- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Maximize the AmEx Platinum Hotel Credit

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

As the COVID-19 pandemic rocked the world in 2020, many credit card issuers rolled out new temporary benefits to help boost value to cardholders.

American Express was no exception, and offered a particularly generous perk: a $200 hotel credit for some holders of The Platinum Card® from American Express . They also extended the amount of time that new cardholders had to meet the minimum spending requirements by three months, then went on to add a bevvy of new incentives , like limited-time bonus rewards, streaming credits, wireless credits and a host of juicy AmEx offers .

Since I’m a travel enthusiast and credit card junkie (admittedly), I found myself flush with newfound perks and growing balances of bonus points from everyday shopping. The problem was, like many people, I wasn’t really traveling.

Here’s how I was able to make use of — and maximize — the $200 travel credit.

» Learn more: How credit card issuers are responding to COVID-19

About the $200 American Express travel credit

Some cardholders of The Platinum Card® from American Express who renewed their card became eligible for a credit up to $200 for travel booked through American Express Travel. Terms apply.

I didn’t give the credit much thought at first. Due to COVID-19 considerations, I had canceled all of my travel for the foreseeable future. Even when I do travel frequently in “normal” times, I rarely book through American Express. I generally prefer to transfer my Membership Rewards points to travel partners to get outsize value.

Still, $200 is a generous credit that I didn’t want to waste. And when my family was starting to go stir-crazy after months of quasi-lockdown, I set out to plan a safe “staycation” using the bonus AmEx travel credit.

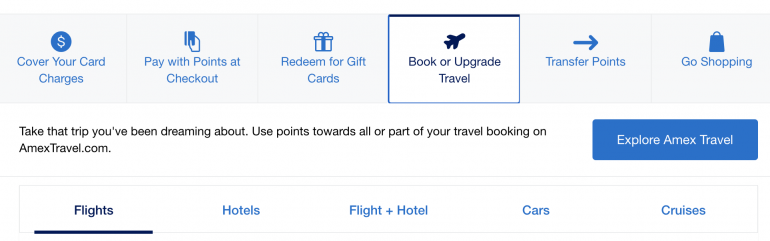

How the booking portal, American Express Travel, works

American Express Travel is a booking portal available to cardholders to book flights, hotels, cruises, tours and flight + hotel package deals. When you log into your AmEx account, just click into your Rewards page and you can find the AmEx Travel portal.

When you make a booking through American Express Travel, you can choose to pay with either your Membership Rewards points or with cash.

If you hold The Platinum Card® from American Express or The Business Platinum Card® from American Express , you’ll earn 5x points when you use your card to charge travel in the AmEx travel. All other Membership Rewards-earning cards will earn 2x points on AmEx travel bookings. Terms apply.

If you choose to pay with points, they’ll be worth 1 cent each. This isn’t a great redemption value, since you can easily get more value for your points by transferring to AmEx’s travel partners . But when you consider that you will earn airline miles (and sometimes hotel points) when you book your trip through AmEx travel, the value jumps up a bit. That’s because the airline or hotel sees this as a “cash” booking rather than an “award” booking, even when you’re using your Membership Rewards.

» Learn more: Best American Express credit cards

How I got out-sized value from my travel credit

Since my family was staying grounded during the pandemic, we decided to take a “staycation” in a nearby hotel. And since we had missed most of our planned travel in 2020, we decided to use the $200 credit toward a splurge for luxury.

When I started hunting for hotel options in the American Express Travel portal, the first several hotels that appeared in my search were designated as being part of the Fine Hotels & Resorts program.

Available only to cardholders of The Platinum Card® from American Express , The Business Platinum Card® from American Express and the Centurion Card from American Express, the FHR program offers extra benefits, including:

Early check-in.

4 p.m. checkout.

Room upgrade (based on availability).

Daily breakfast for two.

$100 property credit (varies by hotel, but dining and spa credits are common).

Since my $200 AmEx credit would cover anything booked through AmEx Travel — including a hotel in the FHR program — I knew I could pack even more value when I combined the benefits.

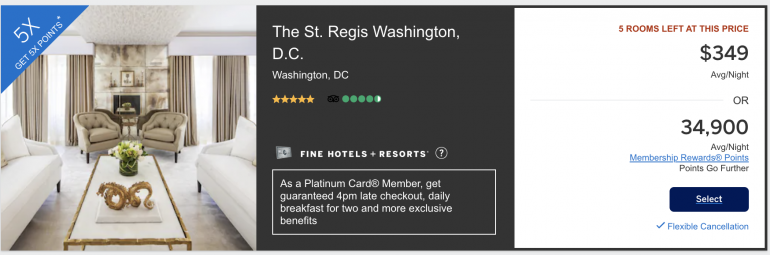

We decided on a “staycation” night at the luxurious St. Regis close to where we live.

When booked through AmEx travel, the room was going for $349 a night. To be clear, booking a hotel through FHR doesn't always give you the lowest rate. If booked directly, a room at this same hotel could have cost $308 for that same night.

But the added benefits from booking through FHR can usually outweigh the added cost.

Here’s how my AmEx travel booking broke down. The room rate was $349, but by booking a FHR property through AmEx travel I got:

The Platinum Card® from American Express credit: $200.

Property credit: $100.

Breakfast credit: $60.

My family got the red-carpet treatment at the St. Regis. We were able to check in early at 11 a.m. to kick off our staycation, and we were upgraded to a larger room with a prime view.

The $100 property credit at this hotel was good for a food and beverage credit, so we used it to splurge on a fancy, socially-distanced tea party, to the sheer delight of our two young kids.

Photo courtesy of Erin Hurd

In the morning, we were informed that we would be given $60 in breakfast credits from our booking. Even at St. Regis prices, that credit was enough for all four of us to enjoy a light breakfast.

At checkout, we had a few incidental charges, including valet parking, that we needed to pay for out of pocket. Since St. Regis is a Marriott brand, I used my Marriott Bonvoy Brilliant® American Express® Card for those charges. The card comes with up to $300 in credits for eligible purchases at Marriott hotels. In September, the $300 Marriott credit will be replaced with a new benefit of up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide. Terms apply.

The bottom line

This staycation was certainly not free, since I pay a hefty $695 annual fee to hold The Platinum Card® from American Express . But by booking a room through American Express’ Fine Hotels & Resorts program, I was able to get even more value from the extra $200 travel credit. Terms apply.

Though earning hotel points can sometimes be hit-or-miss with FHR bookings, I was pleasantly surprised a few days after checkout to see that I had earned Marriott Bonvoy points and an elite night credit on this booking.

If you have The Platinum Card® from American Express and are eligible, make sure you remember to use your extra $200 AmEx travel credit whenever you’re ready to travel again. The credit is good for travel through the end of 2021. Check your AmEx account to see if you have the offer, or contact customer service through online chat or over the phone to confirm your eligibility.

To view rates and fees of The Platinum Card® from American Express, see this page .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

All products and listings featured on Condé Nast Traveler are independently selected by our editors. If you purchase something through our links, we may earn an affiliate commission.

