We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

How to use a United Airlines trip credit (and few details you need to know)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

It’s been about a year since your summer 2020 travel dreams were dashed against the stone of COVID-19. Do you have trip vouchers, credits, or funds that are soon to expire?

Several airlines have extended travel credits into 2022. Whether you’re in a rush to use them or not, it’s nice to have a visual guide to explain the process to you. I just repurposed my 2020 United Airlines flight credit for an upcoming trip to the West Coast next month. I’ll show you how easy it is to use a United flight credit and give you a couple of tips along the way. And how you can pair a United credi t card with it to get the most value.

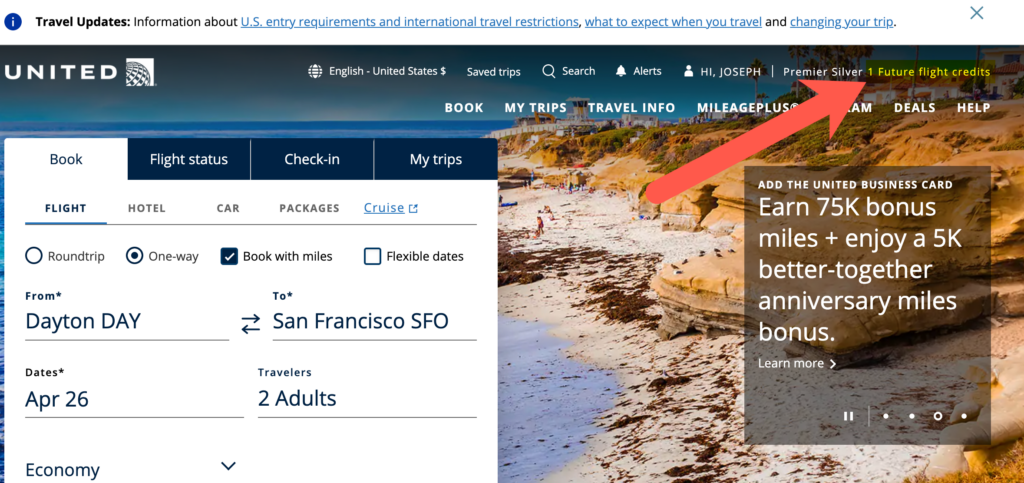

Step 1. Find future flight credits at the top of the page

Once you log into your account, you’ll find any flight credits displayed at the top left of the screen. Click that to get the process started.

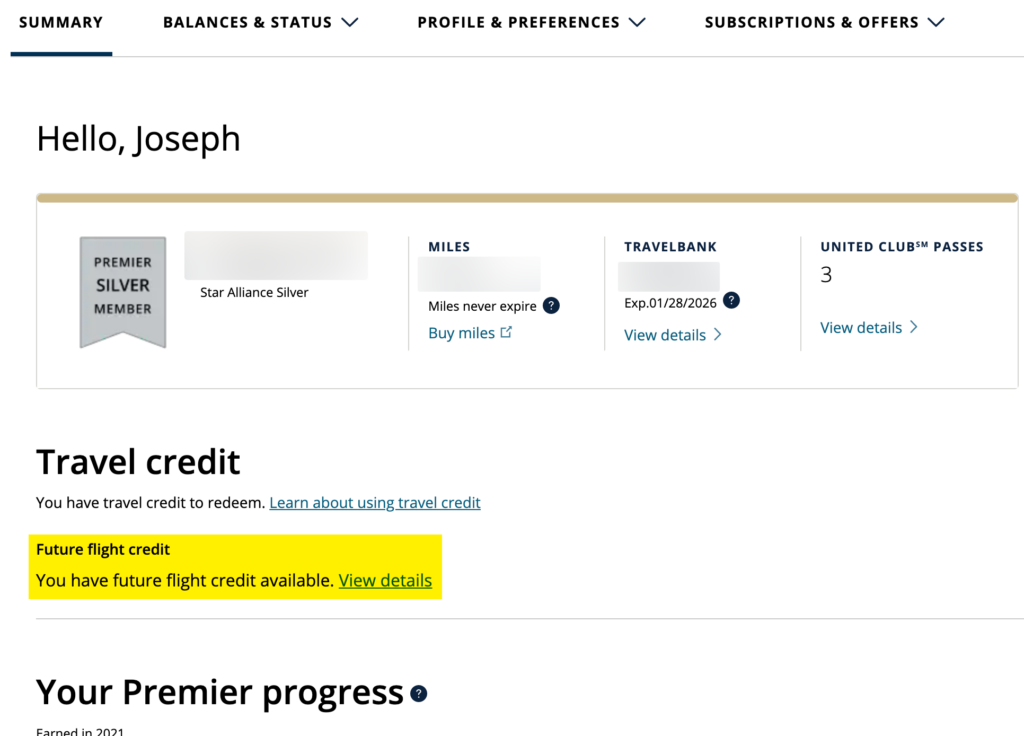

Step 2. Click the details of your future flight credit

You’re now taken to your dashboard displaying your mileage balance, TravelBank balance, elite status progress, etc. Under “Travel credit,” you’ll see any future flight credit you’ve accrued. Click “View details.”

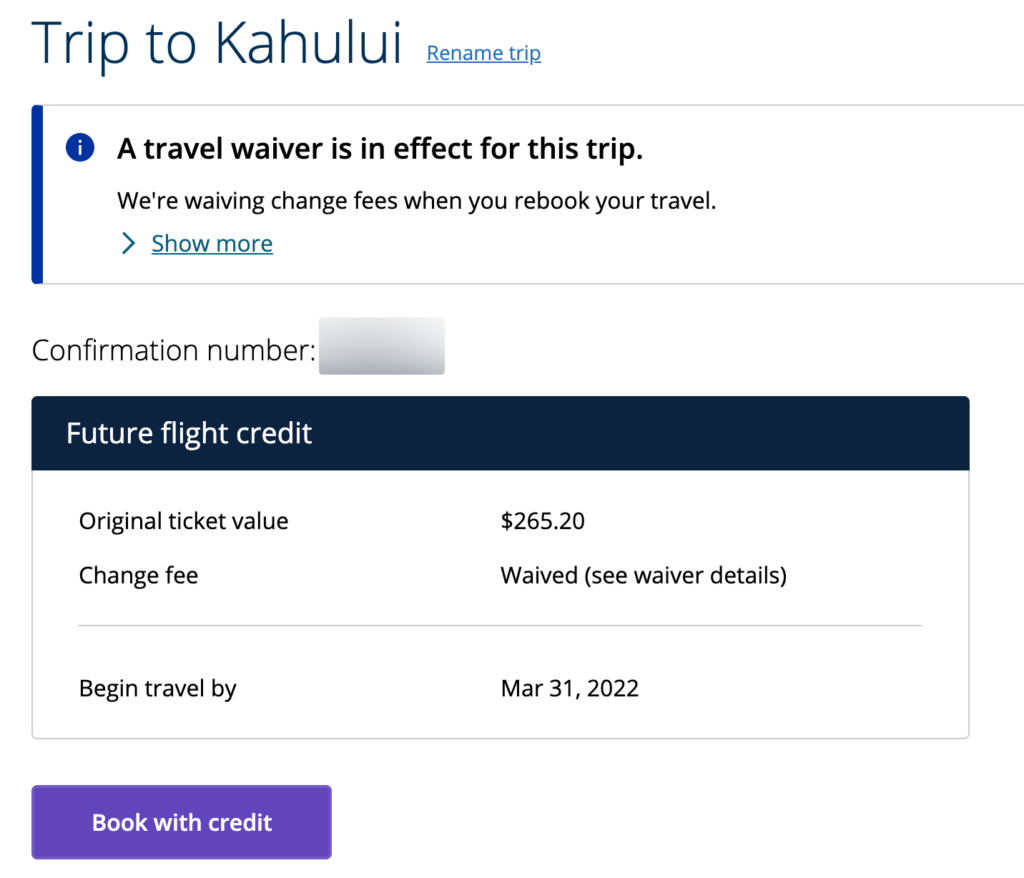

Step 3. Click “Book with credit”

I’ve only got credit from one canceled trip. United prominently displays the value of that flight which can be attributed to another United trip. You’ll also find the expiration date for your flight here.

Click “Book with credit.”

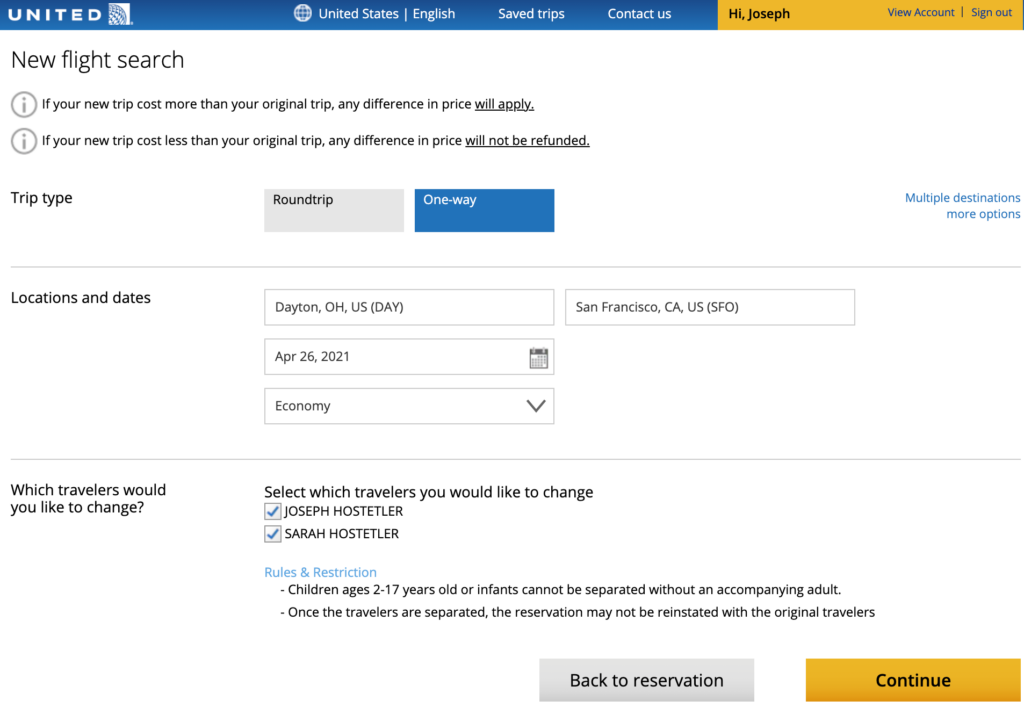

Step 4. Enter your new travel info

You’re now carrying your trip credit’s value along with you as you search for new flights. Enter your new details, check all the passengers that will be traveling with you, and click “Continue.”

