Best Travel Insurance in the Philippines

Traveling is an adventure filled with excitement and unpredictability. While we often focus on the itineraries and experiences, it’s crucial not to overlook one essential aspect: travel insurance. In the ever-changing landscape of global travel, especially in the context of COVID-19, securing the right travel insurance has become more important than ever. This guide will walk you through the best travel insurance options in the Philippines, helping you make an informed choice for a worry-free journey.

Table of Contents

Top Travel Insurance Options in the Philippines

1. oona travel insurance.

When it comes to comprehensive coverage at competitive prices, OONA Travel Insurance stands out. Offering up to ₱5 million in coverage for medical, hospitalization, and travel inconveniences, OONA ensures that you and your family are well-protected. With premiums starting at just ₱330, it provides an affordable yet extensive safety net.

Key Benefits:

- Up to ₱5 million coverage for medical emergencies abroad.

- 24/7 worldwide protection and assistance services.

- Cashless medical assistance, akin to HMOs.

- Coverage for COVID-19-related medical treatment for both domestic and international trips.

2. PGAI Travel Shield Insurance

PGAI Travel Shield Insurance offers tailored coverage options for international travel, with a focus on medical and emergency expenses. With up to ₱2.5 million coverage and premiums starting at ₱361, it’s an excellent choice for those seeking robust protection.

Highlights of PGAI Travel Shield Insurance:

- 24-hour Worldwide Assistance with the ability to call collect for support.

- Cashless claim settlements up to the policy limit.

- Inclusion of COVID-19 in the Medical Necessary Expenses Benefit.

- Emergency Medical Evacuation and Repatriation Benefits.

3. PGA SOMPO TravelJOY Plus

PGA SOMPO’s TravelJOY Plus is designed for the happy traveler who prioritizes safety. It offers up to ₱2.5 million in medical expenses coverage, with premiums starting at ₱463. This plan stands out for its inclusivity, covering individuals from infants to seniors up to 85 years old (99 for Schengen Visa Countries).

Notable Features:

- 24/7 hotline assistance and mobile support.

- Cashless benefits for emergency treatments or hospitalizations.

- Special cruise coverage.

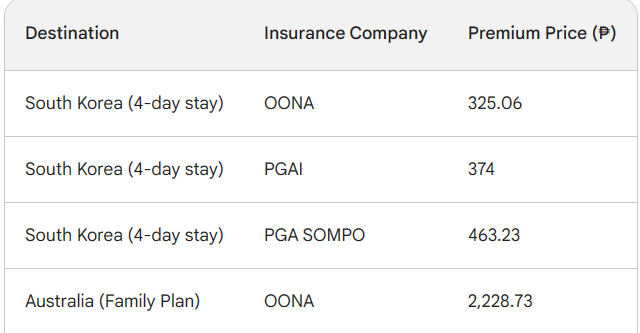

Comparing Travel Insurance Premiums for Popular Destinations

When planning an international trip, one of the key considerations is the cost of travel insurance, which can vary significantly depending on your destination. This section provides a comparative analysis of travel insurance premiums for some popular destinations among Filipino travelers, helping you make a budget-conscious decision.

For example, a short 4-day trip to South Korea can see varying insurance costs. With OONA Travel Insurance, the premium is approximately ₱325.06, offering substantial coverage. In contrast, PGAI Travel Shield Insurance sets their premium a bit higher at ₱374, with PGA SOMPO TravelJOY Plus coming in at ₱463.23. This variation in pricing is reflective of the different coverage options and benefits each company offers.

You may check out a sample price comparison per destination here:

Moving to a different region, let’s consider Australia – a favorite destination for many. For a family plan, which generally provides coverage for two adults and children, the premiums can be more substantial due to the broader coverage required. OONA’s premium for such a plan in Australia is about ₱2,228.73. This increase in premium cost reflects the added risk and extended coverage necessary for family travel.

When comparing these premiums, consider the nature of your trip and the specific needs of your travel party. A solo traveler on a short trip may find a basic plan sufficient, while families or those engaging in adventure activities may require more comprehensive coverage. Additionally, some destinations may have higher medical costs or greater risks, which can be reflected in the insurance premium.

Remember, the peace of mind and security travel insurance provides can be invaluable, especially in unfamiliar destinations or in case of unexpected events. So, while considering the costs, also weigh the benefits and coverage each plan offers to ensure a worry-free and protected travel experience.

Why You Need Travel Insurance

The unpredictability of travel makes insurance a necessity. From delayed flights and natural disasters to medical emergencies, travel insurance provides a safety net. It covers lost passports, baggage issues, trip cancellations, accidents, and even death. Particularly with the prevalence of COVID-19, insurance acts as a crucial buffer, offering peace of mind and financial protection.

Travel insurance isn’t just about addressing the unexpected; it’s about ensuring a worry-free experience. Here are the most common types of coverage:

- Personal Accident Benefits : This covers death and burial expenses if the insured suffers a fatal accident or permanent disability during the trip.

- Travel Inconvenience Benefits : Compensates for expenses due to delays, cancellations, and other travel inconveniences.

- Medical & Hospitalization Benefits : Crucial for hospital stays and medical care abroad.

- Personal Liability Benefits : Reimburses for loss of personal items like baggage and documents.

Each of these coverages ensures that the financial burdens of unforeseen events are minimized, allowing you to focus on recovery or resolution.

Customizing Your Travel Insurance

Travel insurance can be tailored to fit your trip’s needs, whether it’s a once-in-a-year vacation or frequent international travel.

For Trip Frequency:

- Single trip policies are ideal for occasional travelers.

- Multi-trip policies suit those who travel several times a year.

- Annual trip insurance is perfect for regular jetsetters, offering 365 days of coverage.

For Individuals Covered:

- Single policies cater to solo travelers.

- Family plans are designed for families, including members below 18 years.

- Group plans offer convenient options for large groups, often with discount rates.

Choosing the right policy depends on how often you travel, who you travel with, and what kind of coverage you need.

Special Considerations for Schengen Travel

For those planning a trip to Europe , Schengen-compliant travel insurance is a must. Not only is it a requirement for a Schengen Visa, but it also needs to cover the entire duration of stay with a minimum coverage of €30,000 for medical emergencies and repatriation. Filipino companies like OONA, Standard, and Malayan offer such policies, ensuring you meet visa requirements while being adequately protected.