The Platinum Card® from American Express Review: How I Use It to Upgrade Rooms, Maintain Airline Status, and More

By Sheryl Bond

Condé Nast Traveler has partnered with CardRatings for our coverage of credit card products. Condé Nast Traveler and CardRatings may receive a commission from card issuers. We don't review or include all companies, or all available products. Moreover, the editorial content on this page was not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are entirely those of Condé Nast Traveler's editorial team.

UPDATE: Welcome offers for the cards listed below may be out of date. Confirm the current welcome offers on each card issuer's site

We have been together for 21 years. It was not love at first sight; I thought you were out of my league. You now have my heart and my wallet . When I first discovered American Express , I did not understand the difference between credit and charge cards. After completing a debt management program with Consumer Credit Counseling in 1995, I used cash for six years to pay for all goods and services. In 2001, I finally applied for the American Express Green Card. In 2003, I upgraded to Gold and finally moved up to Platinum in 2006.

It was not until I started carrying The Platinum Card® from American Express that I began traveling, and now that I understand the travel rewards game, I can play. Read on for my review of the card and how I make the most of its many benefits.

Is the American Express Platinum Card worth the $695 annual fee?

Yes—the $600 in airline fee, hotel, and Uber Cash credits (terms apply; enrollment required) alone are worth the annual fee. But also consider splitting the costs: You can add an authorized user to your card for $195. I recruited my sisters to join me and my son in 2021 when the Platinum Card fee increased from $550 to $695. We split the $870 total between the four of us. (See the Platinum Card's rates and fees .)

Thanks to her card, Bond took $200 off her hotel stay at SLS Baha Mar and received a $100 experience credit to use during her stay.

Platinum Card travel benefits and perks

The Platinum Card has more than 20 travel benefits and perks —here is how I use a few of the most valuable ones. (Terms apply to travel benefits and perks; enrollment is required.)

My most used benefit is the $200 annual Uber Cash credit. I take a ride share to and from the airport when a complimentary hotel shuttle is unavailable. The credit breaks down to $15 per month with an extra $20 in December. If I don't spend the credit on transportation, I use it to order food through Uber Eats.

Then there is the annual hotel credit: I took advantage of the $200 credit for my prepaid two-night stay in the Bahamas at SLS Baha Mar . Because SLS is in the American Express Hotel Collection, I received a $100 experience credit to spend at designated restaurants, spas, or resort activities. When I checked in, an upgrade was available to an ocean view room, another benefit of reserving rooms in the Hotel Collection.

To avoid the stress of long lines while going through security screenings, my family takes advantage of the PreCheck credit. When you pay for a Known Traveler Number with your Platinum Card, you will receive an $85 credit. My son and I were both approved for TSA PreCheck and received an adjustment on our cards. Global Entry and Clear credits are available too.

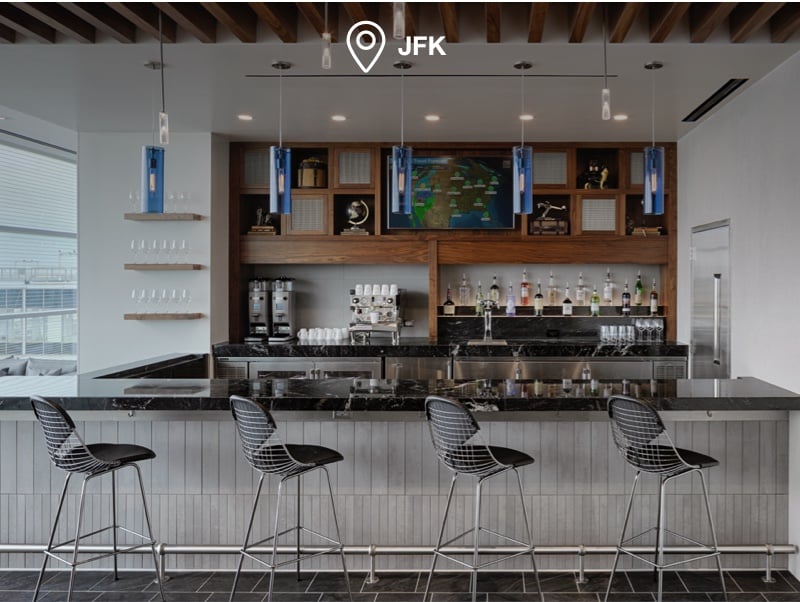

Another major perk of the card is access to the Global Lounge Collection, which includes Centurion, Escape, and Priority Pass Lounges. For now, two guests can tag along at no additional cost. If the rules change for lounge access, my authorized users can still enter because they have the same lounge benefits as me. On a recent trip to Las Vegas , my guest and I arrived at the Centurion Lounge in time to enjoy breakfast and lunch. The meals and cocktails would have cost more than $100. If your flight is on Delta, you will receive complimentary access to the Delta Sky Club. However, your guests will need to pay the $39 fee.

For those looking to maintain airline status, here is a travel hack that involves using the lounge perk: If it’s close to the end of the year and I’m short on segments, I will find a cheap flight on Southwest, fly early in the morning, hang out in a lounge, and take a flight home later that day. I do not spend money on food or waste points on a hotel, but I earn flights to keep my A-List status .

You can also use this hack to qualify for the Southwest Companion Pass Promotion every September to allow a companion to fly with you for free (taxes and fees apply) for two months starting in January. To take advantage of the promotion, register your Rapid Rewards number, purchase a round-trip or two one-way flights, and travel by the designated date. (To note, you cannot use points to book.) If you are not a Rapid Rewards member, register for free.

Because two checked bags fly free, I use the $200 airline fee credit to purchase alcoholic beverages on Southwest. You can also change your preferred airline every year in the benefits section of your AmEx portal. If you fly Delta, you may want to choose the airline as your preferred carrier and use the airline $39 fee credit to pay for your guest to enter the Sky Club.

By CNT Editors

By Todd Plummer

By Caitlin Morton

By Lale Arikoglu

When I checked in at the Marriott for a timeshare vacation package in August, I informed the front desk clerk of my Gold Elite Status. She upgraded my room from the seventh to the 30 th floor, where I watched the sunrise every morning. In addition, you also receive automatic Gold Status with Hilton Honors . However, you must be a member of each hotel reward program and enroll online or call the American Express Platinum Card Service for it to be enabled.

Current welcome offer

As of publication, new cardholders can earn 80,000 Membership Rewards points after spending $8,000 on purchases within their first six months of card membership.

How to earn points

Cardholders earn 5x points on flights booked directly with airlines or with American Express Travel, as well as 5x points on hotels booked with American Express Travel (on up to $500,000 in purchases per calendar year). While not as steep, you can earn 1x membership rewards points by paying for recurring expenses like cell phone and internet bills with your card. I set up my home security system and mobile accounts for autopay, and my son also uses autopay for streaming services with no added charge.

For those who are members of a Dining Rewards Program with a specific airline or hotel, know that you can link your Platinum Card to the program, too. You will earn both AmEx Membership Rewards points and points for your specific loyalty program. Lastly, it's worth noting I also earn points on all my authorized users' purchases.

