NATAS Fair August 2024: Dates, Directions, and Details

Last update: 28 May, 2024

Gear up for the biggest travel fair in Singapore as the popular NATAS Travel Fair returns in August 2024!

Bringing together top-notch travel providers, tourism boards, and more, the NATAS Holidays Travel Fair is where you can start planning your dream vacation — think fantastic promos and packages, fun activities, free goodies, and more!

Whether you're a beach bum or a city explorer, there’s bound to be something that tickles your fancy. With well-known agencies like Nam Ho Travel, ASA Holidays, Chan Brothers, and more at the fair, there’ll be a plethora of different tour packages and deals to choose from!

In addition, you’ll be able to speak to various national tourism boards and find out more about the destinations you want to visit. From secret spots to must-visit attractions, you’ll be able to learn all there is to learn directly from travel experts before planning your big trip!

What is NATAS Holidays Travel Fair?

The NATAS Travel Fair is Singapore’s largest consumer travel fair and is held twice a year in February/March and August/September. Its organising body, the National Association of Travel Agents Singapore (NATAS), brings together numerous travel agencies, tourism boards, airlines, and hotels under one roof to showcase the latest tourism products and trends.

It is the ideal opportunity to discover the best itineraries for that year-end vacation!

When is NATAS Fair August 2024?

16 to 18 Aug 2024

Friday to Sunday

10am to 9:30pm

Where will the NATAS Fair August 2024 be held?

Singapore EXPO

1 Expo Dr, Singapore 486150

Hall 4 and 5

How much does it cost to enter NATAS Fair August 2024?

Admission is FREE!

Stay tuned for the updated floor plan coming soon!

List of Exhibitors at NATAS Holidays Travel Fair 2024

Stay tuned for the updated list of exhibitors coming soon!

Getting to NATAS Fair 2024

Address: Singapore Expo, Hall 5, 1 Expo Drive, Singapore 486150

Singapore EXPO is a 15-minute drive from the CBD. Click this link for parking information .

By taxi or ride-hailing apps

The nearest drop-off point to Hall 5 is Foyer Two (next to Expo MRT station). Take note that fares may be subject to peak-hour surcharges.

Singapore EXPO is served by the Expo MRT station. Two lines connect to this station, the East-West (Green) Line and Downtown (Blue) Line.

There are several bus stops from which you can walk to Singapore EXPO:

- Expo Station Exit E (bus number 20 and 118)

- Besides Carpark G on Upper Changi Road East (bus numbers 12, 24 and 38)

- Outside Hall 1 on Upper Changi Road East (bus numbers 12, 24 and 38)

- Besides Carpark J on Xilin Avenue (bus numbers 35, 35M, 47, and 118)

- Opp Changi City Pt. (bus number 20 and 47)

Tour Packages

- Group Tours

- Free and Easy

Travel Deals

- Credit Cards

- Online Booking Sites

- Attractions and Activities

Popular Destinations

- Netherlands

- New Zealand

- South Korea

- Switzerland

- Advertise With Us

- Terms of Use

- Privacy Policy

Our Other Media Properties

- TripZilla.com

- TripZilla.in

- TripZilla.id

- TripZilla.my

- TripZilla.ph

- TripZilla.vn

- HalalZilla.com

- TravelExcellenceAward.com

Ultimate guide to the Citi travel portal

fCiti is a TPG advertising partner.

The new Citi travel portal launched earlier this year , offering an enhanced user experience, more hotel options and a new feature for booking activities and attractions. Citi Travel with Booking.com is powered by Rocket Travel by Agoda, utilizing the features and booking availability of Booking.com's brands.

In this article, we will explore the functionality of the new Citi travel portal, discuss any potential drawbacks and clarify who can access this booking engine. Additionally, we will provide a step-by-step guide on using the portal to book your desired travel experiences and explain how to pay using your ThankYou points.

What is the Citi travel portal?

There are four main selling points for using Citi Travel with Booking.com.

First, it provides a one-stop shop for travel that you can pay for with your Citi ThankYou points while booking multiple elements of a trip simultaneously. This can be simpler than transferring points to separate airline or hotel partners and booking your trip piece by piece — and you can even use as many or as few points as you want. The downside is that you might achieve less value from your points to gain simplicity.

Second, the portal allows you to use points to pay for travel beyond flights and hotels, such as guided tours and theme park tickets. You can't do this with Citi's list of transfer partners, and you may achieve better value paying for travel with points in Citi's portal than you would by cashing out your points .

Third, certain card benefits require using the Citi travel portal. This is true of hotel benefits built into the Citi Prestige® Card (no longer open to new applicants) and Citi Strata Premier℠ Card (see rates and fees ). We'll explore those below.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Lastly, if you're paying for travel (and not using points), you may be interested in the bonus points available when using Citi Travel with Booking.com. Competitors like the Chase Ultimate Rewards travel portal , American Express Travel and Capital One Travel offer higher earn rates (depending on which credit cards you have) when booking your travel in the bank's portal rather than directly.

With the Citi Strata Premier℠ Card , you can earn 10 points per dollar on reservations for hotels, rental cars and eligible attractions.

Through June 30, 2024, Citi cardholders can earn bonus points as follows:

- 10 points per dollar on reservations for hotels, rental cars and eligible attractions with the Citi Prestige® Card (no longer open to new applicants)

Through December 31, 2025, Citi cardholders can earn bonus points as follows:

- 5 points per dollar on these same bookings with the Citi ThankYou® Preferred Card (no longer open to new applicants) and the Citi Rewards+® Card (see rates and fees )

The information for the Citi ThankYou Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The fact that Citi's portal provides a one-stop shop for your vacation is its main strength. The ability to book hotels, rental cars and even entrance tickets to tourist attractions in one place (and even pay for these with your points) provides great simplicity.

Related: The ultimate guide to Citi ThankYou Rewards

How to use the Citi travel portal

Citi's portal sets itself apart from competitors by being available to anyone with a credit card earning Citi ThankYou points . For comparison, some travel portals reserve their best features for cardholders with expensive premium credit cards . Thus, you can access the portal with the $495-a-year Citi Prestige Card and the no-annual-fee Citi Rewards+ Card .

You can access Citi Travel with Booking.com by clicking this link and logging into your Citi account. If you have multiple Citi credit cards, you must select which card you want to use for booking travel. Once you select a card, you're ready to start booking travel.

How to book flights using the Citi travel portal

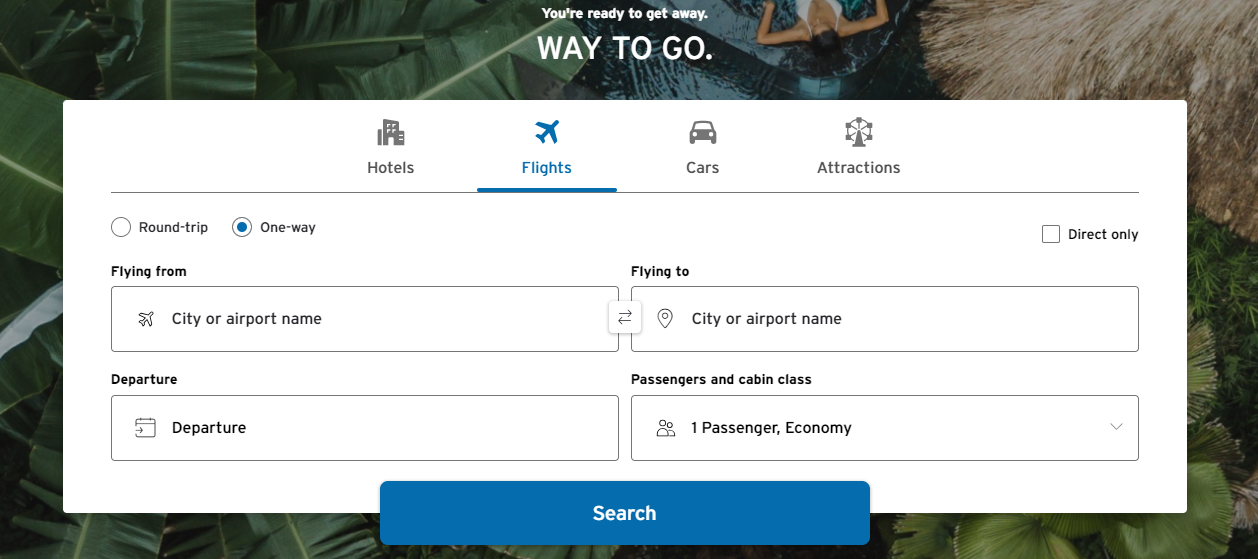

Booking flights in Citi's portal functions similarly to other portals. You'll choose whether this is a one-way or round-trip flight and provide the route, number of passengers, dates and class of travel. Unfortunately, you can't book multi-city itineraries.

Here's an example search from Chicago to Los Angeles. Note that you can use cities for your search if you don't have a specific airport preference.

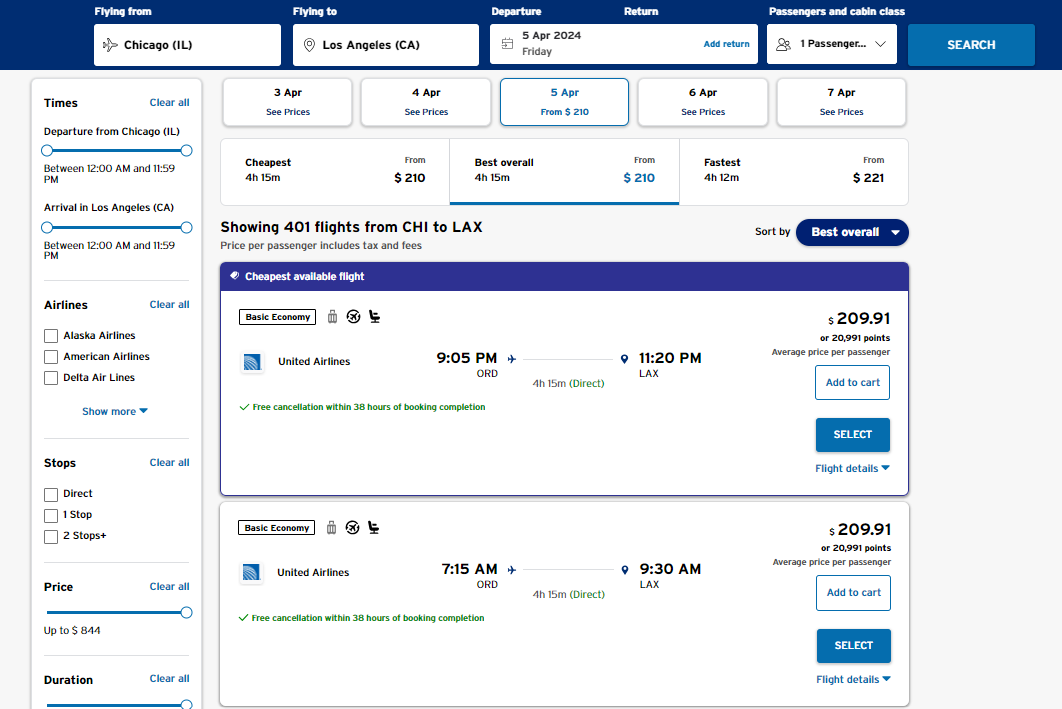

The Citi Travel portal offers many filters and sorting options to help you find the most suitable travel options. These filters allow you to refine your search based on price, duration, departure and arrival times, number of connections and even your preferred airline. Furthermore, you can sort the results using these options without losing any filtering choices.