Payment Methods and Ease of Access

The digital era has simplified the process of buying and managing travel insurance. You can pay premiums through various methods, including:

- Debit or credit cards.

- Auto-debit arrangements.

- Online banking websites and apps.

- Over-the-counter at banks and payment centers.

- Post-dated checks.

These options offer flexibility and convenience, allowing you to manage your travel insurance from anywhere in the world.

Filing Insurance Claims: A Step-by-Step Guide

In case of an emergency or issue during your trip, it’s important to know how to file a claim:

- Contact your insurer immediately when an incident occurs.

- Gather proof such as police or medical reports, receipts, and other relevant documents.

- Fill out the claim forms provided by your insurer.

- Prepare the necessary documents for your specific claim type.

- Submit all documents and proofs to your insurance provider.

Note : Each insurance company has its specific requirements, so it’s essential to check these in advance.

Video: How to Get Travel Insurance?! | JM BANQUICIO

Still undecided on what travel insurance to get for your next international trip? Check out this video shared by travel blogger, JM Banquicio, where he shares his go-to travel insurance for the convenience, budget-friendly features, and overall ease of use. Be sure, however, to check the fine print so you can be assured that you have all the coverage that you need as some do not cover pre-existing conditions, and some other features. Again, the main thing here is to do your due diligence to research each package’s terms and conditions once you have your options presented to you.

Frequently Asked Questions

1. is travel insurance mandatory for international travel.

It depends on the destination. Some countries, especially those in the Schengen Area, require travel insurance for visa issuance. Even if not mandatory, it’s highly recommended for unforeseen events.

2. Does travel insurance cover COVID-19-related issues?

Most modern travel insurance policies now include coverage for medical expenses related to COVID-19. However, coverage for trip postponements or cancellations due to the pandemic may vary, so check the specific policy details.

3. What is the best time to purchase travel insurance?

Ideally, buy travel insurance soon after booking your trip. This ensures that you’re covered for any potential trip cancellations or other unforeseen events leading up to your departure.

4. Can I get travel insurance for a single trip if I travel frequently?

Yes, but frequent travelers might benefit more from a multi-trip or annual policy, which can be more cost-effective and convenient than purchasing a single-trip policy each time.

5. Are there age limits for travel insurance?

Age limits vary by insurance provider. Some policies cover infants to seniors up to 85 years old, and others may have different age brackets. Always check the age limits before purchasing a policy.

6. How does destination affect my travel insurance premium?

Destinations with higher medical costs or perceived higher risks (like extreme weather or political instability) may have higher premiums. Insurance providers assess the overall risk of the destination when setting premiums.

7. Are adventure sports and activities covered by standard travel insurance?

Many standard policies exclude high-risk activities like extreme sports. If you plan to engage in such activities, look for a policy that specifically covers them or consider an add-on.

8. What should I do if I need to make a claim?

Contact your insurer immediately if an incident occurs. Collect and prepare necessary documentation like medical reports, police reports, receipts, etc. Then, follow the insurer’s process for filing a claim, which usually involves completing a claim form and submitting the required documents.

Choosing the right travel insurance is crucial for a hassle-free journey. With various options available, it’s important to consider your specific travel needs, destinations, and the types of coverage you require. The right insurance not only offers peace of mind but also ensures that you are well-prepared for any unforeseen circumstances during your travels.

READ NEXT: 10 Best Travel Agencies in the Philippines

Disclaimer : The information provided in this blog post is intended for general informational purposes only. It is not intended as financial, legal, or insurance advice. While we strive to present the most accurate and up-to-date information, insurance policies and their details, including coverage, premiums, and terms, are subject to change by the respective insurance providers. Therefore, we cannot guarantee the accuracy or completeness of the information at the time of reading. Readers are advised to conduct their own research and consult directly with insurance companies or qualified professionals before making any decisions regarding travel insurance.

People applied for our Travel Plan

In the last 2 hours

Travel Insurance with optional Covid-19 Coverage now available!

Travel Insurance Plan

Designed to protect you against unforeseen events while travelling., at a glance.

Travel Assistance Plan is designed to protect you against unforeseen events while travelling. It protects you against flight cancellation, medical emergency, emergency accommodations or vehicle accidents.

Eligibility and Coverage

● Individuals and families from 0 to 80 years old may avail.

● Additional Covid Coverage for individuals and families ages 0-65 years old available for International Travel only.

● Coverage will start 24 hours before the date of departure and 24 hours after arrival date.

Calculate Your Premium

Total Premium:

Flight Assistance Benefit

Flight Delay

covers the expenses for meals, tours and accommodation in the event the trip is delayed at least six(6) hours.

Trip Cancellation

covers to pay the unused and non-refundable portion of travel, accommodation expenses and tours in case that the insured can no longer proceed with the trip due to unforeseen events indicated in the policy.

Missed Connecting Flight

covers the reimbursement of the expenses incurred due to acts of nature or intervention by the Authorities up to the limit indicated in the policy during the trip.

Baggage Delay

covers the expenses for the purchases of the basic clothing and toiletries in case of the delay of the luggage during the trip minimum of six(6) hours.

Baggage Loss / Damage Airline and other items in safekeeping of a common carrier

covers for loss, stolen or damaged baggage of the insured incurred during the trip indicated in the plan.

Loss of Travel Documents

covers the cost to replace the new Passport or documents as well as the accommodation expenses indicated in the policy.

Trip Curtailment

covers the expenses of the unused portion of the tour or accommodation if the trip needs to be terminated due to the unavoidable events indicated in the policy.

Aircraft Hijack

covers to pay the insured to the delay or interruption (minimum of 12 hours waiting period maximum 10 days as a result of aircraft hijacking.

Medical Assistance Benefit

Hospital Income

covers to pay the assured of a fixed amount indicated in the plan for each day of confinement minimum of 18 hours.

Medical and Hospitalization Expenses

including follow-up treatment covers the payment of hospital expenses in case of medical emergencies during the trip up to the limit indicated in the policy.

Delivery of Medicines

covers the delivery of the medicines prescribed urgently by a doctor to the insured during the trip.

Emergency and Accidental Dental Expenses

covers the necessary emergency dental treatment of the insured during the trip.

Repatriation of Mortal Remains

covers the necessary arrangements for the insured's transport or repatriation of mortal remains to the usual country of residence during the trip in case of death.

