Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Citi Travel With Booking.com Portal: Your Guide to Booking Flights, Hotels, Car Rentals, Theme Parks and More

Chris Hassan

Social Media & Brand Manager

234 Published Articles

Countries Visited: 27 U.S. States Visited: 26

Keri Stooksbury

Editor-in-Chief

41 Published Articles 3375 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1201 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

What is the citi travel with booking.com portal, cards that earn citi thankyou points, why should you use the citi travel with booking.com portal, how to access the citi travel with booking.com portal, how to book a flight through the citi travel with booking.com portal, how to book a hotel through the citi travel with booking.com portal, how to book a rental car through the citi travel with booking.com portal, how to book attractions through the citi travel with booking.com portal, how to book a cruise through the citi travel with booking.com portal, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Citi ThankYou Points are an often underappreciated yet valuable points currency. Often overshadowed by the bigger players like Chase and American Express, Citi offers cardmembers the opportunity to earn and redeem points with some great travel partners.

While transferring points to partners may often yield better value, using points to book travel via Citi’s travel portal can be a convenient option. And the updated Citi Travel with Booking.com portal makes that process even easier and more robust.

In this guide, we will show you exactly what the Citi Travel with Booking.com portal is, who can use it, how to use it, and whether or not you should use it.

Ready? Let’s go!

The Citi Travel with Booking.com portal is a third-party online travel agency (OTA) run by, you guessed it, Booking.com . This portal operates very similarly to other OTAs such as Orbitz and Expedia .

Like other online travel agencies, users have the option to book flights, hotels, rental cars, activities, and more. However, since it’s linked to your Citi account, you can redeem Citi ThankYou Points towards travel at a rate of 1 cent per point.

Who Can Use the Citi Travel with Booking.com Portal?

Unlike other travel portals, like AmexTravel.com , you can only use the Citi Travel with Booking.com portal if you have a Citi credit card that earns ThankYou Points.

Some of our favorite travel cards are issued by Citi. The option to earn flexible points with cards that have some great everyday bonus categories is an excellent way to level up your travel game.

If you want to boost your Citi ThankYou Points balance, here are some of our favorite cards:

The Citi Strata Premier℠ Card is a great all-around travel rewards card that allows you to earn big rewards on a variety of purchases like air travel, at restaurants, supermarkets, gas stations, and more, along with flexible redemption options, all for a modest annual fee.

- 10x points on hotels, car rentals, and attractions booked through CitiTravel.com

- 3x points on air travel, other hotel purchases, restaurants, supermarkets, gas stations, and EV charging stations

- $100 annual hotel benefit

- $95 annual fee

- Earn 70,000 bonus ThankYou ® Points after spending $4,000 in the first 3 months of account opening, redeemable for $700 in gift cards or travel rewards at thankyou.com

- Earn 10 points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

- Earn 3 points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas and EV Charging Stations.

- Earn 1 Point per $1 spent on all other purchases

- $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com. Benefit applied instantly at time of booking.

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

- APR: 21.24%- 29.24% Variable APR

- Foreign Transaction Fees: None

This no annual fee card rewards cardholders for everyday purchases. Earn bonus points at supermarkets and gas stations, plus your points are rounded up on every purchase.

- Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com

- Plus, as a special offer, earn a total of 5 Thank You ® Points per $1 spent on hotel, car rentals and attractions booked on CitiTravel.com through December 31, 2025.*

- 0% Intro APR on balance transfers for 15 months from date of first transfer and on purchases from date of account opening. After that, the variable APR will be 18.74% – 28.74%, based on your creditworthiness. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Earn 2X ThankYou ® Points at Supermarkets and Gas Stations for the first $6,000 per year and then 1X Points thereafter. Plus, earn 1X ThankYou ® Points on All Other Purchases.

- The Citi Rewards+ ® Card – the only credit card that automatically rounds up to the nearest 10 points on every purchase – with no cap.

- No Annual Fee

- APR: 0% intro APR on balance transfers and on purchases for 15 months. After that, the variable APR of 18.74% - 28.74%.

- Foreign Transaction Fees: 3% of each purchase transaction in US dollars

Great card for the average spender with no specific focus category; worry-free cash-back earning on everything!

The Citi Double Cash ® Card has long been one of the top cash-back credit cards on the market, and the card now has the ability to earn Citi ThankYou Points!

This means that cardholders of the Double Cash card will now earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. Cash back is earned in the form of ThankYou Points . This means each billing cycle, you will earn 1 ThankYou point per $1 spent on purchases and an additional ThankYou point for every $1 paid on your purchase balance as long as there is a corresponding balance in your Purchase Tracker.

Citi has turned the Double Cash card into a top choice for those who are looking for an everyday, no-fuss credit card.

- Uncapped 2% for every $1 spent (1% when you buy and another 1% when you pay)

- Flexible redemption options

- No annual fee

- No bonus categories

- 3% foreign transaction fees

- Bonus Offer: Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This offer will be fulfilled as 20,000 ThankYou ® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases.

- To earn cash back, pay at least the minimum due on time.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Citi Double Cash ® Card Travel Portal Limited Time Offer: Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions, excluding air travel, when booked through the Citi Travel SM portal on ThankYou.com or by calling 1-800-Thankyou and saying “Travel.” Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024.

- APR: 0% Intro APR for 18 months on balance transfers, then 19.24% - 29.24% Variable

- Foreign Transaction Fees: 3% of the U.S. dollar amount of each purchase

Citi ThankYou Rewards

Earn big on purchases in your top eligible spend category, up to the first $500 each billing cycle, with no annual fee!

The Citi Custom Cash ® Card is inventive when it comes to cash-back credit cards. Instead of earning a set amount of cash-back on predetermined bonus categories, the Citi Custom Cash card earns 5% cash-back on your highest eligible spend category each billing cycle, without an annual fee.

Thanks to that unique perk, you’ll never need to worry about whether you’re using the right card for the right purchase, as your Citi Custom Cash card will always pay you 5% back on whichever category you end up spending the most on each month.

- 5% cash-back (on up to $500 each billing cycle) from your largest purchase category, including restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, and live entertainment

- Multiple redemption options

- Your 5% category is limited to $500 in spend ($25 in cash-back) each month

- Not particularly rewarding for any purchases outside of your top 5% cash-back category

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou ® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked via the Citi Travel℠ portal through 6/30/2025.

- No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- Citi will only issue one Citi Custom Cash ® Card account per person.

- APR: 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% - 29.24%.

- Foreign Transaction Fees: 3%

While many in the travel community prefer to earn points and then transfer them to partners to book award redemptions, that process can be complicated and confusing to some people.

For a lot of people, booking through an OTA, like the Citi Travel with Booking.com portal, is straightforward and easy — and if that helps you book more travel, then you should absolutely do it.

But there are plenty of other reasons to use the Citi Travel with Booking.com portal as well …

Bonus Points

To kick off the launch of the new portal, Citi is offering up to 10 ThankYou Points per $1 spent on hotels, car rentals, and attractions if you hold a Citi Prestige ® Card or Citi Strata Premier ℠ card . If you hold the Citi Rewards+ card , you can earn up to 5 ThankYou Points per $1. This promotion is valid through December 31, 2025.

