVID in certain countries, along with geopolitical tensions, are having a significant impact on global tourism market opportunities.

During the years of the Covid-19 pandemic, the global tourism market dealt a near-fatal blow, and the market players' income declined due to severe lockdown circumstances and the suspension of transportation options. However, after the lifting of the lockdown, the tourism business recommenced in 2022 and is expected to return to its previous growth rate in the next one to two years.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Govt. Initiatives to Bode Well for the Market

Health tourism produces significant cash in emerging nations, allowing them to expand their healthcare operations. As a response, public bodies have increased their engagement through travel and tourism websites in support of healthcare services. For instance, in February 2018, the administration of Thailand announced the requirements for granting smart visas for professionals or entrepreneurs willing to engage in launching new enterprises, which could assist global health tourism service providers in expanding their operations in Thailand.

As per the previous tourism market report, Thailand was ranked as the most popular medical tourist attraction in 2019. Thailand's prominence as one of Asia's most popular dental tourism destinations has contributed to its overall market development.

Increasing per capita income is driving the growth of global tourism market leading to continuous growth in international tourism. Over the last five years, tourism market in emerging economies, especially countries in South America and Asia have driven the global tourism market. Compared to a decade ago, global tourism market has undergone a lot of changes. Emerging economies now account for more market share as compared to developed economies. As per International Travel Association (ITA), the number of international tourists arrivals in the U.S.is expected to grow from 69.8 million in 2013 to 83.8 million by 2018.

Government bodies and organizations such as World Tourism Organization UNWTO are promoting tourism in order to attract diverse tourists across the globe. These initiatives are leading to the growth of global tourism market. Adventure tourism is new concept in tourism market driving the overall tourism market. Further, medical tourism is also a new trend observed in global tourism market. Significant price difference of medical procedures between different countries is driving the trend of medical tourism across the world. Global sports and game events is another driving factor for the global tourism market. People travel to enjoy sports events such as FIFA World Cup 2014, London Olympics 2012 and ICC World Cup 2011. However, disease outbreaks such as Ebola in specific countries affect the global tourism up to large extent. Ebola outbreak in West Africa affected the tourism market in African region.

The global tourism market is segmented on the basis of type, industry products, activities involved and geography. On the basis of type, international tourism and domestic/local tourism are the two major types of tourism market. Along with it, on the basis of purpose of travel or tourism the market for global tourism is segmented into adventure tourism, leisure business travel, conference or seminar travel, business tourism, visiting relatives and friends. The companies providing tourism services offer various products and services to their customer. Thus, the industry products included in the global tourism industry are traveler accommodations, travel arrangement and reservations, air transportation, other local transport such as car rental , food and beverage establishments, recreation and entertainment, gasoline and other retail activities. Further, the industry activities considered within the global tourism market include traveler accommodation services, providing hospitality services to international tourists, airline operation, automotive rental, travel agent and tour arrangement services. Countries such as U.S., Germany and France are popular destinations for global tourism; but in recent years other less well known countries from Asia and Africa have emerged as destinations of interest for international travelers. Thus, tourism service providers are realigning their services in order to reap the economic benefits from this trend

The global tourism market has a low level of concentration as there are large numbers of international and local players in tourism market. The market for global tourism is highly fragmented in nature. Aban Offshore Ltd., Accor Group, Crown Ltd., Balkan Holidays Ltd., Fred Harvey Company and G Adventures are some of the players in global tourism market.

This research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data and statistically-supported and industry-validated market data and projections with a suitable set of assumptions and methodology. It provides analysis and information by categories such as market segments, regions, product type and distribution channels.

