An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Travel, Tourism and Outdoor Recreation

Promoting america’s tourist communities.

- Share this page

EDA Awards 185 Grants to Rebuild and Restrengthen American Travel, Tourism, and Outdoor Recreation

Travel, Tourism & Outdoor Recreation Fact Sheet (PDF)

American Rescue Plan Fact Sheet (PDF)

Click here to view the American Rescue Plan Map

The U.S. Economic Development Administration’s (EDA) Travel, Tourism, and Outdoor Recreation program invested $750 million in American Rescue Plan funding to support communities across the country whose economies were hard hit by damage to these sectors from the COVID-19 pandemic. With funding going to every state and territory across 185 awards, EDA’s investments are rebuilding the travel and tourism sector and creating a more equitable, competitive, and resilient industry.

Learn more about the Travel, Tourism, and Outdoor Recreation grantees by exploring the American Rescue Plan Impact Map .

The Travel, Tourism, and Outdoor Recreation program is divided into two components:

- State Tourism Grants: $510 million in direct awards to help states quickly invest in marketing, infrastructure, workforce and other projects to rejuvenate safe leisure, business and international travel.

- Competitive Grants: $240 million to help communities that have been hardest hit by challenges facing the travel, tourism, and outdoor recreation sectors to invest in infrastructure, workforce, or other projects to support the recovery of the industry and economic resilience of the community in the future.

Each state or territory is utilizing its directly allocated funds to engage in activities that best support their travel, tourism, and outdoor recreation sectors. These activities include but are not limited to workforce training, new construction or upgrades to existing tourism infrastructure, tourism marketing and promotion, and tourism-related economic planning. The competitive grant program is distributed across 126 awards to support communities across the country as they rebuild and strengthen their travel, tourism, and outdoor recreation sectors. The competitive funding is expected to generate $1.1 billion in private investment and to create or save 10,291 jobs , according to grantee estimates. This program was designed to prioritize equity, and as a result, more than 50% of competitive awards are expected to directly benefit historically underserved communities and populations. In addition, $29.3 million across 12 awards is supporting coal communities and $21.2 million across 9 awards is supporting Indigenous communities.

Program Resources

- Notice of Funding Opportunity

- Frequently Asked Questions

- Travel, Tourism and Outdoor Recreation presentation slides (PDF)

- State Tourism Grant Allocations

- One Pager (PDF)

- Visit www.eda.gov/contact to find contact information for your Economic Development Representative

- EDA Program List

- Find Open Funding

- Resources & Tools

- Accessibility

- Commerce.gov

- EDA Archives

- Information Quality

- Massachusetts

- Operating Policies

- Privacy Policy

9 Ways to Get Business Funding for Tours and Activities

Business funding is the act of providing resources, such as time, money, and effort, to finance a company and its projects. It can be a crucial practice, especially if your tour or activity requires substantial upfront costs or if you run into financial trouble.

When talking about business funding, it’s not just about EU programs and government schemes. There are multiple ways to finance your business and some will be better than others, depending on your circumstances.

In this post, we’ll present nine different options for funding your business. This way, we hope you’ll be able to choose the right source of funding for your situation and get a good overview of the alternatives you have.

Ready? Let’s go.

The main sources of business funding

There are several main ways to acquire business funding – whether you’re just starting out or you’ve been in business for a while. These range from traditional bank loans to modern methods like peer-to-peer lending.

1. Pre-sales

The best way to fund your company is usually revenue. With pre-sales, you get all or part of a payment up-front, meaning you can use that revenue to acquire the resources you need to provide your tour or experience.

The most common example of a pre-sale is when customers buy products online. The same goes for booking tours and activities in advance of the delivery date. Effectively, you’re getting the revenue first so you have some time to utilize it.

If you’re just starting out or expanding with a new experience, consider creating some buzz ahead of the launch date. For example, this Harry Potter-themed escape room was fully booked for months ahead long before its official launch date.

It should be noted that pre-sales work best when you need relatively small amounts of cash. For bigger sums, you can turn to other funding sources.

Where pre-sales aren’t enough, grants can help you secure bigger amounts of cash. Grants are essentially money given to you for a specific purpose, such as developing the tourism sector in a given region.

As such, you don’t need to pay the money back (unless you misuse the grant). In most cases, grants are provided by the government or local authority.

Grants may sound too good to be true, so you might ask “where’s the catch”?

To start off, the competition for grants is usually high. This means you will have to provide a better plan and showcase more potential than other companies applying for the same business funding.

In addition, there are often specific requirements in terms of how to spend the funding and what type of businesses can apply. So the supply of grants is limited by their purpose and you can apply only for the ones that you’re eligible for.

Finally, grants often co-finance projects, meaning that you have to provide some part of the funding using other sources.

As the saying goes: “There ain’t no such thing as a free lunch”. To acquire a grant, you will need to put in the time and effort required. This involves researching the right options in your region and preparing great applications that stand out from your competition.

If you’re based in the EU and want to learn more about grants, check out this guide on EU funding for the tourism sector .

3. Buying assets on credit

If you need business funding for buying assets and equipment, then you can arrange for later payment with your suppliers. This will give you extra time to generate revenue and use it to pay for the new purchases.

If you have a good relationship with your suppliers already, you can try and negotiate a favorable time frame, often up to 90 days from the purchase date. However, if you’re just starting out , it might be hard for you to buy assets on credit, especially when dealing with established and reputable suppliers – which you should do.

4. Friends and family

If you’re confident about your business model, you might also turn to friends and family for initial support.

While it could feel uncomfortable, you may find that people are happy to get involved and lend you some money. It’s exciting to back new projects and most importantly – they probably trust you.

Needless to say, adding money to your relationships may add some pressure – so you need to choose the people you approach wisely. It might be a good idea to offer them to partner with you and get a part of the business. But if you’d like to keep full control, you can try and arrange an interest-free loan from someone close to you.

Bank loans are often the first source people think about when it comes to business funding. And yes, they are still a viable option, especially in good economic conditions.

If you’re eligible for a bank loan and you can’t source enough funding using one of the methods above, then turning to banks may be a good next step.

Bank loans are more readily available but come with extra costs like fees and interest. If you’re new in business, it will be hard to get a loan. But if you’ve been trading for a while (normally at least 3 years) and you have good financial metrics, you might get a good deal.

5. Angel investors

If there’s no way to acquire enough business funding using upfront payments, grants, or loans, then you can turn to equity financing through angel investors.

Angel investors can back you with both cash and expertise in exchange for a share in the business. There are both good sides and bad sides to this arrangement.

The good part is that you’re likely to secure the funding you need while getting an experienced business person to advise you.

The bad part is that you’ll need to give up part of your ownership and control over the company. Also, angel investor money might not be enough if you need lots of business funding. In Europe, the typical angel investment will not exceed 50,000€ so you might have to turn to other sources if you require bigger amounts.

6. Venture capital

Venture capital firms make bigger investments – usually at least 500,000€ to 1,000,000€. They are a logical next step if you need considerable business funding and your company is in overall good shape.

The downside is that VCs typically require a substantial part of your business and decision making power. They also look for companies with high-growth potential, meaning that you need a strong selling point to stand a chance of acquiring such funding.

7. Alternative finance

Alternative finance relates to funding methods outside the traditional financial system (e.g. bank loans). They often involve small contributions from multiple investors (sometimes hundreds or thousands) instead of few but large contributions.

For example, approaches like peer-to-peer lending have grown a lot in recent years and there are many platforms that let individuals contribute to businesses through debt financing.

This means you can tap the crowd and get access to a new and growing capital market – and it’s all done online. The platforms which facilitate peer-to-peer lending usually take care of the legal aspects and due diligence.

Depending on where you live, there will be several types of funding you can acquire. If getting a loan or selling shares is not available, then you’ll probably have access to 2 other types of funding: donation and reward-based.

Donation funding is normally applicable to community projects and charities. However, reward-based funding is often a viable option – it lets you create rewards that people receive in the future in exchange for their contributions. Rewards can be things like merchandise or even early bird tickets to your tour or activity.

While not available to everyone, this type of funding can be a great alternative to more traditional methods of financing.

To learn more, you can check out this article with the top European peer-to-peer lending platforms .

8. Side project

In some cases, you can finance your tour or activity through a side venture. This can be totally unrelated or it could be a complementary product/service.

The most famous example of this type of funding is Airbnb. The founders financed their initial idea by selling politically-themed breakfast cereal.

This unusual side venture earned them over $40,000 so they could finance their activities in the early days of Airbnb.

So perhaps there’s something you can easily do on the side that lets you start or expand your business?

9. Joint venture

Another interesting way to get financing is by forming a joint venture with another business.

Joint ventures are partnerships between companies that establish a new entity, often to work on a mutually beneficial project. The idea behind joint ventures is achieving synergy and utilizing each business’ resources better.

So if you have contacts in adjacent industries, you can try and “join forces” to provide a better service together. This way, you can make use of your complementary resources instead of searching for other types of business funding.

Perhaps a potential partner can provide you with premises and you can acquire the rest of the assets? Or maybe you have all the necessary equipment but need working capital?

Whatever the situation, you will often find that partnering with a business from an adjacent industry can be helpful.

Bonus tip: Minimize risk

The business funding methods above can help you acquire the resources you need to start or expand your company. But we should also note what to avoid.

Amassing credit card debt or risking your private property is almost always a bad idea. You should approach business funding with care and ideally consult with a professional whom you know and trust.

While not essential, business funding can be important for starting and growing your tour or activity.

There are multiple ways to acquire business funding, but some options are better than others in the light of your specific situation.

When possible, you should always aim to finance your company with customer revenue.

If that’s not an option, you can turn to sources like grants which you don’t need to pay back.