Note that while there aren’t any fees for changing your flight, you’ll still have to pay the difference if your new fare is more expensive than your trip credit — but if your new fare is less than your trip credit, you will forfeit the difference in your trip credit. For example, if you’ve got a $100 trip credit, but your new flight is $90, you’ll lose $10.

This is a good principle to keep in mind when reserving your flights. Perhaps try to book two one-ways instead of a round-trip, so if you have to cancel, your trip credits will be smaller and you’ll have less chance of forfeiting value.

Step 5. Choose your new flight

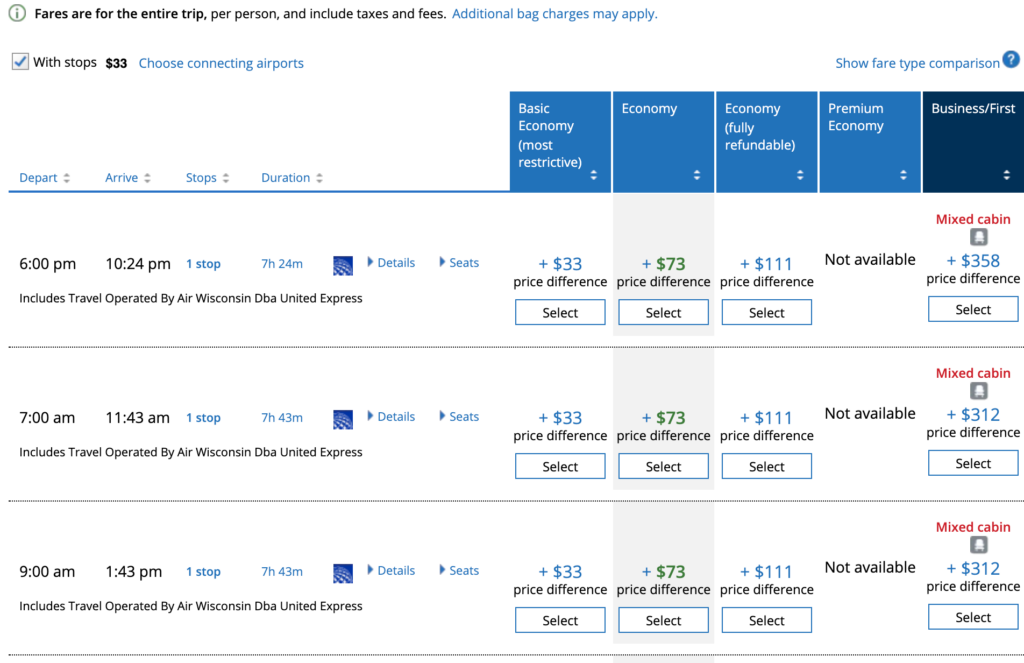

Your new airfare doesn’t have to be the same origin and destination — your trip credit can be used towards any flights. I changed my flights from Portland-Maui to Dayton-San Francisco. In your search results, United displays flight prices relative to your applied flight credit. As you can see, most flights are at least $33 more expensive per person.

As a side note, I’m able to choose United Basic Economy (the absolute worst seats), because I have the United℠ Explorer Card, which negates most of the restrictions that Basic Economy enforces. For example, United cardholders can bring a carry-on bag for free, and they’ll receive preferred boarding. Basic Economy travelers without a United credit card will board dead last and aren’t allowed to bring a carry-on.

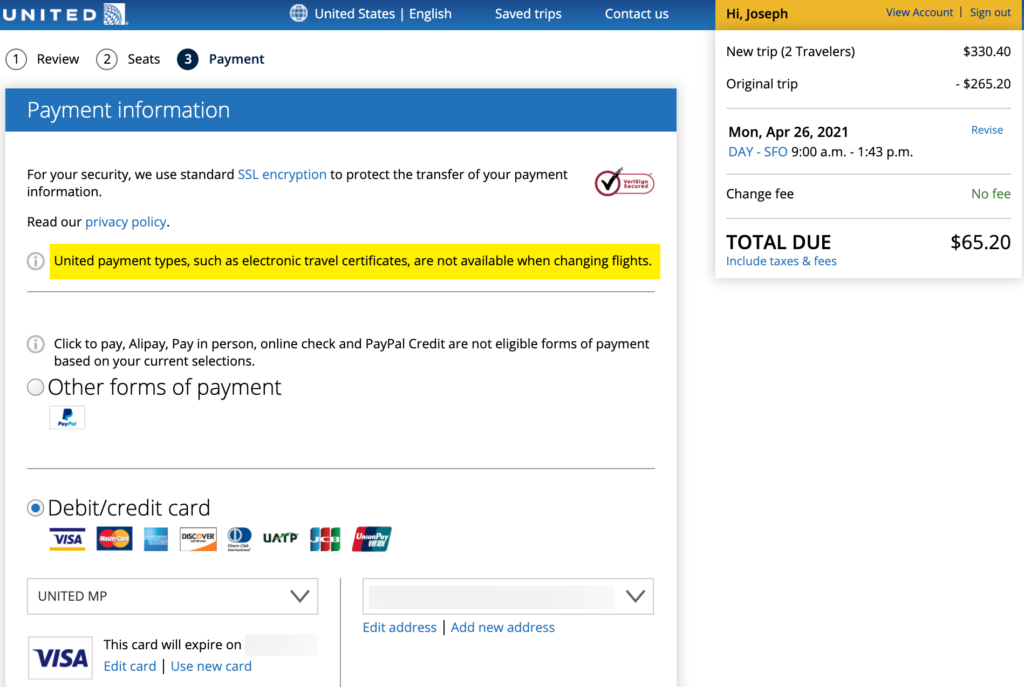

Step 6. Reserve your trip

You’ll then need to review your trip details, and it’s time to check out! You can see the actual cost of the itinerary minus the applied trip credit.

Something big to note is that you can’t mix any United TravelBank cash with a trip credit. If you’re applying a previously canceled trip’s value to your flight, any remaining value will have to be paid in cash. An unfortunate truth.

Bottom line

If you’ve got another voucher in another program, let us know if you need help with that. Also check out our guide to making American Airlines flight credits more valuable . It could save you literally $1,000+ — just look at the comments!

For more travel tips and how-tos delivered to your inbox once per day, subscribe to our newsletter !

Joseph Hostetler

Joseph Hostetler is a full-time writer for Million Mile Secrets, covering miles and points tips and tricks, as well as helpful travel-related news and deals. He has also authored and edited for The Points Guy.

More Topics

Join the Discussion!

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

6 Things to Know About United TravelBank

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Whether you're saving up for a special occasion — like a honeymoon — or just an upcoming getaway, many travelers opt to save future travel funds in a dedicated bank account. For United Airlines loyalists, this process can be even simpler.

United MileagePlus account members can access a budgeting tool called United TravelBank. Let's dive into the things you'll want to know about the service, how to use it and if it's worth "saving" money in this account at all.

What is United TravelBank? How does it work?

United's TravelBank is pretty much what it sounds like — an online account designed for accumulating travel funds for future United flights. It aims to simplify United MileagePlus members’ budgeting for future personal and/or business flights.

Once the account is set up and has money in it, it syncs with both united.com or the United mobile app as a payment option.

» Learn more: How to use the United MileagePlus X app to earn miles

What to know about United TravelBank

1. you can purchase united travelbank credits for your account.

United gives MileagePlus members the opportunity to buy deposits for their own TravelBank account. However, you can only purchase TravelBank credits in one of six amounts:

If you want to deposit a different amount, you can do so across multiple transactions. Say you want to deposit $150. Just purchase $50 in funds and then make another purchase of $100.

The only limitation is that you can't exceed $5,000 per day per MileagePlus account, meaning that you can do at least five purchases per day.

2. United TravelBank credits are valid for five years

Does United TravelBank expire? Yes. Purchased funds are valid for five years from the date the funds are deposited into your TravelBank account. That gives you plenty of time to use the funds.

That's a much longer validity than other types of airline travel credits. For instance, when purchasing airfare on United, you generally only have 12 months from the date of purchase to use those funds for a flight. So, if you really aren't sure that you'll be able to travel in the next year, you can use the United TravelBank to stash money away for future airfare purchases.

Even with the generous expiration policy, we recommend using up your full TravelBank balance whenever possible to avoid leaving money on the table.

3. You can get United TravelBank credits by holding an IHG card

One of the unexpected ways to get United TravelBank credits is through select IHG credit cards. IHG One Rewards Premier Credit Card and IHG One Rewards Premier Business Credit Card customers can enroll to get up to $50 in TravelBank Cash each calendar year. Cardholders get one deposit of $25 in early January of each year and another $25 deposit in early July.

However, these funds work differently from purchased TravelBank funds. Instead of having five years of validity, you only have a little over six months to use these funds before they expire. The $25 deposited in early January expires on July 15 of the same calendar year, and the $25 funded in July will expire on Jan. 15 of the next year.

During the two-week crossover period, you could have up to $50 in active TravelBank funds from this IHG credit card benefit. That's probably not going to be enough to cover an entire flight, but at least it can save you some out-of-pocket cost on your next United flight.