Arrangement for Funeral Assistance

provides financial assistance for funeral expenses of the insured's family due to insured's death caused by accident up to the limit indicated in the policy.

Medical Evacuation or Repatriation

covers to pay the transfer or repatriation of the insured to a properly equipped health center or to his/her usual place of residence.

Compassionate Visit

covers the expenses for the transfer of a person chosen by the insured from the usual country of residence in the event that the insured is hospitalized as an in-patient for more than five(5) consecutive days as a result of injury or sickness during the period of the trip.

Other Benefits

Assistance of bail bond payment.

It covers to advance funds on behalf of the insured up to the policy limit.

Personal Liability

It covers the damages and expenses incurred by the insured for bodily injury and property to third parties.

Personal Accident and Disablement

It covers any accidental injuries or death suffered by the insured during the travel.

Child Guard

It covers the expenses for the economy round trip transfer of one immediate family member, having the same country of residence as the insured, to look after the minor during the trip should the insured be hospitalized for more than five (5) consecutive days or is deceased, and accompanied by a minor during the event and if no adult accompanies said minor.

Advance of Money

It covers the assistance to arrange to forward cash up to the limit indicated in the plan in the event of the robbery, loss or stolen of cash or credit cards and accidents.

View Your Policy

Subscribe to our newsletter, join our mailing list to receive latest news and updates., terms of use, privacy policy, customer security, fund price and statistics, head office, 2/f & 3/f morning star center 347 sen. gil j. puyat avenue 1200 makati city philippines, +63 2 8890 1758 +63 2 8895 8519 / 8895 8524.

Policy Viewer

Policy Number

Passenger's name, departure date, return date.

Date of Birth

Contact number, email address, nationality, tin/sss/gsis, passport number, hazardous sports, cruise ship, chartered plane.

Your password already expired. Please change your password

In view of the ongoing large-scale demonstrations in Hong Kong , please be advised that wars, with or without prior declaration, and any conflicts or international interventions using force or duress, events arising from terrorism, mutiny or crowd disturbances as well as damage caused during the course of strikes are not covered under our Travel Assistance Plan ( Asia and Worldwide ).

- Skip to primary navigation

- Skip to main content

- Skip to footer

10 Best Travel Insurance Companies & Plans in the Philippines

Last Updated on – Jul 13, 2023 @ 1:17 pm

What’s the best travel insurance in the Philippines? When it comes to the best travel insurance providers in the country, AXA’s iON – Smart Traveler stands out. This insurance is not only affordable but also has a comprehensive list of coverage including medical expenses, personal accident, travel inconveniences, personal belongings, emergency medical evacuation, and many more. Other insurance plans worth considering include Pioneer Insurance, Standard Insurance, World Nomads Explorer Plan, and AIG Travel Guard.

See the Full List

He finally pulled it off—a quick weekend getaway in Kuala Lumpur to give his frayed nerves the much-needed rest they deserve.

Exploring the majestic rock formation inside Batu Caves was the first item in his itinerary. As he was climbing up the steps of this popular Malaysian destination, he notices the monkeys roaming around.

He goes near one to tries to pet it. As he reaches for its head, the monkey jumps, grabs his hand and bites it.

After wiping off the blood from his palm, he looks for a guide who takes him to the nearest hospital for a rabies shot. He was advised to take antibiotics, anti-inflammatory, and pain medicine for the next few days.

Doctors told him he had nothing to worry, he can continue on with his trip the same day.

But even if his trip was off to a bad start, he was still thankful for one thing:

His travel insurance paid for all medical expenses.

Who was the guy? Dunno, really.

But it was an actual testimonial posted by one of the customers of a travel insurance company which we’ll check out later.

The lesson?

Don’t touch ‘em monkeys.

Also, travel insurance is valuable whenever these kinds of things happen.

Because while we’re all hopeful that the trip will go smoothly and according to plan, sometimes, sh*t happens.

And it’s not only tourist-biting monkeys were talking about here.

Travel insurance can also provide protection for your gear/belongings, pay for trip cancellations, problems with baggage, emergency medical situations, and more.

So read on to learn everything you need to know about travel insurance. It’s a small price to pay to get protection and peace of mind for your whole trip.

Related: 79 Visa-Free Countries (+eVisa & VOA) for Philippine Passport Holders

What is a Travel Insurance?

It’s a contract or arrangement with an insurer to guarantee some form of compensation for a specified loss, illness, accident, damage, interruption, and others during your travels.

Put simply, it provides you with coverage for unexpected situations whether traveling domestically or abroad.

How Travel Insurance works?

Like regular insurance, it works by paying a fee to buy a policy. The policy is essentially the contract that states the types of reimbursements or refunds that your insurance can pay for.

For example, say you have a business trip to Spain. Three days before your flight, you experience chest pains and decide to get a checked by a doctor. He concludes that you contracted pneumonia through some form of bacteria.

You were advised to cancel the trip. Will you get reimbursed for travel expenses you already paid like tickets and accommodation?

Yes—if you have travel insurance.

Depending on the type of policy you purchased, expenses incurred for the trip will be reimbursed by your insurance company .

What does a Travel Insurance cover?

Travel insurance can reimburse you on the following expenses:

- Canceled trips

- Medical emergencies

- Lost baggage

- Emergency Evacuation

- Legal costs (for unexpected incidents you didn’t cause)

- Protection of property (gear and possessions) and more.

Related: 40+ Ways to Save Money while Traveling

Types of Travel Insurance in the Philippines

While you’ll see different types of travel insurance policies out there, the two main types are Vacation Plan and Travel Medical Plan .

1. Vacation Plan Insurance

This type of travel insurance is considered to be the widest in terms of coverage. Most sub-types fall under this category. Package plan, trip cancellation, trip insurance, and the generic, “travel insurance” are considered as types of vacation plan insurance.

What coverage does vacation plan insurance provide? Here are some of the most common items covered:

- Interrupted/Cancelled Trips

- Medical Emergencies

- Lost/Delayed Baggage

- Gear protection

- 24/7 Assistance

You’ll notice that medical emergencies are still included under Vacation Plan insurance. This is because some all-in-one policies also include it on the coverage.

However, if you only seek to have medical coverage when traveling and feel like you won’t need the rest, then the next type of travel insurance is what you should get.

Related: Complete International Travel Checklist

2. Travel Medical Plan

Your health insurance provider usually provides only partial or zero coverage when traveling.