No Blackout Dates

If there is a seat on the flight you want, you can book it. There are no blackout dates or stress about finding award availability. With the Citi Travel with Booking.com portal, if you see a flight, you can book it.

Earn Airline Miles

One of the nice things about booking flights through an OTA is the fact that you still earn airline miles and elite-qualifying miles despite not booking directly through the airline.

Use Points and Money

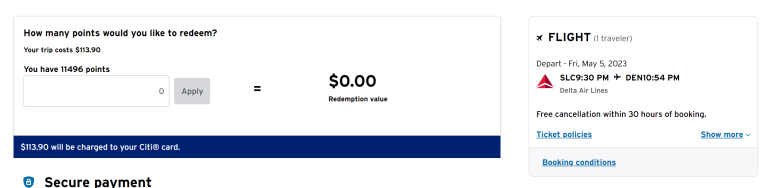

If you are a little short on points or don’t want to use them all, you can use a combination of points and money to pay for your travel.

At checkout, simply select how many points you want to redeem and the difference will be calculated for you to pay in cash.

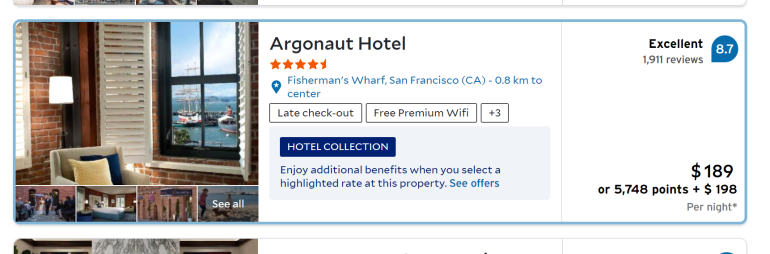

Book Nonchain Hotels

While points are great for booking hotels from the big chains, your options are limited when it comes to independent, boutique hotels.

That is when booking through an OTA like the Citi Travel with Booking.com portal comes in handy. You can use your ThankYou Points to book hotels that otherwise wouldn’t have been possible.

Get a Fourth Night Free

One of the many benefits of the Citi Prestige card (no longer open to new applicants) is that cardholders are eligible for a fourth night free at select hotels.

Simply select a hotel for 4 or more nights and if the hotel is eligible, the price will reflect the discount.

Pool Citi ThankYou Points

If you are short on points or want to boost your balance, Citi allows members to combine ThankYou Points.

This can be done online or by calling the phone number on the back of your Citi credit card.

Luxury Collection and Hotel Collection Benefits

As part of the new travel portal, Citi is gradually introducing 2 new programs for hotel bookings; Luxury Collection and Hotel Collection.

These programs offer unique benefits at select hotels, although the number of hotels is still quite limited. However, you can expect the following if you book:

Luxury Collection Benefits (Citi Strata Premier Card and Citi Prestige Card members):

- $100 experience credit

- Room upgrade, upon availability

- Daily breakfast for 2

- Complimentary Wi-Fi

- Early check-in, upon availability

- Late checkout, upon availability

Hotel Collection Benefits (All Eligible Cardmembers):

Hot Tip: It’s not all positive — if you book a chain hotel via the Citi Travel with Booking.com portal you are typically ineligible to receive any elite night credits or elite benefits during your stay.

Accessing the Citi Travel with Booking.com portal is pretty straightforward. You can simply visit Citi Travel with Booking.com and log in with your Citi credentials.

From there you will have options to choose Hotels, Flights, Cars, and More . Let’s start with booking flights.

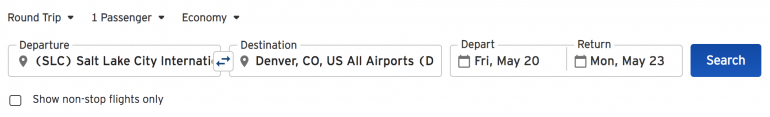

Once you are logged in and click on Flights , you will be directed to the online search tool — which may look familiar if you have used Booking.com before.

Searching for a flight using the Citi Travel with Booking.com portal is pretty straightforward.

Simply select:

- Round-trip or one-way (multicity is no longer an option)

- Flying from

- Departure date

- Return date (if applicable)

- Cabin class

Once you have started a search, the results will populate and you will have additional options to filter through the flights.

Currently, you can filter flight results by:

- Departure times

- Arrival times

Citi will even break down the results into 3 categories: Cheapest , Fastest , and Best overall, which is a combination of low price and short duration.

By default, the results are shown by price per person, but you can also sort them by:

- Total journey time (fastest first)

- Best overall (cheap, short flights)

- Outbound departure time (earliest first)

- Outbound arrival time (earliest first)

- Stops (fewest stops first)

Once you have found a flight that works for you, click on the blue Select button to proceed with the booking.

If eligible, you will be prompted with options to upgrade your seat, similar to what airline websites offer.

After confirming your selection and adding the passenger information, click the Continue to payment button where your flight details will be shown alongside your Citi ThankYou Points balance.

You then will have the option to use points, pay with your Citi card, or a combination of both. From here, you can use as many (or as few) points as you would like to cover the cost of the flight, and if there is a balance, it will be charged to your Citi card.

After confirming the information, simply click on Complete Purchase and your ticket will be issued. As with most OTAs, there is a 24-hour cancellation window.

Comparing Rates

While it isn’t uncommon for flight prices to fluctuate and be slightly different between online travel agencies and with airlines directly, during our search we found that most prices were the same price on Google Flights as they were through the Citi Travel with Booking.com portal.

While prices are often similar, it is always a good idea to double-check prices on Google Flights.

As an extra data point, American Airlines was charging 11,500 miles for that flight, so that was slightly less than the 12,790 Citi ThankYou Points needed.

Once logged in, click on the Hotel tab to start the booking process through the Citi Travel with Booking.com portal (the default landing page may already be set to hotels).

Searching for a hotel is pretty straightforward and similar to many other OTAs.

- Destination

- Check-in date

- Check-out date

- Number of guests and rooms

If you have a Citi Prestige complimentary 4th night free available, there will be a message displaying that information.

Once you have started a search, the results will populate and you will have additional options to filter through hotel options.

Currently, you can filter hotel results by:

- Price per night

- Property type

- Sustainability

- Distance to center

- Neighborhood

- Star rating

- Payment options

- Guest rating

- Room amenities

- Near popular attractions

- Location rating

- Property facilities

- Room offers

- Beach access

- Location highlights

- Number of bedrooms

- Popular hotel brands

By default, the results are sorted by Best match , but you can sort by lowest price , distance , and top reviewed , as well.

Hot Tip: Beware, the prices shown on the first page do not include taxes and fees , so the price may change significantly from one page to another.

Once you have found an option that works for you, click on the hotel to proceed with the booking.

After finding a room that you like, click Add to cart or Check out to be directed to the Review page where you will enter the guest information.

Citi Prestige Card Benefit

On the next page, if you have a Citi Prestige card, you will have the option to apply the Complimentary 4th Night Benefit.

If you don’t have a Citi Prestige card, you can skip ahead.

Citi Strata Premier Card Benefit

If you have a Citi Strata Premier card, you can receive $100 off a single hotel stay of $500 or more.

This $100 credit is available once per calendar year when booking via the Citi Travel with Booking.com portal, and you will have the option to use it or not.

After filling out the guest information, click on Continue to payment.