To change the sorting order of the results, click on the "Best overall" drop-down menu on the right side above the price of the first result.

Once you have selected a flight, you will be prompted to provide passenger information, including names, dates of birth, frequent flyer numbers and known traveler numbers for TSA PreCheck and Global Entry (if applicable).

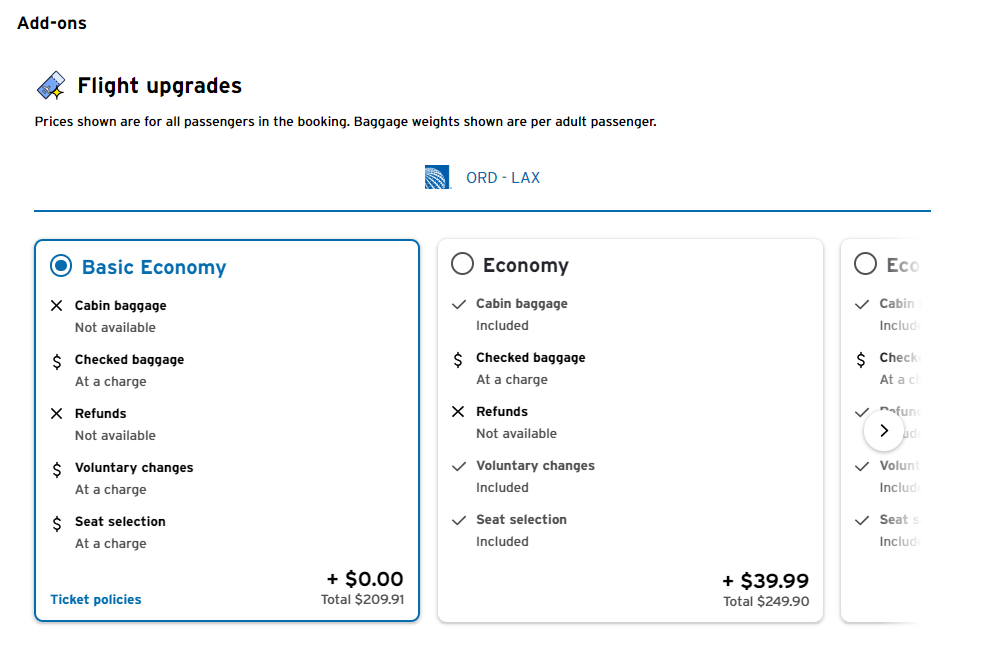

Additionally, before making your payment, you can upgrade to a higher class of travel if it is available. This is the first time you'll see the cost to book a main cabin fare instead of a basic economy fare.

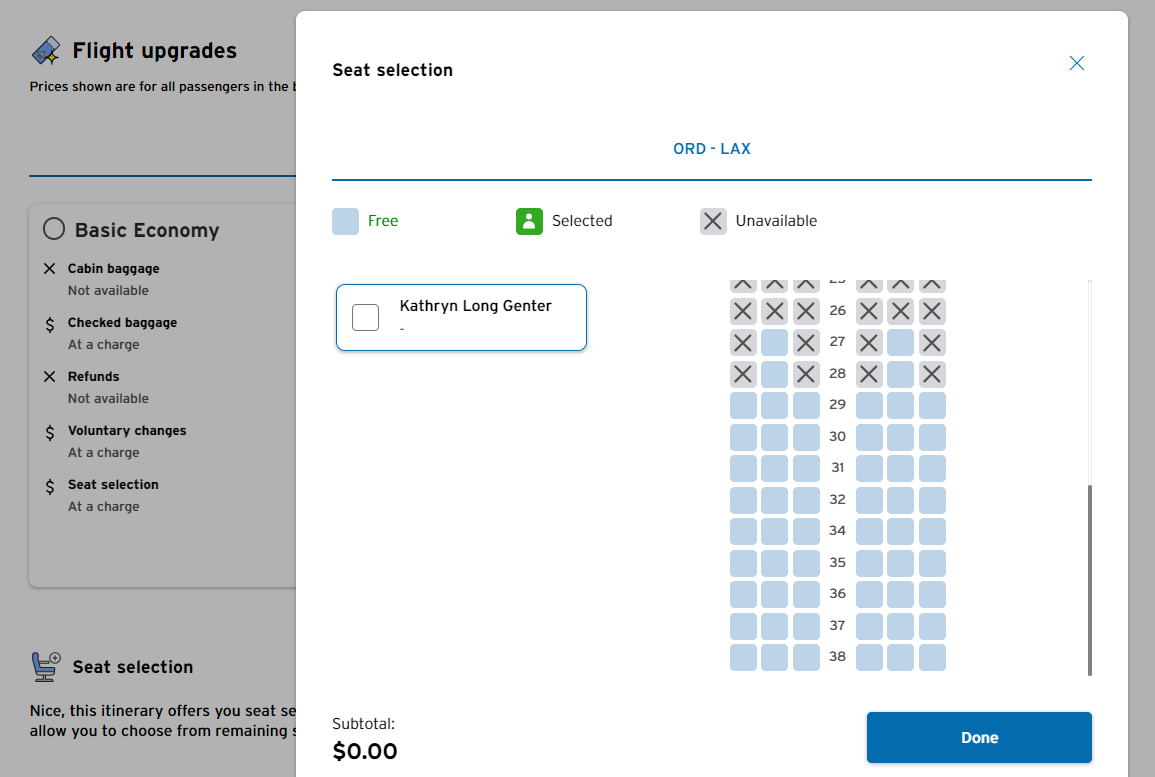

And if your fare class lets you select a seat, you can do so before heading to the payment page.

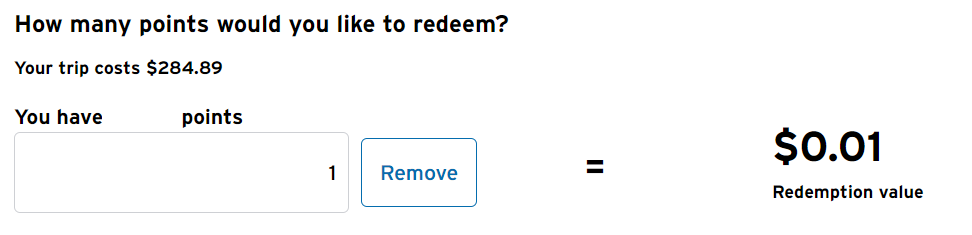

On the final page, you'll choose how you want to pay (with your points, credit card or a mix of the two) and complete your purchase. The redemption rate is an underwhelming 1 cent per point. For context, our valuations peg ThankYou points at 1.8 cents apiece, which you should be able to get by maximizing Citi's transfer partners .

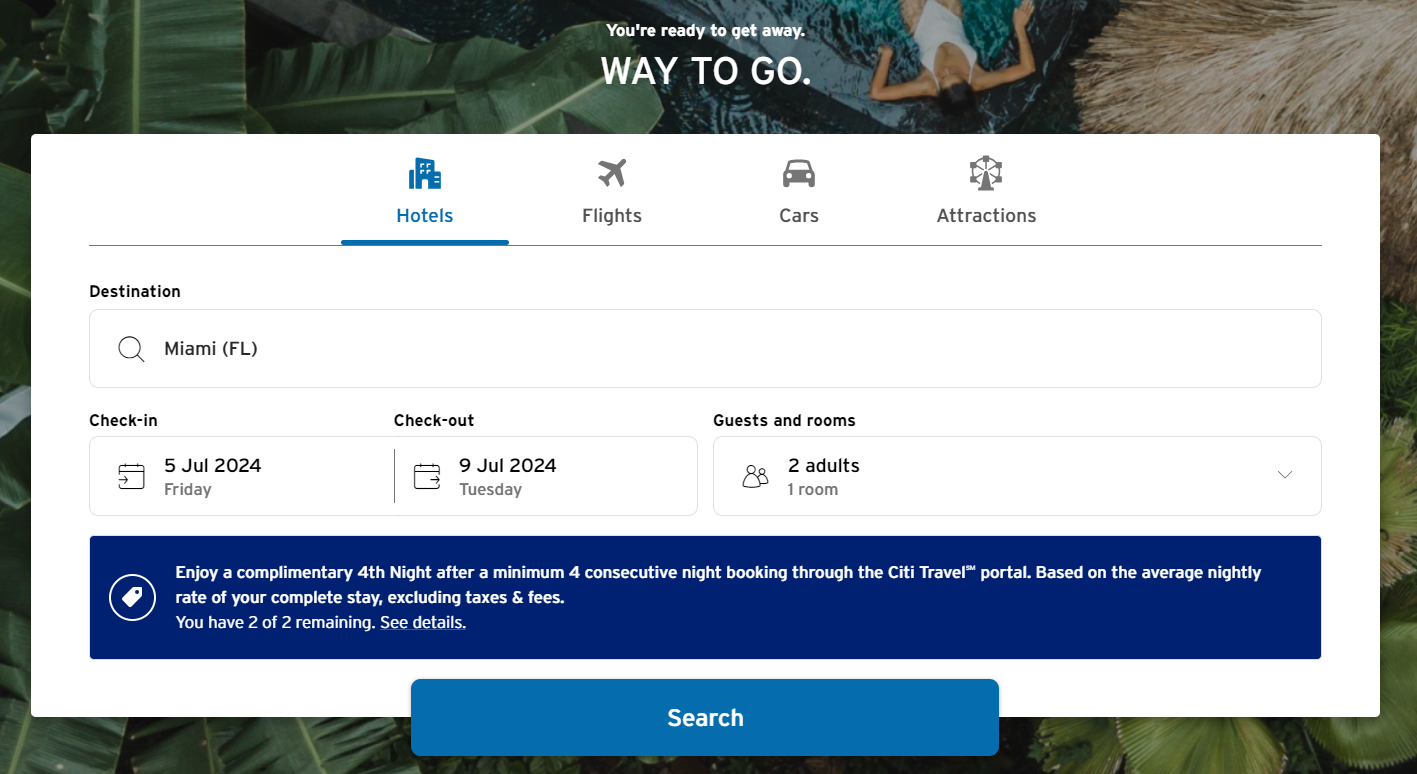

How to book hotels using the Citi travel portal

Booking hotels will feel familiar to those who have used other portals.