A travel medical plan ensures you have adequate medical assistance should the need arise when you’re away from your home country.

- Medical Expenses

- Emergency Evacuations

Related: Easiest Countries to Get a Citizenship

Why do you need Travel Insurance?

The answer will vary from one person to another. Essentially, however, you’re paying for peace of mind. It’s protection for your pockets.

Same reason why you get a car insurance or life insurance : It helps sidestep any headaches caused by unforeseen expenses during your travels.

Think about it: Say the guy who got bit with the monkey earlier didn’t have insurance. He’ll be forced to shell out money from his own pockets to pay for the medical expenses.

That could have affected his budget for the trip, forcing him to cancel some of the items on his itinerary to make up for the expense.

Or maybe someone fell ill back home and you need to go back ASAP. With the right travel insurance, you can reimburse the fees you paid and get back home without worrying about “wasting” what you paid for.

The same applies if your destination country is suddenly reported to experience some form of weather disturbance or natural calamities (typhoons/hurricanes/earthquakes) and you are forced to bail out. Travel insurance keeps you compensated for the expenses you already paid for.

Also Useful: How to Get a Philippine Passport: DFA Online Appointment & Requirements

How much does Travel Insurance cost in the Philippines?

It varies. Most will fall within the range of Php 500 to Php 3000 for a single trip (4 days to a week, based on the estimated quotes provided by each insurer. More on this later).

There are several factors that affect how much your quote will be.

These are age, type of activities you’ll do during your travel, level of coverage, destination country, length of travel, medical conditions, and others.

To give you an idea of how much travel insurance costs, I’ve pulled up some sample quotes from GoBear (a comparison website).

For travel insurance packages for trips to Asian countries (single trip):

Price range: Anywhere from Php 400 to Php 800

For travel insurance packages to other countries/worldwide (single trip):

Price range: Anywhere from Php 500 to Php 3000

Best Travel Insurance Companies for Filipinos Traveling Abroad

We’ve compiled a list of travel insurance companies currently offering various policies depending on your needs. Read on to compare, you might find this useful on your next travel abroad.

Note: Please make sure to visit each insurer’s official website to get up-to-date rates. Policy coverage shown here may vary from the insurer’s product page depending on the type of plan you will avail of.

1. World Nomads

Service coverage: Worldwide Prices start at: $38 for Standard Plan; $42 for Explorer Plan

World Nomads Pty Ltd is a travel insurance company based in Sydney, Australia. It was founded in 1999 and has been a go-to insurance provider for most independent (and adventurous) travelers worldwide.

Policy coverage:

They provide emergency medical support, evacuation assistance, trip cancellation, and even include coverage for adventure sports and activities (which is not usually provided by other insurance companies).

If you check their site, you’ll see that they offer a myriad of insurance features that the more “Active” nomads will find useful. These include the following:

- Pain relieving dental treatment

- Prescribed medicines by a doctor or specialist

- Daily emergency cash allowance in hospital

- Hospitalization or treatment by a doctor or specialist

- Physiotherapy or chiropractic treatment

- Treatment by acupuncture or osteopath

- Counseling after an assault or mugging

- Sports & adventure activities

- Study, work and volunteer

2. AXA iON – Smart Traveler

Service coverage: Worldwide Prices start at: Php 990 (Essential Plan)

AXA iON is AXA Philippines’ travel insurance service. They have a pretty comprehensive list of options which includes the following:

Policy Coverage:

- Personal accident

- Emergency Medical Evacuation and Repatriation

- Travel Inconveniences

- Personal Belongings

- Other Benefits (Personal liability, hijacking, kidnapping, funeral and burial expenses)

3. AIG Travel Guard

Service coverage: Worldwide Prices start at: Php 400 (1 to 4 days)

AIG is a global insurance company that has been around for decades, catering to businesses, institutions, and individuals worldwide. One of their products is AIG Travel Guard, which is focused on providing insurance solutions to traveling individuals.

- Medical expense

- Medical evacuation

- Repatriation expense

- Child Guard

- Compassionate visit

- Baggage delay

- Trip cancellation

- Trip termination

- Baggage and personal effects

- Flight delay

- Loss of travel documents

- Personal liability

4. Fortune General

Service coverage: Worldwide Prices start at: Php 900 (1 week)

Fortune General (FGen), has revamped its travel insurance services to include more features. They provide insurance for people traveling to Asia, Schengen (Europe), and to the rest of the world.

- Accidental benefit

- Medical expense and hospitalization

- Medical evac or repatriation

- Emergency Dental Care

- Repatriation of Family Member

- Repatriation of Mortal Remains

- Compassionate Emergency Visits

- Compassionate Emergency Return

- Care for Minor Children

- Flight Delay

- Missed connecting flight

- Trip diversion

- Strikes and aircraft hijacking

- Emergency trip cancellation

- Emergency trip termination

- Personal belongings and baggage

- Other services

5. Pacific Cross

Service coverage: Worldwide Prices start at: Php 500 (Executive Peso Plan)

Pacific Cross is a medical, accident, and travel insurance service provider. It was founded in the Philippines and now operates across various branches across Asia.

Their market focus is on ASEAN countries, providing insurance products to residents in the Philippines, Thailand, Vietnam, Cambodia, Indonesia, and Hong Kong.

- In-patient and Out-Patient care

- Emergency dental treatment

- Emergency room availment and in-patient reimbursement for pre-existing conditions

- Recreational activities

- Recreational extreme sports

- Implants coverage necessitated by a covered accident

- Hospital income

- Funeral and burial expenses

- Land vehicle rental excess protection

6. Malayan Travel Master

Service coverage: Worldwide Prices start at: Php 375 (4 days in ASEAN)

Malaysian Travel Master touts itself as “The most comprehensive international travel health insurance in the Philippines”. They offer competitive pricing on their packages and caters to both local and international travels.

- Personal Accident

- Emergency medical treatment (excluding pre-existing conditions)

- Recovery of travel expenses

- Travel inconvenience benefits

- Travel assistance benefits

- Value-added features

7. MAPFRE Philippines

Service coverage: Worldwide Get a quote: Contact MAPFRE at [email protected]

MAPFRE Insular offers non-life insurance packages which are mainly focused on motor vehicles and other niche areas like engineering, marine cargo, fire, and allied lines, surety and microinsurance.