Buying on credit, bank loans and support from friends and family are other options – if you’re confident you can pay for your purchases later.

If you can’t secure credit for one reason or another, consider offering a share in your company. This can happen through angel investors or venture capital firms if you’re at a later stage.

Finally, consider alternative financing options like peer-to-peer lending or reward-based crowdfunding.

Where that’s not enough, you can create a side business or set up a joint venture with another business to finance your company.

Whichever type of business funding you choose, the crucial thing is to approach the topic with care and make sure you avoid risky moves.

You might also like:

- How to Conduct Market Research for Tour and Activity Companies

- The Top Online Travel Agencies for Selling Tours and Activities

- 10 Ways To Get Free Advertising For Your Tour Or Activity Business

- How to Set Up an Online Store for Your Leisure Business

- The Best Content Management Systems For Tour And Activity Operators

Related Articles

Stay updated with Regiondo by signing up for our Newsletter

Get a personalized demo or create your free account now

Take your business to the next level with Regiondo - it's free to get started and you don't need a credit card.

Funding Options for a Travel Agency

When starting or growing a business, one of the most important decisions you’ll have to make is how to finance it. There are many different funding options available, each with its own advantages and disadvantages. In this article, we’ll discuss some of the most common funding options for travel agencies.

Before Seeking Funding For Your Travel Agency Business

Before obtaining funding for your travel agency business, you’ll need to do some preliminary work. You’ll need to create a business plan for your travel agency and determine how much funding you need.

You should also open a business bank account. This will make it easier to track your expenses and keep your finances separate from your personal assets.

Common Funding Options for Travel Agency Companies

There are numerous business financing and funding options available for a travel agency company. The most common ones are:

Bootstrapping

Bootstrapping a travel agency company is often the best option for new entrepreneurs, as it doesn’t require any outside funding. With this option, you can use your personal savings to cover initial costs such as business licenses, website development, and marketing.

This option has the advantage of being relatively low-risk since you’re not borrowing money from anyone else. However, it can sometimes be difficult to start and sustain a business without any outside investment.

Debt Financing

Personal loans from family & friends.

Another common financing option is loans from family and friends. This can be a good option if you don’t have enough money to cover your start-up costs. However, it’s important to establish a clear repayment schedule and to make payments on time to avoid damaging relationships.

Business Loans from SBA or Local Bank

The Small Business Administration (SBA) offers a variety of loans for travel agency businesses, including start-up loans, new equipment financing, working capital loans, and real estate loans. These loans are issued through local banks, and they come with relatively low-interest rates. There are also traditional bank loans and lines of credit that can be used to fund your travel agency business.

Business Credit Card

A company credit card is a good option for financing travel agency businesses. It allows you to borrow money up to a certain limit, and you can use the card to pay for expenses such as marketing, supplies, and travel.

The advantage of a credit card is that it can help you build your credit history and score as a business. However, you should make sure to pay off your balance each month to avoid accruing interest charges.

Equity Financing

Angel investors.

Angel investors are individuals or groups who invest in early-stage travel agency businesses in exchange for an equity stake in your company. This can be a good option for business owners who want to grow their business quickly, as angel investors can provide financing and mentorship.

However, angel investors often expect a high return on their investment, so you’ll need to be prepared to give up a 10% – 30% share of your travel agency company.

Other Funding Options

There are a number of other funding options available for travel agency businesses, including crowdfunding and grants. Crowdfunding allows you to raise money from individual investors through platforms such as Kickstarter or Indiegogo. Grants are available from a variety of sources, including the government and private foundations.

Create Your Business Plan

As mentioned above, for many of these options, you will need a solid travel agency business plan to make a strong case to potential investors or lenders. A well-written business plan can help you secure funding and grow your business.

There are a number of funding options available for travel agency businesses. The most common ones are bootstrapping, debt financing, business credit cards, equity financing, and grants. To secure funding, it is important to have a well-written travel agency business plan.

- About Company

- Investment Project Financing

- Long-Term Loans

- Lending up to 90%

- Refinancing

- Finance and Technology

- Latest Projects

- Questions and Answers

- Real Estate

- Oil and Gas

- Mining and Handling

- Industry and Environment

Financing and Engineering

- Thermal Power Plants

- Financial model for a thermal power plant

- Thermal power plant project financing

- Commercial and industrial loan for thermal power plant

- Thermal power plant design

- Thermal power plant construction

- Thermal power plant modernization

- Hydroelectric Power Stations

- Financial model for a hydroelectric power plant

- Hydropower plant project financing

- Commercial and industrial loans for hydropower plants: bank funding

- Hydropower plant design

- Hydropower plant construction

- Hydropower plant modernization

- Solar Power Plants

- Financial model of the solar energy project

- Solar power plant project financing

- Industrial and commercial loans for solar power plants: bank financing

- Solar power plant design

- Solar power plant construction

- Solar thermal power plant construction

- Solar power plant modernization

- Financial model of the wind farm project

- Wind farm project financing

- Commercial and industrial loans for wind farms: bank financing

- Wind farm engineering services

- Wind farm construction

- Wind power plant modernization

- Electrical Substations

- Financial model of electrical substation

- Electric substation financing

- Substation design

- Substation construction

- Substation modernization

- Waste Processing Plants

- Financial model for waste processing plant

- Waste processing plant financing

- Waste recycling plant design

- Waste processing plant construction

- Waste processing plant modernization

- Water Treatment Plants

- Financial model of water treatment plant

- Wastewater treatment project financing

- Wastewater treatment plant design

- Wastewater treatment plant construction

- Wastewater treatment plant modernization

- Sea Ports and Terminals

- Financial model of the seaport

- Financing for seaport projects

- Seaport engineering design

- Seaport construction

- Seaport modernization and expansion

- Liquefied Natural Gas Plants

- LNG plant financial model

- LNG plant project financing

- LNG plant design

- Construction of liquefied natural gas plants

- LNG plant modernization

- LNG Regasification Terminals

- LNG regasification terminal financial model

- LNG regasification terminal project financing

- LNG regasification terminal design

- LNG regasification terminal construction

- LNG regasification terminal modernization

- Mining and Processing Plants

- Financial model of a mining and processing plant

- Mining and processing plant financing

- Mining and processing plant design

- Mining and processing plant construction

- Mining and processing plant modernization

- Chemical Plants

- Financial model of a chemical plant

- Chemical plant project financing

- Chemical plant design

- Chemical plant construction

- Chemical plant modernization

- Mineral Fertilizer Plants

- Financial model of a mineral fertilizer plant

- Mineral fertilizers plant financing

- Mineral fertilizer plant design

- Mineral fertilizer plant construction

- Mineral fertilizer plant modernization

- Cement Plants

- Financial model for a cement plant

- Cement plant project financing

- Cement plant design

- Cement plant construction

- Cement plant modernization

- Publications

Tourism property: financing and investment loans

ESFC Investment Group offers assistance in financing tourism property projects around the world, including large hotels, resorts and entertainment centers.

Understanding tourism property financing

Market trends in tourism industry, financing tourism property by countries and regions, europe: germany, uk, france, italy, austria, turkey etc., asia-pacific: china, japan, korea, india, indonesia, australia, north america: united states, canada and mexico, middle east: uae, saudi arabia etc., africa: egypt, nigeria and south africa, south america: brazil, argentina, columbia etc., oceania: fiji, papua new guinea, new zealand, financing options for tourism properties.

Traditional loans vs specialized financing

Government programs and incentives, low-interest loans, tax incentives, industry-specific programs, private lenders and partnerships, private lenders, strategic partnerships, equity financing, mezzanine financing, investment loan strategies in tourism property financing.

Creating a solid business plan

Risk mitigation strategies, demonstrating roi, industries and services.

- Investments and Loans

- Project Finance

- Finance and Construction

- Consulting and Engineering

- Infrastructure

- Agriculture

- Thermal Energy

- Solar Energy

- Wind Energy

- Mining and Processing

- Chemical Industry

- Water Treatment

- Waste Recycling

- Cement and Concrete

(800) 949-0401 Apply Now

- Equipment Financing Application

- Equipment Leasing

- Equipment Lines of Credit

- Vendor Financing

- Section 179 Tax Deductions

- Commercial Financing Application

- Commercial Lines of Credit

- Capital Equipment Financing

- Commercial Real Estate Financing

- Commercial Aircraft Financing & Leasing

- Small Business Loan Application

- Traditional Term Loans

- Business Lines of Credit

Merchant Cash Advances

- Unsecured Working Capital Loans

- Asset Based Financing Application

- Invoice Financing

- Inventory Financing

- Recourse Factoring

- Traditional Factoring

- Accounts Receivable Financing

- Growth Equity

- Venture Capital

- Mezzanine Capital

- Testimonials

- Partner With Us

- Client Loyalty Program

- Frequently Asked Questions

- Crestmont Capital Blog

- Crestmont Capital Careers

- Travel Agency Company Business Loans

- Crestmont Capital

- Small Business Lending

Funding for Travel Agency Companies

Travel agency companies seeking financing often turn to the same sources, including banks, credit cards and loans from friends and family. Unfortunately, these options can hinder a business before it even has a chance to flourish.

In today’s economic world, it’s that much harder to receive the financing your travel agency business needs from traditional lenders like banks, and those who do qualify may find they’re dealing with stringent loan terms and uncompromising repayment conditions.

Meanwhile, credit cards may provide owners with the small business financing they require in the short term, but they also often come with high interest rates that can drive up debt and lead to significant financial headaches down the line.

Finally, while friends and family can often be counted on to support a business endeavor, mixing money and personal relationships is usually a recipe for disaster. The chances that family and friends have enough money to loan for business financing are quite low.