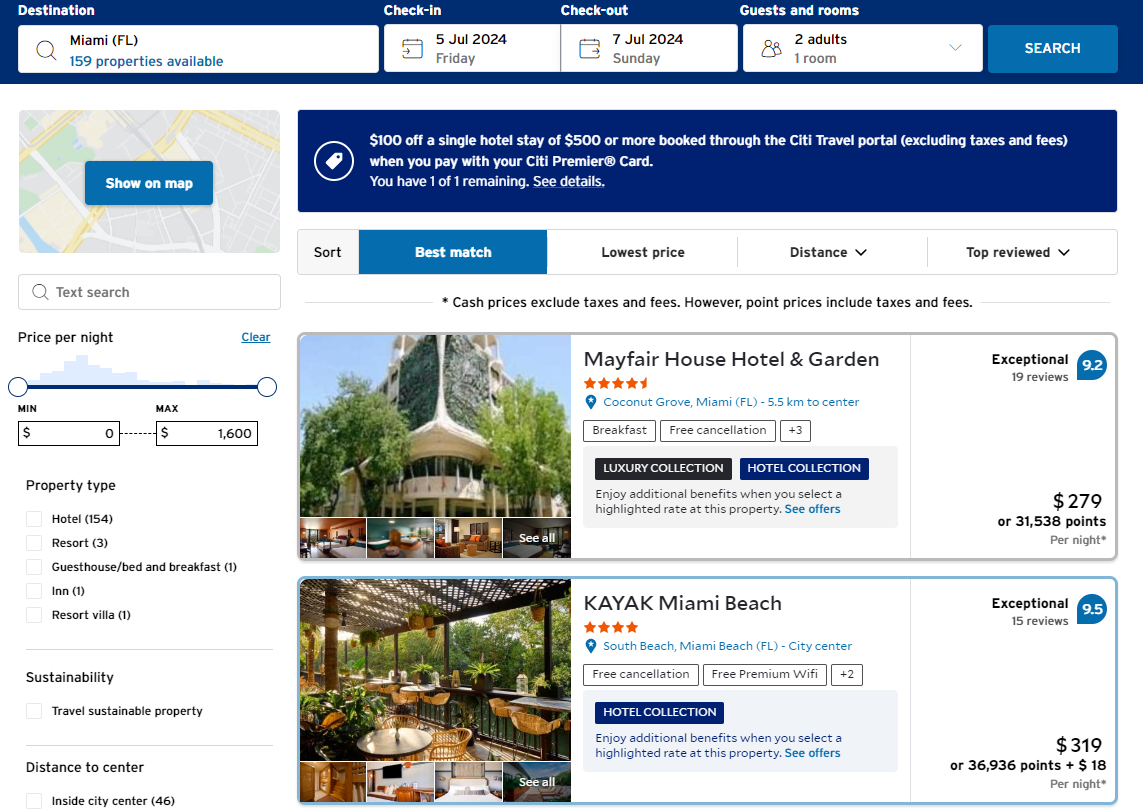

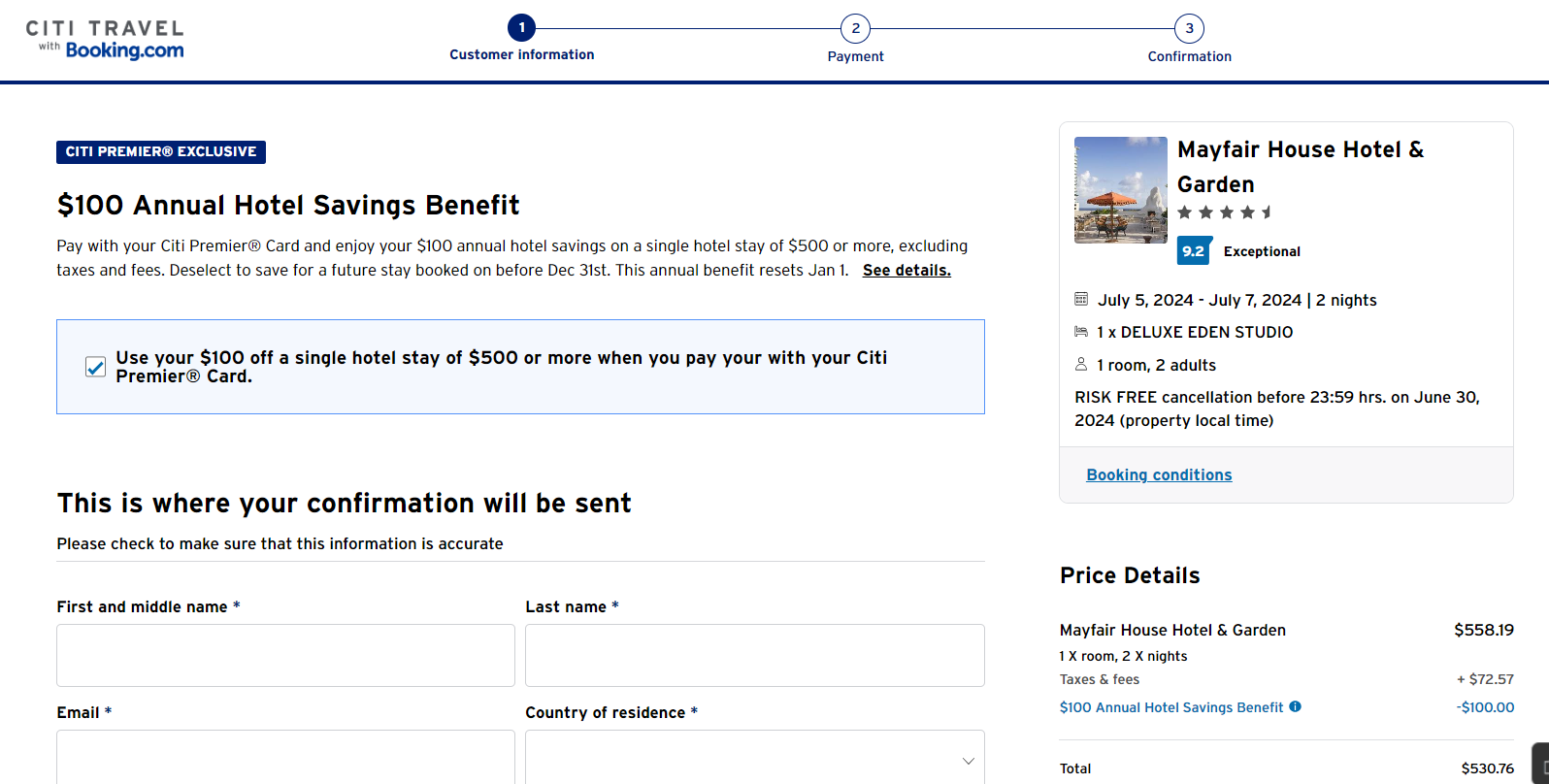

You should choose your Citi Strata Premier or Citi Prestige card before beginning your hotel search if you intend to use those cards' benefits. Strata Premier cardholders can use a $100 hotel credit each calendar year on a booking of $500 or more. In contrast, Prestige cardholders get a fourth night free on hotel bookings in the portal, available up to twice per calendar year.

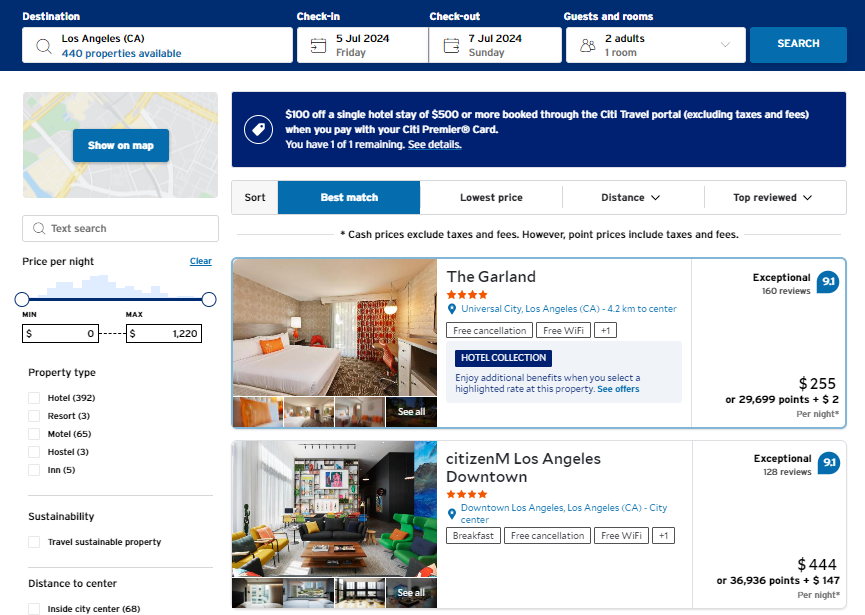

From here, you can add filters to help you reduce your results, such as by price, neighborhood, star rating and nearby attractions.

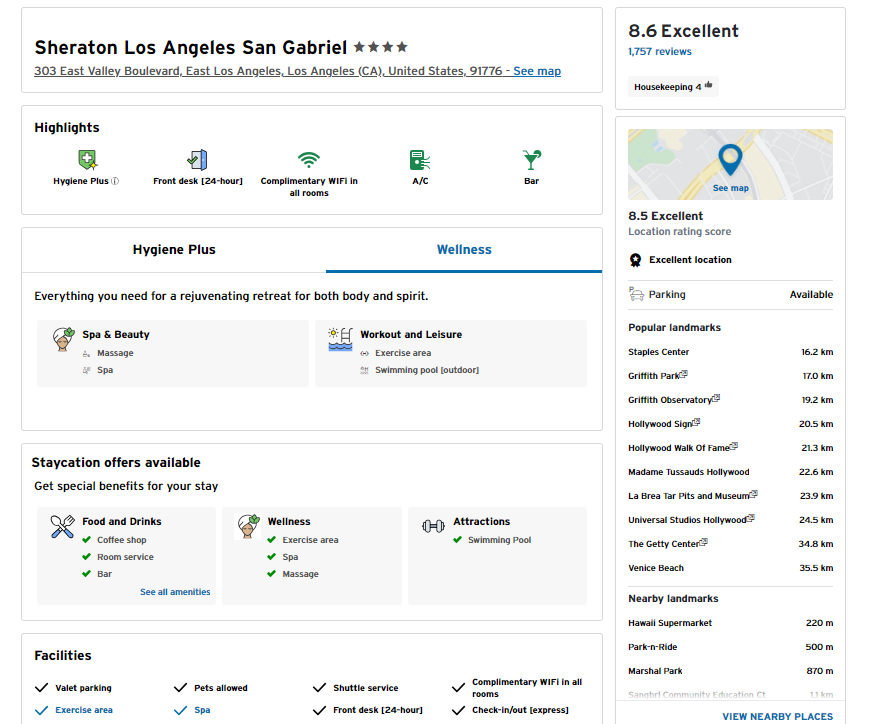

Once you pick a property, you'll see details on its amenities and features.