Finally, on the Payment page, you will have the option to apply your Citi ThankYou Points towards the total at a rate of 1 cent per point. So, for example, using 10,000 points would reduce the total by $100.

Hotels always want guests to book directly with them in order to avoid paying commission fees to online travel agencies, so it’s not uncommon to see prices be different from site to site.

That is why hotels do not provide elite benefits when booking through an OTA, as an extra incentive to book direct.

In the case of the Citi Travel with Booking.com portal, our example was actually cheaper than the price on Expedia as well as directly with the hotel, which is great news for Citi cardholders.

The total for 4 nights via the Citi Travel with Booking.com portal was $1,228, before factoring in any card benefits or points. The price for the same room and dates directly with the Loews Sapphire Falls Resort was $1,266.09 — $38.09 more expensive.

Once you are logged in, click on the Car tab to start booking a car through the Citi Travel with Booking.com portal

If you have searched for a rental car using an online travel agency before, you will notice that the layout is quite similar.

- Same drop-off

- Different drop-off (if applicable)

- Pickup city or airport

- Drop-off city or airport (if applicable)

- Driver’s age

- Pick-up date

- Drop-off date

- Pickup time

- Drop-off time

Once you have started a search, the results will be displayed and you will have some additional options to filter through the rental car inventory.

Currently, you can filter rental car results by:

- Vehicle type

- Rental agency

- Cancellation fee

- Price per day

By default, the results are sorted by price — lowest price first.

Additionally, you can see the results on a map, which can be helpful if you are picking up somewhere besides an airport.

Once you have found a price that works for you, select the car to proceed with the booking.

After adding the driver information, you can now use as many (or as few) Citi ThankYou Points as you would like to cover the cost of your rental car.

After confirming all of the information, simply click on Confirm Purchase and your confirmation will be emailed to you. The cancellation policy will vary based on the car and rate you selected.

As a reminder, rental car company-specific credits and benefits will not be available when booking through a third-party travel agency.

Rental car rates are constantly fluctuating, so booking a car with a generous cancellation policy is a good idea in case you find a better price later on.

Comparing prices for this guide was an excellent example of that. In our sample search, Expedia had the same car class from SIXT, but for $22 more for the week. However, Expedia also had several rental car companies that Citi didn’t, many of which were cheaper.

But the good news is, renting via the Citi Travel with Booking.com portal was cheaper than booking directly with SIXT, which was the same price as Expedia, plus you can use points.

One thing to note was the lack of other well-known rental agency options. For example, in Miami, there were many companies that we had never heard of, and the portal was missing big names like Hertz and National. Meanwhile, in Boston, there was only 1 option: Payless. Definitely do your research and don’t rely solely on the Citi search results.

Bottom Line: It is always a good idea to compare OTAs as well as directly with the rental car company when searching for a car. See our guide on finding the best websites for finding cheap car rentals for more tips!

Booking an attraction (think: theme parks) is an awesome feature of the updated Citi Travel with Booking.com portal.

Once you log in, click on the Attractions tab to start the booking process via the portal.

To start, simply type in the city you would like to visit and click Search .

Once the attractions have been populated, you can filter them by:

You can also sort by:

- Lowest price first

- Highest rating first

Once you have found an activity that you like, click on it to bring up more details.

Click on See Options to search for availability and additional ticket options.

If there is availability for your request, click the blue Choose button and then add the number of travelers in your party.

You can now use as many or as few Citi ThankYou Points as you would like to cover the cost of the attraction. If you are short on points, don’t worry, you can add the difference to your Citi card.

After confirming the trip information, simply click Confirm Purchase and your ticket will be emailed to you. As a quick note, many attractions are nonrefundable.

Comparing prices on local activities can be difficult because many of them are run by individuals or small companies who may not be on all booking sites.

However, for this example, we chose a 1 day Park-2-Park ticket for Universal Orlando, which sells directly from UniversalOrlando.com for $217.26.

Booking via the Citi Travel with Booking.com portal would be $15 more expensive, per person. That may not be a big deal if you are planning on using your ThankYou Points, but it is something to consider.

Booking a cruise with Citi ThankYou Points was never an easy task, and with the rollout of the new Citi Travel with Booking.com portal, it appears that Citi has decided to move away from that category.

You can still find the occasional river cruise or local boat tour via the attractions search, but weeklong trips to the islands, for instance, are not available at the moment.

Bottom Line: If you are looking to book a cruise, we can show you the best websites to book cruises at the cheapest prices .

Overall, the refreshed Citi Travel with Booking.com portal is a convenient, easy-to-use, and valuable travel tool for those who don’t like to deal with transferring points to partners.

Redeeming Citi ThankYou Points at a rate of 1 cent per point won’t get you the greatest redemptions, but if you would otherwise not use the points, using them (or earning them) to book travel through the portal is a solid deal.

There are unique perks, like being able to use points at nonchain hotels, but there are drawbacks as well, like not receiving elite night credits and other loyalty perks at some of the chain hotels and rental car companies.

While the cruise section is nonexistent, the booking process for flights, hotels, and car rentals is easy and straightforward, and theme parks are now an option — which is always a plus in our book.

If you have some Citi ThankYou Points and are looking for an easy way to redeem them for some upcoming travel, the Citi Travel with Booking.com portal is just a few clicks away.

The information regarding the Citi Rewards+ ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Double Cash ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Custom Cash ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information for the Citi Prestige ® Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer. The information for the Citi ThankYou ® Preferred Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Strata Premier℠ Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Related Posts

![citi travel portal 2023 Skyscanner: How To Find Flights, Hotels & Car Rentals at the Best Prices [2024]](https://upgradedpoints.com/wp-content/uploads/2019/04/Skyscanner-on-phone.webp?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- American AAdvantage

- United MileagePlus

- Delta SkyMiles

- British Airways Executive Club

- Southwest Rapid Rewards

- JetBlue TrueBlue

- Alaska Mileage Plan

- Marriott Bonvoy

- Hilton Honors

- IHG One Rewards

- World of Hyatt

- Accor Live Limitless

- Radisson Rewards

- Amex Membership Rewards

- Chase Ultimate Rewards

- Citi ThankYou Rewards

- Capital One Rewards

- Brex Rewards

- Bank Rewards Cards

- Airline Cards

- Hotel Cards

- Business Cards

- Cashback Cards

- 0% APR & Balance Transfer Cards

- Best Cards for Everyday Spending

- Best Cards for Dining

- Best Cards for Groceries

- Best Cards for Gas

- Best Cards for Travel

- Best Cards for Purchase Protection

- Best Cards for Elite Status

- Best Cards for Lounge Access

- How a Signup Bonus Works

- Types of Card Benefits

- Credit Card Application Rules

- Managing Your Credit Score

- Meeting Spending Requirements

- Buy Points and Miles Promotions

- Types of Reward Points

- Airline Partners & Alliances

- Beginner’s Guide to Buying Points

- Which Flights Are Bookable With Miles

- Finding Award Availability

- Miles Needed for a Free Flight

- Track Your Points

- Mile Transfer Times

- Merchant Lookup Tool

- Reverse Merchant Lookup

- Credit Card Spend Analysis

- Transaction Analyzer

- Travel Trends

- Advertiser Disclosure

Everything You Need To Know About the Citi Travel℠ Portal

AwardWallet receives compensation from advertising partners for links on the blog. Terms Apply to the offers listed on this page. The opinions expressed here are our own and have not been reviewed, provided, or approved by any bank advertiser. Here's our complete list of Advertisers .