How to spend/redeem points

You can use membership rewards points to pay eligible charges on the card, at check-out with select merchants, buy gift cards, book travel, or transfer points. Stack your benefits! Occasionally, I redeem points for Uber gift cards to add to my Uber account. I saved $354 off the cost of my reservation at SLS Baha Mar when I used the $200 Hotel Credit and applied 22,000 membership rewards points to the booking. Finally, I purchase and share Hilton Honors and Marriott Bonvoy gift cards with my authorized users.

The bottom line

American Express was the first company to offer me a card in 1986 after graduating from college. More than 20 years later, the Platinum Card is my ultimate travel card. On a trip to Washington, D.C., I booked a room at the Waldorf Astoria and walked straight to the Smithsonian Institution Museums. I also reserved a room at Lotte New York Palace and crossed the Macy's Thanksgiving Day Parade off my bucket list. I “ don't live life without it ,” and my travels have been elevated ever since.

See rates and fees for the Platinum Card here .

Condé Nast Traveler has partnered with CardRatings for our coverage of credit card products. Condé Nast Traveler and CardRatings may receive a commission from card issuers.

Packing List

By signing up you agree to our User Agreement (including the class action waiver and arbitration provisions ), our Privacy Policy & Cookie Statement and to receive marketing and account-related emails from Traveller. You can unsubscribe at any time. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

The 9 Best Credit Cards for Hotel Upgrades & Perks [2024]

Christine Krzyszton

Senior Finance Contributor

312 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3265 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1179 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![amex travel room upgrade The 9 Best Credit Cards for Hotel Upgrades & Perks [2024]](https://upgradedpoints.com/wp-content/uploads/2022/01/Conrad-New-York-Midtown-suite-living-room.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

The best credit cards for hotel upgrades — summary, best personal cards for hotel upgrades, best business cards for hotel upgrades, additional credit cards for hotel upgrades, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Upgraded Points: Expertise You Can Trust

Our seasoned and experienced team brings years of expertise in the credit card and travel sectors. Committed to integrity, we offer data-driven guides to help you find the card(s) that best fit your requirements. See details on our intensive editorial policies and card rating methodologies .

- Content by Leading Industry Experts

- Routine Updates and Fact-Checks

- First-Hand Credit Card Experience

- Shared Across 200+ Top Outlets

The U.P. Rating System

- 1039+ Expert Credit Card Guides

There are fewer ways to start your hotel stay on a more positive note than hearing the phrase: “You’ve been upgraded.” Whether it’s a more spacious room, a spectacular view, or both, receiving an upgraded experience for no extra charge is definitely a welcome perk.

There are several ways to secure an upgraded hotel room and other on-site benefits. One way is to meet the hotel loyalty program’s annual stay (and occasionally additional spending) requirements to achieve elite status. Elite status can qualify you for upgraded rooms, free Wi-Fi, breakfast, late checkout, and many more on-site benefits.

There is, however, a shortcut to receiving hotel program elite status or elite-style benefits: by simply holding a hotel-branded credit card or luxury credit card .

That’s the focus of today’s article. We’re taking a look at the best cards for securing upgraded hotel rooms and other on-site perks. We’ll dive into the top travel rewards cards that offer complimentary hotel loyalty program elite status, perks at specific hotel collection properties, free night certificates, and hotel-branded cards that offer much more than just an upgraded room.

If you’re looking for those elusive upgraded accommodations with a view, you’ll want to stick with us as we discuss the best cards for securing these perks — complimentary, of course.

Let’s review the upgraded hotel room benefits you’ll receive from each of our featured cards.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 125k (or 150k) points with the Amex Platinum. The current public offer is 80,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

The Amex Platinum card is well known for its premium travel benefits, earning valuable Membership Rewards, and flexible redemption options. It’s also a great card for hotel elite benefits, including those that offer upgraded rooms .

How the Card Upgrades Your Hotel Experience

You’ll have plenty of opportunities for upgraded rooms and other on-site perks using the Amex Platinum card with complimentary hotel loyalty program elite status and elite-style benefits at specific hotel groups.

Here are the hotel-related benefits that come with the card. Note that some benefits require enrollment so be sure you explore your benefits to get the most out of your card:

- In addition to room upgrades , Gold Elite status members receive the fifth consecutive reward night free, late checkout, free Wi-Fi, welcome points, and 25% bonus points earned on paid stays.

- You’d normally have to stay 25 nights in a calendar year to earn Marriott Bonvoy Gold Elite status and be eligible for upgraded rooms.

- Hilton Honors Gold status comes with free breakfast, room upgrades , the fifth consecutive award night free, late checkout, free Wi-Fi, and bonus points.

- To earn Hilton Honors Gold status, you would normally have to stay 40 nights or have 20 stays in a calendar year at Hilton properties.

- On stays of 2 nights or more, enjoy upgraded rooms whenever available. In addition, you’ll receive a $100 hotel credit to be used on qualifying dining, spa, and resort activities. Use your card to reserve the prepaid reservation and earn 5x Membership Rewards points.

- Receive room upgrades when available, daily breakfast for 2, late checkout, early check-in, free Wi-Fi, and a welcome amenity worth at least $100. No minimum stay is required.

- Get $200 back in statement credits each year on prepaid Fine Hotels + Resorts or The Hotel Collection bookings, which requires a minimum two-night stay, through AmexTravel.com when you pay with your card.

Hot Tip: Learn more about the Hotel Collection and Fine Hotels & Resorts in our overview and comparison of the benefits and perks of each program.

Why We Like the Card Overall

We like the Amex Platinum card for its long list of premium travel benefits, which includes worldwide access to more than 1,400 airline lounge properties . The card also earns valuable Membership Rewards points and comes with statement credits for specific purchases at Saks Fifth Avenue and Uber , for example.

Bottom Line: In addition to offering hotel elite status, statement credits, and benefits at luxury hotel collections, the Amex Platinum card earns Membership Rewards points that can be transferred to the American Express transfer partners where the points can be redeemed for free hotel nights and flights. The card also comes with travel/shopping protections and benefits and is one of the best cards around that helps you upgrade your flight experience, too.

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Member FDIC

- APR: 22.49%-29.49% Variable

Chase Ultimate Rewards

While the Chase Sapphire Reserve card does not come with hotel program elite status, the card does offer the opportunity for an upgraded experience at these hotel collection properties.

- Receive an upgraded room, when available, a local amenity unique to the property, such as dinner, spa, or resort credit, early check-in/late checkout when available, daily breakfast for 2, and free Wi-Fi.

- Enjoy an upgraded room, when available, a $30 hotel credit, the fourth night free, complimentary Wi-Fi, breakfast for 2 or a complimentary beverage, and late checkout.

- Receive a VIP welcome amenity and complimentary breakfast.

We like that the card comes with a complimentary Priority Pass Select membership that provides worldwide lounge access to over 1,400 properties. The card also offers elevated earnings on travel and dining and comes with a $300 travel credit that is easy to use, even for upgraded hotel rooms .

The card earns valuable Ultimate Rewards points that can be redeemed for travel at 50% more value via the Chase travel portal or transferred to the Chase transfer partners for even greater potential value. You’ll also find the card packed with premium travel insurance and shopping protections/benefits.