The report covers exhaustive analysis on

- Market Segments

- Market Dynamics

- Market Size

- Supply & Demand

- Current Trends/Issues/Challenges

- Competition & Companies involved

- Value Chain

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Regional analysis includes

- North America

- Latin America

- Western Europe

- Eastern Europe

- Middle East and Africa

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Recommendations

Travel and Tourism

Wildlife Tourism Market

Published : March 2024

Medical Tourism Market

Published : November 2023

Turkey Medical Tourism Market

Published : July 2023

Tourism Security Market

Published : February 2023

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

Global Tourism Value Chains, Sustainable Development Goals and COVID-19

- First Online: 20 September 2020

Cite this chapter

- Godwell Nhamo 3 ,

- Kaitano Dube 4 &

- David Chikodzi 5

3395 Accesses

6 Citations

This chapter presents a conceptual framework and setting for the book. This is informed by the desire to link three critical thematic areas, namely, (i) the global tourism value chains, (ii) COVID-19 and (iii) the 2030 Agenda for Sustainable Development (AfSD) and the 17 embedded sustainable development goals (SDGs). Bringing in the SDGs adds value given that there are three SDGs (SDGs 8, 12 and 14) that make specific reference to tourism. Furthermore, COVID-19 negatively impacted many SDGs leading to governments, civic and private organisations revising budgets to channel resources towards “flattening” both the COVID-19 and economic curves. Understanding the global tourism value chains assists in opening up the complex tourism space and to systematically document COVID-19 impacts along with the industries within the value chain nodes. To this end, this chapter comes across mainly as an essay with heavy dependence on value add from the document and critical discourse analysis, as well as a meta-analysis of secondary data sources. The chapter is useful from both a theoretical and practical application points of view. A section bringing the nexus of the thematic focus areas is slotted in towards the end, with a critique of how the tourism sector should address shortfalls in relation to the SDGs within the COVID-19 pandemic.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Abeydeera, L. H. U. W., & Karunasena, G. (2019). Carbon emissions of hotels: The case of the Sri Lankan hotel industry. Buildings, 9 , 227. https://doi.org/10.3390/buildings9110227 .

Article Google Scholar

Abuhjeeleh, M. (2019). Rethinking tourism in Saudi Arabia: Royal vision 2030 perspective. African Journal of Hospitality, Tourism and Leisure, 8 (5), 1–16.

Google Scholar

Ahmed, F., Ahmed, N., Pissarides, C., & Stiglitz, J. (2020). Why inequality could spread COVID-19. The Lancet . https://doi.org/10.1016/S2468-2667(20)30085-2 .

Alarcón, D. M. (2017). Goal 5: Gender equity. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 34–38).

Alonso-Almeida, M. M., Borrajo-Millán, F., & Yo, L. (2019). Are social media data pushing overtourism? The case of Barcelona and Chinese tourists. Sustainability, 11 , 3356. https://doi.org/10.3390/su11123356 .

Antràs, P. (2020). Conceptual aspects of global value chains . Washington, DC: World Bank Development Economics.

Book Google Scholar

Armitage, R., & Nellums, L. B. (2020). Considering inequalities in the school closure response to COVID-19. The Lancet . https://doi.org/10.1016/S2214-109X(20)30116-9 .

Baldwin, S. A., & Del Re, A. C. (2016). Open access meta-analysis for psychotherapy research. Journal of Counselling Psychology, 63 (3), 249–260. https://doi.org/10.1037/cou0000091 .

Ben-Daya, M., Hassini, E., & Bahroun, Z. (2017). Internet of things and supply chain management: A literature review. International Journal of Production Research . https://doi.org/10.1080/00207543.2017.1402140 .

Boussauw, K., & Vanoutrive, T. (2019). Flying green from a carbon neutral airport: The case of Brussels. Sustainability, 11 , 2102. https://doi.org/10.3390/su11072102 .

Bramwell, B., Higham, J., Lane, B., & Miller, G. (2017). Twenty-five years of sustainable tourism and the Journal of Sustainable Tourism: Looking back and moving forward. Journal of Sustainable Tourism, 25 (1), 1–9. https://doi.org/10.1080/09669582.2017.1251689 .

Campbell, A. M. (2020). An increasing risk of family violence during the Covid-19 pandemic: Strengthening community collaborations to save lives. Forensic Science International: Reports, 2 , 100089. https://doi.org/10.1016/j.fsir.2020.100089 .

Cañada, E. (2017). Goal 8: Decent work and economic growth. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 45–51).

Christian, M., Fernandez-Stark, K., Ahmed, G., & Gereffi, G. (2011). The tourism global value chain: Economic upgrading and workforce development . London: Centre on Globalization, Governance & Competitiveness, Duke University.

Daly, J., & Fernandez-Stark, K. (2017). Barbados in the cruise tourism global value chain . Durham: Centre on Globalization, Governance & Competitiveness (CGGC).