Being able to redeem my rewards in a variety of ways is one of my favorite aspects of collecting flexible points currencies like Citi ThankYou ® Points. I'll always argue that the best way to use ThankYou ® Points is by transferring them to Citi's 20 travel partners . But you also can use them to book several types of travel directly, including flights, hotel stays, rental cars, and activities. How? By using the Citi Travel SM portal.

Although you won't get the same value for your points that you could by transferring them to partner loyalty programs, the flexibility offered by the Citi Travel portal is excellent. It's also easy to use. We'll dig into all the details here, including a walkthrough of how to book various types of travel using the portal.

Page Contents

What Is the Citi Travel Portal?

Earning citi thankyou points, booking hotels, booking flights, basic economy, booking rental cars, booking activities and attractions, when it makes sense to book through the citi travel portal, when to avoid using the citi travel portal, final thoughts, what is the phone number for citi travel, do flights booked with thankyou points earn miles, who has access to the citi travel portal.

The Citi Travel portal — officially Citi Travel with Booking.com — is a one-stop-shop online travel portal that lets you book flights, hotel stays, rental cars, and activities. It's similar to the Chase Travel and Amex Travel portals, if you're familiar with those. You can book trips using an eligible Citi credit card, or you can redeem Citi ThankYou Points for your travel.

As of early 2023, Citi Travel is powered by third-party provider Booking.com and functions similar to Booking.com's online travel agency (OTA), although the user interface isn't quite the same. The options presented won't be exactly the same as what you will find with Chase Travel or other OTAs (e.g., Expedia). However, if you've navigated any of these before, finding your way around Citi Travel will be easy enough.

The only requirement to be able to use the Citi Travel portal is that you hold a card earning Citi ThankYou Points.

How Much Are ThankYou Points Worth Through Citi Travel?

Citi ThankYou points are worth 1 cent each when redeemed through the Citi Travel portal. This low value per point is one of the downsides of using Citi Travel. Unlike when you book through the Chase Travel portal , having a specific premium credit card will not get you any extra value for your points.

Contrast this with the average 2.06¢ per point that AwardWallet users get from their ThankYou Points. This is because our users overwhelmingly redeem their points by transferring them to Citi's transfer partners and redeeming them for premium travel with airlines and hotels. However, it can be a lot more work to get this sort of value out of your points.

If you value simple, straightforward redemption options — especially a one-stop-shop where you can potentially book all the travel you need — the Citi Travel portal is still worth using.

Citi offers a nice array of ways to earn ThankYou Points . If you're looking to boost your points balance, consider one of the cards below. The Citi Strata Premier℠ Card is a mainstay in my wallet. The Citi Double Cash ® Card is an excellent choice as well, as you earn 2% cash back on all purchases: 1% when you buy plus 1% as you pay. But these earnings come in the form of ThankYou Points, which you can use in several ways, including redemptions for travel that are worth more than using your earnings for cash back. Plus, the card doesn't charge an annual fee.

Other cards that provide access to the Citi Travel portal include:

- Citi Strata Premier℠ Card

- Citi Double Cash ® Card

- Citi Custom Cash ® Card

- Citi Rewards+ ® Card

- Citi ThankYou ® Preferred Card (no longer open to new applicants)

- Citi Prestige ® Card (no longer open to new applicants)

Related: Build a Winning Combo of Citi ThankYou Rewards Cards

How To Book Using the Citi Travel Portal

You'll need to log into Citi Travel using your normal Citi account credentials; you can access the login page here . If you have more than one ThankYou Point-earning card, the first thing you'll be asked to do is select which one you'd like to use to book travel. Select a card and click “Search for Travel” at the bottom of the page.

It is at this moment that I must comment on Citi's website functionality. While I generally don't have issues accessing my card accounts, successfully logging into my account and beginning a search through Citi Travel didn't always happen without a hitch. I'd often land on an error page. Know that if this happens to you, you're not alone. This is honestly the most frustrating aspect of using Citi Travel.

Assuming login and card selection are successful, you'll land at the main Citi Travel search page. Here, you can select whether to book hotels, rental cars, flights, or attractions. This landing page is similar to other travel portals and should look familiar.

Now, let's dive into how to search for hotels and other accommodations.

Booking hotels and other accommodations with Citi Travel is straightforward. Simply select “Hotels” on the main search page, and then enter your destination, dates, and the number of guests. You'll be presented with a list of accommodation options bookable through the travel portal.

It's important to note that you're not stuck with only hotels. In my searches, there were often bed and breakfasts, serviced apartments, and hostels. There are certainly not the vacation rental options you'd find with Airbnb, for example, but you'll find more than just hotels.

Below are the top results for a sample Citi Travel Portal hotel search for properties in New York City. If you've booked hotels with other OTAs, navigating the search should be pretty intuitive. The default sorting option is “Best Match,” which seems to prefer Hotel Collection properties (more on those below). You can see the price in both points and cash, top featured amenities, and the average guest rating. I did notice that the guest ratings for each property are not identical to those you'll see at Booking.com. It seems Citi Travel has its own ratings .

There are numerous filter options in the panel to the left of the results, including property type, neighborhood, star rating, guest rating, and room amenities. It's easy to change the sorting and filtering to find properties to your liking.

If you select a particular hotel, you can view photos and explore its features and amenities.

From here, you can scroll down to select a particular room. Since the Citi Travel Portal is powered by Booking.com, all available room types should show up. This gives you a lot more flexibility than booking with many hotel loyalty programs, where you're restricted to base-level rooms or must fork over additional points for an enhanced room or suite.

How does pricing compare to other booking channels?

When you initially search, you may notice that the cash prices displayed exclude taxes and fees but the points prices (often shown as a combo of points and cash) include taxes and fees. Unfortunately, to do a price comparison with other sites, you'll have to add the stay to your cart to see the final price after including taxes and fees.

It's important to note that you may not be provided the best price through Citi Travel. The first comparison I made was between Citi Travel and Booking.com, the site that powers the Citi Travel portal. One would think both sites would offer the same price, but that wasn't the case.

Here is Citi Travel's price for a stay at the Royalton New York, a random property I selected from the search results. Ignoring the current hotel savings offer, the four-night stay costs $1,810.19.

Through Booking.com, the cost is $1,590.62. Citi Travel is charging ~$220 more! This is for the same room type and a similar cancellation policy.

Here is a second example of price shopping among sites for a four-night stay at The Westin New York at Times Square:

- Citi Travel: $1,927.77

- Booking.com: $1,927.80

- Expedia.com: $1,522.95

In this case, the Citi Travel and Booking.com prices are nearly identical. But they are substantially more than Expedia's price. Make sure you compare the Citi Travel portal price against other sites. You might get a better deal elsewhere.

Hotel Collection benefits

As part of revamping the travel portal and switching its provider to Booking.com, Citi launched two hotel programs: Hotel Collection and Luxury Collection. Eligible Citi cardholders can enjoy exclusive savings and perks at these properties, including free breakfast for two, free Wi-Fi, and early check-in and late check-out, when available. With Luxury Collection bookings, guests are eligible for room upgrades at check-in, based on availability, and receive a $100 on-property credit for use during their stay.