Fortunately, there is still a wealth of options for business financing available to owners across the country.

Why Choose Crestmont Capital for your Travel Agency Company Business Loans ?

At Crestmont Capital, we understand that no two travel agency companies are alike, and that’s why we view each scenario individually to ensure that our clients get the financing that suits their business needs. By looking at each business on an individual basis, we can approve many more business owners than our competition.

We can provide funding programs for travel agency companies with less-than-stellar credit, newer businesses, and businesses that perform well but can’t show it with financial statements. Our financing terms can range from 3 months to 10 years! With our common sense process, we approve a large percentage of our applications and are able to our clients significantly more capital. It only takes a few seconds to apply and less than 24 hours for approval.

- No Collateral Required, 100% Unsecured Funds

- Minimal Paperwork Required, Quickly Get Funded Within 24 Hours

- Bad Credit OK, Our Programs are Business Performance Driven

- No Upfront Fees

- Receive Your Approval Within Hours

Custom Tailored Travel Agency Company Business Loans

Small business loans provide your travel agency business with the cash it needs to expand, increase or replace inventory, advertise, consolidate debt, or even pay taxes. We do not offer “one-size-fits-all” lending. We work with you to make sure you understand all your options and help you to choose a loan that makes sense for your travel agency business.

SBA loans are the cream of the crop of small business loans. The Small Business Administration partially guarantees SBA loans, and because of this, lenders are willing to lend to small businesses more often and with better terms. SBA loans come with exceptionally ideal terms, but they will be the hardest type of business loan for which to qualify.

- Stretching Out High Limit Debt Over a Period of Up To 30 Years

- Prime Based Interest Rates

- Freeing Up Cash Flow

- Loan Amounts Up To 50 Million

- The Security of a Small Business Administration Loan

Business term loans offer a straightforward, affordable funding solution for small businesses. A traditional business term loan is a lump sum of capital that you pay back with regular repayments at a fixed interest rate. The set repayment term length will typically be one to five years long. Most business owners use the proceeds of term loans to finance a specific, one-time investment for their small business. Like an SBA loan, the terms of a traditional term business loan are ideal, but the requirements are somewhat stringent.

- Flexible terms from 2-5 Years to Fit Your Business’s and Industry Needs

- Low Cost of Funds

- Monthly Payments

- Long-Term Paybacks for Long-Term Projects

- Limited Documentation required for approval

- Grow Your Business The Way You Best See Fit

Businesses face emergency expenses and impromptu investment opportunities. Sometimes, they may not have the necessary funds available. That’s where a business line of credit comes in to play. Our Small Business Line of Credit Process makes this desire a reality.

With a business line of credit, you get access to a pool of funds which you can draw from whenever you need capital. Unlike a traditional business loan, you have the flexibility to borrow up to a specific, set amount. Then you repay only the amount you withdrew, with interest. Business lines of credit are conveniently available whenever needed, so you can use it to handle gaps in cash flow, get more working capital, or address almost any other emergency or opportunity.

- Immediate Access to Funds With No Waiting or Application

- Completely Unsecured with NO Collateral Needed

- Only Pay on Your Outstanding Balance and Not Your Loan Amount

- Regular Limit Increases Available Without Needing Further Documentation

- Every Payment is 100% Tax-Deductible

Unsecured working capital helps businesses with their daily costs. Sometimes, businesses experience lapses in working capital which affect their ability to maintain daily operations. Unsecured working capital is a method of financing that can keep things running.

Our working capital programs provide the funds a small business needs at terms that make sense for the success of that business. We offer loans up to $500,000 with little or no documentation. Our loans can be funded and the cash in your account in as little as 24 hours. The loans are unsecured, meaning we don’t need an interest in any assets for collateral. Apply for a working capital loan or working capital line of credit and watch your business grow. Once you apply, we do the work and leave you free to do what you’d actually like to be doing, running your travel agency business.

- $20,000 to $500,000 With Limited Documents Required

- Up To 2 Million With a Full Financial Package

- No Collateral Required

- Flexible Terms

- No Restrictions on the Use of Funds

- 100% Tax-Deductible

Start Up Business Loans

You did it! You opened your travel agency business. You’ve carefully planned and fine-tuned. Now, there’s one more obstacle between you and getting your business off the ground: money. Without it, you can not implement your ideas. Fortunately, there are startup loans for small businesses!

A startup business loan is a type of financing specifically tailored to help get new, small travel agency businesses the capital they need to get things moving. Fortunately, Crestmont Capital has a variety of startup loans to fit your new business’s financial needs.

- Skip the Bank Merry-go-Round

- Man or Woman, Young or Not-So Young – Everyone Has Options

- Quickly & Easily Get Money You Need

- Interest Rates 3.25%+

- Bad Credit Options Available

- Approval Rate Over 95%

Sometimes, businesses need fast cash. Often, going through the process of procuring a traditional loan will take too long, and the requirements are stringent. In these cases, merchant cash advances (MCA’s) can come in handy.

An MCA isn’t technically a loan; it’s an advance. With this option, we will advance your business’s future credit and debit card revenues that you will repay in a predetermined daily percentage of your business’s credit and debit card revenues. In a nutshell, you will receive an upfront sum of cash in exchange for a percentage of your future sales. Plus, they’re some of the easiest and quickest loans to acquire! Crestmont Capital offers a variety of flexible MCA options for your travel agency company cash needs.

- Quick access to funds

- Completely unsecured with no collateral needed

- Easy approval process

- Bad credit is accepted

- No restriction on the use of funds

INSTANT QUICK QUOTE

Recent Blog Posts

- Private Equity

- Equipment Financing

- Asset Based Financing

- Commercial Financing

- Small Business Loans

Get Started Now

- Privacy Policy

- Terms & Conditions

- Your Profile

- Your Subscriptions

- Support Local News

- Payment History

- Sign up for Daily Headlines

- Hospitality, Marketing & Tourism

New program offers interest-free loans to tourism businesses

- Share by Email

- Share on Facebook

- Share on LinkedIn

- Share via Text Message

PacifiCan is the federal economic development agency dedicated to help British Columbians, and it is launching a new $108-million program that provides interest-free loans up to $250,000 to eligible tourism businesses that apply by Feb. 20.

News of the program comes as countless B.C. small businesses, including tourism operators and restaurateurs, are at risk of folding because owners accepted interest-free Canada Emergency Business Account (CEBA) loans during the pandemic and now need to pay the money back by Jan. 18.

Failing to meet CEBA's repayment deadline would mean that the small-business owners would not be able to keep a portion of the original loans.

PacifiCan's program's mission is to increase the size of small and medium-sized tourism businesses in the province, thereby creating jobs, a more competitive industry and potentially globally successful businesses. Approximately 15 per cent of the program's loans are set to be for Indigenous applicants.

Businesses and not-for-profit organizations can apply for the funding, with not-for-profit ventures able to keep the money and not pay it back.

Businesses that get loans would enter into contracts and agree to repayment schedules.

To be eligible, applicants must have financially viable businesses that have operated for a minimum of two years in B.C.

"Restaurants, accommodation and retail are not normally eligible," PacifiCan's information page on the initiative says. "Some exceptions can be made for restaurants or accommodations that are an anchor for a tourism community."

Recipients who get funding must spend the money by March 31, 2026.

Project that are chosen to receive loans must include at least one of the following priority areas: • they support active tourism – projects that attract domestic and international visitors to participate in outdoor recreational experiences. This also includes improvements to make active tourism inclusive and accessible; • they increase tourism benefits for communities; • they support Indigenous tourism industry – projects that are either Indigenous-owned or led that improve or increase Indigenous tourism experiences; • they support economic, environmental and cultural sustainability; • they extend the tourism season; and • they complement support provided through provincial programs.

Preference will be given to project proposals that have a high impact on creating or maintaining jobs, increase visitors and achieve strong revenue growth. The winning bids are also expected to have a lasting impact that is felt long after the life of the project. Preference is also given to projects that align with community or regional tourism strategies and have funding outside of PacifiCan that comprises more than have of the projects' total values.

The intent of the program is to help fund infrastructure upgrades, such as trail development and leasehold improvements. It can also fund costs incurred when designing new or improved tourism products and services. Business owners can use the money to buy or rent machinery. They can also use it to pay for community engagement, planning, marketing, product demonstrations and acquiring new technology.

They are not able to use the PacifiCan loan to refinance existing debt, buy assets at prices that exceed fair market value or pay for lobbying. Other ineligible costs include salary bonuses, dividend payments, entertainment expenses, motor vehicles, land or building acquisitions, donations and ongoing operational costs.

It is unclear what uptake the program will have given the discontent felt by many small-business owners due to the CEBA loan program fiasco.

The CEBA program helped fund small businesses that were forced to close or limit operations due to public health mandates during the pandemic.

Businesses in the program applied for interest-free government loans up to $60,000, with the incentive being that $20,000 would be forgiven if the rest was repaid by a future date.

Prime Minister Justin Trudeau's government recently granted a modest extension to the repayment deadline: to Jan. 18, 2024, from December 31.

Small business advocates, such as BC Restaurant and Food Services Association CEO Ian Tostenson, have called that 18-day extension "disappointing," and are urging Ottawa to push the repayment deadline into 2025.

“Two-thirds of small businesses do not have the money to repay their CEBA loan and half of those have no capacity to borrow in order to secure the forgivable portion, said Canadian Federation of Independent Business CEO Dan Kelly. "If a business cannot repay the loan in full by Jan. 18, their CEBA debt increases by as much as 50 per cent, creating the potential for a quarter million business failures."

[email protected]

twitter.com/glenkorstrom

This has been shared 0 times

More hospitality, marketing & tourism.