Hilton Honors American Express Aspire Card

Automatic Hilton Diamond status, an annual free night, and a travel and resort credit make this the perfect card for those who stay in Hilton hotels.

The information regarding the Hilton Honors American Express Aspire Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Paying hundreds of dollars for an annual fee on a co-branded hotel card might seem ridiculous, but you should know that the Hilton Honors American Express Aspire Card is much more than your run-of-the-mill hotel credit card.

The Hilton Aspire card is not only a phenomenal card for Hilton Honors loyalists , but even those who visit Hilton hotels just a few times a year can still get excellent value out of all the benefits that are packed into this card.

So let’s have a look at what makes the card so valuable to travelers.

- 14x points per $1 on Hilton purchases

- 7x points per $1 on select travel and at U.S. restaurants

- 3x points per $1 on all other purchases

- High annual fee of $550

- Earn 175,000 Bonus Points after you spend $6,000 in purchases on the Hilton Honors American Express Aspire Card in the first 6 months of Card Membership. Offer ends 7/31/2024.

- Earn 14x Hilton Honors Bonus Points when you make eligible purchases on your card at participating hotels or resorts within the Hilton portfolio .

- Earn 7x Hilton Honors Bonus Points for eligible purchases: on flights booked directly with airlines or amextravel.com, on car rentals booked directly from select car rental companies, and at U.S. restaurants.

- Earn 3X Hilton Honors Bonus Points for other purchases on your card.

- Enjoy up to $400 in Hilton Resort Credits (up to $200 in statement credits semi-annually) on your card each anniversary year when you stay at participating resorts within the Hilton portfolio.

- Enjoy complimentary Diamond status.

- $550 annual fee.

- APR: 20.99% - 29.99% Variable

The Hilton Aspire card is one of the best hotel-branded cards available and is known for offering a unique package of hotel-related perks just for having the card.

The Hilton Aspire card is the only hotel-branded card that comes with valuable top-level hotel elite status . With Hilton Honors Diamond status , you’ll enjoy the best that the Hilton Honors loyalty program has to offer.

Here are some of the hotel perks you’ll enjoy with the Hilton Aspire card:

- Free hotel night certificate after card approval and each card anniversary

- The benefits of Diamond status include upgraded rooms (even suites when available) , free breakfast or breakfast credit, lounge access, free Wi-Fi, bonus points, and a welcome amenity

- 14x earnings at Hilton properties when paying with your card

- Up to $400 Hilton Resort credit

- Up to $100 credit for a 2-night or more stay at Waldorf Astoria or Conrad properties

Without the Hilton Aspire card, you would need to stay 60 nights, 30 stays, or earn 120,000 points from stays in a calendar year to achieve top-level Hilton Honors Diamond status.

The Hilton Aspire card is packed with travel benefits.

The card comes with hundreds of dollars in statement credits for specific purchases including a $200 airline credit . In addition to elevated earnings at Hilton, you’ll receive 7x earnings on qualifying flights, car rentals, and at U.S. restaurants.

For those looking for a Hilton-branded card with a lower annual fee with complimentary Gold status and corresponding upgrade benefits, have a look at the Hilton Honors American Express Surpass ® Card .

To learn more about all the best Hilton-branded cards and the associated benefits, check out our complete overview.

Bottom Line: All Hilton-branded credit cards come with a generous welcome bonus that can be redeemed for free hotel nights, elevated earnings at Hilton, on-site benefits, and complimentary elite status. If you stay at a particular hotel brand even once or twice a year, you’ll benefit from having a hotel-branded credit card.

Marriott Bonvoy Brilliant ® American Express ® Card

A premium card for Marriott fans who want perks like an annual statement credit and Free Night Award, plus a fast track to Marriott elite status.

The Marriott Bonvoy Brilliant ® American Express ® Card is a premium card designed with road warriors and Marriott Bonvoy loyalists in mind.

So is the card a worthwhile addition to your wallet?

- 6x points per $1 at hotels participating in Marriott Bonvoy program

- 3x points per $1 on flights booked directly with airlines and restaurants worldwide

- 2x points per $1 on all other purchases

- Steep annual fee of $650 ( rates and fees )

- 6x points per $1 is the same earn rate offered with lower annual fee alternatives like the Marriott Bonvoy Bevy™ American Express ® Card

- Earn 95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership.

- $300 Brilliant Dining Credit: Each calendar year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made on the Marriott Bonvoy Brilliant ® American Express ® Card at restaurants worldwide.

- With Marriott Bonvoy Platinum Elite status, you can receive room upgrades, including enhanced views or suites, when available at select properties and booked with a Qualifying Rate.

- Earn 6X Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy ® . 3X points at restaurants worldwide and on flights booked directly with airlines. 2X points on all other eligible purchases.

- Free Night Award: Receive 1 Free Night Award every year after your Card renewal month. Award can be used for one night (redemption level at or under 85,000 Marriott Bonvoy points) at hotels participating in Marriott Bonvoy ® . Certain hotels have resort fees.

- Each calendar year after spending $60,000 on eligible purchases on your Marriott Bonvoy Brilliant ® American Express ® Card, you will be eligible to select a Brilliant Earned Choice Award benefit. You can only earn one Earned Choice Award per calendar year. See https://www.choice-benefit.marriott.com/brilliant for Award options.

- $100 Marriott Bonvoy Property Credit: Enjoy your stay. Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton ® or St. Regis ® when you book direct using a special rate for a two-night minimum stay using your Card.

- Fee Credit for Global Entry or TSA PreCheck ® : Receive either a statement credit every 4 years after you apply for Global Entry ($100) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck ® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant ® American Express ® Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

- Each calendar year with your Marriott Bonvoy Brilliant ® American Express ® Card you can receive 25 Elite Night Credits toward the next level of Marriott Bonvoy ® Elite status. Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express. Terms apply.

- Enroll in Priority Pass™ Select, which offers unlimited airport lounge visits to over 1,200 lounges in over 130 countries, regardless of which carrier or class you are flying. This allows you to relax before or between flights. You can enjoy snacks, drinks, and internet access in a quiet, comfortable location.

- No Foreign Transaction Fees on international purchases.

- With Cell Phone Protection, you can be reimbursed, the lesser of, your repair or replacement costs following damage, such as a cracked screen, or theft for a maximum of $800 per claim when your cell phone line is listed on a wireless bill and the prior month's wireless bill was paid by an Eligible Card Account. A $50 deductible will apply to each approved claim with a limit of 2 approved claims per 12-month period. Additional terms and conditions apply. Coverage is provided by New Hampshire Insurance Company, an AIG Company.

- $650 Annual Fee.

- APR: 20.99%-29.99% Variable

Marriott Bonvoy

With thousands of properties worldwide, Marriott Bonvoy offers one of the largest global hotel footprints. It’s a big plus for the Marriott Bonvoy Brilliant card that you have so many properties to enjoy your hotel benefits.