Luxury Collection and Hotel Collection bookings are available only to those with the Citi Prestige Card or Citi Strata Premier . These programs are similar to other luxury hotel programs, such as American Express' Fine Hotels + Resorts and Chase's Luxury Hotel & Resort Collection.

Related: How To Receive Elite Hotel Benefits Without Elite Status

As you peruse the Citi Travel portal, you may notice that Hotel Collection and Luxury Collection properties usually get first billing in the list of results. Click on “See offers” to see the perks you can enjoy and the terms of each.

If you want to specifically filter for Hotel Collection or Luxury Collection properties, these are conveniently located at the top of the many filters in the left panel.

However, there's a catch: You have to book a specific rate to receive the Hotel Collection or Luxury Collection benefits. Sometimes, the premium simply isn't worth it for what you receive. Consider this rate difference for a stay at the Mondrian South Beach in Miami. An additional $195 plus taxes per night for Hotel Collection perks? There's no way that's worth it for early check-in and daily breakfast.

Will I get hotel elite status benefits booking through the Citi Travel portal?

If you book through the Citi Travel portal, you likely won't receive hotel elite benefits with major chain hotels. Bookings with Citi Travel are treated as third-party reservations, and most hotels don't honor elite benefits for these. This is a big downside compared to booking directly with a hotel. I often count on hotel elite status perks to add substantial value to my stay. Free breakfast for a family can add up to a lot of daily savings! Plus, you won't receive stay credit on these bookings, which means it won't help your progress toward qualifying for elite status.

There are plenty of hotels available in the Citi Travel portal that aren't associated with major chains, though. If you don't have loyalty to a particular chain, this loss of benefits isn't a worry. Booking hotels through Citi Travel also remains useful if you're specifically looking for properties outside what is offered by major chains (e.g., boutique bed and breakfasts) or if you're looking for hotels in an area devoid of major chains.

Using the Citi Strata Premier‘s $100 annual hotel perk

If you have the Citi Strata Premier , make sure you select that card on the landing page before starting your hotel search. This will automatically apply the annual hotel savings benefit — $100 off a booking of $500 or more, excluding taxes and fees — offered by the card. You can use this benefit once per year and must book through Citi Travel to enjoy this credit.

Using the Prestige Card‘s fourth-night free benefit

Those who still hold the Prestige Card (which isn't available to new applicants) get a fourth night free on hotel bookings, available twice each year when booking through Citi Travel. If you have this card, ensure you select it on the first page before beginning your searches; otherwise, you won't enjoy this benefit.

Now that we've covered how to book lodging, let's move on to booking flights through Citi Travel. You can use the portal to book flights similar to how you'd use any other OTA. To search for a flight, simply select the “Flights” option on the search screen and key in your origin, destination, whether you want one-way or round-trip travel, flight date(s), number of passengers, and cabin class. You also can select whether you want “Direct only,” which will eliminate flight options with connections.

Citi Travel will present a list of flight options based on your search criteria. At this point, you can sort and filter in various ways. The default sorting is “Best Overall,” which is somewhat subjective but typically includes a shorter travel time with fewer connections. You can filter by carrier, departure or arrival time, number of stops, and price, among other options.

Flight availability

You can book most flights on major domestic and international carriers using the Citi Travel portal. You'll have more options at your fingertips when searching for flights through Citi Travel rather than restricting yourself to using award miles. Mixed-carrier itineraries that normally aren't available using award miles are sometimes an option with Citi Travel.

It's important to note, however, that there are some low-cost carriers that can't be booked in the portal. Some are available with a phone call, while others aren't available at all. Here's a look at low-cost carriers you can and cannot book with Citi Travel:

- Book online: Flybe, JetBlue, and WestJet

- Book via phone: Air Asia, GOL, Pegasus, Southwest

- Cannot book at all: Spirit, Frontier, Sun Country

To book over the phone, contact the ThankYou Service Center at 833-737-1288 .

Related: Can You Book Low-Cost Carriers with Amex, Capital One, Chase, or Citi Points?

Flight pricing

Flight pricing should be similar and competitive to what you find when booking directly with airlines, barring the use of any discount codes or other promotions currently available. Pricing should mirror other OTAs, as well. You'll sometimes see a bigger variation with international carriers than with U.S. airlines. Remember that you'll get 1 cent per ThankYou Point when using points to book flights. Therefore, a $200 ticket will cost 20,000 ThankYou Points.

You'll get the biggest bang for your buck booking economy flights with Citi ThankYou Points. This is because the redemption value you get from economy award flights (booked via the airlines' loyalty programs) is often less than what you can get out of business-class awards — but not always. It pays to check for award flights to see if there are any Citi ThankYou transfer partners you can use to book the flight you want.

Related: The Best Citi ThankYou Point Sweet Spots for Flights in North America

Do flights booked with ThankYou Points earn miles?

Yes. Unlike an award ticket, when you book a ticket through Citi Travel using ThankYou Points, your ticket will earn miles based on the carrier's earning methodology. This is because you're actually booking a cash ticket and then redeeming your ThankYou Points at 1 cent each to cover the cost. Make sure you enter your frequent flyer number to earn miles on any tickets booked.

You also should consider the fact that you earn award miles when comparing the cost of an award ticket to that of a ticket booked through Citi Travel. This may affect which booking method you choose. If you're chasing elite status, this is something else to factor in, as well. Paid tickets can earn elite miles, segments, qualifying dollars, and/or points that help you qualify for status. Award tickets typically don't.

Example economy flight comparison: Citi Travel portal vs. transfer partner

Consider this itinerary from San Francisco (SFO) to Newark (EWR). It is available for $163.90 cash or 16,390 Citi ThankYou Points when booked in the Citi Travel portal.

You can book this as an award using Avianca LifeMiles — one of the Citi ThankYou transfer partners. At first glance, paying 13,500 LifeMiles seems like the better deal. However, make sure you consider the taxes and fees, plus any miles earned by your ticket. LifeMiles charges a redemption fee, so the total cost of the flight would be 13,500 Citi ThankYou Points (transferred to LifeMIiles) plus $30.60. Now it's close to a wash.

Doing a little digging, this cash fare would be a United Airlines K-class ticket. Crediting this ticket to LifeMiles, you'd earn 1,282 miles. You'd give these up if you booked an award ticket. Now the math clearly shows that booking through the Citi Travel portal is the better option.

Related: Citi's No Annual Fee Cards and the Strategy Behind How to Get Them

Be careful: Citi will present Basic Economy flight options for some carriers. These are clearly labeled, however, so it should be easy to avoid them. If you're looking at a Basic Economy itinerary, it'll clearly say so. However, you'll need to know each carrier's name for their Basic Economy equivalent. No matter what it's called, it'll be displayed within a rectangle above the carrier name.

One gripe I have with Citi Travel is that Basic Economy cannot be filtered out of the search . This is problematic. At times, I'd like to eliminate all Basic Economy flights from the results to compare the cheapest economy fares that are not Basic. Instead, you have to select a flight, and then choose a different fare class on the booking screen. If you're wondering why all your options are Basic Economy, this is the reason. Don't worry: You still can book a normal economy fare. You just need to do so after selecting a flight option.