They currently offer a Travel Insurance package for both international and domestic use.

- Medical expenses and hospitalization benefits

- Trip cancellation and curtailment benefit

- Accidental death and permanent disability of insured

- Repatriation of mortal remains

8. FPG Insurance

Service coverage: Worldwide Prices start at: Php 450 (Classic Plan – 4 days)

Operating under the Zuellig Group of Companies, FPG Travel is the company’s insurance offering for individuals who need protection during their travels.

- Medical treatment/expenses

- Emergency dental care

- Medical evacuation and repatriation

- Return of a family member when traveling with the insured

- Trip cancellation and curtailment

- Delayed departure

- Loss of travel documents and money

- Luggage delay

9. Standard Insurance

Service coverage: Worldwide Prices start at: Php 495 (Asia Protect Peso – 8 days)

Standard Insurance offers both ASEAN and International travel insurance packages. They offer competitive rates for as little as Php 500 for a coverage of up to Php 500,000 (ASEAN).

- Emergency Medical Assistance

- Emergency Travel Assistance

- Travel Inconvenience Benefits

- Personal Liability Benefit

- Personal Accident Liability

10. Pioneer Insurance

Service coverage: Worldwide Prices start at: Php 399 (ASEAN 4 days)

Pioneer Life Inc was established in 1964 and is currently 100% Filipino-owned after the joint venture with Allianz AG of Germany in 2003.

- Emergency trip cancellation and termination

- Damage to baggage

- Loss of baggage

- Loss of personal money

- Loss of Travel documents

5 Tips for Buying the Best Travel Insurance

Tip #1: determine what type of insurance you need.

Before choosing a travel insurance, you should ask yourself the following questions:

- What type of activities will I be doing on the trip?

- Will I be carrying valuable possessions or baggage?

- Is there a chance or reason for the trip to get canceled?

- How much am I willing to pay for insurance?

- Does this company have a decent track record?

And other similar questions. The goal is to have a nice checklist that ticks off everything you think you’ll need for the trip.

For example, say you’re a professional photographer. You’ll be traveling to Europe for a paid assignment. Since you’ll be carrying valuable (read: expensive) gear, it’s crucial that the travel insurance you get prioritizes coverage for possessions and/or baggage-related assistance.

Tip #2: Make sure it has sufficient medical coverage

Seasoned travelers will tell you that the most expensive potential money drain (if you don’t have travel insurance) are medical-related. Accidents and injuries can range from minor to serious, easily costing you thousands of pesos from your own pocket.

A good travel insurance policy should be big enough to cover both minor and major medical issues.

Also, try to get one that has separate coverage for emergency evacuation. Since you’ll be getting insurance anyway, better get the best one you can afford.

Having the option to have a helicopter fly you off to the nearest hospital during a medical emergency (during your travels to hard-to-reach locations) or natural disaster/calamity is highly valuable and could spell the difference between life or death.

Tip #3: As with any agreements or contracts, you should always check the fine print.

Two companies might offer similar-looking plans but the other is cheaper.

What’s the deal?

Almost always, you’ll know it by reading the fine print carefully. One might be cheaper, but with it comes a slower and more painful claims process.

The speed of getting your claims can make or break a trip, so better be careful in choosing your insurance so you won’t regret it later.

Tip #4: Take advantage of your credit card perks

Most credit card companies include travel insurance as one of the perks for their travel-focused credit cards. It’s part of their “Frequent Traveler’s” package and it can prove valuable for saving yourself a couple of hundred to a few thousand pesos for travel insurance.

Check out our list for best credit cards for travel to know more which ones provide free travel insurance.

Tip #5: Know what’s not included in your policy

Again, this goes along with doing your homework as you decide on which travel insurance company to go with.

What’s not usually covered:

- Extreme adventure activities (though some insurers provide packages for these types of activities)

- Alcohol and drug-related incidents

- Baggage/luggage issues due to the carelessness of policyholder

- Pre-existing conditions (double-check with the insurer)

Bonus tip: Purchase travel insurance at least 2 days before your trip.

Most policies get activated within 24-48 hours within approval. You don’t want to head out without adequate protection activated yet. Be safe, apply and get approved early.

Check with the insurer to confirm the exact date of when the insurance will apply.

How to Claim your Travel Insurance

It’s quite easy, actually. You just need to contact your insurer via their preferred method.

They will then ask you to submit the required documents to serve as proof of the validity of the claim.

In general, it’s a good idea to provide as much documentation as you can so as to avoid any further delay brought about by insufficient requirements.

Always check with your insurance provider what they will need exactly to approve your claim as it may vary from one insurer to another.

Required documents for claiming travel insurance due to trip cancellation:

- Documentation supporting the reason why you need/had to cancel the trip

- Invoice of trip expenses which may include the details (what, when, where) of the trip itself, airline tickets, room or hotel accommodation receipts

- Receipts and itemized bills for all trip expenses

- Physician’s statement (for medical-related incidents)

- Police reports (for stolen baggage or vehicular accidents)

- Unused tickets

In conclusion:

Benjamin Franklin once said, “By failing to prepare, you are preparing to fail”.

Travel insurance is one of those things that you need but hope you’ll never need to use. That’s just the way insurance works. Should you do, however, you’ll be thankful you have it.

Remember: Don’t be penny wise and pound foolish . A few hundred pesos for travel insurance is a tiny price to pay for protection from potentially massive expense later. Save yourself from this trouble and get adequate protection.

Disclaimer: Grit PH strives to post up-to-date information on all investment, banking, and other financial products we feature. However, information may change without notice. Therefore, we do not guarantee the accuracy of the information listed on the website, including those provided by third parties at any particular time.

It is best to review the updated terms and conditions of your chosen financial institution. Grit PH is not affiliated with the companies mentioned in the article. All testimonials and opinions are representative only of the writer’s experience, but the results will be unique to each individual.

About Amiel Pineda

Amiel Pineda is the Head of Content at Grit PH.

He started freelance writing in 2010 doing product reviews and tech news. In 2018, he became a full-time freelancer, writing in the financial space and creating content for clients in various niches.

Prior to freelancing full-time, he worked 7 years in the financial services industry for a Fortune 500 company.

He also writes on his personal blog, Homebased Pinoy (https://homebasedpinoy.com/), where he shares tips and guides as a work-from-home freelancer, along with NFT-game guides.