Daly, J., & Fernandez-Stark, K. (2018). St. Lucia in the cruise tourism GVC . Durham: Centre on Globalization, Governance & Competitiveness (CGGC).

Daly, J., & Gereffi, G. (2017). Tourism global value chains. In R. S. Newfarmer, J. Page, & F. Tarp (Eds.), Industries without smokestacks: Industrialisation in Africa reconsidered (pp. 68–89). Oxford: Oxford University Press.

De Lima, C. A., Alves, P. M. R., De Oliveira, C. J. B., De Oliveira, T. T. N., Barbosa, K. B., Marcene, H. C., & De Oliveira, S. V. (2020). COVID-19: Isolations, quarantines and domestic violence in rural areas. SciMedicine Journal, 2 (1), 44–45. https://doi.org/10.28991/SciMedJ-2020-0201-7 .

De Man, F. (2017). Goal 14: Life below water. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 80–85).

Dube, K., & Nhamo, G. (2019a). Climate change and potential impacts on tourism: Evidence from the Zimbabwean side of the Victoria Falls. Environment, Development and Sustainability, 21 (4), 2025–2041.

Dube, K., & Nhamo, G. (2019b). Evidence and impact of climate change on South African national parks. Potential implications for tourism in the Kruger National Park. Environmental Development . https://doi.org/10.1016/j.envdev.2019.100485 .

Dube, K., & Nhamo, G. (2020a). Major global aircraft manufacturers and emerging responses to the SDGs agenda. In G. Nhamo, O. Odularu, & V. Mjimba (Eds.), Scaling up SDGs implementation emerging cases from state, development and private sectors (pp. 99–113). Cham: Springer International Publishing.

Chapter Google Scholar

Dube, K., & Nhamo, G. (2020b). Tourist perceptions and attitudes regarding the impacts of climate change on Victoria Falls. Bulletin of Geography. Socio-economic Series, 47 (47), 27–44.

Eijgelaar, E., & Peeters, P. (2017). Goal 13: Climate action. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 75–79).

Ensign, P. C. (2001). Value chain analysis and competitive advantage. Journal of General Management, 27 (1), 18–42.

Fang, Y., Yin, J., & Wu, B. (2018). Climate change and tourism: A scientometric analysis using CiteSpace. Journal of Sustainable Tourism, 26 (1), 108–126.

Fernandez-Stark, K., & Bamber, P. (2018). Jamaica in the tourism global value chain . Durham: Centre on Globalization, Governance & Competitiveness (CGGC).

Frederick, S., Bamber, P., & Cho, J. (2018). The digital economy, global value chains and Asia . Durham: Centre on Globalization, Governance & Competitiveness (CGGC).

G20 (Group of Twenty Countries). (2019). Advancing Tourism’s contribution to the Sustainable Development Goals (SDGs) . Tokyo: G20.

Gereffi, G., & Fernandez-Stark, K. (2011). Global value chain analysis: A primer . Durham: Centre on Globalization, Governance & Competitiveness (CGGC).

Gereffi, G., Humphrey, J., Kaplinsky, R., & Sturgeon, T. J. (2001). Introduction: Globalisation, value chains and development. IDS Bulletin, 32 (3), 1–8.

Hall, C. M. (2019). Constructing sustainable tourism development: The 2030 agenda and the managerial ecology of sustainable tourism. Journal of Sustainable Tourism, 27 (7), 1–17.

Hong, Y., Cui, H., Dai, J., & Ge, Q. (2019). Estimating the cost of biofuel use to mitigate international air transport emissions: A case study in Palau and Seychelles. Sustainability, 11 , 3545. https://doi.org/10.3390/su11133545 .

IAEG-SDGs (Inter-agency and Expert Group on SDG Indicators). (2019). Tier classification for global SDG indicators 11 December 2019 . IAEG-SDGs.

Jaeger, L. (2017). Goal 3: Good health and well-being. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 21–26).

Jennings, H. (2017). Ensure availability and sustainable management of water and sanitation. In A. Sud: Transforming tourism: Tourism in the 2030 agenda (pp. 39–44).

Jones, P., Hiller, D., & Comfort, D. (2017). The sustainable development goals and the tourism and hospitality industry. Athens Journal of Tourism, 4 (1), 7–18.