Eligible cardholders can go to ihg.com/united to register to start receiving this new card benefit. You'll need to log into your IHG One Rewards account and then provide your United MileagePlus number and last name to complete registration. The terms and conditions note that it may take up to two weeks after registration before you receive your first $25 TravelBank deposit.

on Chase's website

4. It’s possible to use credit card travel credits to fund your United TravelBank

United TravelBank purchases often code as travel expenses on your credit card bill. That means you can earn bonus points when using credit cards with a travel bonus category. And you might even be able to use credit card travel credits — such as the Chase Sapphire Reserve® $300 annual travel credit , the Citi Prestige® Card $250 air travel credit or certain other credit card incidental fee credits.

» Learn more: The best airline credit cards right now

5. You can't use United TravelBank funds for other travel purchases

A major downside of the United TravelBank is that funds can only be used to book United-operated or United Express-operated flights, plus certain subscription products.

Travelers living near an airport with a strong United presence may not mind being limited to flying United. However, if Delta Air Lines, Alaska Airlines or American Airlines offers a much cheaper airfare, you won't be able to use your United TravelBank funds to purchase those flights.

Likewise, United TravelBank funds can't be used for hotels or car rental purchases.

» Learn more: United vs. Delta — Which is best?

6. The United TravelBank doesn't earn interest

Another downside of saving funds through the United TravelBank is that you won't earn interest on the saved funds. Over the past few years, interest rates have been so low that you wouldn't have missed out on much interest income by placing funds in the United TravelBank instead.

However, now that interest rates are increasing , you might be able to grow your travel funds faster by saving funds in an actual savings account rather than the United TravelBank.

» Learn more: Compare savings account rates in your ZIP code

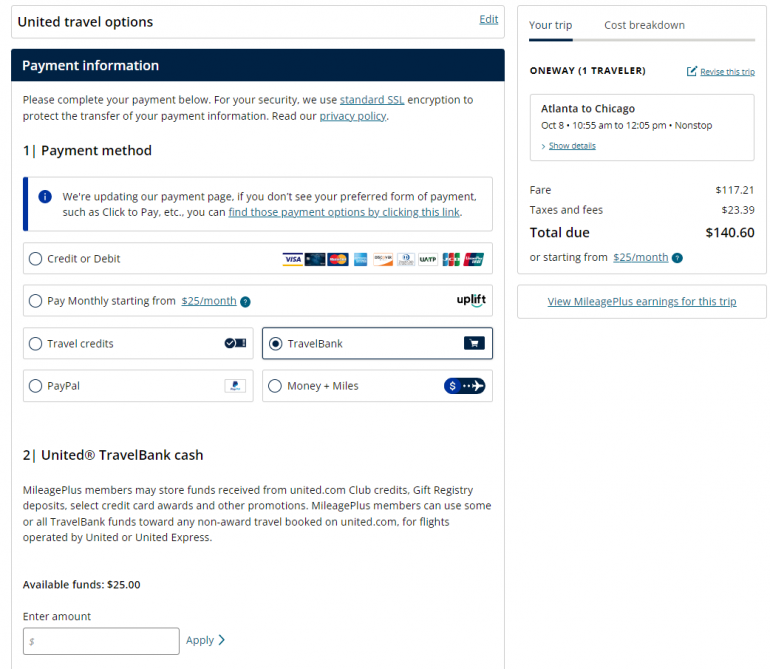

How to use United TravelBank

Once you’ve added money to the TravelBank account, you can select TravelBank cash as a payment option when logged into united.com or the United app.

When you're ready to use your travel funds, just log into your United MileagePlus account and search for a paid flight. On the checkout page, select the TravelBank payment option. Then, you can then enter precisely how much of your funds you want to apply to this booking.

Note that you can only use TravelBank funds for flights priced in U.S. dollars. And unfortunately, you can't use TravelBank funds to pay taxes and fees on a MileagePlus award ticket. For cash bookings, TravelBank monies can be used to cover the ticket price, taxes and surcharges.

Even if you have enough funds to cover the entire purchase, you may want to charge part of your flight booking to a credit card that provides travel insurance .

TravelBank cash can be used alone or in combination with other accepted forms of payment, such as Apple Pay, Visa Checkout or PayPal.

Is United TravelBank worth it?

The United TravelBank provides travelers with another way of stashing away funds for future travel. MileagePlus members can fund as little as $50 at a time, up to $5,000 per day. Your funds are valid for five years from the date of deposit, giving you plenty of time to use them.

However, funding the United TravelBank locks you into booking paid flights through United, decreasing the flexibility of your money. You can't even use TravelBank to pay for taxes and fees on award travel. So, you may only want to deposit funds in the TravelBank if you're sure that you will be paying for a United flight in the near future.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-2x Earn 2 miles per $1 spent on dining, hotel stays and United® purchases. 1 mile per $1 spent on all other purchases

50,000 Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

1x-2x Earn 2 miles per $1 spent on United® purchases, dining, at gas stations, office supply stores and on local transit and commuting. Earn 1 mile per $1 spent on all other purchases.

75000 Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

1x-3x Earn 3x miles on United® purchases, 2x miles on dining, select streaming services & all other travel, 1x on all other purchases

60,000 Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Airlines + Airports

How to Use Airline Flight Credits — So You Never Lose Out Again

Here’s what you need to know about using flight credits — including the specific rules for Delta, American, and other top airlines.

:max_bytes(150000):strip_icc():format(webp)/ProfilePicturewithPurpleBackground-664a02d95891481192058cd33c92d512.png)

What are flight credits?

How to use a flight credit, what to know about flight credit expiration policies.

- Airline-specific Flight Credit Rules to Keep in Mind

Ralf Hahn/Getty Images

Fight credits can come in many different forms, but they are usually the result of a canceled flight. Since the ability to cancel or change a flight without fees has become more commonplace over the last few years, flight credits have also become something frequent fliers are dealing with more often.

Using flight credits can be confusing because their terms and conditions aren’t universal — every airline has its own set of rules regarding flight credits. Here’s everything you need to know about flight credits, including how to use them, when they expire, and how to extend them. Plus, we’ll look at flight credit policies from five major U.S. airlines.

Related: What to Do If Your Flight Is Canceled, According to a Travel Expert

Flight credits, also referred to as travel credits, are credits received after canceling a flight. They are usually tied to the original ticket, so keep that information handy when you are ready to re-book your flight.

Generally, you’ll be able to book a new flight using a credit on your airline’s website. If your original ticket had multiple forms of payment, you may need to call to complete a booking using a flight credit.

If you booked the original ticket through a travel agency, you’ll need to contact the travel agency to cancel the flight and again when you want to book a new ticket with the flight credit.

Flight credits usually have an expiration date. While the length of time a credit is valid varies by airline, more often than not, they are good for one year.

Remember that some airlines start the one-year clock when the original ticket was issued, not when the flight credit was generated. So, if you book a flight and then need to cancel it six months later, your flight credit may only be valid for an additional six months.

Anna Harrison, a travel advisor and owner of Travel Observations, an affiliate of Gifted Travel Network, who is also a member of the American Society of Travel Advisors, always reminds clients of another important factor when considering flight credit expiration dates. “Remember ‘fly by’ dates can be different than ‘book by’ dates,” she stresses.

Check with your specific airline to see if you need to book your travel by the flight credit expiration date or if you actually need to travel by that date. Whether or not you can extend a flight credit after its expiration depends on the specific airline. However, most flight credits can’t be extended after their original expiration date.

Caroline Purser/Getty Images

Airline-specific Flight Credit Rules to Keep in Mind

Delta air lines ecredits.

Delta Air Lines flight credits are called eCredits, and they can be used toward the payment of any Delta flight, including taxes and fees. Passengers can use up to five eCredits at a time.

Delta eCredits can be generated from an unused or partially used ticket, as compensation for service issues, from ticket exchanges that result in unused funds, or from e-gift certificates.

To redeem your Delta eCredit, you’ll need your 13-digit eCredit number that begins with 006.

Delta eCredits are valid for one year from the day the original flight was booked, and travel must be booked by the expiration date.

American Airlines Flight Credits

American Airlines has three types of travel credits: trip credit, flight credit, and travel vouchers. We’re focusing on flight credits, which are issued for canceled flights or unused tickets. AA flight credits can be used to book non-award flights only. These credits can’t be applied to extras like seat charges or baggage fees .

The flight credit must be used on travel that begins within one year of the original travel date, not from when you cancel the original flight. If you book your flights far in advance, this can leave you with a short amount of time to use the credit.

Reservations using flight credits can be booked online for flights within the U.S., Puerto Rico, and the U.S. Virgin Islands using the record locator or ticket number of the original flight. For reservations using more than one flight credit or for international travel, you’ll need to call American Airlines to book. American Airlines flight credits aren’t transferable — they can only be used for the person named on the original flight — and they can’t be extended past their expiration dates.

JetBlue Travel Bank Credits

JetBlue flight credits are also called travel bank credits. Travel credits can be used for JetBlue flights, including taxes, the air portion of a JetBlue Vacations package, change fees on Blue Basic fares, and increased flight costs due to a change on a Blue Basic ticket. The passenger name doesn’t have to match the name of the travel bank account holder, so it’s easy to use your JetBlue flight credits for someone else.

JetBlue travel credits can’t be used for any other charges, including baggage fees , Even More Space seats, or pet fees.

To redeem your JetBlue flight credits without a TrueBlue account, you’ll need to create a Travel Bank account. Once you have travel credits, you’ll get 2 emails from JetBlue containing your Travel Bank username and a temporary password, which will allow you to set up an account. If you have a TrueBlue account, you’ll be able to see the amount of your flight credits in the Travel Bank Credit section of your online account.

JetBlue travel credits are valid for one year from the original ticketing date. Unlike many airlines, you only need to book your travel by the expiration date, but travel can be completed after the credit expires. If a reservation made using a JetBlue travel credit is canceled, the credit expiration date will not reset. JetBlue travel credits can’t be extended.

United Airlines Future Flight Credits

If you cancel a United Airlines flight or change to a less expensive itinerary, you’ll receive a future flight credit. In addition to airfare, these flight credits can be used for extras like seat selection when they are chosen during the booking process. Future flight credits can only be used for the person named on the original flight that was canceled or changed.