Education: Technological Institute of the Philippines (Bachelor of Science in Electrical Engineering) Focus: Freelancing, Entrepreneurship, Financial Products, Investing & Personal Finance

Reader Interactions

February 10, 2019 at 1:04 pm

What travel insurance for old but fit, 86 year old can you recommend?

April 15, 2019 at 2:31 am

This is actually helpful, thanks.

May 22, 2019 at 12:42 pm

Medical insurance to use working abroad such as USA?

August 12, 2019 at 3:33 am

Hi Amiel, thanks for this. When World Nomads stopped supporting Filipino travelers early this year, we had to search for alternatives which are not as good as what World Nomads offered. This is really helpful. I just have some follow up questions: 1. Are these the “best” or “the only” providers offering travel insurance to Filipinos? 2. If the best, what was your criteria for saying that? 3. Is your list ranked from best to worst among the list of the best? 4. What then in your opinion is the best among these and why? Thanks. Gio

September 28, 2019 at 1:30 am

Do you know any travel insurance companies that offer insurance to travelers aged 70+? It seems like all of them stops at 70 year olds 😭

November 15, 2021 at 9:42 pm

Hi, would you know insurance companies offering travel insurance with covid19 coverage and covers travelers 75 years old and above as well? Thank you.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

We need your help!

Our team is currently conducting research for an upcoming guide focusing on starting a business in the Philippines . We would greatly appreciate your contribution, which should only require a few seconds of your time.

Thank you in advance!

- Digital Marketing

- Search Engine Optimization (SEO)

- Digital PR & Link Building

- Social Media Marketing

- Digital Advertising (PPC & Social)

- Content Marketing

- Copywriting

- Email Marketing

- Conversion Optimization

- Web/App Development

- Ecommerce Development

Please enable JavaScript in your browser to complete this form. Name * Location of Business * Number of Employees * 1 - 10 11 -50 51 - 100 100 - 500 500+ Phone Number * Email * Insurance Company Standard Insurance AXA Philippines BDO AIG Submit

Please enable JavaScript in your browser to complete this form. Full Name * Company Name * Mobile Number * Email Address * Submit

Please enable JavaScript in your browser to complete this form. Name * Contact Number * Email Address * Target Location Preferred Developer * Ayala Land SM Prime Megaworld Alveo Land DMCI Homes Federal Land Robinsons Land Corp Vista Land and Lifescapes Filinvest Land Shang Properties Century Properties Empire East Rockwell Land Comment Submit

Disclosure: Your personal details will not be shared with any third-party companies. We’ll just need your contact details so our resident real estate agents can reach you to provide you with the details for any of the listed property developments you’re interested to invest in.

Please enable JavaScript in your browser to complete this form. Name * Age * Location* Phone Number * Email Address * Insurance Company Sun Life Financial Pru Life U.K. AXA Philippines AIA Philippines Manulife Insular Life BPI-AIA BDO Life Etiqa FWD Insurance Allianz PNB Life Website Get a Quote

Disclosure: Your personal details will not be shared with any third-party companies. We’ll just need your contact details so our resident financial advisors can reach you to provide you with the details for any of the listed insurance company you’re interested in.

For your holidays in Philippines and abroad

Travel insurance for the philippines.

Welcome to the enchanting archipelago of the Philippines, a tropical paradise renowned for its pristine beaches, vibrant coral reefs, and warm hospitality. From the bustling streets of Manila to the stunning landscapes of Palawan, this diverse nation captivates travelers with its rich history, delicious cuisine, and breathtaking scenery.

As you embark on your journey to the Philippines, it's essential to make sure that your travel adventure is safeguarded. In this guide, we'll delve into the importance of securing travel insurance for the Philippines, so you can immerse yourself in the activities of this Southeast Asian gem with confidence.

- What should your Travel insurance cover for a trip to Philippines?

- How Does Travel Insurance for Philippines Work?

- Do I need Travel Insurance for Philippines?

- How Much Does Travel Insurance Cost for Philippines?

Our Suggested AXA Travel Protection Plan

What types of medical coverage does axa travel protection plans offer.

- Are There Any COVID-19 Restrictions for Travelers to Philippines?

- Traveling with pre-existing Medical Conditions?

What should your travel insurance cover for a trip to the Philippines?

At a minimum, your travel insurance should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Brazil.

How Does Travel Insurance for the Philippines Work?

Imagine you're exploring the beautiful islands of the Philippines, and suddenly a natural disaster, such as an earthquake, strikes the region. In this unfortunate situation, the "Emergency Evacuation & Repatriation" benefit from AXA Travel Protection becomes crucial. The policy may offer provisions for evacuating you to the nearest appropriate medical facility or repatriating you to your home country in the face of a serious crisis, ensuring your safety and well-being during unexpected events like natural disasters.

Here are more ways travelers can benefit from an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Additional Optional Travel Benefits

- Rental Car (Collision Damage Waiver) : Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I Need Travel Insurance for the Philippines?

While not obligatory, having travel insurance becomes crucial when exploring the Philippines. Situated in the Pacific Ring of Fire, an area prone to earthquakes, typhoons, and volcanic eruptions, the country presents potential risks that make obtaining suitable insurance coverages a necessity. It's vital to be prepared for unforeseen circumstances and make sure you have the proper protection in place during your visit.

Here are more reasons why having travel insurance is recommended for trips to the Philippines:

Medical Emergencies : Given the geographical location of the Philippines, having coverage for emergency medical expenses is important. In the event of unforeseen accidents or illnesses during your trip, this benefit offers coverage for hospital stays and doctor's fees, offering the confidence you need to explore the archipelago.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

Trip Cancellation: With the unpredictability of weather conditions and unforeseen circumstances in the Philippines, having coverage for trip cancellation is important for all travelers. Whether it's due to sudden illness, injury, or unexpected events, this benefit offers reimbursement for canceled trips.

How Much Does Travel Insurance Cost for the Philippines?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

Total Trip cost: The total amount of non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

Age: L ike any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to the United Kingdom will be offered three tiers of insurance: Silver, Gold and Platinum . Each offer varying levels of coverage to cater to individual's preferences and travel needs.

AXA presents travelers with three travel plans – the Silver, Gold and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Philippine hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers to consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses.