Cultural Tourism Funding Opportunities

AIANTA collects funding opportunities that may be of interest to Indigenous or Native American tourism & hospitality enterprises looking to grow their tourism, culture, heritage, arts, agritourism or other culture and heritage programming.

Open Funding Opportunities

DOT/FHWA: Development Deployment of Innovative Technologies for Concrete Pavements

Deadline: May 20, 2024

Tourism Tip: Use innovative technologies relating to the design, production, testing, control, construction, investigation, operation and impacts of concrete pavements.

MAP Round 2 2024 Request for Proposals (RFP)

Tourism Tip: Create lasting change to activities on National Forest System lands or adjacent public lands.

Rural Development Broadband ReConnect Program

Deadline: May 21, 2024

Tourism Tip: Use loans or grant funds for costs of construction, improvement or acquisition of facilities and equipment needed to provide broadband service.

National Endowment for the Humanities: Cultural and Community Resilience

Deadline: May 22, 2024

Tourism Tip: Address the impacts of climate change by safeguarding cultural resources and fostering cultural resilience through identifying, documenting and/or collecting cultural heritage and community experiences.

First Nations Development Institute Advancing Tribal Nature-Based Solutions

Deadline: May, 22, 2024

Tourism Tip: to support climate action through nature-based solutions based on Native knowledge.

Western SARE: Research and Education Invitation for Proposal

Deadline: May 23, 2024

Tourism Tip : Develop a project incorporating research and education that brings together a team of researchers, students, ag professionals and producers.

Natural Resources Conservation Service Grazing Lands Conservation Initiative

Deadline: May 26, 2024

Tourism Tip : Develop a more strategic and comprehensive approach to support grazing systems, reach underserved producers and address climate change.

NPS Historic Preservation Fund Tribal Historic Preservation Office Grants

Deadline: May 30, 2024

Tourism Tip : Preserve historic properties and cultural traditions through the designation of a Tribal Historic Preservation Office or annual THPO grant funding.

Clean Energy Technology Deployment on Tribal Lands

Tourism Tip : Install clean energy technology and/or energy efficiency measures on Tribal lands.

Newman’s Own Foundation: Food Justice for Kids Prize – Indigenous Food Justice

Tourism Tip : Reclaim traditional food practices and systems to enable Indigenous children to learn about, grow, gather and cook Native foods.

USDA Rural Cooperative Development Grants

Deadline: May 31, 2024

Tourism Tip : S tart, improve or expand rural cooperatives and other mutually-owned businesses to help improve economic conditions in rural areas.

Union Pacific Foundation Community Ties Giving Program: Local Grants

Tourism Tip : Create, sustain or expand artistic and cultural experiences, provide recreational opportunities or preserve and restore nature along the UP footprint.

NEH Public Impact Projects at Smaller Organizations (PIPSO)

Deadline: June 12, 2024 (anticipated)

Tourism Tip: Use interpretive strategies to advance your public programming , strengthen interpretive skill sets or enhance community engagement.

DOE Clean Energy to Communities

Deadline: June 14, 2024 (anticipated)

Tourism Tip: Help your community understand different institutional contexts, resources, challenges, opportunities and ambitions to implement clean energy.

USFS Tribal Wildlife Grant Program

Deadline: June 21, 2024

Tourism Tip : Use for planning or managing programs to benefit wildlife and their habitat, especially those with cultural or traditional importance. Funding can also be used for mapping, surveys and public education.

National Forest Foundation Matching Awards Program

Tourism Tip : Provide o pportunities for your community to benefit from activities on National Forest System lands or adjacent public lands.

Bank of America Charitable Foundation

Tourism Tip : Focus on economic mobility in small businesses and support for community arts and cultural institutions.

USDA Rural Energy for America Renewable Energy Systems & Energy Efficiency Improvement Loans & Grants

Deadlines: June 30, and September 30, 2024

Tourism Tip: Use guaranteed loan financing or grant funding for renewable energy systems or to make energy efficiency improvements.

National Credit Union Administration Community Development Revolving Loan Fund

Deadline: July 1, 2024

Tourism Tip: Use loans and technical assistance grants to help your credit union support the communities and tourism enterprises they operate.

NEA Grants for Arts – Part II

Deadline: July 11, 2024

Tourism Tip: Use the funds to assist with art projects that tell the story of your place and culture. Grants are available for arts projects in a variety of artistic disciplines.

National Forest Foundation’s Collaborative Capacity Program for Forests & Communities

Tourism Tip: Support collaboration-based activities to benefit forests and grasslands currently managed by the US Forest Service through the National Forest System.

NPS Cultural Resources Management Services

Deadline: July 15, 2024

Tourism Tip: Work in partnership with the NPS to conduct various activities, including, but not limited to, studies outlined in the NPS Cultural Resource Management Guidelines.

VIA Art Fund Artistic Production Grants

Deadline: July 18, 2024

Tourism Tip: Awards to individual artists, nonprofit organizations or institutions to support new artistic commissions outside museum or gallery walls, within the public realm or in nontraditional exhibition environments.

O’Reilly Automotive Foundation Inc.

Deadline: July 31, 2024

Tourism Tip: In communities with O’Reilly Auto Parts companies, create a project that addresses economic stability in your tourism programs.

NEA Our Town Grants

Deadline: August 1, 2024

Tourism Tip: Develop a placemaking project that integrates arts, culture, and design activities to strengthen communities over the long term.

America Walks: Community Change Grants

Deadline: October 17, 2024

Tourism Tip: Use funds to create change and walking opportunities within your community.

NDN Collective Community Action Fund

Deadline: October 31, 2024

Tourism Tip : Support climate disaster response efforts to climate disasters such as flooding, fires and earthquakes.

Western SARE Professional Development Program

Deadline: November 1, 2024

Tourism Tip: Engage professionals to conduct educational programs and activities that incorporate environmental, economic and social dimensions of agriculture.

Receive AIANTA Updates

AIANTA Newsletters

View the AIANTA Newsletter Archive for more information.

Guides & Publications

USDA Resource Guide for American Indians and Alaska Natives

The USDA recently published a Resource Guide for American Indians and Alaska Natives (AI/AN) to provide tribal leaders and tribal citizens, 1994 Land-Grant Tribal Colleges and Universities, AI/AN businesses and non-governmental organizations serving AI/AN communities with a tool for navigating USDA resources. This guide provides readers with a comprehensive summary of USDA Programs.

Recreation Economy at USDA Economic Development Resources for Rural Communities

USDA’s Forest Service (FS), Rural Development (RD) and the National Institute for Food and Agriculture (NIFA) developed this resource guide for rural communities to identify resources that develop the recreation economy. The report forecasts that interest in outdoor recreation will continue over the next 30 years.

Resources for Rural Entrepreneurs: A Guide to Planning, Adapting, and Growing Your Business

In 2022, in collaboration with a network of federal partners, the USDA Resources for Rural Entrepreneurs guide provides resources for start-ups and already-established rural businesses. RD offers more than 40 loan, grant, and technical assistance programs to help improve the economy and quality of life in rural America. Many of these programs can also support community-based entrepreneurial planning and growth. USDA partners with community leaders and developers, local, state and Tribal governments, cooperatives, nonprofits, private organizations and a nationwide network of participating lenders skilled at building local economies.

Stronger Together, Federal funding and planning strategies designed to promote sustainable economic development in rural America

In 2022, the U.S. Department of Commerce Economic Development Administration (EDA) and the U.S. Department of Agriculture Rural Development (USDA RD) published Stronger Together a joint planning resource guide to help community organizations access USDA and EDA resources to build strategies to boost economic development in rural America. The guide is separated into four key focus areas: Planning and technical assistance, Infrastructure and broadband expansion, Entrepreneurship and business assistance and Workforce development and livability.

Federal Resources for Native Arts & Cultural Activities

In 2020, the National Endowment for the Arts published the Federal Resources for Native Arts & Cultural Activities, a guide providing information to connect Native communities to resources that can sustain and invigorate arts and cultural heritage initiatives. It is a consolidation of opportunities offered by federal agencies for organizations looking for funding and other resources to support Native arts and culture activities.

Grants.gov provides a unified site for interaction between grant applicants and the U.S. federal agencies that manage grant funds. The site allows applicants to search for funds by agency.