Kamble, S. S., Gunasekaran, A., & Sharma, R. (2018). Analysis of the driving and dependence power of barriers to adopt industry 4.0 in Indian manufacturing industry. Computers in Industry, 101 , 107–119.

Kamp, C., & Mangalasseri, S. (2017). Goal 1: End poverty. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 10–15).

Kang, K., & Rhee, C. (2020). A post-coronavirus recovery in Asia – Extending a “Whatever it takes” lifeline to small businesses . Retrieved from https://blogs.imf.org/2020/04/23/a-post-coronavirus-recovery-in-asia-extending-a-whatever-it-takes-lifeline-to-small-businesses/ . Accessed 24 Apr 2020.

Kaplinsky, R., & Morris, M. (2001). A handbook for value chain research . Toronto: International Development Research Centre (IDRC.

Karschat, K., & Kühhas, C. (2017). Goal 15: Life on land. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 86–90).

Kitamura, Y., Ihisugi, Y., Karkour, S., & Itsubo, N. (2020). Carbon footprint evaluation based on tourist consumption toward sustainable tourism in Japan. Sustainability, 12 , 2219. https://doi.org/10.3390/su12062219 .

Kösterke, A. (2017). Goal 9: Industry, innovation and infrastructure. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 52–57).

Ladki, S. M., & Mazeh, R. A. (2017). Comparative pricing analysis of Mecca’s religious tourism. International Journal of Religious Tourism and Pilgrimage, 5 (1), 20–28. https://doi.org/10.21427/D76Q7Z .

Lee, J., Davari, H., Singh, J., & Pandhare, V. (2018). Industrial artificial intelligence for industry 4.0-based manufacturing systems. Manufacturing Letters, 18 , 20–23.

Loayza, N., & Pennings, S. (2020). Macroeconomic policy in the time of COVID-19: A primer for developing countries . Washington, DC: World Bank.

Lui, Y., Dong, E., Lki, S., & Jie, X. (2020). Cruise tourism for sustainability: An exploration of value chain in Shenzhen Shekou Port. Sustainability, 12 , 3054. https://doi.org/10.3390/su12073054 .

Macola, G., & Unger, L. (2018). Value chain analysis tourism Myanmar . Nay Pyi Taw: The Centre for the Promotion of Imports from developing countries (CBI).

Mahase, E. (2020). Covid-19: Trump threatens to stop funding WHO amid “China-centric” claims. The BJM, 369 , m1438. https://doi.org/10.1136/bmj.m1438 .

Mole, B. (2020). 175 now infected with coronavirus on cruise ship, including quarantine officer: Japan is now planning to test everyone aboard . Retrieved from https://arstechnica.com . Accessed 23 Apr 2020.

Monshausen, A. (2017). Goal 10: Reduced inequalities. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 58–62).

Nhamo, G. (2014). Green growth: A game changer ushering in the death of the internal combustion engine? WIT Transactions on Ecology and the Environment, 186 . https://doi.org/10.2495/ESUS140051 .

Nhamo, G., & Swart, R. (2012). A scholarly framework for measuring business responsibility to climate change in South Africa. Issues in Social and Environmental Accounting, 6 (1&2), 50–71.

Nhamo, G., Nhemachena, C., & Nhamo, S. (2020). Using ICT indicators to measure readiness of countries to implement Industry 4.0 and the SDGs. Environmental Economics and Policy Studies, 22 , 315–337.

Nicola, M., Alsafi, Z., Sohrabi, C., Kerwan, A., Al-Jabir, A., Losifidis, C., Agha, M., & Agha, R. (2020). The socio-economic implications of the coronavirus and COVID-19 pandemic: A review. International Journal of Surgery . https://doi.org/10.1016/j.ijsu.2020.04.018 .

Novelli, M., & Jones, A. (2017). Goal 4: Quality education. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 27–33).

Omarjee, L. (2020). Does the oil price crash signal relief for SA consumers? Retrieved from https://m.fin24.com/Economy/does-the-oil-price-crash-signal-relief-for-sa-consumers-20200421 . Accessed 21 Apr 2020.

Onyeaka, H. K., Zahid, S., & Patel, R. S. (2020). The unaddressed behavioral health aspect during the coronavirus pandemic. Cureus, 12 (3), e7351. https://doi.org/10.7759/cureus.7351 .