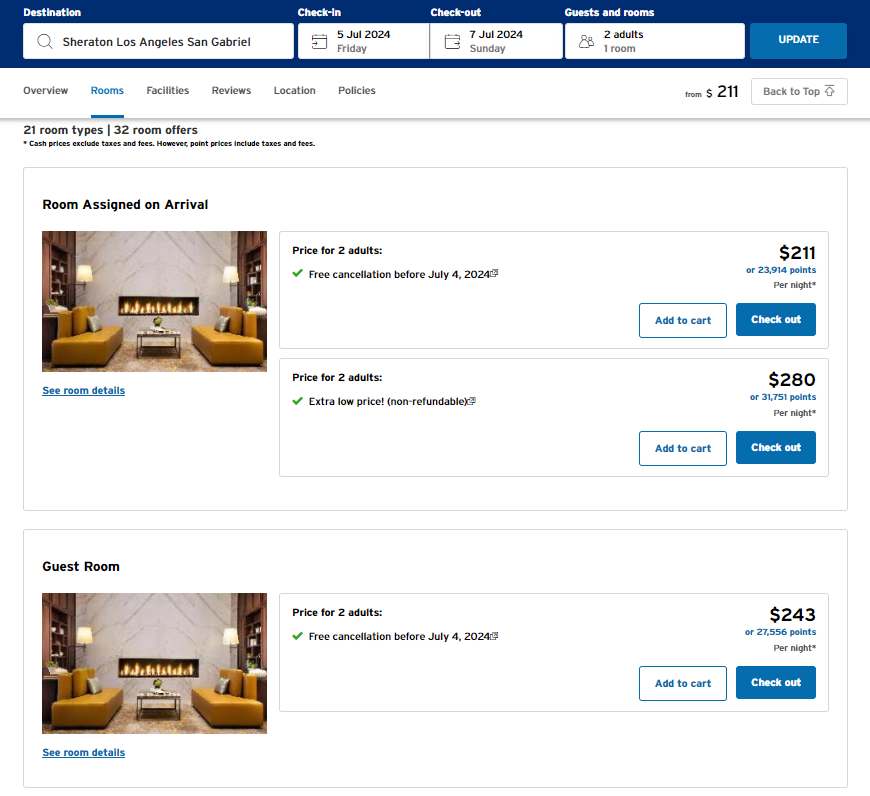

Then, you can select your desired room.

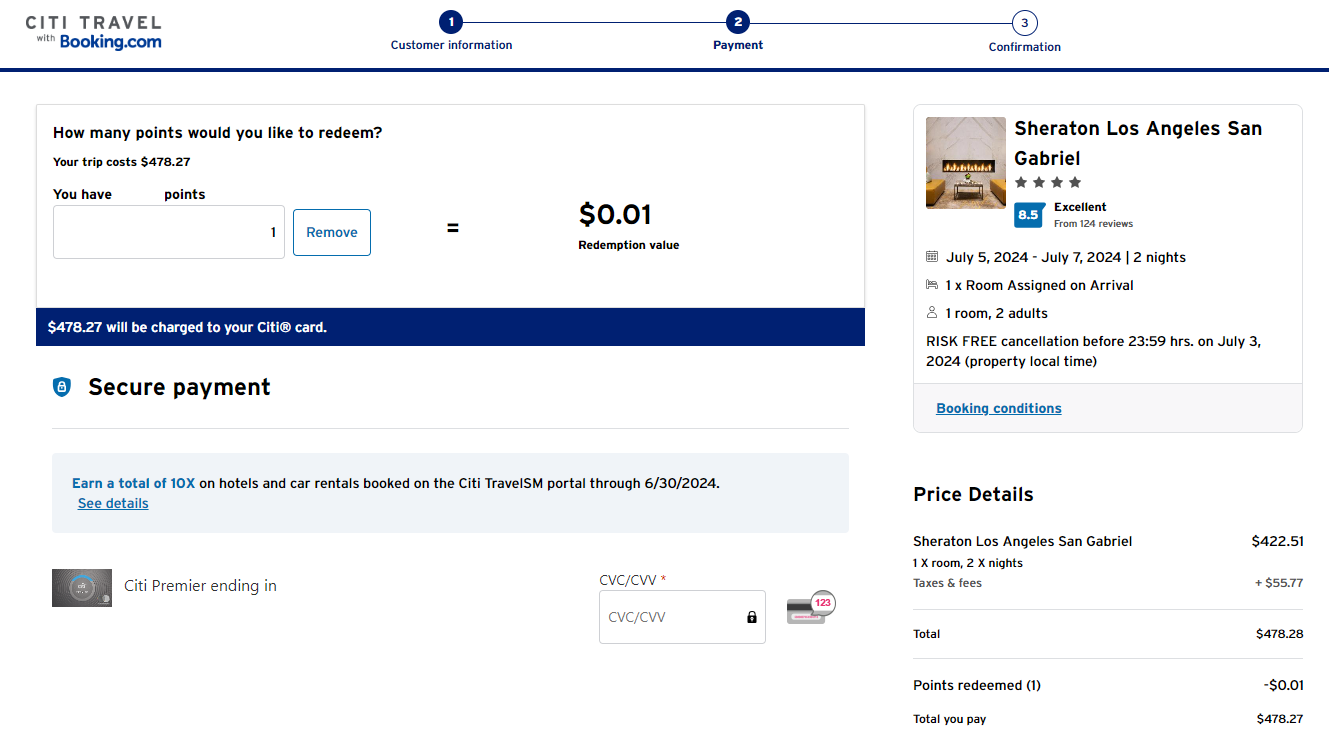

After choosing a room type, you can pay with points at checkout. Again, each point is worth a lackluster 1 cent.

You'll also have the option to view the cancellation policy before paying. Since policies can vary, ensure you know whether it's possible to change or cancel your booking before you make the final payment.

However, if you book a hotel that's part of a major loyalty program — like Hilton Honors or Marriott Bonvoy — through Citi, you likely won't earn points, nor will you enjoy any elite status perks on your reservation.

Hotel Collection and Luxury Collection properties

Alongside its revamped portal, Citi has introduced two new hotel programs, namely the Hotel Collection and the Luxury Collection. These programs offer similar advantages to other luxury hotel programs offered by credit cards .

Reservations through the Hotel and Luxury Collection have no minimum stay requirements. However, access to the Luxury Collection is exclusive to Citi Strata Premier and Citi Prestige cardholders.

You will receive guaranteed benefits such as daily breakfast for two people and complimentary Wi-Fi for Hotel Collection bookings. In addition to these perks, the Luxury Collection offers a $100 on-property credit, which can be used based on the policies of each hotel. Both programs also provide other benefits, such as early check-in, late checkout and room upgrades (specifically for Luxury Collection bookings, subject to availability at check-in).

Unfortunately, you can't filter search results specifically for Hotel and Luxury collections properties. To identify these properties, you must look for a tag or description indicating their inclusion in your search results.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

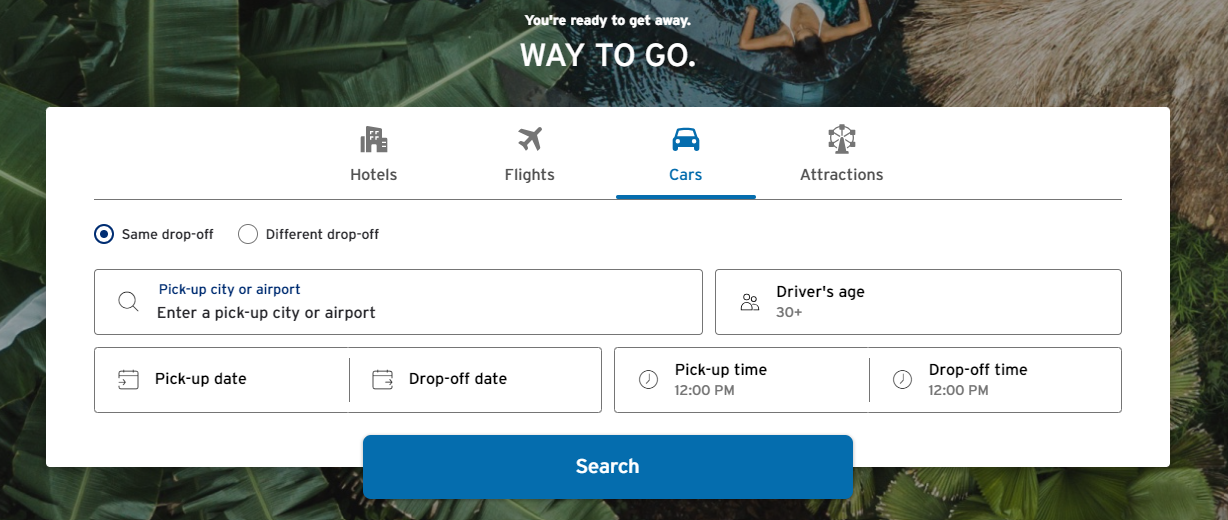

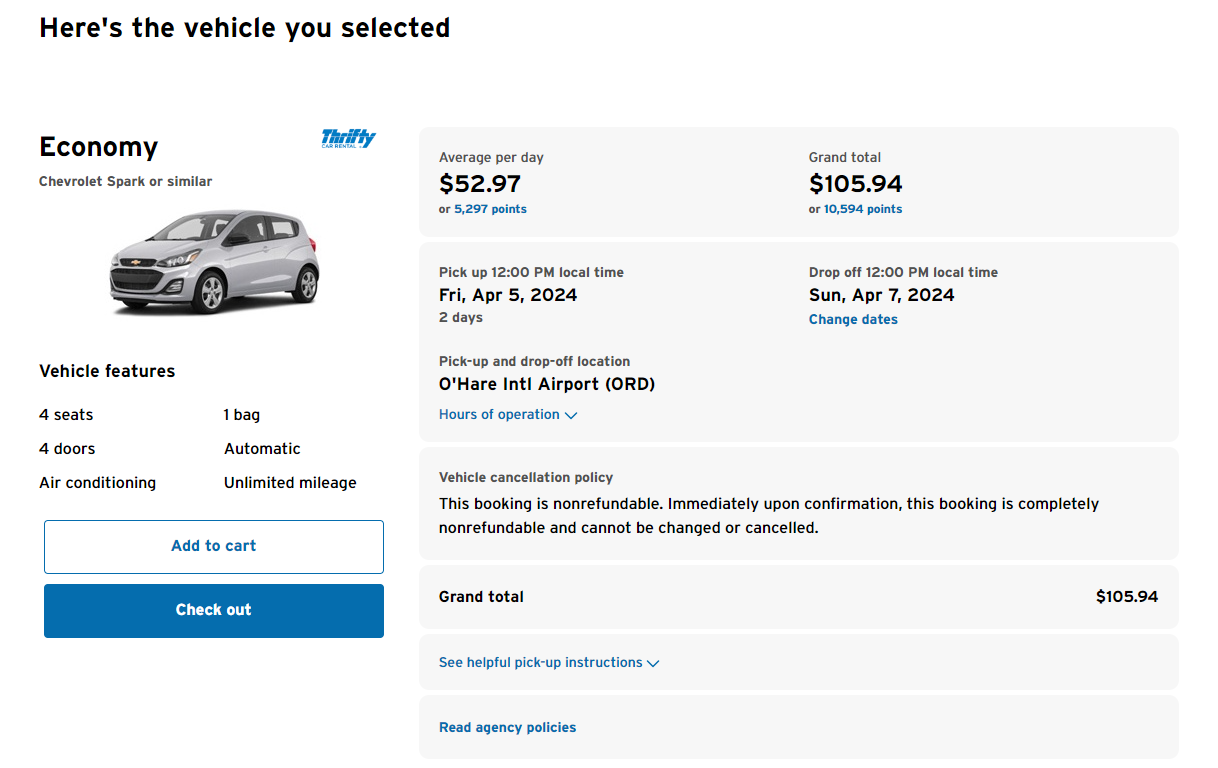

How to book rental cars using the Citi travel portal

Searching for rental cars feels familiar and works quickly.