The Platinum Plan is your go-to choice if you're looking for extra coverage for the Philippine experience. "Cancel for Any Reason" offers greater flexibility for those unexpected twists in your travel plans and the "Rental Car (Collision Damage Waiver)" offers assistance when you're out exploring the Philippines's stunning landscapes in a rental car.

AXA covers three types of medical expenses:

Emergency medical: Covers unforeseen situations like fractures, burns, sudden illnesses, and allergic reactions.

Emergency evacuation and repatriation: Covers your immediate transportation home in the event of an accidental injury or illness.

Non-medical emergency evacuation and repatriation: Offers assistance for evacuating a destination promptly due to events unrelated to health issues. These events may include occurrences like natural disasters or civil unrest.

Are There Any COVID-19 Restrictions for Travelers to the Philippines?

The Philippine government has lifted the requirement for international travelers to show a vaccination certificate in order to enter the country. This means that anyone can now travel to the Philippines, regardless of whether they are vaccinated against COVID-19.

Traveling with preexisting Medical Conditions?

Traveling with preexisting medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum Plan . offer coverage for preexisting medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plan with a pre-existing medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60 day look back period. We're here to make sure you travel with ease, no matter your health situation.

1.Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2.When should I buy Travel Insurance to the Philippines?

It's advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14-days of making your initial trip deposit.

3.Do Americans need travel insurance in the Philippines?

While travel insurance is not mandatory for U.S. citizens traveling to the Philippines, it is strongly recommended. Travel insurance may offer sufficient coverage in the event of unforeseen travel or health emergencies.

4.What is needed to visit the Philippines from the USA?

US citizens entering the Philippines must have a passport valid for at least 6 months beyond their departure. Additionally, they must complete the eTravel Portal within 72 hours before or upon arrival and show a return ticket to the port of origin or the next destination.

5.What happens if a tourist gets sick in the Philippines?

If you become sick in the Philippines, travelers with AXA Travel protection can contact the AXA Assistance hotline 855-327-1442 . Contact information is typically provided within the insurance documentation. Please read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

Top Travel Insurances for the Philippines You Should Know in 2024

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Known for its stunning beaches, lush rainforests, and vibrant culture (including the famous Ati-Atihan Festival and Sinulog Festival), the Philippines is a great destination for travellers from abroad. Although travelling to the Philippines can be an accessible holiday destination for many people, out-the-pocket healthcare costs in the country tend to be expensive, so it's a very good idea to arrive there with travel insurance under your belt.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to the Philippines and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

Philippines Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for the Philippines:

Best Travel Insurances for the Philippines

- 01. Should I get travel insurance for the Philippines? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to the Philippines scroll down

Heading to the Philippines soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Do I Need Travel Insurance for the Philippines?

No, there's currently no legal requirement to take out travel insurance for travel to or through the Philippines.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to the Philippines or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for the Philippines:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to the Philippines. It lets you choose between various plans tailored to meet the specific needs of your trip to the Philippines, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for the Philippines:

- Policy names: Varies

- Medical coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip coverage: Excellent - but only available for US residents.

- Customer support: FAQ, live chat and phone support

- Pricing range: USD 25 to USD 150 /traveller /month

- Insurance underwriter: Lloyd's, Petersen, and others

- Best for: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer support: FAQ, live chat, phone support

- Pricing range: USD 80 to USD 420 /traveller /month

- Insurance underwriter: David Shield Insurance Company Ltd.

- Best for: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy names: Nomad Insurance, Remote Health

- Medical coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing range: USD 45 to USD 160 /traveller /month

- Insurance underwriter: Tokyo Marine HCC

- Best for: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to the Philippines? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to the Philippines

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for the Philippines. However, we strongly encourage you to do so anyway, because the cost of healthcare in the Philippines can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Credit Cards and Loans

- Blog and Guides

- Check Credit Score

The Best Travel Insurance in the Philippines, For Every Budget

Whether you need comprehensive or cheap travel insurance, we have just what you need here.

The Right Travel Insurance For All Destinations.

At eCompareMo, we've put together a comprehensive list of worldwide travel insurance plans that will cover you wherever you're headed.

More providers, more options

Easily compare travel insurance from top insurance companies.

100% transparent & customizable

Get exactly what you paid for--no hidden charges.

Fast issuance

Get your FREE quote and policy issued within minutes.

A Proper Travel Insurance Is Essential When Traveling to Europe, USA, Canada, Asia, and Schengen Territories.

For anyone traveling outside the country, travel insurance may be required, depending on your destination.

But beyond that, it's an essential cover to protect you from any travel-related mishaps you might encounter along the way. Risks can mount up once you travel to foreign places. Lost baggage and baggage delays, missed flights and flight delays, missing passports, sicknesses, and accidents—these are just some of the most common inconveniences that happen during out-of-town trips, especially during peak travel periods.

Travel insurance is a product made specially to protect you, your family, your documents, and your belongings from potential emergencies that may come your way. You can be confident that whatever travel inconvenience happens to you and your family, travel insurance is there to save your day. Everyone wants to look forward to having the best experience on their trip, and travel insurance can help you get that extra peace of mind.

What People Say About Getting Travel Insurance With eCompareMo

eCompareMo is rated 4.3/ 5 based on 128 reviews from the past 6 months.

I was in dire need of a travel insurance for my Euro trip. I searched everywhere but only eCompareMo was able to issue me a policy on the same day. I was able to score the best rates too!

Travel Insurance Explained

While it can be an additional expense, travel insurance is an indispensable tool that you will be thankful to have if travel-related disruptions happen.

What is Travel Insurance?

Travel Insurance refers to a type of insurance that covers flight delays and accidents, medical expenses, and other losses experienced during travel, be it trips within the Philippines or trips to Asia, Schengen, USA and Canada, and other destinations worldwide. It is recommended for anyone traveling outside the country, whether for business or pleasure, so you can have the best experience possible.

Why is Travel Insurance Important?

There might be instances when unforeseen problems arise while you're traveling: accidents, lost documents & valuables, delays, trip cancellations, and illnesses. While they're already a hassle in and of themselves, these can be especially tough when you're on foreign soil. That's why you need a reliable travel insurance policy to cover these costly financial expenses.

Reasons why getting travel insurance is essential

- Getting assistance abroad. It’s like having a helpline when and where you need it. In a foreign country, the language barrier can be quite the deal-breaker. Travel Insurance makes sure that you get the best and highest-quality assistance regardless of your location, in terms you can understand.