Federal Agencies

- U.S. Department of Commerce

- Economic Development Administration (EDA)

- Small Business Administration

- Regional Innovation Strategies

- Minority Business Development Agency

U.S. Department of Interior

- Bureau of Indian Affairs

- National Park Service

- Fish and Wildlife Service

- Bureau of Land Management

- Bureau of Reclamation

Bureau of Indian Affairs (U.S. Department of Interior)

- Office of Indian Energy and Economic Development

- Division of Transportation

- Division of Economic Development

National Park Service (Department of Interior)

- Grants & Financial Assistance

- Tourism Program

- Tribal Preservation Program

- National Historic Landmarks

- National Register of Historic Places

- Rivers, Trails and Conservation Assistance Program

- Conservation and Outdoor Recreation Division

- Cultural Resources

U.S. Department of Housing and Urban Development (HUD) www.hud.gov/program_offices/public_indian_housing/ih

- Office of Economic Development

- Indian Community Development Block Grant

U.S. Department of Health and Human Services

- Administration for Native Americans (ANA)

- Social and Economic Development Strategies (SEDS)

- Sustainable Employment and Economic Development Strategies (SEEDS)

- Native Youth Initiative for Leadership, Empowerment, and Development (I-LEAD)

U.S. Department of Agriculture (USDA)

- Business & Industry Loan Guarantees

- Community Connect Grants

- Rural Business Investment Program

- Rural Economic Development Loan & Grant Program

- Rural Microentrepreneur Assistance Program

- Socially-Disadvantaged Groups Grant

- Strategic Economic and Community Development

- Value-Added Producer Grants

- U.S. Forest Service (trail construction, archaeology)

National Endowment for the Arts (NEA)

- Our Town ($25,000 – $200,000)

- Challenge America ($10,000 underserved populations)

- Art Works ($10,000 – $100,000)

National Endowment for the Humanities (NEH)

- Division of Preservation and Access

- Documenting Endangered Languages

- Sustaining Cultural Heritage Collections

- Preservation Assistance Grants for Smaller Institutions

- Office of Challenge Programs

Institute of Museum and Library Sciences (IMLS)

- Native American Library Services: Basic Grants

- Native American Library Services: Enhancement Grants

- Native Hawaiian Library Services Grants

- Museums for America

- Inspire! Grants for Small Museums

- Museums Empowered

- National Leadership Grants for Museums

- Laura Bush 21st Century Librarian Program

- Museum Assessment Program

- Accelerating Promising Practices for Small Libraries

U.S. Department of Transportation www.transportation.gov/grants

- Office of Infrastructure Finance and Innovation

- National Scenic Byways Program

- Office of Tribal Transportation

Environmental Protection Agency (EPA)

- Building Blocks for Sustainable Communities

State Tourism, Arts & Economic Development Agencies

Arts.gov State and Regional Arts Councils arts.gov/partners/state-regional

California Arts Council arts.ca.gov/grants

California Governor’s Office of Business & Economic Development business.ca.gov

Montana Tourism Office marketmt.com

Nevada Arts Council: Folklife Community Grant nvartscouncil.org/grants

New Mexico Tourism Office newmexico.org/industry/work-together/grants

Oregon Tourrism traveloregon.com/grants

Additional Resources

Community Foundations www.cof.org/community-foundation-locator The Council on Foundations, founded in 1949, is a nonprofit leadership association of grantmaking foundations and corporations. Use their search tool to find local funding resources.

The Grantsmanship Center www.tgci.com The Grantsmanship Center offers training, publications and consulting to help organizations find funding. The Center provides free access to its Funding State-by-State database listing each state’s top grantmaking foundations, community foundations, corporate giving programs and State website homepages.

Candid (formerly the Foundation Center and GuideStar) candid.org/

Candid is an online source for grants available through private foundations, corporate foundations, and other nonprofits that accept grant proposals. It also provides research on nonprofits and guides, like the 990 Finder.

Bureau of Indian Affairs

Juan Bautista de Anza National Historic Trail

Native American Agriculture Fund

Lewis & Clark National Historic Trail

Bureau of Land Management

National Endowment of the Arts

National Park Service

United States Forest Service

- Branch Structure

- News Currently selected

- 90% of the cost for a new resource-efficiency audit or the full cost for reviewing an existing resource efficiency audit by the National Cleaner Production Centre of South Africa; and

- grant funding to qualifying small and micro enterprises on a sliding scale from 30% to 90% of the total cost of implementing qualifying resource efficiency interventions, which is capped at R 1 million.

- Secretary’s Corner

- GAD Activities

- GAD Issuances

- Mission and Vision

- Department Structure

- Key Officials

- Citizen’s Charter

- Attached Agencies

- General Info

- Culture & Arts

- People & Religion

- Tourism Industries Products

- Promotional Fair and Events

- Doing Business

- Philippines RIA Pilot Program

- Tourism Demand Statistics

- Standards Rules and Regulations

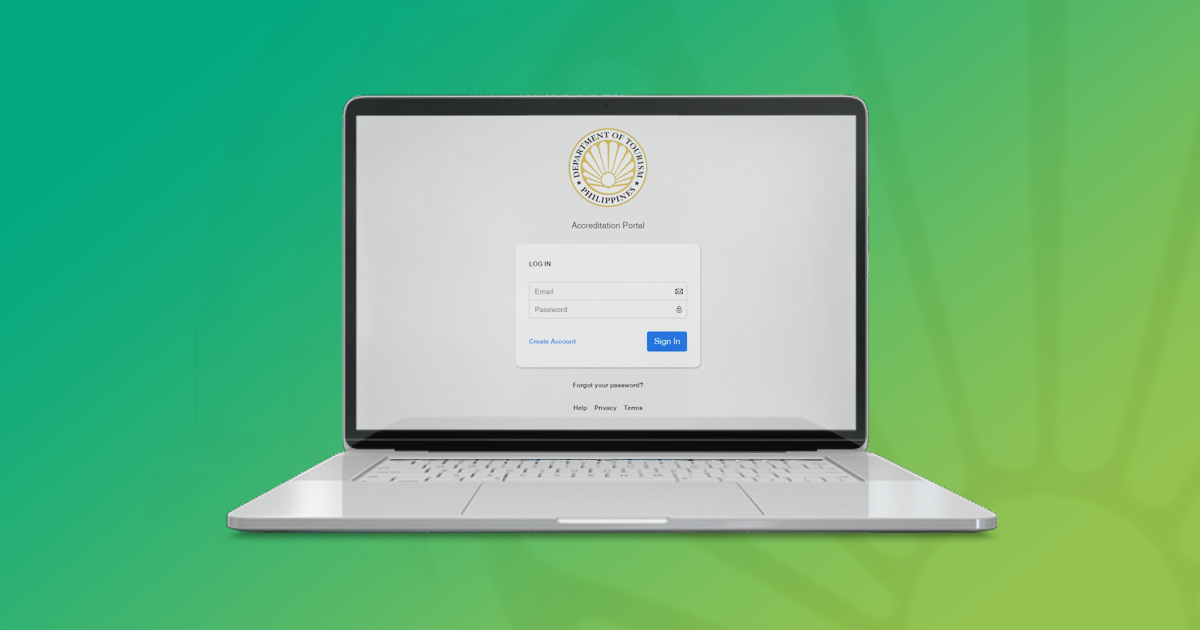

- Online Accreditation

- Accredited Establishments

- Learning Management System (LMS)

- News and Updates

- Announcements

- Publications

- Bids and Awards

Zero interest loans, no collateral, easy terms for distressed tourism businesses

The Department of Tourism (DOT) disclosed on Thursday (Sept. 17) some details of the loan program for tourism MSMEs that is being finalized with the Small Business Corporation (SB Corp) of the Department of Trade and Industry (DTI).

Under the Bayanihan to Recover As One Act (Bayanihan 2), the SB Corp was allocated funding for its COVID-19 Assistance to Restart Enterprises (CARES) and was thus directed to expand its loan programs including that for tourism and “to administer loans for DOT but subject to guidelines from the DOT.” Accordingly, the DOT in consultation with its tourism stakeholders has been in constant dialogue with the SB Corp to come up with the appropriate guidelines for the loan program for tourism MSMEs.

During the hearing for the Department’s 2021 budget, Tourism Secretary Bernadette Romulo-Puyat disclosed some details of the guidelines that have been so far agreed upon. SB Corp will prioritize DOT-accredited MSMEs to make it easier for the tourism stakeholders to avail of the loan. No collateral will be required for the loan, which is interest-free, payable in three years with a one-year grace period for a total loan term of four years. The loan application, which will include a two- to three-minute video presentation, may be submitted online. If the loan is approved, a minimal service charge for loan administration will be charged by the SB Corp.

“The agreement is to focus on MSMEs, which is also the emphasis in the Tourism Response and Recovery Plan (TRRP). Our priority now is to sustain our tourism workforce. By providing the working capital needed through these loans, the tourism businesses that have lost much because of the pandemic will be provided with a lifeline,” stressed Puyat.

The P6 billion credit facility may also be made available to non-accredited businesses provided that they are licensed by the local government unit (LGU).

The credit facility is part and parcel of the P10.1 billion package for the tourism industry under Bayanihan 2, which also includes P1 billion for tourism road infrastructure to be implemented with DPWH; P100 million for DOT-accredited and LGU licensed tour guides; and P3 billion to be administered by the Department of Labor and Employment (DOLE) for cash-for-work program to help DOT-accredited enterprises and its displaced employees.

Puyat stressed that the policy for the P3 billion program is not just a release of funds. It will be used as a cash-for-work or cash-for-training mode “because the intention of both departments is to ensure that apart from the cash, the stakeholders will receive something permanent in the process.”