- Complimentary Marriott Bonvoy Platinum Elite status

- Earns 6x points per dollar spent at Marriott properties

- Annual free hotel night award worth 85,000 points

- 25 elite qualifying night credits each year towards Marriott Bonvoy elite status

- $100 property credit at Ritz-Carlton or St. Regis properties

- Free premium Wi-Fi

The Marriott Bonvoy Brilliant card offers 3x earnings on flights purchased directly from the airline and 2x earnings on all other purchases .

Every Marriott Bonvoy -branded card comes with hotel elite status or elite qualifying nights that help you reach higher elite status faster. Learn more about all of these cards in our article on the best cards for Marriott Bonvoy loyalists .

Just like personal hotel credit cards, these business cards offer travelers the opportunity for upgraded hotel experiences.

The Business Platinum Card ® from American Express

This card is ideal for business travelers who enjoy luxury travel and are looking for a card loaded with benefits!

The Business Platinum Card ® from American Express is a premium travel rewards card tailored toward business owners who are frequent travelers with a high number of annual expenses.

When you factor in the large number of perks that the card offers like the best airport lounge access at over 1,400 lounges , along with tons of annual credits, it’s easy to see why this card can is a top option for frequent traveling business owners.

Hot Tip: Check to see if you’re eligible for a huge welcome bonus offer of up to 170,000 points with the Amex Business Platinum. The current public offer is 150,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

- 5x Membership Rewards points per $1 on flights and prepaid hotels at Amex Travel

- Access to over 1,400 worldwide airport lounges as part of the American Express Global Lounge Collection

- Get 50% more Membership Rewards points (1.5 points per $1) on eligible purchases in key business categories, as well as on purchases of $5,000 or more (cap applies)

- High annual fee of $695 ( rates & fees )

- Airline fee credit does not cover airfare, only incidentals like checked bags

- Welcome Offer: Earn 150,000 Membership Rewards ® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

- 5X Membership Rewards ® points on flights and prepaid hotels on AmexTravel.com, and 1X points for each dollar you spend on eligible purchases.

- Earn 1.5X points (that’s an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card ® . Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card ® , here.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to the Card.

- $189 CLEAR ® Plus Credit: Use your card and get up to $189 in statement credits per calendar year on your CLEAR ® Plus Membership (subject to auto-renewal) when you use the Business Platinum Card ® .

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 03/2023.

- $695 Annual Fee.

- APR: 19.49% - 28.49% Variable

Hot Tip: Check to see if you’re eligible for a huge welcome bonus offer of up to 170,000 points with the Amex Business Platinum. The current public offer is 150,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

You’ll enjoy all the same hotel upgrade benefits with the Amex Business Platinum card as the personal consumer version — Gold Elite status with Marriott Bonvoy and Gold status with Hilton Honors, upon enrollment, plus elite-style benefits at American Express’ The Hotel Collection and Fine Hotels & Resorts.

We like that the Amex Business Platinum card earns valuable Membership Rewards points that can be redeemed for travel via AmexTravel.com or transferred to travel partners for the potential of even greater value.

In addition, you’ll find value in statement credits of up to $400 for Dell Technology purchases , and up to $200 credit for airline incidental fees .

With car rental benefits, shopping protections, and a long list of valuable travel insurance benefits, there’s plenty of value to derive from the card.

The Hilton Honors American Express Business Card

An excellent option for business owners and business travelers who stay at Hilton properties often and want perks like Hilton Honors elite status.

For frequent business travelers who regularly stay in Hilton hotels, The Hilton Honors American Express Business Card is a great option.

Not only will the card help you earn more points on all of your Hilton stays, but you’ll also receive automatic elite status and travel protections.

Here’s a detailed look at all the benefits this card offers so that you can determine if it’s a good fit for you.

- Earn 12x points per $1 on eligible Hilton purchases

- Earn 5x points on other purchases made for the first $100,000 in purchases each calendar year, 3x points thereafter.

- Complimentary Hilton Honors Gold status, and the ability to spend your way to Diamond status

- $195 annual fee ( rates and fees )

- Welcome Offer: Earn 130,000 Hilton Honors Bonus Points after you spend $6,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership.

- Earn 12X Hilton Honors Bonus Points on eligible Hilton purchases.

- Earn 5X Hilton Honors Bonus Points on other purchases made using the Hilton Honors Business Card on the first $100,000 in purchases each calendar year, 3X points thereafter.

- Enjoy up to $240 back each year for eligible purchases made directly with Hilton.

- Enjoy complimentary Hilton Honors™ Gold Status with your Hilton Honors Business Card. With Hilton Honors Gold status, you can enjoy benefits at hotels and resorts within the Hilton Portfolio. As a Gold member, earn an 80% Bonus on all Base Points you earn on every stay getting you to free nights faster.

- You may receive an upgrade to Hilton Honors Diamond status through the end of the calendar year if the total eligible purchases on your Card Account during a calendar year reach $40,000 or more.

- Enjoy complimentary National Car Rental ® Emerald Club Executive ® status. Enrollment in the complimentary Emerald Club ® program is required. Terms apply.

- Terms apply.

Hilton Honors loyalty program

Enjoy complimentary Gold status, with the opportunity to earn Diamond status after spending $40,000 on the Hilton Business Amex card in a calendar year.

You can expect these hotel benefits with Gold status:

- Free breakfast or breakfast credit, room upgrades to executive room level , and free Wi-Fi

- No resort fees on award stays

- 80% bonus points earnings on spending at Hilton properties

- Earn big when you stay at hotels and resorts in the Hilton portfolio

- Enjoy complimentary National Car Rental ® Emerald Club Executive ® status. Enrollment required.

- Receive up to $240 back each year for eligible purchases made directly with Hilton

If your business involves travel and staying at Hilton properties, investigate the Hilton Business Amex card to see if it could be a fit for your operation.

Your points will go further when you utilize Hilton’s fifth-night free benefit. Reward stays of 5 consecutive nights or longer receive a credit for the average of the rewards points spent.

Marriott Bonvoy Business ® American Express ® Card

A great option for business owners who stay in Marriott hotels and want automatic elite status.

Business travelers who opt for Marriott as their hotel chain of choice will definitely want to consider the Marriott Bonvoy Business ® American Express ® Card . The card offers great benefits to cardholders like a complimentary hotel night once a year, complimentary Gold Elite status, and multiple point redemption options.

- 6x Marriott Bonvoy points on each dollar of eligible purchases at hotels participating in the Marriott Bonvoy ® program.

- 4x points for purchases made at restaurants worldwide, at U.S. gas stations, on wireless telephone services purchased directly from U.S. service providers and on U.S. purchases for shipping.

- Moderate annual fee of $125 ( rates and fees )

- No premium perks like airport lounge access

- Limited Time Offer: Earn 5 Free Night Awards, valued at up to 50K points each for eligible stays. Offer ends 7/10. Resort fees & terms apply.

- Receive a 7% discount on eligible bookings as a benefit of being both a Marriott Bonvoy ® member & a Marriott Bonvoy Business ® American Express ® Card Member when you book directly with Marriott through an eligible channel for a participating property under the Amex Business Card Rate.

- 2x points on all other eligible purchases.