- Spares you from costly unexpected expenses. Getting medical treatment abroad can burn a serious hole in your pocket. With a travel insurance policy in hand, fees from getting medical attention will be handled by your coverage.

- Reimbursement for any losses or expenses. Stolen baggage and flight cancellations are no fun. Incidents like these often require you to shell out extra money. Your Travel Insurance is there to make up for your losses and unwanted expenses in the form of cash reimbursement.

Travel Insurance Sample Coverage

International.

- Provides personal accident insurance, medical insurance coverage

- Includes travel inconvenience & emergency assistance

- More than 20% estimated total savings

- More than 30% estimated total savings

Worry-free Travel Insurance From The Top Providers in the Philippines

Compare quotes from top travel insurance companies in the Philippines to make your travel smooth-sailing.

Travel Insurance FAQ

Here are some other answers to questions you might have about travel insurance.

How do I choose the right travel insurance?

With all the different types of Travel Insurance coverage, how do you tailor-fit the best travel insurance package for your trip and budget? Here are a few helpful tips:

- First ask yourself: How much protection do I need? Do you want security from the worst possible scenario? Or do you want very specific coverage? Many Travel Insurance providers offer a variety of packages that cater to specific needs and budgets.

- Look for an insurance policy that has a high coverage limit when it comes to medical expenses. The higher the coverage, the more potential savings you have.

- Get a Travel Insurance package that has 24/7 assistance so that you are assured of help whenever an emergency arises.

- For frequent travelers—or those flying more than four times a year—opt for an annual Travel Insurance plan that has worldwide coverage. With this, you save money and bring peace of mind with you on any trip you go to.

- Carefully compare all the Travel Insurance plans in the market before buying to avoid regrets.

What are the requirements for getting travel insurance?

Policyholders need to meet the following criteria:

- Aged between 1 and 80 years old

- Traveling locally or internationally

To apply for Travel Insurance, you must give the following requirements:

- Duly accomplished application form

- Itinerary showing destinations

- Mode of travel (air, land, sea)

- Dates of travel

- Photocopy of any valid ID

- Birth certificate

Do I really need travel insurance, even if I'm just traveling domestically or to nearby countries?

If you want to focus more on your trip and Insta-worthy posts than the worries, then yes, it is a must.

When is the best time to buy Travel Insurance?

It is recommended that you purchase one right after you book your trip and get a confirmation. Make sure that your policy covers the essentials, such as the destination's itinerary, luggage and baggage items, and medical assistance, among others.

Is luggage loss or theft always covered?

Most Travel Insurance providers in the Philippines provide luggage loss or theft cover. So whether it’s accidental loss, damage, or theft, you’re sure to have some backup. In case your luggage gets misplaced or delayed, your Travel Insurance has got it covered too.

Does Travel Insurance cover extreme sports and outdoor activities?

This is a special type of cover for adrenaline junkies. Make sure you clear this one with your insurance agent if they provide one.

Where can I apply for travel insurance that's fit for my budget and has a reliable history of supporting travelers over the years?

You can quickly access travel insurance quotes from top insurance companies for FREE at eCompareMo. We've partnered with the best travel insurance providers in the Philippines to give you the freedom to choose from only the best Travel Insurance coverage. Use our Wizard to fine-tune your selection and compare affordable packages for travel care insurance in the Philippines that suit your budget. It only takes a few taps and clicks to get a result!

How long do I have to wait to get travel insurance?

While it may take days for other travel insurance providers to offer you their quotes and policies, you can instantly see and compare quotes from leading providers here at eCompareMo. Find your preferred travel insurance provider, get a FREE quote, and apply for a travel insurance policy within minutes.

IATF OKs New, Looser Adjusted Travel Protocols

Child Car Seat Law FAQ: Here's What You Need to Know

Zambales To Open Beaches For Tourists Soon

Updated MECQ, GCQ, MGCQ Travel Guidelines For Every Province In The Philippines

All The GCQ Travel Guidelines For Non-Essential Personnel You Need To Know

Credit Cards

Our products, company updates.

- Career Opportunities

- Press Releases

- Our Insurance Services

- Car Insurance

- Prepaid Health Products

- CTPL Insurance

- Property Insurance

- Health Insurance

- Travel Insurance

- Personal Accident Insurance

To know about insurance

- Car insurance guide to CTPL

- What to do after a car accident

- Car insurance coverages and claims

- Understand CTPL coverage

- CTPL vs Comprehensive Car Insurance

- How to file a car insurance claim

- Grab and TNVS car insurance

- Processes in motor insurance claim

- Guide to buying secondhand cars

- Types of car insurance coverage

- What to do in case of a car accident

- To know about car insurance renewal

- Our Loan Services

- Personal Loan

- Housing Loan

- ORCR Sangla Personal Loan

- Business Loans

Calculators

- Personal Loan Calculator

- Housing Loan Calculator

Quick guides about loan

- What is an emergency loan

- What is no collateral loan

- Loan for Call Center Agents

- OWWA Loan Starter Guide

To know about loan

- How to get approved for personal loan

- How to apply for personal loan

- What to know about personal loan

- Key processes for personal loan

- Types of personal loan

- Loan secured by employer

- Loan secured by deposits

- Our Credit Card Services

- Best Credit Cards

- Airmiles Credit Cards

- Cashback Credit Cards

- Fuel Rebate Credit Cards

- No Annual Fee Credit Cards

- Promotions Credit Cards

- Rewards Credit Cards

- Shopping Credit Cards

- Travel Credit Cards

- Women’s Credit Cards

To know about credit cards

- How To Apply For a Credit Card

- Credit Card Types and Features

- What is Cashback and Rebates?

- What is Balance Transfer?

- All Banking Products

- All Insurance Products

Find and apply online

- Our Loans Services

- All Articles

- Credit Card

Travel Insurance in the Philippines Guide: Coverage, How to Choose, Tips

- What is travel insurance?

How does travel insurance work?

- Why should I get travel insurance?

- Do I need travel insurance when going to the Philippines?

- When is the best time to get travel insurance?

- What does travel insurance cover?

Emergency Accident & Sickness Medical Expenses

Trip cancellation insurance, trip delay insurance, trip interruption travel insurance, non-medical emergency evacuation travel insurance, luggage and personal property insurance, adventure and sports travel insurance, accidental death and dismemberment, gear and electronics cover.

- What does travel insurance not cover?