Published:January 28, 2021

Recent News

PHILIPPINES AND BRUNEI DARUSSALAM SIGN LANDMARK AGREEMENT TO BOOST TOURISM COOPERATION

FUSING MILITARY HERITAGE WITH CULTURAL TOURISM WHILE INCREASING SAFETY AND SECURITY OF TOURISTS AT THE WALLED CITY

PBBM, FRASCO LEAD INAUGURATION OF TOURIST REST AREA IN PAGUDPUD

DOT, GO NEGOSYO HONOR ENTREPRENEURS, TRAVEL INFLUENCERS IN TOURISM SUMMIT 2024

FRASCO BACKS UPGRADE TO PHL AIRPORTS, PUSHES FOR THE DEVELOPMENT OF SECONDARY GATEWAYS

51 CENTRAL LUZON TOUR GUIDES RECEIVE OVER P2.55M WORTH OF FREE INSURANCE COVERAGE, AND TOUR GUIDING KITS FROM TOURISM CHIEF TO CELEBRATE 51ST FOUNDING ANNIVERSARY OF DOT

FRASCO HIGHLIGHTS ROLE OF GASTRONOMY TOURISM IN GLOBAL FORUM; BARES EFFORTS TO PUSH FOOD TOURISM IN PH

TOURISM CHIEF BARES PLAN TO LAUNCH TOURIST FIRST AID FACILITIES, ADD HYPERBARIC CHAMBERS IN PH

TOURISM CHIEF THANKS PBBM FOR “CHIBOG TOURISM” ENDORSEMENT ALIGNING WITH DOT GASTRONOMY TOURISM PROMOTION

DOT, TPB TO LEAD PHL DELEGATION TO ARABIAN TRAVEL MARKET AND SEOUL INTERNATIONAL TRAVEL FAIR 2024

SAMAR PROVINCE, DOT TOUT 3 NEW TOURISM CIRCUITS

DOT CHIEF: PHILIPPINES RECEIVES 2 MILLION INTERNATIONAL VISITORS; TOURISM RECEIPTS HIT PHP158 BILLION IN THE FIRST THREE MONTHS OF 2024

PH FORGES EXPANDED TOURISM TIES WITH QATAR

PBBM LAUDS WINNERS OF DOT’S TOURISM CHAMPIONS CHALLENGE; RAISES FUNDING FOR LGU INFRA PROPOSALS TO P255M

DOT UNVEILS TOURIST REST AREA IN PALAWAN

THE PHILIPPINES VIES FOR 7 AWARDS AS ASIA’S BEST FOR THE 2024 WORLD TRAVEL AWARDS

LOVE THE FLAVORS, LOVE THE PHILIPPINES: THE PHILIPPINE EATSPERIENCE OPENS IN RIZAL PARK AND INTRAMUROS IN MANILA

DOT CHAMPIONS GENDER EQUALITY WITH SUCCESFUL HOSTING OF INAUGURAL PATA INTERNATIONAL CONFERENCE ON WOMEN IN TRAVEL

PHILIPPINES TO BEEF TOURISM COOPERATION WITH AUSTRIA

THE PHILIPPINES RECORDS 1.2M INTERNATIONAL TOURISTS IN FIRST TWO MONTHS OF 2024

DOT, TPB TO ELEVATE PHILIPPINE EXPERIENCE, LEAD BIGGEST PHL DELEGATION TO ITB BERLIN 2024

TOURISM CHIEF BACKS CALLS FOR RETURN OF BOLJOON PULPIT PANELS TO CHURCH

CRK ROUTES ASIA 2024 WIN TO BOOST PH INT’L TOURIST ARRIVALS

TOURISM CHIEF LAUDS ‘CULTURAL HERITAGE AND HISTORY’ OF ZAMBOANGA SIBUGAY, COMMITS DOT’S SUPPORT TO PROVINCE’S TRANSFORMATION INTO A ‘TOURISM GEM’

DOT BOOSTS MEDICAL TOURISM EFFORTS WITH THE RELEASE OF UPDATED ACCREDITATION GUIDELINES FOR DENTAL CLINICS

DIVE TOURISM CONTRIBUTES P73 BILLION TO PH ECONOMY IN 2023 FRASCO

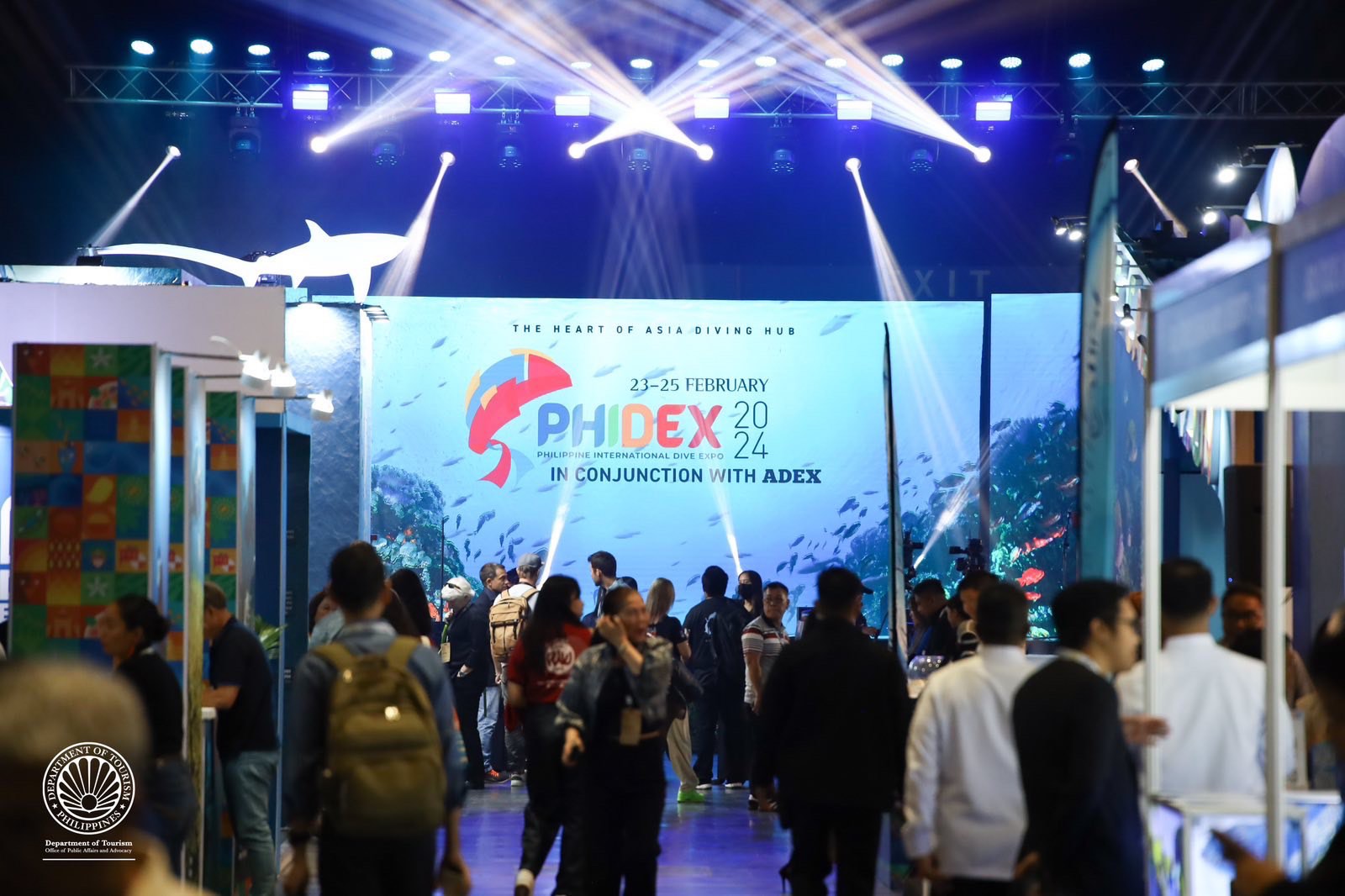

DOT TAKES THE LEAD IN UNITING THE GLOBAL DIVING COMMUNITY WITH PHIDEX 2024

PATA INTERNATIONAL CONFERENCE ON WOMEN IN TRAVEL TO BE HELD IN BOHOL, PHILIPPINES FROM MARCH 20 – 22, 2024

DOT TO PROVIDE SUSTAINABLE TOURISM DEVELOPMENT TRAINING FOR TOURISM OFFICERS THROUGH AIM, ATOP PARTNERSHIP

ZOZOBRADO TAKES OATH AS PHILIPPINE RETIREMENT AUTHORITY CHIEF

DOT AWARDS BRAND NEW TWO-BEDROOM SMDC CONDO TO FIL-CANADIAN WINNER OF BISITA, BE MY GUEST PROGRAM

NEXT STOP: ENTERTAINMENT HUB

DOT REVIVES PHILIPPINE TOURISM AWARDS

DOT LAUDS WINNERS OF ASEAN TOURISM AWARDS 2024

DOT TO HOST THE PHILIPPINE INTERNATIONAL DIVE EXPO (PHIDEX) IN FEBRUARY 2024

PHL IS LEAD COUNTRY COORDINATOR ON THE DEVELOPMENT OF THE ASEAN TOURISM DEVELOPMENT PLAN POST-2025

DOT, TIEZA EARMARK P15 MILLION FOR MANILA CENTRAL POST OFFICE RESTORATION PROJECT; FRASCO REITERATES SUPPORT FOR PH HISTORIC SITES, HERITAGE TOURISM

FRASCO TO LEAD PH DELEGATION AT THE ASEAN TOURISM FORUM 2024 IN LAOS

DOT CHIEF: SINULOG ALLOWS TOURISTS TO IMMERSE “IN AN EXPERIENCE THAT TRANSCENDS THE ORDINARY

DOT, DMW LAUNCH BALIK BAYANI SA TURISMO PROGRAM

PALAWAN GETS NOD AS WORLD TOP TRENDING DESTINATION IN 2024 BY TRIPADVISOR’S BEST OF THE BEST

DOT CHIEF: MORE LONG WEEKENDS TO BOOST DOMESTIC TOURISM IN THE COUNTRY

DOT Chief: Philippines surpasses yearend target with 5.45 million int’l visitor arrivals in 2023, int’l visitor receipts surge at PHP482.54 billion

Frasco proudly presents WTA awards to PBBM

DOT lauds PPP framework for Tourist Rest Area in Carmen, Cebu

DOT breaches industry targets for 2023; Frasco bullish on country’s continued tourism transformation under Marcos administration in 2024

Philippines cited for Global Tourism Resilience, wins World’s Best Beach, Dive, City Awards

DOT inaugurates first Tourist Rest Area in Bohol Island

PH wins big at international award-giving bodies

Philippine tourism earnings surge to 404B in first 10 months of 2023 – DOT chief

DOT hails inclusion of CRK as world’s most beautiful airport

DOT chief joins global tourism leaders in WTM Ministers’ Summit 2023 in London

Philippines, Japan ink deal on tourism cooperation

UNESCO Gastronomy City citation for Iloilo boosts gastro, creative tourism – Frasco

DOT’s Alternative Livelihood Training Program signals hope and recovery as Oriental Mindoro’s tourism industry bounces back after oil spill woes

Dot wins back-to-back best videos at world tourism organization competition.