After providing your location, dates, times and age, click "Search." From the available results, you can use the following filters:

- Vehicle type

- Rental company

- Free cancellation option availability

After choosing a car, you can see the full details and cancellation policy on the next page.

As with other items in Citi Travel with Booking.com , you can add your rental car to the shopping cart (if booking multiple travel elements) or go straight to check out to pay and reserve. Again, you can pay with points at a rate of 1 cent apiece.

How to book attractions using the Citi travel portal

One standout feature of Citi's travel portal is the ability to book attractions along with your hotels, flights and rental cars. This convenient option allows you to make a single transaction for all your travel needs, and you can even use your points to pay for them.

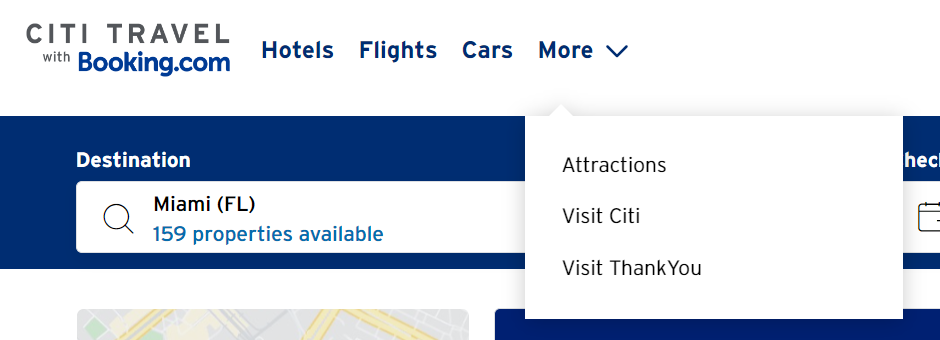

To access this feature, look for the "Attractions" option in the main search bar. However, depending on your location within the portal, you may need to click "More" in the drop-down menu and select "Attractions" from there.

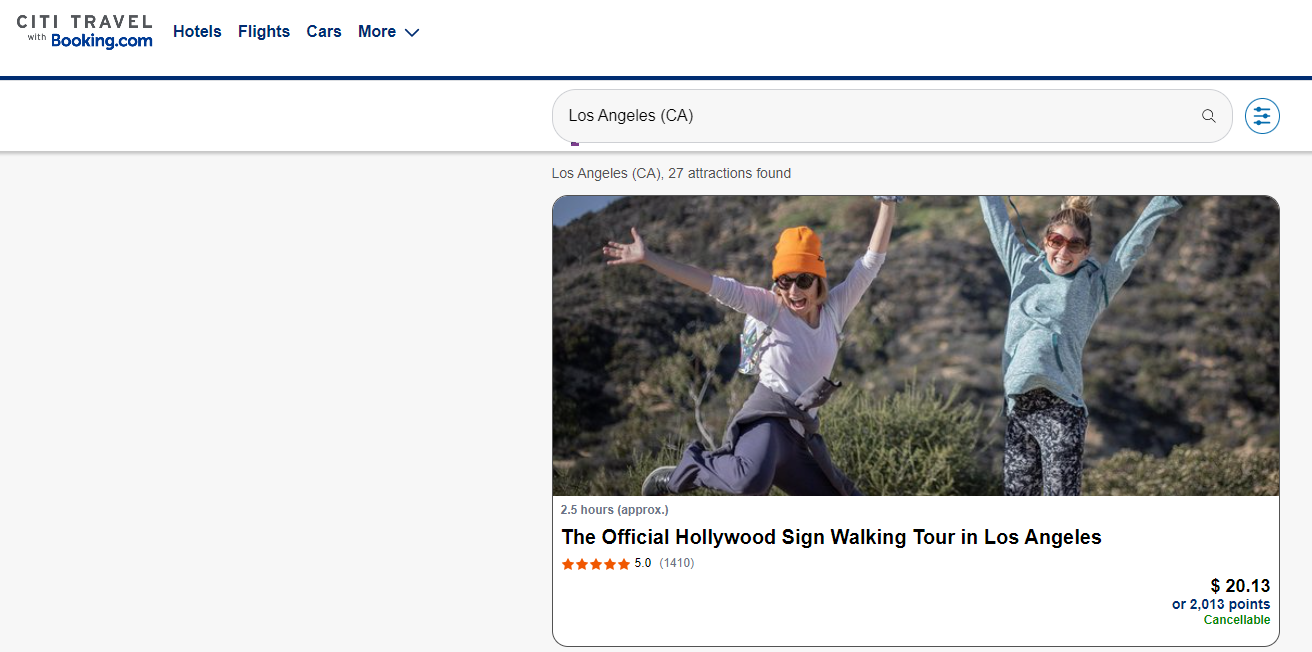

Once you search for a destination, you'll see all available options— from entrance tickets for tourist sights to guided tours. For example, you can book a guided walking tour of the Hollywood Sign.

When you see an activity or tickets you want to purchase, click on the tile. This will take you to a page with details about this offering and cancellation policies.

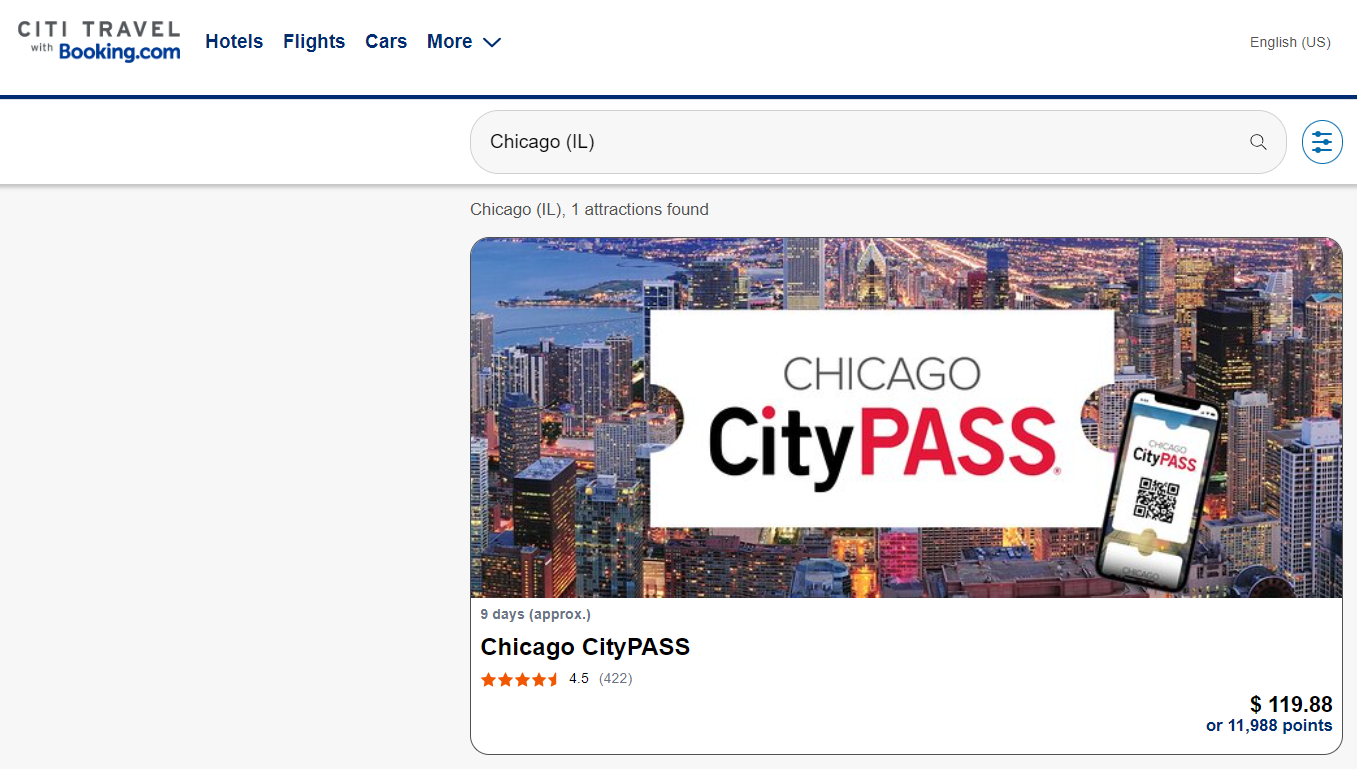

One noteworthy option is Chicago CityPASS tickets, including access to five popular attractions. Click on "Check availability" in the top right corner to choose your preferred date to find pricing and availability.

As with other elements of Citi's portal, you can pay for attraction bookings using ThankYou points with a value of 1 cent apiece.

More things to consider about the Citi travel portal

Now that you know how to use the Citi travel portal, here's some general guidance to maximize your experience.

As always, we recommend comparing prices. There is no guarantee that Citi Travel with Booking.com will offer the best price for your trip. It's recommended to compare the prices you see on the portal with prices available when booking directly with hotels, airlines, rental car companies or tour providers.

If you plan to pay with points, check if you can get better value by using fewer points with Citi's transfer partners . Transferring points to programs like Wyndham Rewards may let you get more value from your points. Check out our guide to redeeming Citi ThankYou points for high-value redemption ideas.

Also, if you book hotels or car rentals through Citi's travel portal, you may forfeit any elite status earnings and benefits. Many loyalty programs require direct bookings to recognize elite status and provide associated perks. Evaluate whether the benefits you would be giving up are worth it.

Finally, Citi Strata Premier and Citi Prestige cardholders have exclusive benefits within the travel portal. Premier cardholders can enjoy $100 off a hotel stay of $500 or more once a calendar year, while Prestige cardholders can get a fourth night free on hotel stays of four nights or more twice a calendar year. If you're making an eligible hotel reservation, you'll see the option to use your available benefit on the payment screen.

You'll also see the benefit(s) highlighted on the hotel search page if you have one of these cards. This includes information on how many more times your benefit can be used.

If you don't see these benefits, check the top right corner of the portal and ensure your Premier or Prestige card is the active card for your searches.

Bottom line

Citi's revamped travel portal allows you to search and make travel reservations for flights, hotels, rental cars, and even tours and attractions. You can book travel up to a year in advance and pay using your Citi ThankYou points or any travel credit card .

Additionally, if you hold the Citi Strata Premier or Citi Prestige, you can utilize your hotel benefits through the portal.

However, it's important to consider potential tradeoffs. Assess your elite status with hotel or rental car companies and determine if you might get better value by booking your travel through another platform. If convenience is your deciding factor, this user-friendly portal offers many results when planning your upcoming vacation.