Like searching for hotels and flights, searching for rental cars in the Citi Travel portal is straightforward. Enter your pick-up and drop-off location(s), the dates and times of both, the driver's age, and you're off and running. One of the nicest aspects of the rental car search — unlike searching for hotels — is that the total price is displayed up front.

You can filter the search results by vehicle type, rental agency, and whether free cancellation is offered. I like that the initial search is sorted by the lowest price first. You also can see whether the reservation offers free cancellation or is non-refundable.

Here are a few things to be aware of when renting a car through Citi Travel:

- Primary auto rental collision damage waiver: Many premium credit cards offer rental car coverage that covers your rental car in the event of a collision. However, Citi's own credit cards do not offer this. This means that rentals made through the Citi Travel portal will never be covered — a major downside — unless you purchase this additional coverage.

- Rental agency “skip the counter” programs: Some rental agencies, such as National and Hertz, offer “skip the counter” programs where you can go straight to the lot to pick out a car. If you rent through Citi Travel, you may not receive these benefits. I can attest that I have received my elite status benefits on many third-party bookings, however, so you may be fine. You may need to contact the rental agency after making a booking and get them to add your loyalty number manually.

- Use of discount codes: If you book through Citi Travel, you won't be able to apply corporate (or any other) discount codes to reduce the cost of your rental.

Attractions are the final category of travel you can book through Citi Travel. There is a multitude of options to pick from, including tours, transportation, events, food experiences, outdoor experiences, cultural experiences, and more. What you can find through Citi Travel is what you would expect to find through an OTA like Expedia or Orbitz — or through a site like Tripadvisor or Viator.

To search for attractions, simply start typing a city name into the search bar. If you type in a country name (or the name of a U.S. state), you'll be prompted with a list of cities to choose from. Once you search for a particular location, you can filter the results by price, star rating, and/or duration. You also can sort by price and popularity. Attractions are also grouped into categories, and you can filter the results by selecting each in the top ribbon.

Attractions is the one type of travel where it seems Citi Travel has a slight edge over making reservations through Booking.com. You'd expect the two sites to have exactly the same price for the same experience. However, I found that Citi Travel was often 3%–5% cheaper than Booking.com. Not huge savings, but certainly something to note. As with everything else in the Citi Travel portal, your ThankYou Points are worth 1 cent each when redeemed for attractions.

Not all locations will have attractions available to book. I tried to enter the towns in my rural area, and none of them showed up in the options. That being said, you should be able to find something in the vast majority of major cities, plus some other areas. It's worth noting that you won't find Disney park tickets in the portal, unfortunately.

Related: Tips for Saving Money at Disney World With Points and Miles

Is It Worth Using the Citi Travel Portal?

This is the big question. With ThankYou Points worth only 1 cent each when redeemed through Citi Travel, it isn't generally worth redeeming them through the portal. Unlike Chase Ultimate Rewards, where you can get 1.25 to 1.5 cents per point — which is more comparable to their value when transferred to loyalty partners — Citi doesn't offer any bonus value. Given that AwardWallet users redeem ThankYou Points for an average of 2.06¢ each when using transfer partners, we recommend that you use them this way.

That being said, there are times when booking through Citi Travel will get you more value than transferring your points. This is most common with economy airfare.

If you're also trying to save money and would rather spend reward points than cash for travel where transfer partners aren't an option, this is another time when using the Citi Travel portal will be worth it. The same goes for those who want to book all their travel in one place. It takes time to understand the ins and outs of loyalty programs; for some, the simplicity Citi Travel provides is a major selling point.

Finally, you always can use the Citi Travel portal to book paid travel. There are some clear reasons to do so. Being able to take advantage of the Citi Strata Premier‘s annual $100 off $500 hotel booking benefit is one of them. Don't write off the Citi Travel portal entirely. It's a great option to have in certain situations.

Using the Citi Travel Portal is generally a good idea:

- When you don't want to worry about travel blackout dates or availability for award travel.

- If you prioritize simplicity and would rather book all your travel in one place.

- When booking an award flight would yield a similar value per point; remember that flights booked through the Citi Travel Portal are revenue fares that earn miles!

- When you can take advantage of certain benefits (e.g., Citi Strata Premier Card annual hotel benefit) or bonus earning promotions.

- If you want to use ThankYou Points to book attractions.

These are the times you'll want to avoid using the Citi Travel portal:

- When booking premium cabin flights, as you'll nearly always do better booking these using award miles from transfer partners.

- When it costs fewer points to transfer them to a loyalty partner and book your travel that way.

- For booking hotels where you want to receive elite benefits.

- When you want travel flexibility; award travel usually has better change and cancellation policies than paid travel.

- For any car rentals; these aren't covered by a primary auto rental collision damage waiver through Citi.

Whether you see the Citi Travel portal as a key tool in planning your travel and redeeming your points or view it as a low-value option you don't care for, it's at least an option to have in your back pocket. The biggest upside I see for some travelers is being able to book your entire trip using one tool. There's also the perk of using points to pay for things where transfer partners aren't an option, such as guided tours or attraction tickets.

Personally, I won't get much value out of the Citi Travel portal. If I'm trying to limit the amount of cash I'm spending on a trip, I may consider using it to book attractions. The low 1-cent-per-point value, though, is a huge turn-off — almost too much for me to stomach. I try to get over 2 cents per ThankYou Point through partners like LifeMiles , Flying Blue , and Turkish Airlines Miles & Smiles .

You can call Citi Travel at 1-833-737-1288.

Yes. Flights booked through Citi Travel are revenue fares, so they will earn award miles. Citi just lets you redeem your ThankYou Points to cover the cost.

Anyone with a credit card earning ThankYou Points has access. However, cards issued by Citi that earn other rewards, such as American Airlines miles, don't provide access to the portal for booking travel.

The comments on this page are not provided, reviewed, or otherwise approved by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Click here to cancel reply.

Notify me of followup comments via e-mail Notify me of followup posts via e-mail

Can the 4th night free combine with the $100 credit for Citi Prestige? Thanks!

Unfortunately, you can’t combine the Prestige and Premier credits because you have to use a single payment method at checkout.

Introduction to the Citi Travel Portal

Accessing the citi travel portal, citi credit cards that earn thankyou points, what to know about the citi travel portal, citi travel portal: your guide to booking and rewards.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Citi Strata Premier℠ Card, Citi Prestige® Card, Citi Custom Cash℠ Card, Citi® Double Cash Card, Citi Rewards+® Card. The details for these products have not been reviewed or provided by the issuer.

- If you have a Citi credit card that earns ThankYou points, you can book your travel with them.

- The Citi Travel Portal is like an online travel agency, allowing you to make bookings with ease.

- You can pay with points (worth 1 cent each), your Citi credit card, or a combination of both.

Citi ThankYou Rewards is a flexible points program that allows you to earn points from eligible Citi credit cards and banking products. You can redeem points in a number of ways, including for travel, cash back, or gift cards.

One of the best ways to use points is for travel, either by transferring Citi ThankYou points to airline partners for award flights (only available with certain Citi credit cards), or through an even easier option available to all program members — the Citi Travel portal.

Citi Travel recently got a big overhaul, and it's now partnered with Booking.com and powered by Rocket Travel by Agoda technology. Here's what to know about the new Citi Travel portal and what to expect if you decide to book.