The Philippines vies for 4 major awards at the prestigious World Travel Awards 2023

DOT chief joins high-level UNWTO Global Education Forum as panelist

The Philippines joins UNWTO General Assembly as Vice President for East Asia and the Pacific; prestigious global position held again after 24 years

DOT BARES 15 TOP LGU PROPOSALS FOR TOURISM CHAMPIONS CHALLENGE

Philippines Named Asia’s Best Cruise Destination 2023 by World Cruise Awards

Filipino Hospitality Excellence soars with DOT surpassing 100k target

TIEZA Philippine Tourism Investment Summit 2023: Uniting Public and Private Sectors to Fuel Tourism Growth

Frasco to join world tourism leaders in 25th unwto general assembly.

LOVE THE PHILIPPINES! Boracay, Palawan, Siargao voted among Asia’s best by Condé Nast Traveler readers

Tourism industry generates Php344 Billion in int’l visitor receipts in 9 months; Frasco seeks Senators’ support to usher in the “Golden Era” of Philippine tourism

DOT launches Tourist Assistance Call Center

Tourism chief visits Tawi-Tawi in PHL, assures LGU, tourism stakeholders of Marcos admin’s full support

Phl records more than 4m foreign visitors; dot optimistic on robust rebound of tourism.

Film Heritage building to rise, boost PH film tourism

DOT chief bares bold prospects for PH tourism at Global Tourism Economy Forum

Frasco to speak at UNWTO Global Tourism Economy Forum

DOT, TPB bring back on-site PHITEX 2023 in Cebu

Frasco thanks lawmakers for the swift approval and support for increase of Php 2.7 B DOT budget

DOT’s Bisita, Be My Guest program awards first raffle winners

Philippines’ FIBA hosting boosts hotel occupancy, visitor arrivals – Tourism Chief

1st Philippine Tourism Dive Dialogue unites Dive Industry: 37B raked in 2022

Boost in PH medical tourism seen with public-private convergence

Philippines wins “Asia’s Leading Dive Destination” at prestigious World Travel Awards 2023

DOT affirms support to peace and security efforts under Marcos administration

Frasco cites PBBM’s policies, programs for the industry at PTM 2023

DOT inks deal with Cebu LGU for more Tourist Rest Areas, “Heritage City” Carcar thanks DOT for TRA

DOT in full support to FIBA World Cup Opening Day

DOT, TESDA ink deal to expand tourism education, reinforce tourism training opportunities

DOT, NCIP ink partnership to empower indigenous peoples, protect and promote cultural heritage through tourism

Lawmakers laud tourism initiatives, bat for higher 2024 budget for DOT

PHL records Php 286B tourism receipts from January to July; Frasco bares efforts to support tourism in Central Visayas

PBBM’s prioritization makes tourism among top drivers of economic growth– DOT Chief

DOT inaugurates first Tourist Rest Area in Mindanao; Frasco bares plan to build 15 more TRAs across the country

Dot records more inbound flights to phl, increase in domestic air routes.

Tourism Chief highlights Culinary Tourism in PHL at World Chefs Asia President Forum 2023

NMP-Cebu to spur tourism development in Visayas Region—Frasco

DOT Chief welcomes e-Visa system for Chinese tourists

DOT positions PHL as one of Asia’s most LGBT-friendly destinations

From courtside to paradise: DOT supports FIBA World Cup hosting with Philippine Tour Packages

DOT bares tourism milestones under PBBM’s first year in office; Secretary Frasco optimistic on exceeding industry targets for 2023

PHL int’l tourist arrivals breach 3M mark; tourism receipts surge at P212.47 billion

Frasco inaugurates first ever DOT Tourist Rest Area in PHL

Pbbm trusts frasco, tourism chief gets widespread support.

Frasco launches Philippines Hop-On-Hop-Off for Manila

DOT chief grateful for continued support from lawmakers, employees

Love the Philippines draws widespread support

DOT’s enhanced branding is Philippines’ Love Letter to the world

Batanes joins UNWTO International Network of Sustainable Tourism Observatories inclusion is a manifestation of Philippines’ successful sustainability efforts in local destinations – DOT chief

The Philippines elected as Vice President of UNWTO General Assembly after 24 Years, nabs Chairmanship of Commission for East Asia and the Pacific

DOT eyes increased arrivals from Cambodia

DOT welcomes positive tourism figures for FY2022; vows sustained industry recovery drive under the Marcos administration

Ph vies for six nominations for the wta 2023.

DOT rallies support of tourism stakeholders on digitalization initiatives

Heritage and Arts Tours in San Juan City get support from DOT

Tourism chief, Deputy Speaker Frasco donate for education of Pagsanjan boatmen’s children

Tour Guides to get more livelihood with Digital Bookings

DOT commits full support on Laguna’s local tourism resurgence; vows for more tourism projects in the province

TWG convened to drive up CRK utilization; travel and tourism to remain ‘spark of hope’ for Clark – Secretary Frasco

Philippines wins Emerging Muslim-friendly Destination of the Year Award (Non-OIC)

Dot supports malacañang heritage tours.

The country’s colorful marine life takes the spotlight in DOT’s Anilao Underwater Shootout

DOT, DND, DILG forge pact to make Mindanao a peaceful and viable tourist destination

DOT, PRA ink partnership

DOT lauds Rosquillos Festival’s showcase of local culture, contribution to local tourism

PHL participation in int’l, local travel and trade fairs yields more than P3 billion in business leads—DOT Chief

More than 43k workers receive dot training on the filipino brand of service excellence (fbse).

DOT vows support to SOCCSKSARGEN, Mindanao

Pbbm approval of phl tourism plan to spur tourism transformation, employment, philippines’ int’l visitor arrivals breach 2m.

DOT lauds PATA’s initiative to rebuild tourism communities in Laguna, Pagsanjan Falls

Filipino tourism frontliners recognized during DOT’s 50th founding anniversary celebration

DOT supports new country brand under the Marcos administration

DOT welcomes the resumption of chartered flights to PHL top destination Boracay

Medical Tourism pushed by Marcos Administration with strategic global partnership – DOT Chief

Frasco meets US filmmakers, media execs to promote Philippine tourism

Record number 1,400 Koreans arrive to Filipino welcome led by Tourism Secretary Frasco

Tourism chief Frasco dives in Puerto Galera, provides alternative livelihood to Oriental Mindoro

Philippine-Turkiye air service deal to boost tourism- DOT Chief

DOT-DOLE Tourism Job Fairs offer more than 8K jobs; 3rd leg set in May

DOT, DOTr jointly conduct inspection at NAIA T2 ahead of Holy Week break

More than 6k jobs up for grabs at DOT’s PHL tourism job fair

Go Negosyo, DOT mount Tourism Summit in Cebu

Business as usual in Puerto Galera; DOT to train tourism workers affected by oil spill for alternative livelihood – Frasco

DOT holds Philippine visa reforms convergence

Philippines hits 260M negotiated sales, bags recognition at the ITB Berlin 2023

DOT chief unveils National Tourism Development Plan (NTDP) 2023-2028 at stakeholders’ summit

Frasco meets with Central Europe tourism players, vows prioritization of tourism under Marcos Administration

Philippines comes back with biggest delegation to ITB Berlin, bags sustainable tourism recognitions

Oil Spill affecting tourist sites – DOT Chief

DOT issues guidelines pushing for more openness for tourism enterprises

Tourism chief to lead biggest PHL delegation to ITB Berlin 2023

PHL feted Best Dive Destination anew

New Flights from Clark to boost tourism, decongest NAIA

Frasco lauds Ilocos Norte’s Tan-Ok festival as manifestation of the Philippine Experience’

Frasco: Panagbenga Festival touts Baguio’s tourism resurgence

DOT extends ‘free accreditation’ for tourism establishments

DOT Chief launches Tourism Champions Challenge’ to spur tourism development in LGUs

PHL secures back-to-back nominations at the 2023 World Travel Awards

Frasco convenes first TCC meeting, forecasts full domestic recovery in 2023

Frasco leads groundbreaking of new tourist pit stop to boost Palawan tourism

Frasco leads grand welcome reception for cruise passengers, says ‘PHL aims to be cruise hub in Asia’

Japanese stakeholders bullish of PHL tourism prospects

PBBM, Tourism chief engage Japanese tourism stakeholders in high-level meet in Tokyo

Tourism chief affirms DOT’s support to PH Dev’t Plan 2023-2028

Chinese tourists receive warm welcome from PHL; DOT foresees swifter tourism recovery with Chinese outbound group tour

PHL, CHINA ink tourism implementation deal

PHL breaches 2.6M arrivals for 2022; DOT chief bullish of 2023 projections

DOT lands on Top 3 Highest Approval Rating among Government Agencies; bares targets for 2023

DOT, DICT ink deal for improvement of connectivity in tourist destinations, digitalization of services

DOT, DMW launch newest incentivized tourism promotions campaign

DOT, TIEZA launch 7th Tourist Rest Area in Pagudpud’s Saud Beach

Tourist Rest Area to rise in Bohol

Luzon’s First DOT Tourist Rest Area to Rise In Baguio City

DOT strengthens PHL-Saudi Arabia tourism relations, engages industry key players

Statement of Tourism Secretary Christina Garcia Frasco on the Launch of the e-Travel System

Filipino hospitality, Philippine sustainable tourism highlighted at WTTC Global Summit Saudi Arabia