Parry, T. D. (2018). What is Africa to me now? African-American heritage tourism in Senegambia. Journal of Contemporary African Studies, 36 (2), 245–263. https://doi.org/10.1080/02589001.2017.1387236 .

Perna, L. W., Orosz, K., & Kent, D. C. (2018). The role and contribution of academic researchers in congressional hearings: A critical discourse analysis. American Educational Research Journal, 56 (1), 111–145. https://doi.org/10.3102/0002831218788824 .

Plüss, C., & Sahdeva, N. (2017). Goal 12: Responsible consumption and production. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 69–74).

Porter, M. E. (1985). Competitive advantage . New York: Free Press.

Porter, M. E. (2001). The value chain and competitive advantage. In D. Barnes (Ed.), Understanding business: Processes (pp. 50–68). London: Routledge.

Porter, M. E., & Kramer, M. R. (2018). Creating shared value. In G. G. Lenssen & N. C. Smith (Eds.), Managing sustainable business: An executive education case and textbook (pp. 323–346). Amsterdam: Springer.

Potash, J. S., Kalmanowitz, D., Fung, I., Anand, S. A., & Miller, G. M. (2020). Art therapy in pandemics: Lessons for COVID-19. Art Therapy . https://doi.org/10.1080/07421656.2020.1754047 .

Potts, T. J. (2012). ‘Dark tourism’ and the ‘kitschification’ of 9/11. Tourist Studies, 12 (3), 232–249. https://doi.org/10.1177/1468797612461083 .

PWC (PricewaterhouseCoopers). (2016). Industry 4.0: Building the digital enterprise . London: PWC.

Quéré, C. L., Jackson, R. B., Jones, M. W., Smith, A. J. P., Abernethy, S., Andrew, R. M., De-Gol, A. J., Willis, D. R., Shan, Y., Canadell, J. G., Friedlingstein, P., Creutzig, F., & Peters, G. P. (2020). Temporary reduction in daily global CO2 emissions during the COVID-19 forced confinement. Nature Climate Change . https://doi.org/10.1038/s41558-020-0797-x .

Ren, Y., Zhao, C., & Fu, J. (2019). Dynamic study on tourism carbon footprint and carbon carrying capacity in Sichuan Province. Journal of Geoscience and Environment Protection, 7 , 14–24.

Rutherford, A. (2017). Goal 16: Good governance. In A. Sud (Ed.), Transforming tourism: Tourism in the 2030 agenda (pp. 97–102).

Spencer, J. P., Safari, E., & Dakora, E. A. N. (2014). An evaluation of the tourism value-chain as an alternative to socio-economic development in Rwanda, Africa. African Journal for Physical, Health Education, Recreation and Dance (AJPHERD), 20 (2:1), 569–583.

Ștefănică, M. (2017). Environmental impact of transportation in the tourism industry – Dimensions and actions. Studies and Scientific Researches – Economics Edition, 25 , 84–89.

Stone, M. (2020). Carbon emissions are falling sharply due to coronavirus: But not for long. https://www.nationalgeographic.co.uk/environment-andconservation/2020/04carbon-emissions-are-fallin-sharply-due-coronavirus-not-long .

Szpilko, D. (2017). Tourism supply chain – Overview of selected literature. Procedia Engineering, 182 , 687–693.

Tang, S., Wang, Z., Yang, G., & Tang, W. (2020). What are the implications of globalisation on sustainability? – A comprehensive study. Sustainability, 12 , 3411. https://doi.org/10.3390/su12083411 .

UNFCCC (United Nations Framework Convention on Climate Change). (2015). Paris agreement . Bonn: UNFCCC.

United Nations. (2015). Transforming our world: The 2030 agenda for sustainable development . New York: United Nations Secretariat.

United Nations. (2020). Shared responsibility, global solidarity: Responding to the socio-economic impacts of COVID-19 . New York: United Nations Secretariat.

UNWTO (United Nations World Tourism Organisation). (2018). Tourism and the sustainable development goals: Good practices in the Americas . Geneva: UNWTO.

UNWTO (United Nations World Tourism Organisation). (2019). Transport-related CO2 emissions of the tourism sector: Modelling results . Geneva: UNWTO.