Overview of the Portal

The Citi Travel Portal is an online travel booking platform that works in a similar way to Online Travel Agencies (OTAs) like Orbitz or Expedia. You can search for flights, hotels, rental cars, and attractions based on your destination, travel dates, and other preferences, and you have the option to pay with Citi ThankYou points, your Citi card, or a combination of both.

Benefits of Booking Through the Portal

Although Citi Travel doesn't get as much attention as American Express Travel or the Chase Ultimate Rewards® Travel Portal , it has many of the same benefits:

- You can book travel with no blackout dates

- There's no need to worry about loyalty program award charts or availability

- Your points are worth a flat 1 cent each toward travel, and you can combine them with cash if you don't have enough for a booking

- You'll still earn airline miles and elite-qualifying miles when you book flights, even when you pay entirely with points

- It's possible to pool Citi points from different credit cards (or even share with friends and family who have Citi ThankYou accounts)

A downside to using the Citi Travel Portal is you won't earn points or elite status credit for hotel stays, and you might not have your elite status recognized because it's considered a third-party booking.

If you're looking for the easiest way to cash in Citi points for travel, the Citi ThankYou Travel Portal is a better choice for most people. That said, it's possible to get more than 1 cent per point in value if you skip the Citi Portal and instead transfer your points at a 1:1 ratio to an airline or hotel partner for award travel — but that involves more legwork.

The full range of partners is available if you have the Citi Strata Premier℠ Card or Citi Prestige® Card (no longer available to new applicants). Otherwise, JetBlue, Choice, and Wyndham are the only airline and hotel options, with a reduced transfer ratio.

How to Log In

To access the Citi Travel Portal, you must be a Citi customer with a ThankYou rewards account. Once you sign in to your Citi account online and click the "View/Redeem" button in the rewards section, you'll land on a screen with several redemption options. Click "Book Travel" in the lower left-hand corner.

Alternatively, you can get to the same screen by signing in with your Citi login details at ThankYou.com .

Once you click "Book Travel," you'll be prompted to select the Citi card account you want to book with if you have multiple Citi cards. Then you'll land on the main Citi Travel search screen.

How to Book Flights with Citi Travel

To search for flights, click the "Flights" tab and enter your departure and destination airport and dates of travel. You'll also have options to select round-trip or one-way flights, class of service, number of passengers, and if you prefer non-stop flights. Then hit "Search."

Next, you'll see a list of flight search results — starting with your outbound flight — which you can sort by price, number of stops, departure time, arrival time, duration, or "best overall" (cheap, short flights). On the left sidebar, there are also filters for the departure and arrival times, airline, number of stops, price range, and total journey duration. To choose a flight, click on the "Select" button, then repeat the process for your return leg if you've searched for a round-trip itinerary.

Once you've selected your flights, you'll be prompted to enter passenger details and will be given options to upgrade your fare (most folks will skip this step). Then, on the final booking screen, you'll have the opportunity to select your payment method — either using your Citi card, ThankYou points, or a combination of both.

How to Book Hotels with Citi Travel

The process of finding a hotel to book through the Citi Travel portal is similar to searching for flights. After selecting the "Hotels" option from the main menu, enter your destination, stay dates, and the number of guests in the search fields.

The results page allows you to sort by property class, price, distance, hotel name, and recommended results. You can filter by price, class, TripAdvisor rating, amenities, nearby landmarks, and even hotels offering deals. One useful feature is the ability to quickly identify properties that have discounted rates by looking for the "Sale" flag in the corner of the hotel listing.

To find out more about the hotel you're interested in, click on the hotel name and you'll be shown different bed options, rate types with cancellation policies, and available packages (breakfast included, for instance) if applicable. Select "Check out" next to the room you want to book. You'll then be asked for guest details (name, address, phone number, and email).

Once you've entered your information, you'll come to the final booking screen where, again, you can choose your method of payment.

How to Rent a Car with Citi Travel

Searching for a car rental through Citi Travel is similarly easy. Once you've clicked "Cars" on the main menu, enter your pick-up location (you can select a different drop-off location if needed), rental dates and times, and the driver's age.

The results list allows you to sort by price, rental company, or car type.

Once you find a car you like, click on its listing to learn more about the rental and enter the driver's name and details.

On the final booking screen, you'll choose your method of payment — again, your Citi card, ThankYou points, or a combination of both.

How to Book Attractions Through Citi Travel

Select the "Attractions" tab on the main search page, and enter the city name where you want to search.

Depending on the destination, you'll get a list of all kinds of activities — from tours and sightseeing tickets to airport transfers and excursions.

When you click on the attraction, you'll get more details about what's included in the activity.

Click "See options" to choose your activity dates, times, and the number of participants.

Once you select "Choose" you'll have the opportunity to enter your traveler details. Then, you'll be brought to the final booking screen where you can select your payment method.

Before you choose between booking through the Citi Portal or transferring points to a partner for an award flight, be sure to compare the number of points required in each case — and verify that an award flight is actually available before you decide on that route.

Earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals and attractions booked through CitiTravel.com. Earn 3X points per $1 on air travel and other hotel purchases, at restaurants, supermarkets, gas stations and EV charging stations. Earn 1X point per $1 on all other purchases.

21.24% - 29.24% variable

Earn 75,000 bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earn 3x points on most travel, restaurants, gas/EV charging, and supermarkets

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earn 10x points on hotels, rental cars, and attractions booked via Citi Travel

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. $100 annual hotel credit on a single stay of $500 or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No foreign transaction fees

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay/interruption benefits and lost/damaged baggage coverage

- con icon Two crossed lines that form an 'X'. Has an annual fee

- con icon Two crossed lines that form an 'X'. Citi Travel rates often are higher than retail cost of travel

Citi offers several different cards that earn Citi ThankYou points:

- Citi Strata Premier℠ Card: Earn 75,000 bonus points after spending $4,000 in the first three months of account opening

- Citi Custom Cash℠ Card : Earn $200 cash back, fulfilled as 20,000 ThankYou® Points, after you spend $1,500 on purchases in the first six months of account opening

- Citi® Double Cash Card

- Citi Rewards+® Card : Earn 20,000 bonus points after spending $1,500 in the first three months of account opening

- Citi Prestige® Card: No longer available to new applicants

If you have the Citi Strata Premier℠ Card, there's an additional incentive to book through the Citi ThankYou portal. Once per calendar year, cardholders can get $100 off a hotel stay of $500 or more (before taxes and fees) when they book through the Citi portal — whether the stay is booked with points, charged to the Citi Strata Premier℠ Card, or a combination of both.

The Citi Travel Portal is a terrific tool if you're looking for a way to redeem points for flights, hotels, car rentals, and attractions without worrying about blackout dates or fussing with loyalty program award charts. You'll even earn frequent flyer miles and elite credits for flight bookings (but you won't earn hotel points or elite nights on hotel stays, because it's a third-party booking).

Anyone with an eligible Citi ThankYou credit card can redeem their points through the portal at a rate of 1 cent each. Or, if you don't have enough points to cover the entire booking, you can pay with your Citi card in combination with rewards to make up the difference.

Even though using the Citi Travel Portal is easy and convenient, it is usually possible to get more value from your Citi ThankYou points by transferring them to Citi's airline and hotel partners. This method requires jumping through more hoops and searching for award availability, so if you'd rather avoid that inconvenience, the Citi Travel Portal is an ideal booking method.