Frasco welcomes Uzakrota World’s Leading Country Award, PHL destinations’ citations

Frasco eyes more urban parks in the Philippines

DOT’s Frasco is among best-performing cabinet officials- RPMD Survey

Frasco hails first-ever North Luzon Travel Fair as critical to revitalizing tourism; reiterates the Philippines’ readiness for visitors

DOT welcomes long holidays for 2023; PBBM signing of Proclamation No. 90 important stimulus to PHL domestic tourism in 2023: DOT chief

PHL visitor arrivals reach 2M; tourism revenue hit 100B – DOT Chief

Philippines hailed as World’s Leading Dive and Beach Destinations

PHL Tourism Chief initiates tourism cooperation talks with Italian Tourism Minister

Palawan cited “Most Desirable Island” in 21st Wanderlust Travel Award

Outlook for Philippine tourism positive – tourism chief

DOT launches 1st North Luzon Travel Fair

Tourism chief to lead PHL contingent to WTM, brings listening tours to FILCOM in UK

PBBM oks easing of stringent travel restrictions

PHITEX 2022 yields record high 173M sales leads

One Health Pass replaced with PHL’s ‘simpler’ eARRIVAL CARD system

Philippine Experience Caravans to roll out 2023 – Frasco

DOT relaunches Philippine Tourism Awards

DOT exceeds 2022 target arrivals; PBBM rallies support for tourism as admin’s priority sector

Siargao, a priority for Tourism Development — Frasco

STATEMENT OF TOURISM SECRETARY CHRISTINA GARCIA FRASCO

DOT bares tourism wins under PBBM’s first 100 days

Tourist Rest Areas for PHL’s top destination – Cebu

Tourist Rest Areas launched in Mindanao

FY 2023 DOT budget submitted to plenary; Senators press for higher tourism budget

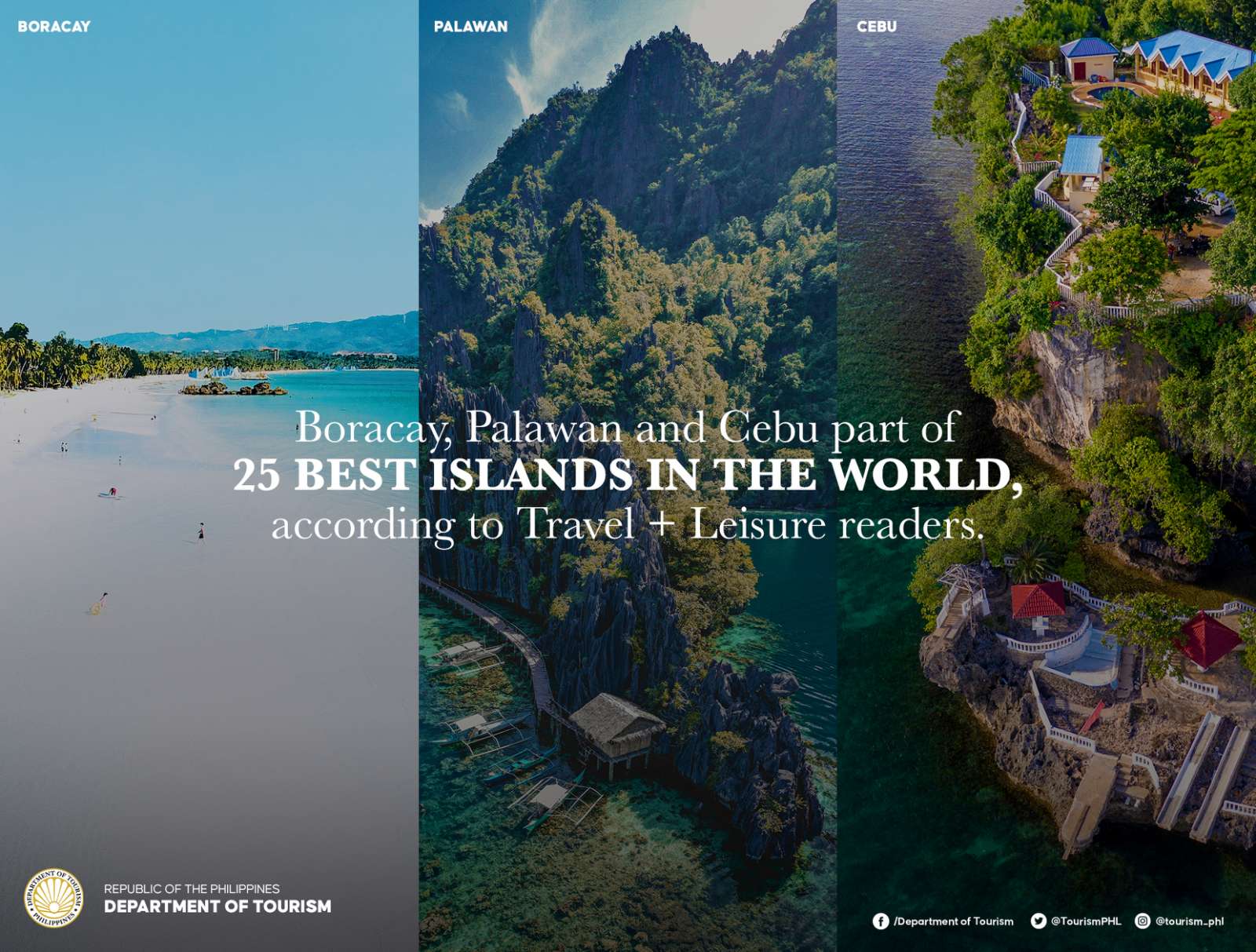

DOT celebrates Philippines’ back to back wins at Conde Naste Traveler Readers’ Choice Awards; Boracay claims spot as top island in Asia anew

Frasco secures CA nod as Tourism Chief

DOT receives HOR nod for P3.573 B budget for 2023

First ever DOT-DOLE nat’l tourism job fair opens

Tourism Chief tackles plans to revive industry, entices foreign investors in New York briefing

PBBM pronouncements at UN meet an “excellent representation” of PHL – Secretary Frasco

DOT-DOLE 1st Philippine Tourism Job Fair pre-registration now open, more than 7k jobs available to tourism job seekers- Sec. Frasco

STATEMENT OF TOURISM SECRETARY CHRISTINA GARCIA FRASCO ON THE LIFTING OF OUTDOOR MASK MANDATE IN THE PHILIPPINES

DOT muling pinarangalan ng Selyo ng Kahusayan sa Serbisyo Publiko 2022

DOT Chief welcomes IATF recommendation to make masking optional when outdoors

Phl scores back to back win in WTA Asia; Intramuros hailed as Asia’s Leading Tourist Attraction of 2022

Frasco lays out DOT plans and programs for industry recovery; lawmakers bat for higher DOT budget

More than 1,500 tourism jobs to be offered in joint DOT-DOLE job fair

Dot to ink tourism job fair program – trabaho, turismo, asenso with dole; domestic, international jobs to be available to tourism job hunters.

Thailand to offer tourism job opportunities to Filipinos– Frasco

PHL tourism chief pushes for increased connectivity, interoperability of vax certs, equalization of opportunities, and sustainability in APEC tourism ministers’ meet

Philippines strengthens tourism ties with Thailand

DOT TRAINS BOHOL VENDORS ON FILIPINO BRAND OF SERVICE EXCELLENCE

20 intl, local dive and marine experts take centerstage at PHIDEX 2022

Measures in place to ensure safe travel to PHL – Tourism Chief

FRASCO OPTIMISTIC OF PH TOURISM RESURGENCE, LAUDS CEBU TOURISM SUCCESS

Frasco eyes visitor-friendly, “distinctly Filipino” air, seaports in PHL

DOT celebrates Philippine Accessible Disability Services, Inc. (PADS) Dragon Boat Team historic four gold medal haul

DOT to facilitate interagency effort to strengthen Filipino Brand of Service

DOT to coordinate on quake-hit tourist destinations, heritage sites

PBBM cites tourism as top-priority; orders infra development, enhancement of Filipino brand

DOT chief takes “Listening Tours” to Luzon

DOT Chief affirms support to National Museum of the Philippines; proposes inclusion of museums in tourism circuits

Boracay, Palawan and Cebu hailed World’s Best Islands; DOT celebrates back-to-back accolades for PHL destinations

Marcos push for Tourism Infra strengthens industry, raises PHL global position – DOT Chief

DOT lauds Boracay’s inclusion in TIME’s 50 World’s Greatest Places of 2022

DOT lauds Cebu-based group win in int’l dance competition

Statement of tourism secretary christina garcia frasco on banaue.

Tourism Chief Frasco kicks off listening tours in VisMin, encourages officials to reach out to LGUs, stakeholders

Tourism chief Frasco to go on ‘listening tours’ starting this week

Dot reports increase in domestic tourism in 2021.

Incoming tourism chief receives warm welcome from employees, vows to bring “LGU perspective” to DOT

DOT’s Philippine International Dive Expo (PHIDEX) returns to Manila next month

First Davao Dive Expo slated on June 24

DOT touts ‘future farms’ as new and sustainable tourist attractions

DOT pitches PHL as ideal retirement destination in Japan Expo

DOT positions New Clark City as premier tourism investment hub

PH’s significant recovery in travel and tourism hot topic in Routes Asia 2022

DOT’s KAIN NA! takes foodies to a multi-sensory adventure

DOT Presents “Escape: Stories from the Road” Podcast

Second (2nd) Online Master TESOL Certification Course

DOT, MMC Foundation partnership brings ER bikes to three Metro Manila tourist sites

DOT spotlights PWDs and women in tourism with new “It’s More Fun for All” campaign

Media release from the department of tourism.