- Receive 1 Free Night Award every year after your Card renewal month. Plus, earn an additional Free Night Award after you spend $60K in purchases on your Card in a calendar year. Award can be used for one night (redemption level at or under 35,000 Marriott Bonvoy ® points) at hotels participating in Marriott Bonvoy ® . Certain hotels have resort fees.

- Enjoy Complimentary Marriott Bonvoy Gold Elite Status with your Marriott Bonvoy Business ® American Express ® Card.

Like the Marriott Bonvoy Brilliant card, the Marriott Bonvoy Business card comes with Gold Elite status. We like that the card provides a faster path to elite status, a free hotel night certificate each year, and elevated earnings at Marriott. The card also comes with a lower annual fee.

- Free hotel night certificate at card anniversary

- 6x earnings at hotels participating in the Marriott Bonvoy program

- 4x earnings at restaurants worldwide, U.S. shipping, U.S. wireless telephone services, and U.S. gas stations

- 2x earnings on all other purchases

For the Marriott Bonvoy business traveler loyalist, this card should be a consideration.

Hot Tip: American Express-issued cards all have access to Amex Offers that frequently contain hotel savings or bonus earnings. Recent examples include a $50 statement credit after making a $200 Marriott purchase, $50 back on a $250 Hyatt purchase, and $50 back on a $175 purchase at Hampton Inn or Hilton Garden Inn hotels. Both business and consumer personal cards are eligible for Amex Offers.

The World of Hyatt Credit Card

Having the World of Hyatt card enhances the benefits you’ll find with the popular and robust World of Hyatt loyalty program . You’ll receive complimentary entry-level Discoverist status that offers upgraded rooms at most Hyatt properties. The card also comes with an annual free hotel night , late checkout, waived resort fees, and bonus points on Hyatt stays.

The World of Hyatt card offers a fast track to Hyatt elite status, an annual free night, and up to 9x points per $1 on Hyatt stays.

The World of Hyatt Credit Card makes your Hyatt stays more rewarding and helps you get coveted World of Hyatt elite status faster. This card is a must-have for any traveler who regularly stays at Hyatt hotels, or even for anyone who’s able to take advantage of the card’s annual free night certificate.

When you factor in all the benefits the World of Hyatt card offers, it’s easy to see why it is one of the best co-branded hotel credit cards on the market.

- Up to 9 points total for Hyatt stays: 4 Bonus Points per $1 spent at Hyatt hotels and 5 Base Points per $1 from Hyatt as a World of Hyatt member

- 2x points per $1 at restaurants, on airline tickets purchased directly from the airline, local transit, rideshares, and fitness clubs/gym memberships

- 1x point per $1 on all other purchases

- $95 annual fee

- Earn 30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening. Plus, up to 30,000 More Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Point, on up to $15,000 spent.

- Enjoy complimentary World of Hyatt Discoverist status for as long as your account is open.

- Get 1 free night each year after your Cardmember anniversary at any Category 1-4 Hyatt hotel or resort

- Receive 5 tier qualifying night credits towards status after account opening, and each year after that for as long as your account is open

- Earn an extra free night at any Category 1-4 Hyatt hotel if you spend $15,000 in a calendar year

- Earn 2 qualifying night credits towards tier status every time you spend $5,000 on your card

- Earn up to 9 points total for Hyatt stays - 4 Bonus Points per $1 spent at Hyatt hotels & 5 Base Points per $1 from Hyatt as a World of Hyatt member

- Earn 2 Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airlines, on local transit and commuting and on fitness club and gym memberships

- APR: 21.49% - 28.49% Variable

World of Hyatt

With a stellar welcome bonus, and up to 9x earnings at Hyatt, it’s easy to earn free nights, plus, earn 2x spent at restaurants, on airline tickets purchased directly from the airlines, on local transit and commuting and on fitness club and gym memberships.

If you’re a small-business owner, you may also want to check out the newly launched World of Hyatt Business Credit Card that offers big earning potential and an easier path to Globalist status.

Hot Tip: Qualification requirements for earning World of Hyatt elite status have been reduced for 2021. Learn more about the value of elite status, more details on the benefits at each level, and how to qualify .

IHG One Rewards Premier Credit Card

The perfect card for IHG fans, offering a free night every year, automatic Platinum Elite status, and your fourth night free on award stays.

If you regularly visit IHG hotels throughout the year, then the IHG One Rewards Premier Credit Card is probably a perfect card to have in your wallet.

The IHG Premier card offers a great bundle of perks and benefits, including automatic Platinum elite status, an annual free night certificate, and travel protections.

- Up to 26x points per $1 on IHG stays

- 5 points per $1 spent on purchases on travel, at gas stations, and restaurants

- $99 annual fee

- Does not earn transferable points

- Earn 140,000 Bonus Points

- Enjoy an Anniversary Free Night at IHG Hotels & Resorts. Plus, enjoy a fourth reward night free when you redeem points for a consecutive four-night IHG ® hotel stay.

- Earn up to 26 total points per $1 spent when you stay at IHG Hotels & Resorts

- Earn 5 points per $1 spent on purchases on travel, at gas stations, and restaurants. Earn 3 points per $1 spent on all other purchases

- Automatic Platinum Elite status as long as you remain a Premier cardmember

- Global Entry, TSA PreCheck ® or NEXUS Statement Credit of up to $100 every 4 years as reimbursement for the application fee charged to your card

- IHG One Rewards Bonus points are redeemable at Hotels & Resorts such as InterContinental ® , Crowne Plaza ® , Kimpton ® , EVEN ® Hotels, Indigo ® Hotels & Holiday Inn ®

We like the IHG brand because you can find an IHG property just about anywhere. And if you stay at IHG properties, even occasionally, you’ll be pleasantly surprised at how the IHG Premier card can earn you free nights and improve your IHG experience.

Here are the features and benefits you can expect from having the card:

- An annual free hotel night certificate at card anniversary

- Complimentary Platinum Elite status

- Earn up to 26 points total per $1 spent when you stay at an IHG hotel

- Earn 5 points per $1 spent on purchases on travel, gas stations, and restaurants.

- Earn 3 points per $1 spent on all other purchases

Platinum Elite status comes with room upgrades , late checkout, 60% bonus points at most properties, free Wi-Fi, and guaranteed room availability. To earn Platinum Elite status, members would normally need to stay 40 nights or earn 60,000 points in a calendar year.

To learn more about elite benefits in the IHG One Rewards program , check out our article where we go into more detail.

If you spend even a few nights a year at a specific hotel brand, you’ll benefit from having a hotel-branded credit card . At the very least, you’ll earn reward points faster, which allows you to redeem for more free hotel nights and receive on-site benefits that make your stay more comfortable. Many cards offer complimentary hotel loyalty program elite status and even free night certificates plus you’ll even find a few without annual fees.

Most points don’t expire as long as you have the associated card, so even if you don’t stay at a hotel brand frequently, you can take your time earning your next free hotel night while enjoying the perks of a hotel-branded card.

If you stay frequently at a specific brand, a hotel-branded card or premium travel rewards card could deliver even greater value.

We’ve given you an overview of some of the hotel-related benefits that come with our featured cards, but there may be even more features and benefits offered on each card — the most significant being credit cards with travel insurance benefits and protections, and also shopping benefits and protections. Prior to applying for any card, you’ll want to review the card’s entire earning, redemption, and benefits package plus the applicable rates and fees.