Citi cardholders can access the travel portal by logging into their online account and navigating to the travel section or directly through the Citi Travel website.

Yes, you can use your Citi points to book flights, hotels, car rentals, and more through the portal. Points can cover all or part of the booking cost.

Typically, bookings made through the portal using your Citi card will earn points according to your card's rewards program.

The portal does not usually charge additional booking fees, but it's always best to review the terms and conditions for any specific charges that may apply.

Yes, you can cancel or modify bookings, but the ability to do so without penalty depends on the specific terms of your booking. Always check the cancellation policy at the time of booking.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to the Citi ThankYou Travel Portal

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use the Citi ThankYou travel portal?

The baseline value of citi thankyou points, how to book travel in the citi thankyou rewards travel portal, benefits of booking in the citi thankyou travel portal, what else you need to know about citi travel portal, how good is the citi travel portal.

Citi has rolled out big changes to its online travel portal that will have a sizable impact on how its credit cardholders search and book travel — whether they’re paying for a trip or redeeming points.

In March 2023, Citi launched its revamped booking platform, officially called Citi Travel with Booking.com. Certain cardholders can book everything from flights and hotels to rental cars and experiences through the portal.

The booking website now offers some 1.4 million hotel options worldwide, including a growing list of properties in Citi’s two new hotel portfolios: the Hotel Collection and Luxury Collection. Bookings in these collections come with special perks such as property credit, free breakfast and more.

The changes give members more options to use Citi ThankYou points. In addition to redeeming ThankYou points for travel, members can also redeem points for cash back or transfer them to airline or hotel partners. In fact, members sometimes extract a higher value from their points by transferring them.

However, applying them toward travel in the Citi’s online travel portal can be a compelling option, particularly given some of the perks available at the platform’s two hotel collections and the current promotion: Now through Dec. 31, 2025, Citi Rewards+® Card cardholders can earn a total of 5x ThankYou Points on hotel, car rentals and attractions booked on CitiTravel.com through Dec. 31, 2025.

In this guide, we’ll go over which cards that members can use the Citi ThankYou travel portal, what the points are worth and when redeeming points through the Citi Travel portal can make sense.

Most cards that earn Citi ThankYou Points offer members access to the Citi Travel portal, including:

AT&T Access Card from Citi (not open to new applications).

AT&T Access More Card from Citi (not open to new applications).

Citi Custom Cash® Card .

Citi Strata Premier℠ Card .

Citi Prestige® Card (not open to new applications).

Citi Rewards+® Card .

Citi Double Cash® Card .

The portal offers cardholders perks like same-day booking opportunities, a 24-hour cancellation window for full refunds and flexible payment options.

Cardholders can redeem Citi ThankYou points between 1 cent to 1.25 cents through the Citi Travel portal or when redeemed for cash back. So, 1 cent per point should be your baseline redemption rate when deciding whether you should transfer points to one of Citi's airline or hotel partners .

If the booking you are considering gives you less than a 1-cent-per-point redemption rate, consider getting cash back instead. Then, pay for that same booking in cash. This may be more optimal than redeeming your ThankYou points at a lower rate.

» Learn more: Plan your next redemption with our credit card points tool

1. Log into your Citi account

One of the benefits of Citi’s new travel portal is that you can book a trip and manage your credit card account with just a single login. Eligible ThankYou members can access the new travel portal directly .

You can redeem Citi ThankYou Points at a rate of 1 cent to 1.25 cents toward the following travel purchases: flights, hotel rooms, car rentals and activities. The Citi Travel portal is powered by Booking.com and Rocket Travel by Agoda, and works like the online travel agencies you’ve likely used before.

» Learn more: How to earn miles through online travel agencies

2. Search your travel dates and destinations

Let’s say you want to book a flight. Select the “Flights” tab and begin your search. Select your trip type (round trip, one way or multicity), and enter the number of passengers and preferred class of service. Input your departure and destination cities and travel dates. Check the nonstop box if necessary and select “Search.”

Review your flight options on the following page. To further filter the search results, you can sort by price, travel duration, as well as departure and arrival time. You can also filter results by the number of stops and operating airlines.

3. Choose to pay with cash, points or a combination of both

Once you select the fare, you’ll have the option to select a payment method: using ThankYou Points or a Citi credit card. If you choose to redeem points, you can either pay in full or redeem for a partial payment.

Here’s an example of a flight booking through the portal: a flight from Salt Lake City to Denver aboard Delta Air Lines. You can see, it’s available for $113.90 or 11,390 ThankYou points — a 1 cent-per-point rate.

You can also type in the number of points you want to apply toward the cost of the flight, select “Apply” and pay attention to the payment summary. If the points cover only part of the fare, use your credit card to pay the remaining amount. Then, enter passenger information and complete your booking.

Follow the same process online to make reservations for hotel rooms, car rentals and activities.

» Learn more: The best travel credit cards you might not have

Historically, transferring ThankYou points to one of Citi’s partners, like airlines or hotel loyalty programs, sometimes results in a higher value for your rewards (in that they are likely to be worth more than 1 cent apiece). In a recent NerdWallet analysis , we value Citi ThankYou points between 1 cent to 1.3 cents per point. However, there are a few reasons you might consider booking travel through the ThankYou Travel portal instead.

Book flights on the dates you want

Let’s get real for a moment: Award travel is great when everything goes according to plan. But what if you want to travel on specific dates and can’t find available seats using miles with a specific airline? In that case, you have to be flexible and pick less convenient travel dates or times.

You can reserve any open seat on a plane by booking your flight through the Citi ThankYou Rewards travel portal because there are no blackout dates.

You might use slightly more points at a fixed redemption rate of 1 cent to 1.25 cents per point, but at least you can fly on your preferred dates. This option works best with inexpensive economy flights.

Book non-chain hotels with points

When you participate in hotel loyalty programs , you end up staying at chains. But what if you want to book that bewitching beachfront bed-and-breakfast and still take advantage of credit card rewards? Well, the good news is if it shows up in the portal search results, you can redeem points to reserve it.

In the Citi Travel portal, hotel reward bookings aren’t limited to chain hotels, which means you can book all kinds of properties outside of popular brands. This benefit is all the more noteworthy now that Citi has bolstered its property offerings through its Booking.com partnership.

Keep money in your pocket

If you’ve amassed a large collection of Citi ThankYou points, you might have more points than you know what to do with. And now that you’re ready to book a trip, you want to make use of your points instead of spending cash — essentially avoiding paying out of pocket for the same expense.

Though you’ll get a redemption rate of 1 cent to 1.25 cents per point, your trip will be paid for entirely with points. This can be a smart money move for the right situation.

Citi Hotel Collection and Luxury Collection

Perhaps the most significant change unveiled as part of the revamped Citi Travel with Booking.com portal is the addition of two hotel portfolios, at which eligible cardholders can enjoy added perks, not to mention, savings in some cases.

Citi is in the process of rolling out its new Hotel Collection and Luxury Collection — both bookable through its new platform. This may sound like a familiar concept. It’s similar to what other major credit card companies have offered through their travel portals, such as American Express Travel’s Hotel Collection and Fine Hotels and Resorts.