To use a flight credit, choose your flight on the United website or mobile app as you normally would. During the checkout process, select Travel Credits as your payment method, and any credits you have will be applied to your total. You can combine multiple future flight credits to pay for one transaction, but they can’t be combined with travel certificates.

If you want to combine your future flight credits with PlusPoints, book your flight with the flight credits first, then request a PlusPoints upgrade.

Future flight credits expire one year after the date they were issued, and your travel must begin by that date to use the credit. Credits can’t be extended.

Southwest Airlines Flight Credits

Southwest flight credits, previously called travel funds, are created after canceling a flight or changing a flight to a lower-priced itinerary. They are easy to use online, and they never expire .

These flight credits are tied to your original flight number. When paying for a new flight, look for the payment section labeled Apply Flight Credits, LUV Vouchers, and gift cards . Then, enter the confirmation number from the original flight and the passenger’s first and last name.

If the original flight that generated the flight credit was a Wanna Get Away fare, it’s non-transferable. If the flight credit was generated from a Wanna Get Away Plus, Anytime, or Business Select fare, it can be transferred to someone else.

Related Articles

How To Easily Redeem And Pay With Travel Voucher On United Airlines

- Last updated May 15, 2024

- Difficulty Beginner

- Category Travel

If you're a frequent flyer or planning an upcoming trip with United Airlines, you might come across the opportunity to redeem a travel voucher. Travel vouchers are an excellent way to save money on your next adventure, and United Airlines makes it simple to redeem and pay with these vouchers. In this guide, we will walk you through the easy process of redeeming and using your travel voucher, ensuring that your travel experience with United Airlines is both seamless and cost-effective. So buckle up and get ready to learn how to make the most of your travel voucher on United Airlines!

What You'll Learn

Introduction to travel vouchers and how they work, step-by-step guide on redeeming united travel vouchers, tips for using united travel vouchers efficiently, common issues and faqs when paying with united travel vouchers.

Travel vouchers are a convenient and flexible form of payment used by many airlines, including United Airlines, to compensate passengers for various reasons. They can be used to pay for future travel or other travel-related expenses. However, if you have never used a travel voucher before, you may have some questions about how they work and how to use them. In this article, we will provide an introduction to travel vouchers and explain how to pay with a travel voucher on United Airlines.

First, let's understand what a travel voucher is. A travel voucher is essentially a credit that can be used towards the purchase of airline tickets or other travel-related expenses, such as upgrades or baggage fees. These vouchers are typically issued by the airline as compensation for inconveniences or as a goodwill gesture to passengers. For example, if you were involuntarily bumped from a flight, had a delayed flight, or experienced a significant issue during your travel experience, the airline may offer you a travel voucher as compensation.

When you receive a travel voucher from United Airlines, it will typically come in the form of an electronic document or email. This document will contain all the necessary information, such as the voucher amount, the expiration date, and any restrictions or conditions that may apply. It is important to carefully read through this document to understand the terms and conditions associated with your travel voucher.

To use your travel voucher to pay for a future flight or other travel expenses, you will need to follow a simple process. Here are the steps to pay with a travel voucher on United Airlines:

- Book your flight: Start by searching for your desired flight on the United Airlines website or app. Select the flight that best fits your travel plans, taking note of the price and any restrictions that may apply.

- Contact United Airlines: Once you have selected your flight, you will need to contact United Airlines directly to complete the booking process. You can do this by calling their customer service hotline or visiting a United Airlines ticket office in person. Provide them with all the necessary details of your flight, including the voucher number and amount.

- Redeem your travel voucher: During the booking process, inform the United Airlines representative that you have a travel voucher that you would like to use as a form of payment. They will guide you through the process and apply the value of your voucher towards the total cost of your flight or other travel expenses.

- Review and confirm: Before finalizing your booking, carefully review the details of your flight and ensure that the voucher has been correctly applied. Confirm that the remaining balance, if any, is accurate and make any necessary adjustments or payments.

- Enjoy your trip: Once your booking is confirmed, you can relax and look forward to your upcoming trip. Remember to bring a printed or electronic copy of your travel voucher with you in case you are asked to provide it during your journey.

It's important to note that travel vouchers are usually non-transferable and non-refundable. Additionally, they may have certain restrictions or limitations, such as blackout dates or a minimum purchase requirement. Make sure to review the terms and conditions of your voucher carefully to avoid any surprises or complications when using it.

In conclusion, travel vouchers are a valuable form of payment that can be used towards the purchase of airline tickets and other travel-related expenses. If you have received a travel voucher from United Airlines, follow the steps outlined in this article to pay for your next flight or travel expenses. By understanding how travel vouchers work and how to use them, you can make the most of this convenient and flexible form of payment. Happy travels!

Should I Exchange Money Before Traveling to Portugal?

You may want to see also

If you have a travel voucher from United Airlines that you want to use for your next trip, you may be wondering how to redeem it. Luckily, United Airlines makes it fairly straightforward to use travel vouchers for payment. In this step-by-step guide, we will walk you through the process of redeeming your United travel voucher.

Step 1: Check the Expiration Date

Before you proceed with redeeming your United travel voucher, it is essential to check the expiration date. United travel vouchers typically have an expiration date, and once that date has passed, the voucher becomes invalid. Make sure to take note of the expiration date and plan your trip accordingly.

Step 2: Visit United Airlines Website

To get started, open your web browser and visit the official United Airlines website. Look for the "Book" or "Reservations" section on the homepage and click on it. This will take you to the flight booking page.

Step 3: Enter Your Travel Details

On the flight booking page, enter your travel details, including your departure and destination airports, travel dates, and the number of passengers. Click on the "Search" or "Find Flights" button to proceed.

Step 4: Select a Flight

After you have entered your travel details, you will be presented with a list of available flights. Choose the flight that suits your itinerary and click on it to select it.

Step 5: Review Your Flight Selection

Before proceeding with the booking, review the flight details to ensure they match your preferences. Take note of the flight number, departure and arrival times, and any layovers or stops. Once you have confirmed that the flight is correct, click on the "Continue" or "Book Now" button.

Step 6: Enter Passenger Information

On the next page, you will be prompted to enter the passenger information for each traveler. Fill in the required fields, including names, contact information, and any special requests. When you have finished entering the details, click on the "Continue" or "Next" button.

Step 7: Payment Options

After entering the passenger information, you will reach the payment options page. Look for the box or section labeled "Payment Method" or "Payment Details." Here, you will have the option to select "United Travel Voucher" as your payment method. Click on this option to indicate that you will be using a travel voucher.

Step 8: Enter Your Voucher Details

Once you have selected the United Travel Voucher option, you will be prompted to enter your voucher details. This typically includes the voucher number and the security code. Fill in the required fields with the information from your travel voucher.

Step 9: Finalize Your Booking

After entering your voucher details, you may need to review and confirm your booking details one last time. Verify that all the information is accurate, and if everything looks good, proceed to the final step of the booking process.

Step 10: Complete Your Reservation

To complete your reservation, submit your booking request. United Airlines will process your payment using the travel voucher, and if there are any remaining charges, you will be prompted to provide an additional payment method.

In conclusion, redeeming your United travel voucher is a simple process that can be completed online. By following this step-by-step guide, you can make sure your travel voucher is put to good use for your next trip. Remember to check the expiration date, enter your voucher details correctly, and review your booking before finalizing it. Enjoy your flight with United Airlines!

The Importance of Travel History for US Visa Approval

United Airlines offers travel vouchers as a form of compensation for various reasons, such as flight cancellations or being bumped from a flight. These vouchers can be a valuable resource when it comes to booking your next trip with United. To make the most of your travel vouchers and ensure a smooth booking process, here are some tips to keep in mind:

- Understand the Terms and Conditions: Before you start using your travel vouchers, it is crucial to familiarize yourself with the terms and conditions associated with them. Each voucher may have specific rules and limitations, such as expiration dates, blackout dates, and restrictions on destinations or fare classes. Take the time to read and understand these terms to avoid any surprises or disappointment down the line.

- Keep Track of Expiration Dates: United travel vouchers typically have an expiration date, beyond which they cannot be used. Ensure that you note down the expiration dates of your vouchers and set reminders well in advance. It's a good idea to use them as soon as possible to avoid any risk of forgetting and losing the value of your vouchers.

- Use Vouchers for Flights Only: United travel vouchers can only be used for flight-related expenses, including the base fare, taxes, and fees. They cannot be used for ancillary services like Wi-Fi, seat selection, or baggage fees. Remember to factor in these additional expenses when planning your trip and have another form of payment ready for them.

- Combine Vouchers for Larger Payments: If you have multiple travel vouchers from United, consider combining them to cover the cost of a single flight or a more expensive fare. United allows customers to combine multiple vouchers for a single transaction, making it easier to use them efficiently and maximize their value.

- Follow the Manual Redemption Process: To use your travel vouchers, you'll need to contact United directly through their customer service channels. This process usually involves speaking with a representative over the phone or submitting an online form. Be prepared to provide the voucher details, such as the unique code, amount, and any other required information. Give yourself ample time to complete this process, especially during peak travel periods when customer service wait times might be longer.

- Be Flexible with Travel Dates: Since United travel vouchers might have blackout dates or restrictions on certain flights, it's essential to be flexible with your travel dates. Consider looking for alternative dates or routes that are open for voucher redemption. This flexibility can significantly increase your chances of finding a flight that fits your schedule and allows you to use your vouchers effectively.

- Plan Ahead and Book Early: Travel vouchers are subject to availability, and the earlier you plan your trip and book your flights, the better chance you have of utilizing your vouchers. Keep in mind that some popular flights or peak travel periods may have limited availability for voucher redemption. Booking in advance will help you secure your desired flights and prevent any last-minute disappointments.

- Keep a Record of Your Voucher Usage: After using your travel vouchers, make sure to keep a record of the flights booked and the remaining balance, if applicable. This record can be helpful for future reference and can aid in addressing any discrepancies or issues that may arise.

By keeping these tips in mind, you can efficiently use your United travel vouchers to save money on your next flight. Remember to plan ahead, understand the terms and conditions, and be flexible with your travel arrangements. Happy flying with United!