The information regarding the Hilton Honors American Express Aspire Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding The World of Hyatt Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Business Platinum Card ® from American Express, click here . For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Hilton Honors American Express Business Card, click here . For rates and fees of the Marriott Bonvoy Brilliant ® American Express ® card, click here . For rates and fees of the Marriott Bonvoy Business ® American Express ® Card, click here . For rates and fees for The Hilton Honors American Express Surpass ® Card, click here .

Frequently Asked Questions

What is the best credit card for getting upgraded hotel rooms.

The best card for securing upgraded hotel rooms is the one that aligns with the brand you frequent and your spending mix.

For example, if Hyatt is your brand of choice, you’ll want a card that offers upgraded rooms, elevated earnings, and good-value redemptions at Hyatt.

To dig deeper into hotel-branded cards, check out our recommendations for Marriott Bonvoy loyalists , Hilton Honors loyalists , frequent guests at IHG , and those who prefer World of Hyatt .

You’ll also find plenty of hotel elite and elite-style benefits on premium travel rewards cards.

What credit score do I need for a hotel credit card?

It depends on the specific hotel-branded card, but you will generally need a very good to excellent credit score to be approved for a Marriott, Hyatt, or Hilton hotel-branded credit card. According to Equifax, a very good score ranges from 740 to 799, and an excellent score is 800 and above.

Other hotel-branded cards may grant approval with just a good credit score, which is considered 670 to 739.

Of course, the higher your score, the more likely you will be approved.

Are hotel credit cards worth it?

If you frequent a particular hotel brand, its branded card can definitely be worth it.

You could receive elevated earnings on your spending at that property, upgraded rooms, on-site amenities, special room rates, free hotel nights, and other hotel benefits that make having a hotel-branded card worthwhile.

How does the fifth night free work?

One benefit that comes with joining some hotel loyalty programs is the opportunity to receive your fifth hotel reward night free.

Marriott Bonvoy offers the fifth consecutive reward night free for program members and Hilton Honors offers the fifth consecutive reward night free for its elite members.

Marriott Bonvoy simply charges points for the first 4 nights and then no charge for the fifth night. Hilton Honors applies an average credit based on all 5 nights and charges the reduced amount after the credit is applied.

The IHG One Rewards program offers a fourth-night free benefit to those with an IHG-branded credit card.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex travel room upgrade CareCredit® Credit Card — Review [2024]](https://upgradedpoints.com/wp-content/uploads/2020/05/Synchrony-CareCredit-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Inspiration

- Destinations

- Places To Stay

- Style & Culture

- Food & Drink

- Wellness & Spas

- News & Advice

- Partnerships

- Traveller's Directory

- Travel Tips

- Competitions

All products are independently selected by our editors. If you buy something, we may earn an affiliate commission.

How to get a free hotel upgrade: 5 tips that actually work

By Olivia Morelli

Arriving at a hotel to discover you’ve been upgraded to a room with more space, extravagant facilities and breathtaking views for no extra cost is a feeling like no other. Some people seem to get very lucky when it comes to freebies or upgrades, but for most of us that scenario is nothing but a pipe dream. We asked some of our favourite travel insiders and hotel experts for their top tips on how to maximise your chances of getting a free hotel upgrade.

Travel during the off-season

Naturally, when a hotel is fully booked and staff are rushed off their feet it’s unlikely that there is much chance of an upgrade. “Guests are more likely to be eligible for upgrades during quieter times, whether that means travelling in the low or shoulder seasons or opting for mid-week stays,” says Michael Caines, UK & Ireland delegate for Relais & Châteaux and chef-owner of Lympstone Manor .

“This is when availability is typically higher and hotels may choose to offer complimentary upgrades upon check in, as it’s in their best interest to provide their guests with the best experience possible,” he explains. There are other benefits to travelling in the off-season , too. You’ll get crowd-free access to typically jam-packed tourist attractions, tables at those otherwise impossible-to-book restaurants, and, more likely than not, cheaper hotel rates, with or without upgrades. Plus, it’s a more sustainable way to travel – visiting during low season helps spread the benefits of tourism to the destination across the year, and placing less emphasis on visiting at peak weather periods could result in an increased appreciation of culture and other local experiences.

Join hotel loyalty programmes

Booking your room directly with the hotel can increase your chances of getting a free upgrade. Most hotels don’t have access to the booking systems of third-party sites, so wouldn’t be able to upgrade guests even if they wanted to. Hotel loyalty programmes are a great way to let a property know how valued their services are, and also make sure you reap the benefits of booking directly. “Keep returning to your favourite hotel and you will always be assured of an upgrade if one is available,” says Neil Kedward, founder and owner of Seren , a hospitality agency dedicated to showcasing the very best places to see, eat and stay in Wales . “Good hotels will identify you as a regular customer and hence a VIP in their minds.”

“If you’re staying with one of the major brands like Hyatt, Hilton, Marriott or IHG, among others, having elite status is a great way to improve your chances of getting an upgrade — especially if you have top-tier status,” Tanner Saunders, senior hotels report at The Points Guy , tells us. “Historically, top-tier Hyatt Globalists have the best luck with upgrades (and the most tangible perks across the board).”

Relais & Châteaux also offers perks for booking directly. “If you book one of the ‘Routes du Bonheur’ itineraries through Relais & Châteaux’s concierge service, you’ll get access to a range of benefits and discounts of up to 15 per cent,” Michael explains. “Some properties offer benefits such as welcome gifts, meals or even a complimentary upgrade when redeeming one of our gift boxes.”

Learn about the perks of using hotel booking sites

Having said that, there can be benefits to booking hotels through certain third-party sites. “You can also get potential room upgrades by booking through a luxury travel advisor at a company like Virtuoso or through websites like Skylark,” Tanner explains.

“The easiest way to get an upgrade from my experience is by using Tablet Hotels , a hotel curation site, or another similar programme which guarantees you an upgrade at check-in, when available,” Andrew Kelly comments. Andrew is the owner and managing director of The Bradley Hare , a cosy pub hotel in a storybook village in Wiltshire. “The price point is quite important. If you are at an Aman or a similar top-end hotel, and you simply ask if any other rooms are available, they will almost always upgrade you, depending on availability. I once got a quadruple upgrade in St. Moritz – I booked through Tablet, and as it was the off-season, they gave me another upgrade. Then, unfortunately for the hotel, the bathroom flooded, and they had to upgrade me again – this time to a full suite!”

“My main reliable source of a room upgrade without paying extra is Booking.com ,” says Katy Maclure, editor of The Detour, a weekly newsletter from Jack’s Flight Club . “I’ve used the platform so many times that I now get free room upgrades as a perk of Genius Level 3. “You usually won’t find yourself in a presidential suite, but getting bumped to a king room instead of a double certainly doesn’t do any harm. The other mega perk of being Genius Level 3 is the free breakfasts.”