Additional reporting by Kyle Olsen.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

The Recommended Minimum Requirements of Citi Credit Cards [2024]

Christine Krzyszton

Senior Finance Contributor

314 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Senior Editor & Content Contributor

119 Published Articles 725 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![citibank travel fair The Recommended Minimum Requirements of Citi Credit Cards [2024]](https://upgradedpoints.com/wp-content/uploads/2024/04/Citi-Premier_Upgraded-Points.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

The value of a citibank credit card, recommended minimum requirements for citibank credit cards, before you apply for a citibank credit card, best citi credit cards for fair (580 to 669) to excellent (740+) credit, best citi business credit cards, best citi credit card for no credit or poor credit, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Citibank is a financial institution that has been around for a long time, dating back to the 1800s. While the bank has offered a wide variety of financial products since that time, it wasn’t until the 1960s that the bank started issuing credit cards.

You won’t find a lot of premium credit cards with high annual fees and luxury travel perks in Citibank’s portfolio, but you will find solid everyday cards that can serve a valuable purpose.

Selecting the card that’s right for your situation may be the easy part, but applying for a card can make one a little anxious. In fact, applying for any credit card can be a leap of faith. We complete the application, hit submit , then hold our breath anticipating a positive outcome.

While it’s not always possible to know for sure if you’ll be approved for a card, you can take steps to increase the probability.

Below, we’ll take a look at what we know about applying for Citi credit cards and how you can increase your chances of approval.

Here are the recommended minimum application requirements for Citibank credit cards and tips for applying.

We’ll talk about applying for Citi cards shortly, but first, let’s look at the potential value of Citi credit cards and establishing a relationship with the Citibank financial institution.

Access to a Variety of Credit Cards

Whether you’re looking for a travel rewards card or a cash-back earning card, you’ll find several choices with Citi. While the best Citi credit cards require fair to excellent credit , those applicants with no credit or poor credit will also have options.

Earning Rewards

Citi credit cards may earn cash-back or 1 of 2 types of ThankYou Rewards Points , which are flexible points that can be transferred to hotel and airline partners or which can be redeemed for a fixed value. Every purchase you make with a Citi credit card, with the exception of a secured credit card, will earn rewards.

Citi also allows you the opportunity to earn ThankYou Points as interest on the funds in your bank accounts.

Multiple Redemption Options

There are many Citi credit card reward redemption options: some cards earn ThankYou Points that can be redeemed for a fixed value for cash-back, travel, gift cards, merchandise, charitable donations, loan payments, and statement credits. Some cards, such as the Citi Strata Premier ® Card, also earn ThankYou Points that offer greater redemption options, including the ability to transfer Citi ThankYou Points to hotel and airline partners.

Citi also offers the option to redeem ThankYou Points for payments on student loans and mortgages.

Shopping Protections and Benefits

While coverage varies by card, you’ll find several shopping protections and benefits on Citi credit cards, including damage and theft protection, purchase protection, extended warranty, and Citi Merchant Offers that can save you hundreds of dollars each year.

Citibank Additional Services

In addition to credit cards, a relationship with Citibank could include access to savings and checking accounts, auto loans, home loans, student loans, wealth management, and more.

If you have a current relationship with Citi, a Citi credit card could be even more rewarding. Some Citi credit cards allow you to pay specific loans with rewards earned on the card.

Bottom Line: You’ll have several options when selecting a Citi credit card, including cash-back cards, travel rewards cards, or a secured credit card. Cards offer several rewards redemption options including travel, gift cards, merchandise, and the option to redeem for loan payments. You’ll also find several shopping protections and benefits on select cards. Additionally, establishing a relationship with Citibank can provide greater access to its additional financial products.

Knowledge is power when it comes to applying for a credit card . Let’s face it, applying for a card you’re not quite qualified for can mean a denial, a hard inquiry on your credit report, and disappointment. Knowing the requirements upfront can help you minimize your chances of being denied.

Here’s what you need to know before applying for a Citi credit card:

What We Know for Sure

You will need a fair to excellent credit score to qualify for the best Citi credit cards . A fair score is generally considered 580 to 669, a good credit score ranges from 670 to 739 and an excellent score is 740 and above.

In addition to general requirements, each Citi credit card has its unique creditworthiness requirements. Most Citi credit cards need at least a fair credit score for approval, although there are choices for a wider range of credit scores.

Citi does not limit how many of its credit cards you can have, but it does limit the number of cards you can apply for (and be approved) within a specific period of time. For personal credit cards, you cannot apply for more than 1 Citi card every 8 days and no more than 2 within a 65-day window.

You cannot apply for more than 1 business credit card every 95 days.

Hot Tip: Unlike some card issuers, Citi allows you to earn a welcome bonus more than once on a specific credit card. You must wait 24 to 48 months since you’ve previously earned the welcome bonus, but you can earn it again. Terms differ by card and whether your card is still open or if you’ve closed it.

Optional but Potentially Helpful

There is no requirement to have an existing Citibank relationship in order to be approved for a Citi credit card, but if this is your first credit card or your first credit card with Citi, opening a bank account could help with approval.

Carrying a balance on your credit card from statement to statement will incur interest charges and negate any rewards you may have earned on your purchases. However, credit card issuers earn money on those customers who do carry a balance.

For this reason, when completing the application, you may want to consider that in the future you may need to carry a balance and indicate this when completing the application.

Bottom Line: You will need to have a fair to excellent credit score to qualify for the best Citi credit cards. You can only apply for 1 Citi credit card every 8 days, with no more than 2 cards applied for within a 65-day time period. If you have poor or no credit , you may still qualify for a secured Citi card. Having an existing account with Citi and indicating you’ll carry a balance from statement to statement can help with approval.

Don’t apply for a Citi credit card, especially your first Citi credit card, without some preparation.

Here are a few tips for increasing your chances of getting approved for a Citi credit card:

Check To See if You Have Offers

Before you apply for a Citi credit card, you’ll want to check to see if you have any existing credit card offers available to you. It’s easy to do and does not affect your credit score.

One option for finding out if you have card offers is through the CardMatch tool . You’ll need to provide minimal information to receive a list of available offers from several different card issuers, including Citi. Y our credit will not get a hard pull when using CardMatch.

There is also a Citi preselection tool that you can use to see whether you are eligible for any offers, using the same no-risk procedure that does not impact your credit.

Either preselection tool may help you uncover offers for the cards you’re most likely to be approved for. Keep in mind that these offers do not guarantee you’ll be approved or that you aren’t qualified for more premium cards, just that your profile matches the card’s general requirements.

Once you submit a card application, Citi will run a hard pull on your credit report to determine your actual creditworthiness.

Know Your Credit History and Score

It makes sense to check your credit report periodically and/or prior to applying for a credit card, to determine if the report is current and accurate . If you find any errors, you’ll be able to initiate a correction and resolve any discrepancies prior to any credit card issuer accessing your report.

Since the Fair and Accurate Credit Transactions Act of 2003 was enacted, you can request a copy of your free credit report from each of the 3 major credit bureaus once each year. And, if you’ve had adverse action such as being denied a credit card, you are eligible to receive a free report from the bureau that was used to make that decision.

Consider Opening a Citi Bank Account

It is not necessary to have an existing Citi bank account to get approved for a Citi credit card, although it may assist, particularly if this is your first credit card or your first credit card with Citi. You may even want to stop by a branch location first, open an account, then apply for a card.

What if You Have Poor Credit or No Credit?

Even if you have less-than-perfect credit or no credit, Citi has credit cards that work for just about any credit situation. A real plus is that once you’ve proven your creditworthiness with Citi, you may qualify for a better card with greater rewards and more benefits.

Bottom Line: Before applying for a Citi credit card, order a copy of your credit card to check for errors, know your credit score, and consider opening a Citi bank account.

The best Citi credit cards have robust earning structures and earn flexible rewards that have multiple redemption options.

Here are some of the best Citi credit cards requiring a fair to excellent credit score:

Citi Strata Premier ℠ Card

[ upgp_table cc_id=551447 ]

The Citi Strata Premier card comes with a generous welcome offer and elevated earnings on everyday spending. We like that the card earns Citi ThankYou Points that offer flexible options at redemption time, including redeeming for travel via the Citi ThankYou travel portal for 1.25 cents per point. We also like that points can be transferred to airline and hotel partners for potentially even greater value.

Citi Double Cash ® Card

Great card for the average spender with no specific focus category; worry-free cash-back earning on everything!

The Citi Double Cash ® Card has long been one of the top cash-back credit cards on the market, and the card now has the ability to earn Citi ThankYou Points!

This means that cardholders of the Double Cash card will now earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. Cash back is earned in the form of ThankYou Points . This means each billing cycle, you will earn 1 ThankYou point per $1 spent on purchases and an additional ThankYou point for every $1 paid on your purchase balance as long as there is a corresponding balance in your Purchase Tracker.

Citi has turned the Double Cash card into a top choice for those who are looking for an everyday, no-fuss credit card.

- Uncapped 2% for every $1 spent (1% when you buy and another 1% when you pay)

- Flexible redemption options

- No annual fee

- No bonus categories

- 3% foreign transaction fees

- Bonus Offer: Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This offer will be fulfilled as 20,000 ThankYou ® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases.

- To earn cash back, pay at least the minimum due on time.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Citi Double Cash ® Card Travel Portal Limited Time Offer: Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions, excluding air travel, when booked through the Citi Travel SM portal on ThankYou.com or by calling 1-800-Thankyou and saying “Travel.” Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024.

- APR: 0% Intro APR for 18 months on balance transfers, then 19.24% - 29.24% Variable

- Foreign Transaction Fees: 3% of the U.S. dollar amount of each purchase

Citi ThankYou Rewards

The Double Cash card could be your go-to card if you’d prefer a card with no annual fee. You won’t be bothered with learning complicated earning structures as each purchase earns 1% cash-back when you make the purchase and another 1% when you pay your bill. That’s a total of 2% cash-back on every purchase.

Citi Custom Cash ® Card

Earn big on purchases in your top eligible spend category, up to the first $500 each billing cycle, with no annual fee!

The Citi Custom Cash ® Card is inventive when it comes to cash-back credit cards. Instead of earning a set amount of cash-back on predetermined bonus categories, the Citi Custom Cash card earns 5% cash-back on your highest eligible spend category each billing cycle, without an annual fee.

Thanks to that unique perk, you’ll never need to worry about whether you’re using the right card for the right purchase, as your Citi Custom Cash card will always pay you 5% back on whichever category you end up spending the most on each month.

- 5% cash-back (on up to $500 each billing cycle) from your largest purchase category, including restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, and live entertainment

- Multiple redemption options

- Your 5% category is limited to $500 in spend ($25 in cash-back) each month

- Not particularly rewarding for any purchases outside of your top 5% cash-back category

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou ® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked via the Citi Travel℠ portal through 6/30/2025.

- No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash ® Card account per person.

- APR: 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% - 29.24%.

- Foreign Transaction Fees: 3%

With no annual fee and the opportunity to earn up to 5% cash-back on your highest bonus-earning category expenses each statement period (up to $500 in purchases each statement period), you’ll find the Citi Custom Cash card is a great everyday spending card.

Costco Anywhere Visa ® Card by Citi

The Costco Anywhere Visa ® Card by Citi is a great Citi’s cash-back rewards card designed specifically for Costco Members.

- Discover one of Citi’s best cash back rewards cards designed exclusively for Costco members

- 4% cash back on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter

- 3% cash back on restaurants and eligible travel purchases

- 2% cash back on all other purchases from Costco and Costco.com

- 1% cash back on all other purchases

- No annual fee with your paid Costco membership and enjoy no foreign transaction fees on purchases

- Receive an annual credit card reward certificate, which is redeemable for cash or merchandise at U.S. Costco warehouses, including Puerto Rico

- APR: 20.49% Variable

- Foreign Transaction Fees: None

If you’re a frequent Costco shopper, you’ll love the Costo Anywhere card , especially if you purchase a lot of gas. The card earns 4% cash-back at any gas station, as well as bonus earnings on EV charging, dining, travel, and at Costco. Plus, the card does not charge an annual fee.

Bottom Line: You will need a fair to excellent credit score to qualify for Citi’s best rewards-earning credit cards .

There aren’t many business credit cards offered by Citibank, and the ones we single out as being among the best, are actually co-branded cards.

Here are our choices for the best Citi business credit cards and the benefits of each one:

Costco Anywhere Visa ® Business Card by Citi

Earn 4% cash-back on gas/EV charging purchases, 3% cash-back at restaurants and travel, 2% cash-back at Costco, and 1% on all other purchases.

- Discover the only business credit card designed exclusively for Costco members

- Whether you’re traveling for business or pleasure, enjoy no foreign transaction fees on purchases

Businesses that spend considerably on gas will benefit from receiving 4% cash-back at any gas station and at EV charging stations , up to $7,000 in purchases each year.

Also, if you’re a business that shops regularly at Costco or Costco.com, cash-back earned on the Costco Anywhere Business card could add up quickly.

With additional bonus earnings on travel and dining, the card is worth considering.

CitiBusiness ® / AAdvantage ® Platinum Select ® Mastercard ®

A low annual fee, a free checked bag, and tons of perks and discounts make this card valuable for business owners who travel.

With the CitiBusiness ® / AAdvantage ® Platinum Select ® Mastercard ® , you get a card that gives you perks like boarding privileges, free checked bags, and discounts on inflight purchases, while also earning more miles for your next award redemption.

- 2x miles per $1 spent on American Airlines purchases

- 2x miles per $1 spent on cable and satellite providers, at gas stations, on car rentals, and on select telecommunications merchants

- 1x mile per $1 spent on all other purchases

- $99 annual fee

- Does not earn transferable rewards

- Designed for businesses

- For a limited time, earn 75,000 American Airlines AAdvantage ® bonus miles after $5,000 in purchases within the first 5 months of account opening.

- First checked bag is free on domestic American Airlines itineraries to reduce travel costs and boost your bottom line.

- 25% savings on American Airlines inflight Wi-Fi when you use your card

- Enjoy preferred boarding on American Airlines flights

- Earn 2 AAdvantage ® miles per $1 spent on eligible American Airlines purchases, and on purchases at telecommunications merchants, cable and satellite providers, car rental merchants and at gas stations

- Earn 1 AAdvantage ® mile per $1 spent on other purchases

- Earn 1 Loyalty Point for every 1 eligible AAdvantage ® mile earned from purchases

- No Foreign Transaction Fees

- APR: 21.24% - 29.99% Variable

American Airlines AAdvantage Frequent Flyer Program

If your business involves travel on American Airlines, you’ll appreciate accumulating 2x AAdvantage miles earned on everyday business purchases such as telecommunications, satellite and cable providers, car rentals, and at gas stations .

Miles earned on the CitiBusiness Platinum Select card can be used to secure award flights that can help offset the cost of business travel.

Plus, if you’re traveling with companions, you, and up to 4 additional travelers, will enjoy flight benefits such as preferred boarding , a free checked bag , and statement credits for inflight purchases.

Bottom Line: If your business shops often at Costco or you or your employees frequently fly American Airlines, Citi’s co-branded business credit cards could be logical choices for a business credit card.

If your credit could use some improvement or you have limited or no credit history, you might want to start your relationship with Citi by selecting its secured card.

Citi ® Secured Mastercard ®

A great option for those with little or no credit history and can help you build your credit.

- The Citi ® Secured Mastercard ® is a no annual fee credit card that helps you build your credit when used responsibly.

- Unlike a debit card, it helps build your credit history with monthly reporting to all 3 major credit bureaus. Once available, you will also have free access to your FICO score online.

- Use your card anywhere Mastercard ® is accepted – worldwide.

- A security deposit is required. Once approved, your credit limit will be equal to your security deposit (minimum of $200).

- Get help staying on track with Auto Pay and account alerts.

- With Flexible Payment Due Dates, you can choose any available due date in the beginning, middle or end of the month.

- Manage your account 24/7 online, by phone, or in our mobile app.

- APR: 26.74% Variable

- Foreign Transaction Fees:

With no annual fee and monthly reporting to the 3 major credit bureaus, the Citi Secured card is accepted anywhere Mastercard is accepted. A minimum required security deposit of $200 is required, but you’ll be able to manage your account online and via mobile, have free access to your FICO score, and select flexible payment due dates that work for you.

There is no minimum credit score required for the Citi Secured card, but if you have had a recent bankruptcy you could be denied.

Hot Tip: If you are reluctant to apply for a secured card, don’t forget to use the CardMatch tool or Citi’s pre-selection tool to see if any secured card offers await you.

Lack of Travel Benefits

While you will find several shopping protections and benefits on various Citi credit cards, you will not find travel insurance protections or benefits. If these protections and benefits are important to you, you may want to consider travel rewards credit cards .

Card Limits and Application Frequency

As we mentioned previously, there is no stated limit for how many Citi credit cards you can have at one time. However, the total amount of credit you already have open with Citi could affect your approval odds. Plus, it’s wise to spread out your applications if you’re applying for more than 1 card with Citi, as you can only apply for 2 cards every 65 days and the applications must be more than 8 days apart.

Reconsideration Line

If you are denied when applying for a Citi credit card, you may want to contact the reconsideration line . It is possible that the denial you received could have been an automated response based on how you completed the application and additional information could change the decision — not always, of course, but it’s worth a phone call to have a real person look at your application.

You can contact the Citi reconsideration line for personal cards at 800-695-5171 or 866-541-7657 for business cards. These numbers were current at the time of writing. If either does not work and you need immediate access, you can easily find these numbers online.

If you need to check the status of your Citi application , you can do so on Citi’s website.

Although Citibank gets far less media attention than rivals American Express, Chase, or Capital One, doing business with Citi offers advantages. We particularly like the Citi Strata Premier card for earning flexible ThankYou Points and the Double Cash card for earning 2% cash-back on every purchase ( 1% cash-back when you make the purchase and another 1% when you pay your bill) — a good choice for non-bonus spending categories and supplementing travel rewards cards.

And, if your credit score could use some improvement, there’s nothing wrong with starting out with the Citi Secured card and working your way up.

Most Citi credit cards don’t have the bells and whistles of the best premium travel rewards cards, but you can find value in several of their card offerings.

The information regarding the Citi Double Cash ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Custom Cash ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Costco Anywhere Visa ® Card by Citi was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Costco Anywhere Visa ® Business Card by Citi was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the CitiBusiness ® / AAdvantage ® Platinum Select ® Mastercard ® was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi ® Secured Mastercard ® was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Strata Premier℠ Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

What are the requirements for a citi credit card.

You will need a fair to excellent credit score to qualify for the best Citi credit cards. A fair score is generally considered 580 to 669, a good credit score ranges from 670 to 739 and an excellent score is 740 and above.

Citi offers a wide variety of credit cards for nearly every credit situation, including a secured credit card that can be secured with a credit score as low as 300.

In addition to your credit score, credit history, income, number of hard inquiries on your credit report, and how much credit you have with Citi will also be considered when applying for a Citi card.

Does Citi give instant approval for credit cards?

Yes, it is possible to be instantly approved for a Citi credit card.

Why did I get denied for a Citi credit card?

One of the most common reasons for denial is too many recent inquiries on your credit report. You could also be denied if your credit score is lower than the requirements for the specific card for which you’re applying, or if your income is not sufficient.

You may also receive a denial if the application was not completed correctly or if you have applied for too many Citi cards in too short a time.

Which is the easiest Citi card to get?

The Citi Secured card is the easiest to obtain as it requires no minimum credit score and can be secured with poor credit or no credit.

However, if you have good credit or better, the card would not be a fit for you.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

Discover the exact steps we use to get into 1,400+ airport lounges worldwide, for free (even if you’re flying economy!).

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![citibank travel fair Venmo Credit Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2021/10/Venmo-Credit-Card-green.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Search & Apply for Jobs

Search by Keyword

Search by Location

Please select a location from the dropdown to proceed.

You are now leaving Citi Careers portal, and entering a third-party site, operated on behalf of Citi.

Our Resume Match feature is available in:

- Philippines

- United Kingdom

- United States

For all other locations, please use our keyword search.

Insider Threat Lead Analyst( Hybrid)

Citi security & investigative services (csis) intelligence combines specialized global intelligence research and analytical resources in support of investigations and security incidents., we are a quickly evolving organization within csis charged with solving some of the most challenging intelligence and analytical questions posed to citi. the work we do will engage your whole brain (as well as a fair amount of your time) and our most impactful achievements have one crucial feature in common: colleagues who embrace our three citi leadership principles., + we take ownership * #thinkingoutsidethebox #problemsolvers, + we deliver with pride * #makinganimpact #lifelonglearners, + we succeed together * #respect #dreamteam, citi is a great place to work, and we do some pretty cool stuff. so, if you think you are up for it, see if these apply to you:, i enjoy working in a creative and high-paced environment where no two days are the same, i am self-aware and use this ability to stay flexible and direct my behavior positively, i enjoy being part of a diverse, multicultural, and globally dispersed team, i communicate openly with others, share my ideas constructively, and listen actively, i value being surrounded by talented, committed, and supportive colleagues, i want my work to be meaningful and impactful, i like to solve problems collaboratively, to be challenged intellectually, and want to take charge of my own career, i embrace change with agility and a positive attitude, a little about this role:, the citi security and investigative services (csis) insider threat lead analyst position requires a high level of domain expertise in area of insider threat. the analyst will provide stakeholders with customized, advanced, professionally crafted intelligence, research, and analytical products. the analyst will be responsible for routinely evaluating insider threat tradecraft and methodologies to identify potential areas for improvement and/or gaps in the industry and developing training plans for the team’s analysts on these identified methodologies. this analyst will work within the insider threat program in collaboration with csis investigations and security across the globe., based in tampa, florida, this individual contributor position will report to the global csis insider threat manager. in support of csis global functions, the incumbent will provide strategic, tactical, and operational analysis as part of the overall insider threat program. this position will encompass reviewing csis investigations (related to fraud, conduct, and cybersecurity) for insider threat or risk potential, conduct in-depth analysis of various data sets related to identity and access management, authorization mechanisms, security architecture, network components, and proxy logs. this role will provide training and awareness activities to appropriate business partners and managers within the organization and provide advice and assistance to ongoing investigations. this position will collaborate on the development of policies and procedures governing these intelligence programs. this position will contribute to and provide guidance on the establishment of processes, procedures, and playbooks, oversee assigned consultations and analytical products, and identify opportunities for program improvement. this position will also identify opportunities to mentor, coach, and ensure professional development of other investigators and analysts as necessary., key responsibilities/ day to day activities, collect insider threat intelligence from various sources relevant to the firm and the industry to conduct risk assessments., analyze the insider risks and potential impact of an incident and make recommendations on controls and mitigation., develop and lead training engagements based on identified internal and external insider threat trends, activities and methodologies., brief findings from insider threat cases to improve behavioral baselines, update network analysis, and improve indicators to identify future threats., assist with consultation engagements across csis investigations., develop leads through engagements with global and regional partners., update workflows and process to ensure alignment with csis investigation programs., gather both technical and non-technical data, analyze information and draw conclusions supported by facts, and develop written reports of findings., identify and incorporate technologies able to facilitate incident management and referrals., create presentations and brief senior managers., liaison with a broad network of partners and peer institution levels to develop best practices., knowledge of a second language is plus. , create, develop, and update charter, runbooks, playbooks, workflows, processes, procedures, and other documentation as needed., help track and manage metrics (kpis/kris) to ensure the advancement of the program., other duties as assigned. , job qualifications, the csis insider threat lead analyst position is a high visibility, experienced position requiring proven experience in intelligence analysis and being part of quickly developing programs in a corporate setting. if you have the following, we would like to talk to you:, work experience:, minimum of 7 years of combined experience in insider threat, counterintelligence, or intelligence., experience in analyzing and investigating insider threat incidents, identifying risks, and recommending controls., familiarity of corporate insider threat tactics, techniques, and procedures., familiarity with the intelligence cycle., proven track record of a taking a mitigation approach to detect and identify, assess, and manage an insider threat program or similar activity., broad knowledge of business processes including business operations, information technology, security, fraud and misconduct investigations, and intelligence production., experience in creating standard operating procedures, guidelines, processes, and intelligence product lines., experience coordinating several projects simultaneously and oversee the execution of daily duties with minimal supervision., strong organizational and facilitation skills., experience in policy development, implementation, and training., experience with enterprise level software tools to analyze large data sets and system logs., experience with host-based insider threat detection tools and advanced analytic methodologies., experience in advising senior management., experience in working with insider threat regulations and information security reports., proven track record of strategic thinking and finding business focused compliance solutions., experience with enterprise level software tools to analyze large data sets and system logs (i.e. splunk microsoft purview)., experience with host-based insider threat detection tools and advanced analytic methodologies (i.e. dtex, symantec dlp)., qualifications:, minimum ba, preferred, post graduate degrees welcomed, demonstrated self-starter and resourceful individual, with experience of operating in fast paced and dynamic operational settings., broad professional experience, including prior international work experience/travel or experience working as part of a globally dispersed team an advantage., excellent communication and presentation skills. ability to effectively communicate, both orally and in writing, through all levels of the organization., self-motivated with the ability and maturity to make decisions in the absence of detailed instructions., ability to identify risk, notify stakeholders, and inform leadership of the risk posed along with courses of action., ability to maintain client relationships to exceed client satisfaction related to csis insider threat services and products., process oriented and able to develop and describe process to a broad audience of varied backgrounds., this job description provides a high-level review of the types of work performed. other job-related duties may be assigned as required..

- Insider Threat Program Manager certificate a plus.

- Some corporate experience a plus.

------------------------------------------------------

Job Family Group:

Job Family:

Primary Location:

Primary Location Full Time Salary Range:

In addition to salary, Citi’s offerings may also include, for eligible employees, discretionary and formulaic incentive and retention awards. Citi offers competitive employee benefits, including: medical, dental & vision coverage; 401(k); life, accident, and disability insurance; and wellness programs. Citi also offers paid time off packages, including planned time off (vacation), unplanned time off (sick leave), and paid holidays. For additional information regarding Citi employee benefits, please visit citibenefits.com. Available offerings may vary by jurisdiction, job level, and date of hire.

Anticipated Posting Close Date:

Citi is an equal opportunity and affirmative action employer.

Qualified applicants will receive consideration without regard to their race, color, religion, sex, sexual orientation, gender identity, national origin, disability, or status as a protected veteran.

Citigroup Inc. and its subsidiaries ("Citi”) invite all qualified interested applicants to apply for career opportunities. If you are a person with a disability and need a reasonable accommodation to use our search tools and/or apply for a career opportunity review Accessibility at Citi .

View the " EEO is the Law " poster. View the EEO is the Law Supplement .

View the EEO Policy Statement .

View the Pay Transparency Posting

Ashley shares 3 tips for Java developers looking to grow their career

“Be creative with your code.” Ashley, Infrastructure Technology Lead at Citi, shares 3 important tips for Java developers looking to grow their career.

Learn More >

Join Fraud Early Warning Sr. Supervisor Hector for a day in the life

Fraud Early Warning Sr. Supervisor Hector talks about originally joining Citi just to get through college, but instead has built a 21-year career here because of the opportunities and mobility available within Citi.

Join Infrastructure Lead Ashley for a day in the #LifeAtCiti

Infrastructure Technology Lead Ashley shares more about tech at Citi, important skills for her role, and how her family has influenced her career.

Related Jobs

Featured career areas.

You have no saved jobs

Previously Viewed Jobs

You have no viewed jobs

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Climate Action

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

City Pair Program (CPP)

The OMB-designated Best-in-Class City Pair Program procures and manages discounted air passenger transportation services for federal government travelers. At its inception in 1980 this service covered only 11 markets, and now covers over 13,000 markets. Today, CPP offers four different contract fares.

Fare finder

- Search for contract fares

Note: All fares are listed one-way and are valid in either direction. Disclaimer - taxes and fees may apply to the final price

Taxes and fees may apply to the final price

Your agency’s authorized travel management system will show the final price, excluding baggage fees. Commercial baggage fees can be found on the Airline information page.

Domestic fares include all existing Federal, State, and local taxes, as well as airport maintenance fees and other administrative fees. Domestic fares do not include fees such as passenger facility charges, segment fees, and passenger security service fees.

International

International fares do not include taxes and fees, but include fuel surcharge fees.

Note for international fares: City codes, such as Washington (WAS), are used for international routes.

Federal travelers should use their authorized travel management system when booking airfare.

- E-Gov Travel Service for civilian agencies.

- Defense Travel System for the Department of Defense.

If these services are not fully implemented, travelers should use these links:

- Travel Management Center for civilian agencies.

- Defense Travel Management Office for the Department of Defense.

Contract Awards CSV

Download the FY24 City Pair Contract Awards [CSV - 1 MB] to have them available offline. The file updates after 11:59 pm Eastern Time on standard business days. Previous fiscal year contract awards can be found on the Fiscal documents and information page . To read more about the contract award highlights, please see our Award highlights .

Instructions for the FY24 CSV file

All fares are listed one-way and are valid in either direction. In the CSV file, Origin and Destination are in alphabetical order regardless of travel direction. The Origin is the airport code (domestic travel) or city code (international travel) that comes first alphabetically and the Destination is the airport or city code that comes second alphabetically.

For example, you are traveling from Washington, DC to London, England. You know the city codes are WAS and LON respectively. The city code LON comes first alphabetically and WAS comes second alphabetically. To find the contract fares, you filter:

City Pair Program benefits and info

CPP offers government travelers extra features and flexibility when planning official travel, in addition to maintaining deep program discounts. These include:

- Fully refundable tickets

- No advance purchase required

- No change fees or cancelation penalties

- Stable prices which enables accurate travel budgeting

- No blackout dates

- Fares priced on one-way routes, permitting agencies to plan multiple destinations

CPP is a mandatory use, government-wide program, designated as a Best-In-Class procurement by OMB. The program delivers best value airfares, and ensures federal agencies effectively and efficiently meet their mission.

CPP saves the federal government time and money by maintaining one government-wide air program. At the acquisition level CPP delivers data analysis, compliance, and uses strategic sourcing to optimize its service.

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Silver price today: Silver is up 20.65% year to date

Farran Powell

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Published 10:41 a.m. UTC June 26, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Oselote, iStock/Gettty Images Plus

What is the current price of silver today?

The price of silver opened at $28.87 per ounce, as of 9 a.m. ET. That’s down 2.34% from the previous day and up 20.65% year to date.

The lowest trading price within the last day: $28.57 per ounce. The highest silver spot price in the last 24 hours: $29.56 per ounce.

Silver spot price

The spot price refers to the price at which silver can be bought or sold “on the spot,” or immediately. The futures price, on the other hand, reflects the price for silver delivered later.

Silver’s spot price in U.S. dollars is denoted as XAG/USD on the foreign exchange market. You can track silver’s spot price in other currencies, including XAG/GBP for British pounds and XAG/EUR for euros. Silver trades 24/7, so its price is always shifting.

Our Partner

Access quick and secure investment.

Silver price chart

This chart shows how silver’s spot price has trended over the last year. The data is updated at 9 a.m. ET and doesn’t have intraday lows or highs.

As of 9 a.m. ET, silver was up 20.65% since Jan. 1. It hit its 52-week high of $32.51 on May 19, 2024. The 52-week low was $20.69 on Oct. 2, 2023.

The spot price represents the current market rate, or what the price is “on the spot.” Like gold prices, silver prices are typically provided in troy ounces. One troy ounce equals 1.097 standard ounces.

Various factors drive spot prices for silver. Many investors opt to trade using futures contracts rather than spot prices.

Precious metals prices

Silver is one of four main precious metals investors can trade via physical bullion , exchange-traded products or futures contracts. Gold, palladium and platinum spot prices are also updated 24/7 in a variety of currencies.

Gold/silver ratio

The gold/silver ratio is the price of an ounce of gold divided by the price of silver per ounce. As of today, the gold/silver price ratio is 80.03.

This is an important tool for comparing the value of gold to the value of silver over time. A higher ratio means gold is trading at a premium to silver. That can often be a sign of economic uncertainty. A lower ratio means silver prices are gaining on gold prices.

Silver price history

Silver prices peaked in January 1980 at $49.45 per troy ounce. They hit a low of $3.56 per troy ounce in February 1993.

Silver’s spot price has fluctuated over the years. Variables such as supply and demand, geopolitical events, currency strength, economic data, and changes in investment trends impact silver prices.

1970 - 2005

Silver was under $10 per ounce in the mid-1970s. It reached nearly $50 in 1980. But silver fell back under $10 by the late 1980s.

2006 - 2024

Silver prices cleared $10 again in 2006.

The Great Recession drove prices higher. In March 2008, spot prices reached about $20 per ounce. But another sharp decline followed. Silver dropped back below $10 by October 2008.

Another major jump occurred a few years later. In April 2011, silver traded at over $45 per ounce.

Silver future prices

Global exchanges exist in cities such as London, Hong Kong, Zurich, New York and Chicago. They allow for nearly 24-hour silver trading. The COMEX plays an essential role in setting silver spot prices. This branch of the Chicago Mercantile Exchange uses futures contracts to project silver prices.

Silver futures are contracts to buy or sell silver for a set price at a set future date.

Silver ETPs