Understanding the Travel Logistics of IPL Teams: A Look into the Modes and Methodologies

United Airlines offers travel vouchers as a method of payment for various services, including flights, seat upgrades, baggage fees, and more. If you have a United travel voucher, it's important to understand how to use it efficiently and avoid any potential issues. In this article, we'll cover some common issues and FAQs when paying with United travel vouchers.

How can I redeem my United travel voucher?

To redeem your United travel voucher, you can follow these steps:

- Visit the United Airlines website or use the mobile app.

- Search for your desired flight or service and proceed to the payment page.

- Look for the "Payment Information" section and select "United payment types."

- Enter the voucher number and other required details.

- Validate the voucher and complete the transaction.

Can I use multiple vouchers for a single purchase?

Yes, it is possible to use multiple United travel vouchers for a single purchase. You can enter the voucher numbers one by one in the payment information section during the transaction.

What if the voucher value is higher than the purchase amount?

If the value of your United travel voucher is higher than the total amount of your purchase, the remaining balance will be issued to you as a new travel voucher. You can use this new voucher for future travel or related services.

Can I combine a United travel voucher with another form of payment?

Yes, you can combine a United travel voucher with another form of payment, such as a credit card. When booking a flight or service, select "United payment types" and enter the voucher number along with the payment information for the remaining balance.

Is my United travel voucher transferable?

United travel vouchers are usually non-transferable. They can only be used by the person to whom they were originally issued. However, there may be some exceptions in special circumstances. It's best to check with United Airlines directly for more information.

What if I lose my United travel voucher?

If you lose your United travel voucher, it may be difficult to retrieve it. It's important to keep your voucher in a secure place and treat it like cash. If you believe your voucher has been lost or stolen, contact United Airlines customer service as soon as possible to report the issue.

Are there any expiration dates for United travel vouchers?

Yes, United travel vouchers typically have an expiration date. It's crucial to check the terms and conditions of your specific voucher to ensure you use it within the valid timeframe. Failure to do so may result in the voucher becoming void and unusable.

How can I check the balance of my United travel voucher?

To check the balance of your United travel voucher, you can visit the United Airlines website and navigate to the voucher balance check page. Enter the voucher number and any other required details to retrieve the current balance.

What if my United travel voucher doesn't work?

If you encounter issues while using your United travel voucher, first double-check the voucher number and details you entered. Ensure they match the information provided on the voucher. If the problem persists, reach out to United Airlines customer service for assistance.

Paying with United travel vouchers can be a convenient and flexible option. By understanding these common issues and FAQs, you can navigate the process smoothly and enjoy the benefits of your voucher. If you have any specific questions or concerns, it's always best to contact United Airlines directly for accurate and up-to-date information.

Exploring the Sunshine State: Can I Travel to Florida for Spring Break?

Frequently asked questions.

To pay with a travel voucher on United Airlines, you can do so by booking your flight online and selecting the option to use a voucher as a payment method during the checkout process.

Yes, you can use a United travel voucher to pay for someone else's flight. During the booking process, you will have the option to enter the voucher details and apply it as a payment method.

To redeem a United travel voucher, you will need to have the voucher code and PIN. When booking a flight online, select the option to use a voucher as a payment method, and enter the voucher details when prompted.

No, United travel vouchers can only be used towards the purchase of flights and associated fees. They cannot be used for other expenses such as hotel bookings or car rentals.

If you have a remaining balance after using a United travel voucher, you will need to pay the difference with another form of payment, such as a credit card. The voucher will be applied towards the total cost of the flight, and any remaining amount must be paid separately.

- Majid Rana Author

- Pop Panupong Author Reviewer Traveller

It is awesome. Thank you for your feedback!

We are sorry. Plesae let us know what went wrong?

We will update our content. Thank you for your feedback!

Leave a comment

Travel photos, related posts.

Tips for Keeping Your Salad Fresh While Traveling

- May 12, 2024

Tips for Traveling from London to Berlin

- May 09, 2024

Uncovering the Thrill: Exploring the Presence of Full-Sized Roller Coasters at Travelling Carnivals

- May 11, 2024

The Ultimate Guide on How to Travel from Keflavik Airport to Reykjavik

- May 17, 2024

The Ultimate Guide on Traveling from Dehradun Airport to Rishikesh

- May 16, 2024

Essential Tips for Traveling in China: The Dos and Don'ts

Bethpage Federal Credit Union Stadium, NY

Bethpage Federal Credit Union Stadium

Around the Globe

Hurricane tracker, severe weather, radar & maps, news & features, winter center, health & activities, weather near bethpage federal credit union stadium:.

- Greenvale , NY

- New York , NY

- Newark , NJ

We have updated our Privacy Policy and Cookie Policy .

Get AccuWeather alerts as they happen with our browser notifications.

Notifications Enabled

Thanks! We’ll keep you informed.

Forget Chase and American Express -- These Travel Cards Will Surprise You

We've all heard of Chase, Amex and Capital One travel cards, but what about those lesser-known (yet just as rewarding) options?

Jason Steele

Credit card expert and founder of CardCon

As a freelance personal finance writer since 2008, Jason has contributed to over 100 outlets including Forbes, USA Today, Newsweek, Time, U.S. News, Money.com and NerdWallet. As an industry leader, Jason has spoken at dozens of conferences and is the founder and producer of CardCon, an annual conference for credit card media. Jason also consults with individuals and small business owners to create customized plans to help them earn and spend travel rewards. He can be reached via his website; JasonSteele.com and on LinkedIn.

Dashia Milden

Dashia is a staff editor for CNET Money who covers all angles of personal finance, including credit cards and banking. From reviews to news coverage, she aims to help readers make more informed decisions about their money. Dashia was previously a staff writer at NextAdvisor, where she covered credit cards, taxes, banking B2B payments. She has also written about safety, home automation, technology and fintech.

Evan Zimmer

Staff Writer

Evan Zimmer has been writing about finance for years. After graduating with a journalism degree from SUNY Oswego, he wrote credit card content for Credit Card Insider (now Money Tips) before moving to ZDNET Finance to cover credit card, banking and blockchain news. He currently works with CNET Money to bring readers the most accurate and up-to-date financial information. Otherwise, you can find him reading, rock climbing, snowboarding and enjoying the outdoors.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

It’s always amusing to see your favorite travel blogger taking trips of a lifetime. But you may wonder how they afford it. Most use credit card rewards to cut costs. But how? What perks are really saving them money and how much are they having to spend to make the rewards worthwhile?

Even though there are hundreds of different credit cards available from major card issuers, most of the buzz is generated by a few of the most popular products, like the Chase Sapphire Reserve ® or The Platinum Card® from American Express .

But I’ve been traveling using credit card rewards and perks for years, and found a few unsung heroes that are just as rewarding as the big-name cards. If you look beyond those popular choices and consider some lesser-known options, you could get a card that holds more value and better perks.

Wyndham Rewards Earner Card

Solid hotel and dining perks for no annual fee

Wyndham Rewards Earner® Card

Next to hotel brands like Marriott, Hilton and Hyatt, Wyndham isn’t as well known. And even then, most people associate Wyndham with budget brands such as Days Inn, Super 8 and LaQuinta. These hotels are fine for their purpose, but most don’t imagine them as part of their ultimate dream vacation.

However, Wyndham is partnered with Caesars Entertainment, a hotel and casino company with properties that dominate the Las Vegas strip. Wyndham also owns Vacasa, a vacation rental management company that has properties in Hawaii, Colorado and Florida.

To earn stays in these areas, you can get the Wyndham Rewards Earner® Card*. It’s a no-annual-fee credit card that offers a few perks including a cardmember booking discount and automatic Wyndham Rewards Gold status, which offers preferred room selection, late checkout and 10% more points on qualifying hotel stays.

Wyndham Rewards Earner® Business Card* is even better. It offers even higher reward rates, a better welcome offer and top-tier Diamond status with Wyndham and Caesars Entertainment.

PenFed Pathfinder Rewards Visa Signature Card

All the premium travel perks with a $95 annual fee

PenFed Pathfinder® Rewards Visa Signature® Card

The PenFed Pathfinder® Rewards Visa Signature® Card has many of the benefits offered by premium rewards cards like the Chase Sapphire Reserve and Capital One Venture X Rewards Credit Card *. The card includes credits for Global Entry and TSA PreCheck , trip delay reimbursement and auto rental collision damage waiver. The card also comes with a few other perks, including a complimentary priority pass airport lounge annual membership.

Here’s the best part: It only charges $95 annually, and even that’s waived for PenFed Honors Advantage Members. PenFed Honors Advantage Members are people with a (free) PenFed checking account, or current or former members of the military.

At this price level, it’s an exceptional rewards card, especially with its 50,000-point welcome bonus after spending $3,000 within the first 90 days. And it’s a good pick if you need to transfer a balance since the card offers a 0% intro APR offer for 12 months (then 17.99% variable) on balance transfers made in the first 90 days, which is good considering the current average credit card APR of 20.66%. With all these features, you’ll be begging your friends to let you pay for dinner.

Frontier Airlines World Mastercard

Affordable flights, but few redemption options

Frontier Airlines World Mastercard®

Frontier has two reputations. The first is for low fares on flights– it’s often possible to book tickets for $19 each way. The other is for high fees for carry-on bags, checked bags and seat assignments. But when you have the Frontier Airlines World Mastercard®* -- which charges a $89 annual fee -- you can earn elite status that lets you waive the costs for these services.

This card offers one Elite Status Point for each dollar spent on purchases, and you can reach their Elite Silver status with 10,000 points. Elite status unlocks free seat assignments and priority boarding.

You’ll reach Elite Gold status after 20,000 points. Elite Gold status offers premium seating and a free carry-on bag. The Frontier card also offers boosted rewards rates for dining and Frontier purchases to help you fast-track earning points.

But this card really stands out for its other perks, including a $100 flight voucher each account anniversary and a generous welcome bonus that can add up to two roundtrip flights. If Frontier is an option for most of your upcoming destinations and you try to travel on a budget, consider applying for Frontier’s co-branded card .

Wells Fargo Autograph Journey Card

Wells Fargo Autograph Journey℠ Card

It’s good by itself, but even better with Wells Fargo’s cash rewards card

Wells Fargo doesn’t have a vast portfolio of rewards cards like its competitors, but its newest travel card -- the Wells Fargo Autograph Journey℠ Card* -- is on par with the Chase Sapphire Preferred® Card . It offers higher reward rates for hotels and flights booked with Wells Fargo compared to Chase’s card. Both cards have a $95 annual fee, but instead of the Sapphire Preferred’s $50 annual hotel credit when booking with Chase, the Autograph Journey has a $50 annual statement credit with a $50 minimum airline purchase when booking with Wells Fargo.

The Wells Fargo Active Cash® Card offers a flat 2% cash rewards on purchases. Even though it’s a no-frills card, you’ll have cellphone insurance and you can transfer your rewards from the Active Cash to airline miles and hotel points and redeem them with your Autograph Journey card.

Read more: Move Over, Chase Sapphire Preferred. This New Travel Credit Card Is Turning Heads

Even though the travel partner list that you can transfer your rewards to for potentially more value isn’t extensive, the points can still offer more savings on trips.

Despite its lack of transfer partners, credit card industry insiders are taking note of its compelling new offerings. So while this card may be flying under the radar now, it won’t for long.

Recommended Articles

Could the wells fargo active cash card lose its crown to pnc’s new card, fed keeps interest rates frozen: what another pause means for your credit cards, i’m happy to pay $550 a year for this credit card. here’s how i get thousands of dollars in value from it, 5 common questions people ask me as a credit card editor.

*All information about the Wyndham Rewards Earner® Card, the Frontier Airlines World Mastercard® and the Wells Fargo Autograph Journey℠ Card has been collected independently by CNET and has not been reviewed by the issuer.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

How to use credit cards to save on business travel

Key takeaways.

- Using the right credit cards can help businesses and individual business travelers save money on travel expenses.

- In addition to earning points and miles that can be redeemed for travel, many credit cards offer travel perks like free checked bags, business lounge access and free hotel stays.

- Choosing the best card for your needs helps you earn rewards you can use to defray the cost of your next business trip or personal vacation.

Business travel can be very expensive, but there are ways to save — and one of the most effective tools for saving money is a credit card. The best business cards for travel can save business travelers both time and money while offering valuable travel rewards and cash back. Premium travel rewards cards can also go a long way toward improving the travel experience by offering travelers upgraded airline seats and free hotel rooms, as well as access to airport business lounges .

Here are a few things you can do to save money on business travel — while adding comfort and convenience — using a credit card.

Use your card to save on hotels

When paying for a hotel stay, one of the most effective ways to save money is to use a credit card that’s offered by the hotel chain. Hotel rewards cards allow you to save money in several ways. First, they feature bonus points or cash back for hotel charges, which can later be redeemed for free night stays. Additionally, a hotel rewards card can offer you credit toward elite status in the hotel loyalty program. And when you hold that status, you’ll enjoy perks like priority customer service, room upgrades and even waived fees.

For example, the World of Hyatt Business Credit Card * from Chase offers the cardholder (and up to five employees) Discoverist status, as well as five qualifying night stays for every $10,000 you spend in a calendar year. After spending $50,000 in a calendar year, cardholders also receive 10 percent of their redeemed points back as bonus points (on up to 200,000 points redeemed) for the remainder of the calendar year. And since you get employee cards at no cost, their spending counts toward the $50,000 requirement.

Discoverists receive extra points and perks like free bottled water and 2 p.m. late checkouts. And when travelers receive top-tier World of Hyatt Globalist status, perks include free breakfast, suite upgrades and free parking on award nights. Cardholders also get access to Hyatt Leverage, Hyatt’s global business travel program that offers special rates on participating Hyatt hotels worldwide.

Save on flights with a companion pass

When you’re traveling with a colleague, nothing saves money like receiving two tickets for the price of one. Thankfully, several airline credit cards offer companion passes . For instance, the Alaska Airlines Visa® credit card from Bank of America offers a companion fare from $122 ($99 fare plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year.

Better yet, the British Airways Visa Signature® Card * from Chase features a Travel Together Ticket that you can earn after spending $30,000 in purchases in a calendar year. This gives you two airline award tickets for just the price of taxes and fees. Just note that British Airways has a habit of imposing notoriously high carrier surcharges, especially on its awards in business in first class.

But perhaps the best companion pass is the one offered by Southwest Airlines, which is normally achieved by earning 135,000 qualifying points in a calendar year. However, holders of a Southwest® Rapid Rewards® Performance Business Credit Card can earn a welcome bonus of 80,000 points for spending $5,000 in purchases during the first three months — getting you more than halfway to the Companion Pass during your first year. And cardholders receive a boost of 10,000 qualifying points every year and can earn qualifying points from credit card spending and flight purchases. Once earned, the Southwest Airlines Companion Pass offers unlimited tickets for your designated companion for just the price of taxes, normally $5.60 each way within the United States.

Get free expedited security

Many business travelers are forced to waste incredible amounts of time going through airport security. But with the right credit card, you and your employees can be reimbursed for expedited security program memberships.

Many credit cards now include reimbursements for TSA PreCheck and Global Entry , which includes TSA PreCheck. TSA PreCheck allows you to go through an expedited security screening where you can leave your shoes on and your 3-1-1 liquids and laptops in your carry-on suitcase. Global Entry offers expedited immigration screening when you arrive in the United States.

Some business credit cards feature a credit of up to $100 for TSA PreCheck or Global Entry — including the Capital One Venture X Business , the Delta SkyMiles® Platinum Business American Express Card and the IHG One Rewards Premier Business Credit Card. In fact, the TSA maintains a list of all cards that offer this free credit . The credit is typically available just once every four years.

Several credit cards also offer free or discounted Clear Plus membership . Clear is a private company that authenticates your identity using biometrics before escorting you to the front of the TSA lines, either PreCheck or standard. For example, The Business Platinum Card® from American Express or a personal card like the American Express® Green Card * offer up to $189 in credits for Clear Plus membership.

If you’re wondering which program would work best for you, here’s our comparison of TSA PreCheck vs. Clear .

Get free business lounge membership

Another way that travelers waste time and money is when they have a layover or an airport delay. Airport food is generally expensive and of inconsistent quality, while sitting around a crowded departure gate can be a waste of productive time. But if you have an airport business lounge membership, then you can enjoy a free meal while having a less hectic place to get work done.

Several cards offer airport lounge access . The American Express Business Platinum offers access to a variety of lounges — including the Centurion Lounges, Delta SkyClubs and the Priority Pass Select lounge network. The Capital One Venture X Business card also offers a Priority Pass Select lounge membership, as well as access to its new and expanding list of Capital One lounges .

Alternatively, you could consider an airline co-branded card. For example, the Delta SkyMiles® Reserve Business American Express Card offers access to the Centurion Lounges and the Delta Sky Clubs while the Citi® / AAdvantage® Executive World Elite Mastercard® offers access to American Airlines Admirals club lounges.

Earn elite status with an airline

Having elite status with an airline frequent flier program can be extremely valuable. Traditionally, the only way to earn that was by actually purchasing airfare and then flying. However, airlines are increasingly offering elite status — in whole or in part — through credit card spending.

For example, the American Airlines AAdvantage rewards program allows you to earn any level of elite status simply through spending on its co-branded credit cards. The JetBlue TrueBlue program offers the chance to earn all four levels of its Mosaic elite status using a combination of credit card spending and flying. The United Quest℠ Card * from Chase allows you to earn 25 Premier Qualifying points (PQPs) for every $500 you spend on purchases with your Quest Card (up to 6,000 PQP in a calendar year) that can be applied toward your Premier status qualification on United MileagePlus , up to the Premier 1K level.

Take advantage of statement credits and more

Although it can be difficult to determine the exact value that some credit card benefits provide, other benefits are much more straightforward. In fact, many business credit cards offer annual statement credits, free checked bags and more.

For example, the Delta SkyMiles Reserve Business card allows cardholders to check their first bag for free when flying with Delta. The United℠ Business Card includes a free checked bag for you and a companion plus an annual $100 statement credit when you make at least seven United airlines purchases of at least $100 per year. Amex Business Platinum cardmembers get up to $200 a year in statement credits toward qualifying airline fees with your selected airline, while The Hilton Honors American Express Business Card offers a “Free Night Reward” after making $15,000 in purchases in a calendar year. You can even earn a second reward night after making $45,000 in purchases during a calendar year.

How to turn business rewards into personal travel

A beauty of earning travel rewards is that they are retained by the credit card’s primary account holder. So if you are a small business owner, you receive ownership of all of the points and miles that you earn from your credit cards — including any rewards earned by authorized users of your cards. Likewise, you also earn rewards for anything you charge to your personal credit cards for company travel your employer reimburses .

Bankrate’s take: This means that you get to keep all the rewards earned by your credit cards, and there’s nothing that says you must use those rewards for business. Therefore, it’s advantageous for small business owners to use cash for tax-deductible business expenses while redeeming their travel rewards for personal travel.

The bottom line

The key to saving both time and money on your business travel is understanding and maximizing the potential of your credit cards, including their travel benefits . By using the right credit card for your needs, you can enjoy more productive business trips while earning points and miles toward your next vacation.

Check out our list of the best small business credit cards or use Bankrate’s free CardMatch tool to find the right card for your business.

*Issuer-required disclosure statement

Information about the World of Hyatt Business Credit Card, British Airways Visa Signature® Credit Card, American Express® Green Card, Citi® / AAdvantage® Executive World Elite Mastercard® and United Quest℠ Card has been collected independently by Bankrate and has not been reviewed or approved by the issuer. Information regarding the Alaska Airlines Visa® credit card was last updated on February 1, 2024 .

How to redeem Chase Ultimate Rewards points for maximum value

You can never have too many Chase Ultimate Rewards points .

This transferable points currency gives you access to some of the best hotel and airline transfer partners in the business, as well as the easy-to-use Chase Travel℠ portal , which allows you to cover a wide variety of different costs for your trip, including car rentals, hotels, flights, tours and activities, as well as some everyday expenses.

Despite increasing competition from American Express Membership Rewards , Citi ThankYou Rewards and Capital One miles , Chase Ultimate Rewards maintains its place as one of the most valuable points currencies on the planet. Plus, the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® card are both currently offering elevated welcome bonuses of 75,000 points after you spend $4,000 on purchases in the first three months from account opening. Therefore, this is a great time to consider applying for a Chase credit card and maximizing your rewards.

If you are new to redeeming Chase Ultimate Rewards points, this stress-free beginner guide will show you how to easily redeem 75,000 points.

However, if you're ready to get serious about traveling more for less, here's everything you need to know about Chase transfer partners and the best ways to redeem your Chase Ultimate Rewards points.

How much are Ultimate Rewards points worth?

TPG values Ultimate Rewards points at 2.05 cents each, which is what you should aim for when redeeming them. The actual value you get from these points depends on how you redeem them.

How can I redeem Chase Ultimate Rewards?

If you redeem your points for cash back or statement credits at the lower-value end, each point is typically worth 1 cent.

A midvalue redemption option is to use your Chase points for virtually any kind of travel booking: Flights, hotels, cruises, tours and rental cars via Chase Travel. If you have the Chase Sapphire Preferred , your points are worth a fixed rate of 1.25 cents each. Meanwhile, cardholders of the Chase Sapphire Reserve get a higher valuation of 1.5 cents per point. This is an excellent redemption option for folks who don't want to deal with complicated award program rules.

If you want to maximize your Ultimate Rewards points, the most valuable option is often to transfer your points to one of 14 airline or hotel partners. From there, you can use them for premium travel bookings, such as premium cabin flights and luxury hotels.

What are the most valuable ways to redeem Chase points?

We've mentioned that transferring your Chase points to a travel partner is often your best bet if you want to get the most value out of your points. Here are some of the best ways to redeem Ultimate Rewards with airline and hotel transfer partners.

Air France-KLM Flying Blue

While Flying Blue prices its awards dynamically, the program has now standardized saver-level pricing for all one-way flights between the U.S. and Europe as follows, regardless of origin or destination, meaning you can connect at no extra cost:

- 20,000 miles in economy

- 35,000 miles in premium economy

- 50,000 miles in business class

Remember that these rates are only for the lowest saver-level seats, which are limited. Booking business class from anywhere in the U.S. to anywhere in Europe for 50,000 Flying Blue miles is a fantastic deal, so jump on this if you find this price on dates that work for you.

Additionally, you could spend a few days in Paris or Amsterdam using the free Flying Blue stopover program . This is a great way to visit another city without paying additional miles or cash. To book Flying Blue stopovers, you'll need to call Flying Blue at 800-375-8723.

Southwest Airlines Rapid Rewards

TPG values Southwest Rapid Rewards points at 1.35 cents each, which is a lot less than the 2.05 cents per-point value of Ultimate Rewards. So, transferring to Southwest isn't a great way to use your Chase Ultimate Rewards points.

However, there are a couple of scenarios where transferring points to a friendly carrier with no change or baggage fees makes sense. First, for inexpensive fares of $100 or less, Rapid Reward points can be worth as much as 1.7 cents per point, which beats the value you get when booking through the portal. Second, if you have a Southwest Companion Pass and are really getting two flights for the price of one award, then your points become worth as much as 3.4 cents per point for inexpensive fares.

Remember, too, that Southwest flights booked with Rapid Rewards points include free changes and cancellations , which gives you a ton of flexibility if the award rate drops after booking.

Singapore Airlines KrisFlyer

Singapore Airlines has several benefits as a potential airline transfer destination for your Ultimate Rewards. First, Singapore is one of the best airlines in the sky, with tremendous service and luxurious onboard products and experiences. The carrier's premium-class products are typically only available through the KrisFlyer program , not with its Star Alliance partners.

Second, Singapore's KrisFlyer program offers fantastic value, with reasonable award charts, low fuel surcharges, routing rules that allow stopovers and the ability to combine multiple partners in one award.

Finally, the online award booking tool is intuitive and easy to use — though be aware that transfers typically are not instantaneous.

Here are some of our favorite KrisFlyer redemptions when using Chase Ultimate Rewards:

- Fly from the mainland U.S. to Hawaii in economy class on United Airlines for 19,500 miles each way

- Fly Singapore Airlines from the U.S. to Europe from 25,000 miles (note: this may be discounted further thanks to KrisFlyer's monthly Spontaneous Escapes offers )

- Fly the world's longest flight in business class from New York to Singapore for 111,500 miles each way

- Fly first class from Los Angeles to Japan or South Korea from 120,500 miles each way

Related: It doesn't get much better than this: Singapore Airlines' A380 in business class from Frankfurt to New York

Iberia Plus

Spain's national carrier remains a mystery to many Chase cardholders despite the significant value Iberia Plus can offer U.S.-based flyers. The carrier offers cheap economy, premium economy and business-class transatlantic flights on its own metal.

Transatlantic business class is priced based on a distanced-based award formula. One-way flights from Miami to Madrid on off-peak dates start at just 21,250 Avios in economy and 42,500 Avios in business class, for instance. There can be less than $100 in surcharges, depending on the class of service you book.

However, prices get even more attractive for shorter routes (based on distance in miles). For example, off-peak flights from Boston to Madrid require only 17,000 Avios in economy, 25,500 in premium economy and 34,000 Avios in business each way, one of the best sweet spots of any airline program.

Related: A review of Iberia's new business-class suite on the A350-900 from Madrid to Mexico City

Virgin Atlantic Flying Club

There are multiple ways to use Virgin Atlantic's loyalty program to unlock value. Thanks to its own distance-based formula, you can redeem points to fly Delta domestic itineraries here in the U.S. starting at 7,500 points per segment, potentially saving you thousands of points compared to the number of miles Delta is asking for the same flight.

Delta One flights to Europe (excluding the United Kingdom) are a flat 50,000 points for nonstop itineraries — though availability tends to be very scant. Instead, consider booking Air France flights in business class. On off-peak dates, flights from the U.S. to most of Europe are just 48,500 points.

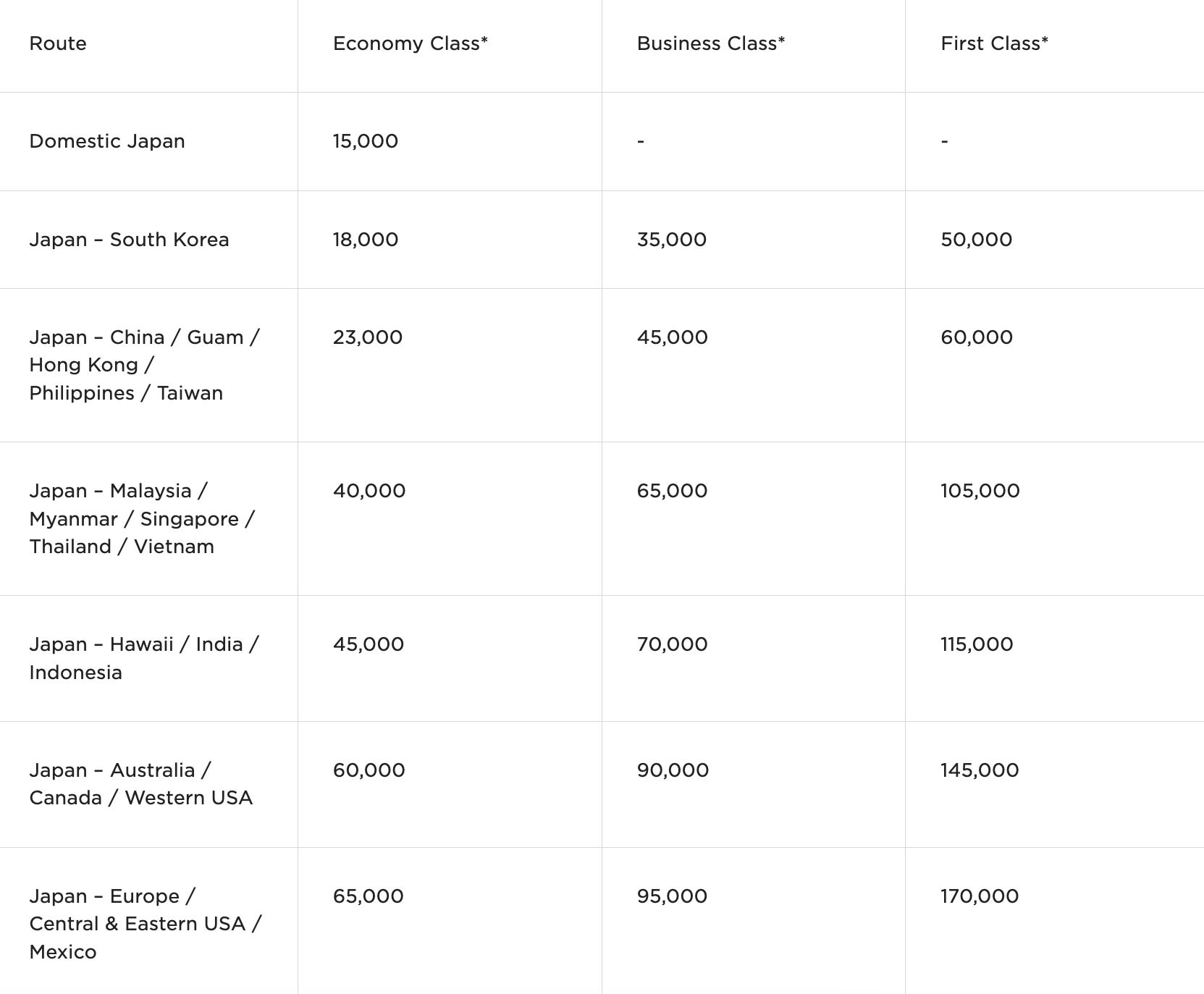

Other partners like All Nippon Airways have award charts so attractive they almost seem like a mistake. You can use just 90,000 Virgin points to fly ANA business class round trip from the West Coast to Japan and 95,000 miles from the central and eastern U.S. to Japan — or one-way for half these prices.

Here is Flying Club's award chart for ANA-operated flights:

Virgin Atlantic also offers attractive fares on flights between the U.S. and the U.K., though taxes on the return flight are quite high. A one-way economy-class flight from the East Coast is just 10,000 points.

Related: How 5,000 credit card points saved me over $650 on a flight to London

British Airways Executive Club

If you need a short-haul, nonstop flight on a Oneworld partner like American Airlines or Alaska Airlines, British Airways Avios can reward you with tremendous savings.

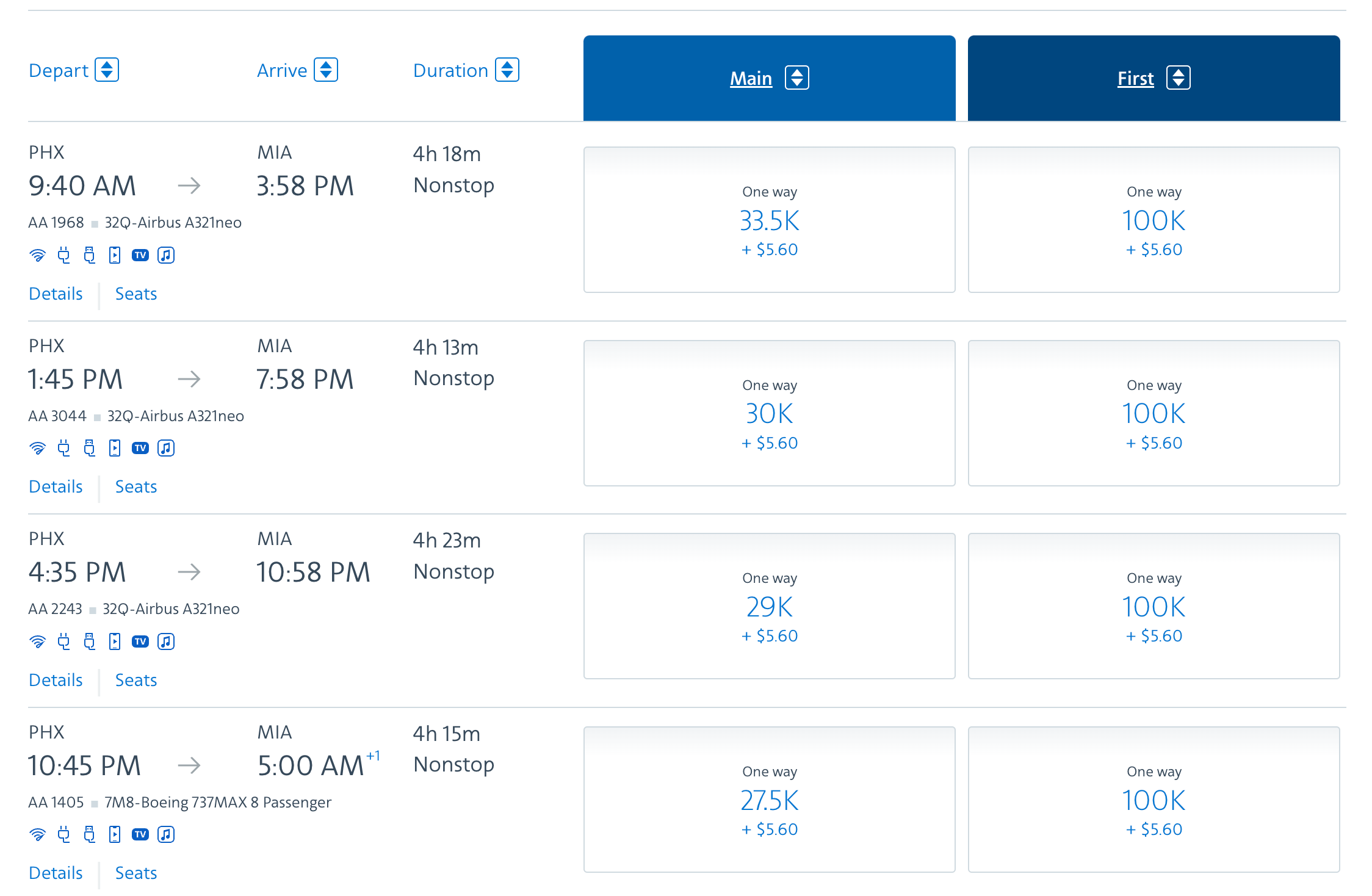

Short-haul flights start at 8,250 Avios for U.S. economy flights up to 650 miles in length, 11,000 Avios for flights 651 to 1,151 miles in length and 14,500 Avios for flights up to 2,000 miles in length. The latter would cover a flight from Phoenix Sky Harbor International Airport (PHX) to Miami International Airport (MIA).

This can be considerably cheaper than what American Airlines charges its American AAdvantage members for the same flights.

British Airways also lowered the cost of Qatar Airways awards when the Doha-based carrier adopted Avios as its own loyalty currency , giving another great option for transferring your Chase points for a valuable award ticket.

Related: British Airways Executive Club: Guide to Avios, elite status and transfer partners

World of Hyatt

One of the best ways to use Ultimate Rewards points is to transfer them to World of Hyatt for low- or high-category properties. Hyatt points are generally worth more than Marriott Bonvoy and IHG points, so Hyatt is often your best hotel transfer partner within Chase Ultimate Rewards.

World of Hyatt also offers an extremely reasonable award chart, with prices ranging from 3,500 to 45,000 points.

If you're looking at standard award nights, the program has value across the spectrum of properties. Category 1 to 5 properties , in particular, can offer some fantastic awards. Examples include the Grand Hyatt Washington (17,000 to 23,000 points), the Grand Hyatt Athens (9,000 to 15,000 points) and the Park Hyatt Mendoza (12,000 to 18,000 points).

Several Category 1 properties sell for over $100 a night (excluding taxes), so redeeming just 3,500 points for these off-peak dates is usually a good decision. An example is the Hyatt Place Tucson-Central, which is bookable for just 3,500 to 6,500 Hyatt points per night.

Higher-tier hotels also have substantial value. For example, redeeming 35,000 to 45,000 points per night at the ski-out Park Hyatt Beaver Creek or 25,000 to 35,000 points per night at the Park Hyatt St. Kitts or the Park Hyatt Maldives Hadahaa can make sense since rooms at these luxury properties routinely sell for over $1,000 a night.

Best cards to earn Chase Ultimate Rewards points

There are many ways to earn Ultimate Rewards points with Chase credit cards. Here is a summary of the best options:

- Chase Sapphire Preferred Card : Best for overall mid-tier cards

- Chase Sapphire Reserve : Best for frequent travelers, dining and travel insurance

- Ink Business Preferred® Credit Card : Best for business travelers

- Ink Business Cash® Credit Card : Best for office supplies and technology services

- Ink Business Unlimited® Credit Card : Best for no-annual-fee business card

- Chase Freedom Flex℠ : Best for earning 5% cash back (or 5 points per dollar) up to a quarterly maximum; activation required

- Chase Freedom Unlimited® : Best for simple rewards

The first three cards earn fully transferable Ultimate Rewards points, while the remaining four are technically billed as cash-back credit cards .

However, if you have an Ultimate Rewards-earning card, you can convert your Chase cash-back rewards to Ultimate Rewards points. For this reason, having more than one Chase card in the family can make sense to maximize your earning and redeeming potential.

Check out TPG's guide to transferring Chase points between accounts for complete details.

Bottom line

The above strategies sample the many redemptions available through the Ultimate Rewards program. If you have the Chase Sapphire Reserve , the Chase Sapphire Preferred Card or the Ink Business Preferred Credit Card , booking through the Chase Travel portal at a rate of 1.25 to 1.5 cents per point will be a solid baseline redemption for many travelers.

However, to really get maximum value, look to utilize Chase transfer partners to book flights and hotel rooms that might otherwise be beyond your means.

With the elevated 75,000 Ultimate Rewards points welcome bonuses available on the Chase Sapphire Preferred and the Chase Sapphire Reserve cards, now is a great time to start earning and redeeming Ultimate Rewards.

COMMENTS

United Airlines - Airline Tickets, Travel Deals and Flights If you're seeing this message, that means JavaScript has been disabled on your browser, please enable JS ...

To use your travel credit, search and select your flight as usual. At checkout, choose travel credit as your payment option. If you are a MileagePlus member, your travel credits should appear ...

Redeeming United flight credits is easy. Just go through the process of booking a ticket, and when you get to the payment page, select "Travel credits" as the payment method. Redeem United flight credits during the booking process. You can combine multiple flight credits toward the cost of a ticket, though you can't combine flight credits ...

Future flight credit. Unlike ETCs, future flight credits can be used to cover the cost of partner flights, even those without a United flight on the same itinerary, as long as those flights are available to book via United, either on United's own website or by calling reservations at (800) 864-8331.

Some insisted customers accept future travel credits instead of full refunds, even if that's ultimately what flyers were entitled to. Fortunately, United has just made it much easier to redeem your ETCs, whenever you're ready to fly again. For years, certificate holders have been able to apply just one ETC per passenger, though recently it has ...

Click "View details.". Step 3. Click "Book with credit". I've only got credit from one canceled trip. United prominently displays the value of that flight which can be attributed to another United trip. You'll also find the expiration date for your flight here. Click "Book with credit.". Step 4. Enter your new travel info.

Step-by-step guide to using your United travel funds. Applying your travel funds to a United flight is both easy and intuitive. First, you'll want to search for a flight directly on the United ...

CHICAGO, Sept. 23, 2021 / PRNewswire / -- United today announced it is giving customers even more flexibility when they need to rebook their travel by helping them to find and use their travel credits. United is the only airline to make it easy for customers to use their credits by automatically displaying them as a payment option during the ...