By Becky Lucas

By Jessica Puckett

By Marti Buckley

By Trish Lorenz

At Booking.com, there are three levels of loyalty perks. Genius Level 1 offers instant 10 per cent discounts for certain hotels, Genius Level 2 increases that discount to 15 per cent and throws in free breakfasts and potential upgrades on select stays, and Genius Level 3 pushes the discount to 20 per cent and increases the likelihood of upgrades. “It says you get free room upgrades from level 2, but I’ve certainly noticed a lot more of them since I reached level 3,” Katy tells us.

Use a credit card when booking hotels

“If you’re not a super frequent traveller or you don’t have elite status at hotels or booking sites, that doesn’t mean you’re out of luck,” Tanner says. “Depending on how you book, you can also have a shot at getting an upgrade. If you have the right American Express card, booking through Amex Fine Hotels + Resorts is a great way to get potential room upgrades at many luxury hotels, along with other perks like free breakfast, a credit to use on dining or the spa, plus guaranteed late check out.”

American Express card members get access to a whole bunch of perks when travelling. Platinum card holders can get free room upgrades at Fine Hotels + Resorts properties when booking on Amex Travel, and other benefits include access to airport lounges and 20 per cent off certain airline fees, for example.

“My husband travels a lot for work and can collect Avios points through his American Express card. In the past, we have qualified for premium flights with companion vouchers and have booked flights to a long haul destination travelling in economy one way and business class return (often to ensure a better sleep before going back to work),” says Lauren Burvill, Traveller’s commerce editor. “It’s happened a couple of times where we’ve found out these flights have been upgraded when we get to the airport, with the economy leg often getting bumped up to premium or business class. It makes the journey so much more enjoyable, and if there’s a chance of being upgraded at the hotel, too, then even better.”

You’d be surprised at how many hotel guests can be quite unfriendly after a long flight or unexpected delays to their journey. Being courteous and kind always goes a long way, but never more so than when you’re hoping for a free upgrade. “Being nice and making the time to have a good conversation with the reservationist to build a great relationship from the outset,” advises Neil. “A good team member will remember your conversation and will always do the best for you on the day if they can.’

Tanner agrees. “If all else fails, you can always simply ask about upgrades when you’re checking in. If something’s available, a little kindness and a smile might get you an upgrade, or a hotel may offer you a paid upgrade at a discount if you just ask,” he tells us. “I’ll never forget being offered a $100 (£78.95) upgrade at the Waldorf Astoria in New York City before it closed — and that $100 moved me from an entry-level room to a massive, multi-room corner suite easily worth quadruple my original room rate.”

More pieces from Condé Nast Traveller

Sign up to The Daily for our editors' picks of the latest and greatest in travel

Expert advice on how to avoid getting hit by extra costs when flying

The ultimate guide to getting through airport security quickly

The real reason you can’t use your phone on a plane

How to pop your ears on a plane : 9 tricks for relieving ear pressure, according to medical experts

- Burner Phones

- Free Trials

- How To Cancel

- Unban Account

- Top Features

How to Snag Hotel Upgrades with Your American Express Cards

Traveling can be an exciting experience, regardless of whether you're going on a business trip or planning for a much-deserved vacation. When it comes to flights, hotels, and accommodations across the board, finding the best deal can be tricky. Many travel sites and hotels will offer a steal of a deal at face value but host underlying fees in the fine print. Fortunately, when you're looking for the best bargains without cheating yourself out of quality service, you can often get a better deal by utilizing American Express hotel upgrades than the "low prices" you see on booking sites.

The credit card service offers a surplus of perks when it comes to traveling, partnering with various hotels across the globe to bring you the best offers. So, once you've booked your hotel of choice, how can you continue to take advantage of the perks and use American Express hotel upgrades to your benefit?

Types of Upgrades You Can Get With American Express

Getting a better room with a nicer view isn't the only upgrade you can look forward to when it comes to using your Platinum American Express card. Some include:

- enjoy a $100 hotel credit to use on dining, spa, or resort activities, when staying at one of the partner hotels

- take advantage of an earlier check-in and later check-out

- daily breakfast for two

- get a free room for your stay if you book with points

Some hotels will include private transportation to and from the airport when using your Platinum Amex to book. Keep in mind, upgrades vary by location and the hotel's ability to accommodate . Fortunately, there are over 1,800 hotels to choose from when it comes to traveling in luxury .

How to Use Your American Express to Get a Hotel Upgrade

In many situations, getting a hotel upgrade is as simple as asking for it upon check-in. Many hotels offer loyalty programs that are similar to credit card rewards - when you book a stay with them, you receive points at the end of your stay. As far as getting an American Express hotel upgrade , it helps to use your Amex card when booking a stay at one of the Collection's hotels. Depending on the hotel and its current inventory, you can utilize your Amex member status to upgrade from a Deluxe or Superior room to a Suite .

American Express allows you to enroll in what's called their 'elite status' level with a simple phone call or online via your account . It's as simple as logging in to your American Express account and visiting the benefits page. From there you can request to be added to the hotel loyalty program. When calling, all you'll have to do is call the number on the back of your card and provide your loyalty membership number for any hotels you're already enrolled with, and request for your account to be upgraded to the hotel loyalty program for Amex.

Once your account has been upgraded, using your American Express to get a hotel upgrade is incredibly simple. You can access the American Express Collection to find a hotel for your needed destination and your gold member status will automatically give you a head start at getting the best upgrades .

Other ways to get a few extra benefits to include but are not limited to:

- Requesting a room with a view or a room with more space in the special requests section while booking

- Paying with Points

- Calling or emailing the hotel to ask about upgrades

- Mentioning the occasion (birthday, anniversary, etc)

All of this information may sound like a lot to do just to get a hotel upgrade, and it can be time-consuming if you're not familiar with all of the benefits American Express offers. Luckily, DoNotPay can handle all of the hassle for you at no extra cost. You'll get the same potential upgrades without the stress of figuring out which hotel has the best offers.

How to Get American Express Hotel Upgrades Using DoNotPay

If you want to get an upgrade using your American Express but don't know where to start, DoNotPay has you covered in 4 easy steps:

Why Use DoNotPay to Get an American Express Hotel Upgrade

There are a lot of reasons why you should choose DoNotPay such as:

More Ways You Can Get a Hotel Upgrade With DoNotPay

Want to take advantage of more hotel rewards with DoNotPay? Check out the deals below:

- Wyndham Hotel Rewards

- Hilton Hotel Rewards

- Choice Hotel Rewards

- How to get an Upgrade at a Sold Out Hotel

- Hotel Upgrade Secrets in Las Vegas

- How to Ask for a Free Hotel Room

Want your issue solved now?

Solve your problem.

Let DoNotPay solve this problem for me.

Hassle Free

We have helped over 300,000 people with their problems. Sit back and relax while we do the work.

Relevant posts

Recent posts.

- Best Overall

- Best for No-Annual-Fee

Best for Independent Hotel Purchases

- Best for Beginners

- Best for Everyday Spending

- Best for Students

- Best Premium Travel Card for Affordability

- Best for Dining and Groceries

- Best for Travel Insurance

- Best for Luxury Travel Benefits

- Why You Should Trust Us

Best Travel Credit Cards of June 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .