Credit cards with travel insurance for 2024

Does your credit card come with travel insurance as an added perk find out here..

In this guide

Credit cards with travel insurance comparison table

Priority pass discounts, which credit cards offer free travel accident insurance, american express preferred rewards gold credit card, amex cashback everyday credit card, british airways american express credit card, british airways american express premium plus credit card, american express rewards credit card, benefits of paying for a holiday on a credit card, what is covered.

- What isn't covered?

How to file a claim with a credit card issuer

Frequently asked questions.

We compare the following card issuers

Credit cards have a number of benefits. Perhaps the most obvious is that they can help you break down the cost of an expensive purchase into more manageable payments over several months – ideally interest-free. But some also come with a range of perks, such as travel insurance.

However, rather than being offered comprehensive travel insurance with your credit card, you’re most likely to be offered “travel accident insurance”. This will cover accidental death or accidents resulting in a permanent injury. How much cover you get will depend on the card and whether you need to pay an annual fee.

Lounge access with Priority Pass

Some of the credit cards that offer free travel accident insurance are outlined below. You’ll notice that all of these are American Express cards.

The Amex Preferred Rewards Gold credit card has an annual fee of £140 (£0 in the first year) and offers the following:

- Travel accident insurance of £250,000 for accidental death or accidents resulting in complete loss of or permanent loss of use of limb, sight, speech or hearing while travelling on a public vehicle where the ticket was bought on the card account.

- Cover for flight delays, overbooking or missed connections of up to £200 if no alternative is made available within 4 hours of the published departure time.

- Baggage delay cover of up to £200 per person for reimbursement costs of essential items if your checked-in baggage has not arrived at your destination within 4 hours of your arrival. This limit increases by an additional £200 if your baggage does not arrive within 48 hours of your arrival.

The Amex Platinum Cashback Everyday credit card has no annual fee and offers the following:

- Travel accident insurance of £150,000 for accidental death or accidents resulting in complete loss of or permanent loss of use of limb, sight, speech or hearing while travelling on a public vehicle where the ticket was bought on the card account.

Travel delays are not covered.

The British Airways American Express credit card has no annual fee and offers the following:

- Travel accident insurance of £75,000 for accidental death or accidents resulting in complete loss of or permanent loss of use of limb, sight, speech or hearing while travelling on a public vehicle where the ticket was bought on the card account.

The British Airways American Express Premium Plus credit card has a £250 annual fee and offers the following:

- Cover for flight delays, overbooking or missed connections of up to £200 if no alternative is made available within 4 hours of the published departure time. Up to an additional £400 is payable for overbookings only if alternative arrangements are not provided within 6 hours.

- Baggage delay cover of up to £750 for reimbursement of costs of essential items following baggage delay by an airline for 6 hours. Up to an additional £1,000 is available if baggage has not arrived within 48 hours of your arrival time.

The Amex Rewards credit card has no annual fee and offers the following:

Although you won’t get full travel insurance with your credit card, paying for a holiday on a credit card gives you protection through Section 75 of the Consumer Credit Act. This means that if your holiday costs more than £100 and up to £30,000, and you paid either a deposit or the full price on your credit card, you should be able to claim your money back if something goes wrong. Examples include if your airline or holiday company goes under or if the trip isn’t as described.

The cost of your flights or holiday must be more than £100 to be covered, but you don’t have to have paid more than £100 on the credit card to qualify. Instead, it’s the cash price of the holiday or flights that matters. Provided your holiday cost more than £100, even if you only paid a deposit of £50 on your credit card and paid the rest in cash or on a debit card, you’ll still be covered for the full amount.

Under Section 75, you’ll be covered against the following:

- The travel company, airline or accommodation provider going bust

- The holiday not being as described

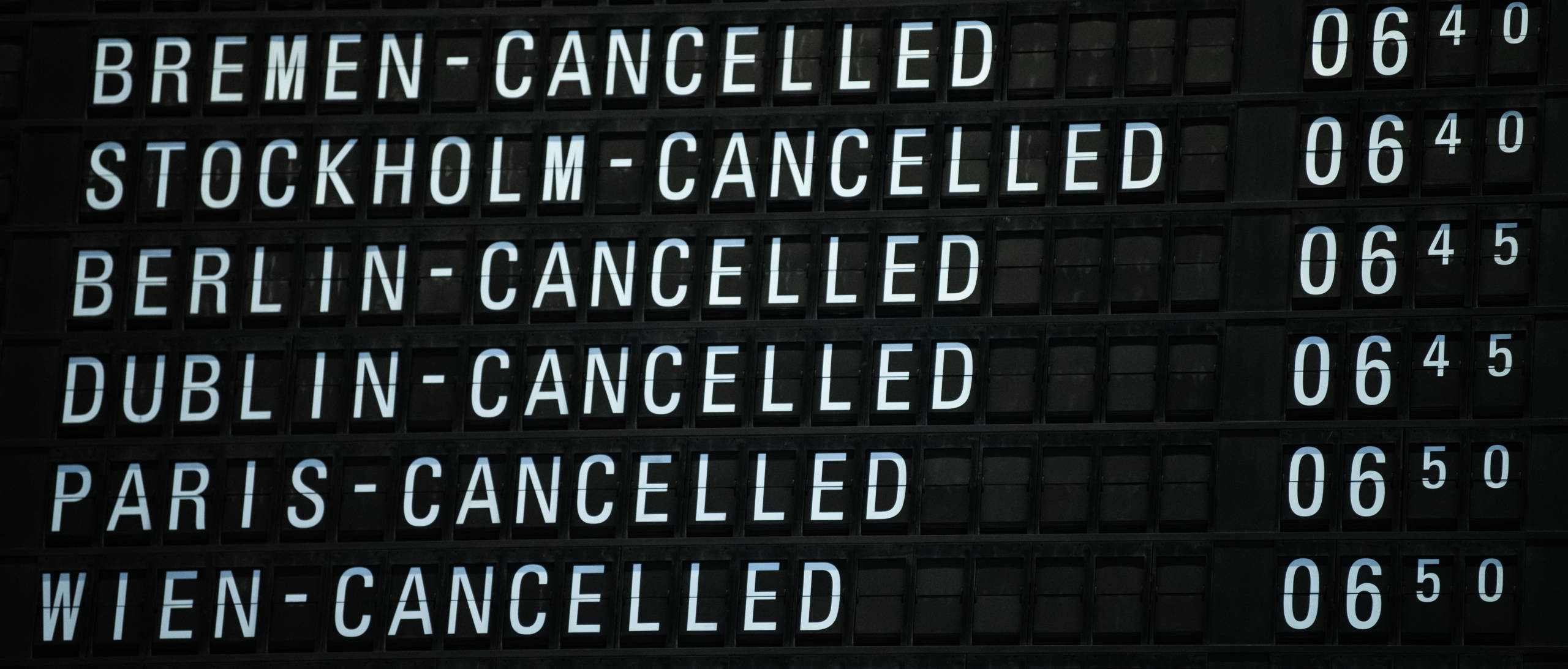

- Your travel provider cancelling the holiday

- Additional expenses that you have to pay for through no fault of your own – for example, if you have to pay for more expensive flights to get home after an airline goes bust

What isn’t covered?

Section 75 won’t cover you in the following circumstances:

- You decide not to take your holiday

- You withdrew cash on your credit card to pay for the holiday

- An additional cardholder paid for a holiday that the primary cardholder won’t be going on

- You bought your holiday through intermediaries such as PayPal – although this will depend on the seller. Note that if you bought your holiday through a travel agent, your ability to claim on Section 75 will depend on who took your payment and what it was for. If the travel agent sold you a package holiday that they put together, you will usually be covered as the travel agent is a party to the contract.

Section 75 means that your credit card company is jointly liable with the holiday firm if something goes wrong. If you need to make a claim, it’s generally best to approach the holiday company first to see if they can help. But if they don’t reply, or if you are able to contact them because they have gone into administration, for example, you can go straight to your credit card company.

The process of making a Section 75 claim can vary depending on the provider. In some cases, you can do this through your mobile banking app or by speaking to someone via an online chat service. In other cases, you will need to contact your card provider by phone or by filling in an online form.

When you make your claim, it’s important to include as much detail as possible as well as any receipts of your purchase. If you’ve already approached the holiday firm, include any evidence of this if you can. Explain what you would like your credit card provider to do, which will usually be to issue you with a full refund, and keep a record of all communication.

If you cannot resolve the issue with either the holiday or card company, you can contact the Financial Ombudsman Service, which can independently assess the case. You must do this within 6 months of your claim being rejected.

Is a credit card with travel insurance all you need?

What's covered under trip cancellation insurance.

Rachel Wait

Rachel Wait is a freelance journalist and has been writing about personal finance for more than a decade, covering everything from insurance to mortgages. She has written for a range of personal finance websites and national newspapers, including The Observer, The Mail on Sunday, The Sun and the Evening Standard. Rachel is a keen baker in her spare time. See full bio

More guides on Finder

Use our calculator to find out how long it would take to clear your credit card balance by making the minimum required payments vs paying a fixed amount each month.

We look at the average APR on credit cards in the UK and how credit card interest rates have changed over time.

£551.3 million was lost to credit, debit and payment card fraud in the UK in 2023. We look at the latest statistics on card fraud in the UK.

Onmo is making its debut into the credit card market with its new card offering limits starting from £200. Here’s what we know so far.

The Yonder credit card has launched in the UK, using open banking to create a personalised picture of your spending habits to help you get the most out of your credit card.

Keebo has launched the UK’s first open-banking credit card, but how does it weigh up against other credit building cards?

Compare student credit cards with low or no annual fees, competitive interest rates and interest-free days to manage your finances and build your credit.

Metro Bank’s no-frills card comes with a single competitive rate and no fees on overseas transactions within Europe.

Get cashback on your purchases with a cashback credit card. Redeem rewards points for cashback or gift cards. Find out more in our guide.

Buy now and pay interest later with a 0% purchase credit card. Compare current offers with 0% p.a. on purchases.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to AmEx Platinum Travel Insurance

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Table of Contents

When does the AmEx Platinum travel insurance kick in?

Amex platinum travel insurance benefits and limits, how to make an amex travel insurance claim, what if the card’s insurance benefits are insufficient, the platinum card® from american express travel insurance, recapped.

Travel insurance can provide peace of mind when you’re away from home, especially when you’ve spent significant money on your vacation. Although you can choose to buy a separate travel insurance policy, not everyone wants or needs to do so.

Many travel credit cards offer complimentary insurance for a variety of occurrences. The Platinum Card® from American Express offers travel insurance with a suite of benefits for eligible travelers, including coverage for trip interruption, rental car damage and lost luggage.

Let’s take a look at travel insurance on The Platinum Card® from American Express , its limits and the benefits it provides.

» Learn more: What is travel insurance?

So, does The Platinum Card® from American Express have travel insurance? The short answer to this is yes, but you’ll need to meet specific requirements for it to apply.

To get coverage from your card, you’ll need to use it to pay for your trip in its entirety. This is true whether you’re looking to utilize the trip insurance or the rental car insurance — you must pay for the full cost with The Platinum Card® from American Express .

Be aware of coverage limitations if you’re traveling using points or miles. While it’s possible to receive benefits when using your card to pay the taxes and fees on a reward redemption, coverage may not always apply.

You may still be covered for trip interruption, delay, and cancellation insurance when using points or frequent flyer miles.

However, rental car and baggage insurance only apply when you’ve used your card to pay for the full cost of whatever you’re buying — no points allowed. The exception is if you redeem American Express Membership Rewards to pay for some or all of the booking.

» Learn more: How does credit card travel insurance work?

We’ve included a breakdown of all the insurance benefits and other travel protections provided by The Platinum Card® from American Express .

Trip cancellation protection

The trip cancellation insurance you’ll receive will pay for any nonrefundable losses you incur due to a covered event.

Given the current climate, you may also be wondering: does The Platinum Card® from American Express travel insurance cover COVID? It can, depending on the reason you need to cancel. Covered events include quarantine imposed by a physician or illness for you, your family members or a traveling companion.

Other eligible events include a change in military orders, inclement weather or jury duty.

If you need to cancel your trip, AmEx will provide up to $10,000 per trip and a maximum of $20,000 every 12 months. Terms apply.

» Learn more: The guide to American Express travel insurance

Trip interruption coverage

As with trip cancellation protection, trip interruption insurance will reimburse you for nonrefundable losses by a covered event.

If your trip is interrupted, American Express will cover you for prepaid land, air and sea travel bookings you’ve missed. They’ll also pay for the cost of an economy-class ticket on the most direct route to rejoin your covered trip (or take you home).

The maximum benefit you’ll receive is $10,000 per trip and up to $20,000 every 12 months. Terms apply.

Trip delay insurance

As it sounds, trip delay insurance will reimburse you for expenses incurred when your trip doesn’t go as scheduled. In the case of The Platinum Card® from American Express , coverage kicks in after you’ve been delayed by at least six hours for a covered reason.

Covered purchases may include food, toiletries, lodging, medication and other personal use items. You’ll be reimbursed for up to $500 on a covered trip and can make two claims within a 12-month period. Terms apply.

Rental car insurance

The Platinum Card® from American Express provides secondary rental car insurance . This means it’ll kick in after other claims — like those made to your personal insurance — have been paid. To activate coverage, you’ll need to decline the insurance offered by the rental car company.

AmEx will provide up to $75,000 due to damage or theft of the rental vehicle, but be aware that the policy doesn’t provide liability insurance.

It’ll also give you up to $1,000 per person (max of $2,000) for personal property lost in the incident and up to $5,000 for accidental injury. Finally, you’ll receive up to $300,000 for accidental death or dismemberment, though the rates will vary depending on the severity of your injuries.

This rental car insurance is valid worldwide with a few notable exceptions, including Australia, Italy and New Zealand. Terms apply.

» Learn more: Credit cards that provide travel insurance

Baggage coverage

Cardholders and their families are eligible for baggage insurance provided they’ve paid for the fare using The Platinum Card® from American Express . This benefit is only for lost baggage; delayed luggage is not protected.

Coverage limits vary depending on whether you’ve checked your bag or carried it on:

Checked bags: Up to $2,000 per person.

Carry-on: Up to $3,000 per person.

Note also that checked baggage is only covered when you’re actually traveling with a common carrier. Meanwhile, carry-on luggage is also covered when traveling to and from or waiting at the terminal.

There are also specific limits for high-risk items such as jewelry and electronic equipment. For these items, you’ll receive a maximum of $1,000 per person per trip. Terms apply.

» Learn more: Baggage insurance explained

Premium Global Assist

What else does The Platinum Card® from American Express travel insurance cover? Although this last benefit isn’t technically a type of travel insurance, it’s worth including as it can offer help while you travel.

AmEx’s Premium Global Assist hotline is a 24/7 service that can assist you in various ways, such as helping you get a new passport, finding translation services and even arranging for emergency medical evacuation.

Although using Premium Global Assist is free, the services that you may end up using are not necessarily covered by AmEx.

There are exceptions to this — if you need repatriation of mortal remains, emergency medical evacuation or if a child under 16 is left without care, AmEx will provide aid at no additional cost. Terms apply.

To file a claim, you’ll need to contact your benefit administrator. The phone number and timeframe will vary according to the type of insurance you’re using:

Trip cancellation, interruption or delay insurance: Within 60 days, call 844-933-0648.

Baggage insurance: Within 30 days, call 800-228-6855 or online .

Rental car insurance: Within 30 days, call 800-338-1670 or online .

» Learn more: The guide to AmEx Platinum rental car benefits

If The Platinum Card® from American Express travel insurance doesn’t seem like it’ll be enough for your trip, or if its coverage doesn’t include features that you’d like to have, consider purchasing a separate travel insurance policy before you travel.

Several companies allow you to compare various policies for any vacation and modify inclusions as you shop.

» Learn more: How much is travel insurance?

The travel insurance offered by The Platinum Card® from American Express includes some pretty generous benefits for travelers, especially since it’s complimentary (the $695 annual fee notwithstanding). Terms apply.

If you want to take advantage of this insurance, pay for your trip using your AmEx card and double-check any other stated requirements before heading out to ensure coverage.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Insurance Benefit: Car Rental Loss & Damage Insurance

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

Insurance Benefit: Premium Global Assist Hotline

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

American Express Travel Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

327 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

45 Published Articles 3395 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1206 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Why purchase travel insurance, travel insurance and covid-19, american express travel insurance options, additional information, how american express travel insurance compares, the value of travel insurance comparison sites, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We frequently discuss the travel insurance coverages that are offered complimentary on most credit cards . We do so because these benefits, especially the long list of travel insurance coverages on premium cards, can save you money, offer peace of mind during your travels, and provide help if something goes wrong.

These complimentary coverages are useful and can offer more than adequate coverage for most trips. However, if you’re investing in an expensive trip or 1 that involves multiple travel providers, purchasing a comprehensive travel insurance policy is a prudent move. You’d also want a travel insurance policy if your trip has a complicated itinerary or if you’re anxious about the possibility of having to cancel any portion of the journey.

Additionally, it’s imperative that if you’re worried about having medical coverage while traveling, you’d want to purchase a travel insurance policy that provides medical coverage.

Fortunately, travel insurance is widely available, reasonably affordable, and simple to secure. There are several reputable travel insurance companies , highly-rated by financial rating organizations such as AM Best , that offer nearly endless options from which to choose.

American Express Travel Insurance , underwritten by AMEX Assurance Company, is one of those highly-respected, highly-rated, established companies offering comprehensive travel insurance solutions.

Join us while we check out the types of policies the company offers, any limitations of which to be aware, and additional options for protecting your next trip appropriately.

Travel insurance can help you avoid losing the investment you made when booking your trip, reimburse you for covered expenses should your trip be disrupted due to a covered event, or pay for emergency medical services.

Policies are designed to cover disruption due to the reasons listed in the policy you purchased. These reasons consist of events that are unforeseen and unexpected.

Here are a few situations where travel insurance could cover your loss:

- You or a covered family member become ill and you must cancel your trip. Trip insurance can cover prepaid non-reimbursable expenses.

- You are injured in an accident during your trip and need to be evacuated to a hospital by air ambulance.

- You become ill during your trip and must return home versus continuing on your journey.

- Your flight is delayed or canceled and you must stay at a hotel and incur expenses for lodging and incidentals.

Whether you should purchase travel insurance or not is a personal decision. If losing your trip investment or having to pay for extra expenses if the trip is disrupted makes you uncomfortable or would present a financial burden, then you should purchase a comprehensive travel insurance policy.

If worrying about having to cancel your trip or having it disrupted during your journey is an issue, purchasing a travel insurance policy will definitely deliver some peace of mind, both prior to and during your trip.

For more tips on buying travel insurance in general, you’ll find valuable information in our guide to buying the best travel insurance .

Bottom Line: The longer, more expensive, and more complicated your trip, the greater the need for a comprehensive travel insurance policy.

When you purchase travel insurance and your trip is canceled, you expect to have coverage. However, not all cancellations are covered — only those specifically listed in your policy.

Once COVID-19 was declared a pandemic, it became a known event and therefore is not covered on travel insurance policies. While it’s reasonable to want to cancel your trip due to fear of COVID-19, canceling a trip due to the fear of any illness is not a covered reason on any travel insurance policy.

There is also no coverage for canceling a trip due to a U.S. State Department announcement warning of COVID-19 in a particular area.

In order to have coverage for voluntary trip cancellations, you would need to purchase “Cancel for Any Reason Insurance” (CFAR) . CFAR is not a stand-alone insurance policy — it is an add-on coverage you select when you purchase a travel insurance policy or coverage you may be able to add to a travel insurance policy after purchase, within an initially specified timeframe.

CFAR insurance is expensive, does not cover the entire cost of your trip, and not all companies sell the coverage, including American Express Travel Insurance.

Additionally, there is a small window of time when you are able to purchase the coverage, including during your initial purchase or up to 10 to 21 days after the purchase, depending on the company.

While American Express Travel Insurance does not cover trip cancellation due to fear of contracting COVID-19, there may be coverage in certain circumstances. For example, if you become sick with the virus and have to cancel your trip as a result, you may have coverage under trip cancellation insurance.

Additionally, if you become ill with the virus during your travels, you may have coverage under Travel Medical Protection. Terms and conditions apply.

Bottom Line: Travel insurance does not cover canceled trips due to fear of getting COVID-19 or a government declaration that a specific destination is unsafe. Cancel for Any Reason Insurance must be purchased to cover these voluntary cancellations.

American Express offers you 2 options when it comes to purchasing travel insurance. You can select a package policy that includes several types of coverages in 1 plan or you can build your own travel insurance plan and select just the coverages that are important to you.

Coverage is worldwide except for where it would violate U.S. trade or economic sanctions. All permanent U.S. residents are eligible to purchase travel insurance with American Express.

Package Policy Options

American Express Travel Insurance offers 4 levels of travel insurance package policy plans — a Basic Plan, Silver Plan, Gold Plan, and Platinum Plan. Each has its own levels of coverage and associated premium cost.

Let’s take a look at the package policy offerings and pricing. We chose a week-long trip for a 40-year old that cost $3,000. Prices ranged from $59 to $208 to cover the entire trip.

With package policies, you can expect to find the following coverages. The limits of coverage differ based on the policy plan you select.

- Trip Cancellation/Interruption — Receive reimbursement for prepaid non-refundable expenses due to cancellation for covered reasons and additional costs if your trip is disrupted, also for covered reasons.

- Global Medical Protection — Receive worldwide emergency medical and dental coverage for the first 60 days of your trip and access to emergency evacuation/repatriation services.

- Travel Accident Protection — Receive coverage for accidental death/dismemberment from the time you leave on your trip until the time you arrive home.

- Global Baggage Protection — Coverage varies from $250 to $2,500 for lost luggage depending on the level selected. Baggage delay coverage starts from 3- to over 24-hour delays, depending on the policy plan selected.

- Global Trip Delay — Receive up to $300 per day, $1,000 per trip, depending on the level of coverage selected. Coverage is valid for delayed/canceled flights or involuntary-denied boarding.

- 24-Hour Travel Assistance — Have global access to planning and emergency assistance before and during your trip.

Bottom Line: American Express Travel Insurance offers 4 different levels of package policies, each comprising a collection of coverages most travelers look for. The plan you select and the level of coverage limits chosen determine the amount of the premium cost.

Custom Select Coverage Options

If some of the coverages in the package plan are not important to you, you can select only the coverage(s) you want and pay accordingly. Perhaps, for example, you have a need for just medical coverage while traveling abroad. You have the option to select just that coverage.

This example shows the levels of coverage available and the associated premium costs. The Gold Plan selected offers up to $100,000 in emergency medical, up to $750 in emergency dental, and up to $100,000 in emergency evacuation/repatriation. The price of this plan would be $32 for the entire trip.

Bottom Line: Having the option to select only the coverages you want allows you to save money by not paying for coverages you don’t need. This is a key benefit of purchasing travel insurance through American Express Travel Insurance. Few travel insurance companies offer the option to purchase stand-alone travel medical coverage.

Pricing By Age

Like most travel insurance companies, American Express Travel Insurance prices its products within age brackets. The price for coverage is the same for everyone in that specific age bracket.

Based on dozens of quotes obtained, pricing brackets were determined to be as follows:

- Age 17 to 40

- Age 41 to 65

- Age 66 to 70

- Age 70 to 80

- Age 81 or over

Knowing this upfront can help you determine if you’re at the beginning of the highest price bracket or the end. For example, if you are 40 years old, you’re going to pay less than a 41-year-old in the next pricing bracket but the same as a 17-year-old.

If you’re a senior and want to learn more about purchasing travel insurance in your 60s, 70s, and beyond , the tips in our article will help guide you in the right direction.

Bottom Line: Knowing a travel insurance company’s age pricing brackets can help you determine which company offers you the best value for your money.

Cancellations and Changes

Here is some information you should know about cancellations and changes to an American Express Travel Insurance policy.

- You can change or modify your policy prior to your trip.

- You can request a full refund within 14 days after receiving your policy documents. Some restrictions vary by state.

- If you have purchased American Express Travel Insurance and your trip was canceled due to COVID-19, you may qualify for a policy refund . Contact AMEX Assurance Company for details at [email protected]. Terms apply.

- Once your trip is completed, you cannot request a refund.

Hot Tip: Due to the overall decrease in travel, many travel insurance companies now allow you to cancel your travel insurance and receive a full refund or extend your policy without extra charges.

To Other Travel Insurance Companies

When comparing other package policies to American Express Travel Insurance, the company’s premiums came up higher overall for this specific trip and traveler (1-week trip, 40-year-old, total value $3,000).

The first policy above with Assistance USA for $77, for example, has coverages similar to the Silver Amex plan which has a premium of $133. The coverage on the $102 Assistance USA plan above compares more with the Amex Gold plan at $157.

Prices will vary considerably based on the types of coverages selected, age, and limits of each coverage. We used policy comparison websites and found similar but not identical policies. With so many different coverage options, it’s difficult to compare apples to apples.

This is a very limited comparison — your results will be different based on your specific details. The most important factors to consider are that you’re purchasing from a highly-rated company, the coverages are a match for your needs, and the premium is one with which you’re comfortable paying.

To Credit Card Travel Insurance

The travel insurance coverages that comes complimentary on your credit card can serve to provide coverage for some trips. For example, if you book a domestic round-trip flight, a hotel, and a rental car, you may have sufficient coverages on your credit card to cover that trip.

Credit card travel insurance coverage, however, is not a replacement for a comprehensive travel insurance policy , for these reasons:

- Most credit card travel insurance coverage is secondary and in excess of other coverage you might have. You’ll normally be working with 2 (or more) entities to get your claim resolved.

- Credit card travel insurance is administered by a third party, not by the issuing financial institution, thus making the claims process potentially redundant and complicated.

- You generally won’t find medical coverage on a credit card. The Platinum Card ® from American Express and the Chase Sapphire Reserve ® offer emergency medical evacuation and there is a small medical benefit on the Chase Sapphire Reserve card.

- Coverage limits are set on credit card travel insurance. Travel insurance policies can offer higher limit options.

- Credit card travel insurances have requirements such as purchasing the trip with the associated credit card.

- Additional coverages can be added to travel insurance policies such as CFAR insurance, a preexisting conditions waiver, and other benefits not available with credit cards.

Bottom Line: While the travel insurance coverages that come with credit cards may be sufficient to cover a simple trip where there is no large investment at stake, these coverages are by no means a replacement for a comprehensive travel insurance policy.

Because travel insurance is widely available and quite competitive, you may find drastic differences in the price you’ll pay between companies and policy offerings. Selecting a company is not difficult as there are dozens of reputable, highly financially-rated, established companies, but comparing policies is essential for getting the best value for your money.

One way to easily compare pricing and coverages is to utilize a travel insurance comparison site to narrow down the appropriate options for your situation.

Here are some of the most popular, easy-to-use comparison sites that only feature highly financially-rated travel insurance companies.

TravelInsurance.com

- Coverage is available instantly

- The comparison tool is easy to use

- The company has a “best price guarantee”

InsureMyTrip

- Calls are handled by licensed agents

- The website contains educational information for understanding travel insurance coverages and policies

- Features nearly 2 dozen companies

SquareMouth

- Compare 90 different policies from over 20 different companies

- Customer service receives high accolades

- Over 86,000 reviews

Bottom Line: Utilizing a travel insurance comparison website can help you quickly narrow your choices to policies that fit your needs and your budget.

There is no doubt that American Express is a financially-stable, established, and well-respected travel insurance company.

One of the company’s strengths is that it offers the consumer the ability to purchase needed coverages separately , such as medical insurance for an international trip. The premiums for such coverage are also very competitively priced. This could be a huge plus if you are not interested in duplicating credit card travel insurance coverages or in having just secondary or excess coverage.

One downside, especially in today’s environment, is that American Express Travel Insurance does not sell CFAR insurance. If this is important to you, you should attempt to find the coverage elsewhere by using comparison sites.

Another downside that may or may not be important is that American Express Travel Insurance does not sell annual or multi-trip policies. You must purchase a new policy for each individual trip.

Also, like several other travel insurance companies, high-risk adventurous activities may not be covered with American Express Travel Insurance. You might look to a company specializing in insuring these activities such as World Nomads .

If you want to make sure you’re purchasing from an established company and have specific coverages you’re more interested in than others, American Express Travel Insurance is a solid decision . For package travel insurance policies, you might be able to realize modest savings by shopping around, but you won’t go wrong with the company selection of choosing American Express Travel Insurance.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

British Airways American Express® Cards

We offer a range of Credit Cards in conjunction with American Express. Find a Card that’s right for you below.

There's a little holiday in the things you buy

60,000 avios. 175+ destinations. 1 card..

For a limited time, get double the usual Welcome Bonus on a BA Amex ® Premium Plus Card. Enough to get a Reward Flight to over 175 destinations from just £1. Twice the Avios. Twice the adventure.

Apply through the link below before 8 October and spend £6,000 in your first three months. Exclusive to Executive Club members.

Rep 139.9% APR Var.

New Cardmembers only. Annual fee applies. Terms apply. 18+ UK residents only, subject to status.

Not ready to apply just yet?

We can send the details of our personal British Airways American Express ® Cards straight to your email inbox so they’re ready when you are.

British Airways American Express® Credit Card

Representative 31.0% APR variable. No annual fee. Assumed £1,200 credit limit with 31.0% per annum variable purchase rate. T&Cs apply.

- Welcome bonus : Get 5,000 bonus Avios when you spend £2,000 in the first 3 months of Cardmembership. New Cardmembers only¹

- Earn rate : Collect 1 Avios for every £1 spent on purchases¹

- Rewards: Get a Companion Voucher when you spend £12,000 each membership year which is now more flexible than ever. From 1 November you will need to spend £15,000 within each membership year to earn a Companion Voucher. T&Cs apply.

Executive Club members can get an increased Welcome Bonus of 5,000 7,000 Avios when you login & apply through our exclusive offer page below by 8 October.

Companion Voucher

Companion Vouchers are even more valuable and flexible than ever and can now be enjoyed with a companion or solo. Get a Companion Voucher when you spend £12,000 each membership year on the Card, which you can use to either take a companion with you in economy only on the same flight or, if travelling solo, get a 50% discount on the Avios price when you book a British Airways, Aer Lingus or Iberia Reward Flight. Taxes, fees and carrier charges apply per person 4 .

*From 1 November you will need to spend £15,000 within each anniversary year to earn a Companion Voucher. For example, if your next anniversary date is 1 Feb 2025 you would need to either spend £12,000 by 31 October 2024 or spend £15,000 by 31 January 2025 to earn your Companion Voucher for this membership year.

Ways you can redeem your Companion Voucher

Travel with a companion : The British Airways American Express Credit Card Companion Voucher entitles you to receive a second economy class seat for a companion travelling on the same flight as you for no additional Avios when you make a Reward Flight booking on a British Airways, Aer Lingus or Iberia flight 4 .

Choose to fly solo : You can use your Companion Voucher as a solo adult travelling on a Reward Flight booking in Euro Traveller or World Traveller (Economy) or other economy cabins and receive a 50% discount on the Avios price for the flight.

More Avios Pricing Options : Whether you’re planning on travelling with a companion or flying solo, you can access all Avios and Money and Reward Flight Saver (RFS) options, meaning your trip could cost as little as £1 in cash 6

Travel benefits

From Travel Accident insurance cover to preferential travel arrangements, we’ll help you along the way*:

- Global Assist® provides help when you travel outside of the UK, in your own language, 24/7 7 .

- Travel accident insurance protects you for up to £75,000 on public transport when you buy your ticket on your Card 7 .

*When enrolled in No Additional Charge Insurance

Eligibility

To save you time before applying for your British Airways American Express Credit Card, it's worth making sure you can say yes to all the following:

- I am aged 18 or over

- I have a current UK bank or building society account

- I have a permanent UK home address

- I have no history of bad debt

- And if self–employed, I have been working for more than one year

- I understand I will not be eligible for any Welcome Bonus award if I hold or have held any personal American Express ® Cards in the past 24 months.

If you've said yes to all of these, then step this way. Your application could take less than 10 minutes and we may be able to give you a response in less than 60 seconds.

British Airways American Express® Premium Plus Card

Representative 139.9% APR variable. £300 annual fee. Assumed £1,200 credit limit with 31.0% per annum variable purchase rate. T&Cs apply.

- Welcome bonus: Get 30,000 bonus Avios when you spend £6,000 in the first 3 months of Cardmembership. New Cardmembers only. 2

- Earn rate: Collect 1.5 Avios for every £1 spent on purchases 2

- Rewards: Get a Companion Voucher when you spend £10,000 each membership year which is now more flexible than ever. From 1 November you will need to spend £15,000 within each membership year to earn a Companion Voucher. T&Cs apply.

- Go further: Collect 3 Avios for every £1 spent on British Airways flights and holidays 2

Executive Club members can get double the usual Welcome Bonus of 30,000 60,000 Avios when you login & apply through our exclusive offer page below by 8 October.

Companion Vouchers are even more valuable and flexible than ever and can now be enjoyed with a companion or solo. Get a Companion Voucher when you spend £10,000 each membership year on the Card, which you can use to either take a companion with you in the same flight and cabin or, if travelling solo, get a 50% discount on the Avios price when you book a British Airways, Aer Lingus or Iberia flight. British Airways American Express ® Premium Plus Cardmembers will have access to additional British Airways Reward Flight seats within business (Club World) when booking with a Companion Voucher, subject to availability. Taxes, fees and carrier charges apply per person 5

*From 1 November you will need to spend £15,000 within each anniversary year to earn a Companion Voucher. For example, if your next anniversary date is 1 Feb 2025 you would need to either spend £10,000 by 31 October 2024 or spend £15,000 by 31 January 2025 to earn your Companion Voucher for this membership year.

Travel with a companion: The British Airways American Express ® Premium Plus Companion Voucher entitles you to receive a second seat for a companion travelling on the same flight as you for no additional Avios when you make a Reward Flight booking on a British Airways, Aer Lingus or Iberia flight.

Choose to fly solo: You can use your Companion Voucher as a solo adult travelling on a Reward Flight booking in any cabin and receive a 50% discount on the Avios price for the flight.

More Avios Pricing Options: Whether you’re planning on travelling with a companion or flying solo, you can access all Avios and Money and Reward Flight Saver (RFS) options, meaning your trip could cost as little as £1 in cash 6 .

Enhanced availability in Club World: Cardmembers who have earned a Premium Plus Companion Voucher can access tens of thousands of extra Reward seats in Club World (long haul Business Class) when booking a Reward Flight with their Companion Voucher. So whether you're choosing to treat yourself or take a lucky companion with you, you'll be travelling in style.

Enjoy our travel protection benefits when you travel with us*:

- Global Assist® provides help when you travel outside of the UK, in your own language, 24/7 7 .

- Travel accident insurance protects you for up to £250,000 on public transport when you buy your ticket on your Card 6 .

- Travel inconvenience insurance covers flight cancellations, delays and delayed luggage when you pay with your Card. exclusions that may apply 7 .

- £200 for flight delay, overbooking or missed connection.

- £750 for baggage delayed by airline for 6 hours.

- An additional £1,000 for extended baggage delay by airline.

To save you time before applying for your British Airways American Express Premium Plus Card, it's worth making sure you can say yes to all the following:

- I understand I will not be eligible for any Welcome Bonus award if I hold or have held any personal British Airways American Express Cards in the past 24 months.

British Airways American Express® Accelerating Business Card

Representative 108.4% APR variable. £250 annual fee. Assumed £1,200 credit limit with 28.5% per annum variable purhase rate. T&Cs apply.

- Welcome bonus: Collect 30,000 bonus Avios when you spend £5,000 in your first three months of Cardmembership 1

- Earn rate: Collect 1.5 Avios for every £20,000 spent, up to 3 times a year 3

- Rewards: Receive an extra 10,000 Avios for every £20,000 spent, up to 3 times a year 3

- On Business: Earn 2 On Business Points for every eligible £1 spent with on qualified British Airways flights purchased with your Card 4

Reward your business every calendar year

With a tiered Avios annual bonus, for every £20,000 spent on the Card, you will receive 10,000 bonus Avios, up to 3 times each year. From everyday business expenses to larger supplier items you'll earn Avios in line with your business spend. With three individual tiers, your rewards balance evolves with your business. Your Avios Annual Bonus resets on 1 January each year, helping you to keep track of your rewards and maximise Cardmembers’ bonus earning potential.

Flexible cashflow management

Your Credit Card gives you access up to 56 calendar days without interest payment terms (when you pay your balance in full) or the choice to pay your balance over time with interest 5 .

Double On Business Points

Exclusively with this Card, earn 2 On Business Points for every £1 spent with British Airways, This is in addition to your everyday Avios and annual bonus. Change, cancel or upgrade your flight booking up to 24 hours before departure of your first flight at no extra charge 6 .

To save you time before applying for your British Airways American Express® Accelerating Business Card, it's worth making sure you can say yes to all the following:

- The business has a current UK Bank or Building Society account

- You/The business have/has no County Court Judgements for non-payment of debt

- You are aged 18 or over

- You have a permanent UK home address

- You will pay the annual Cardmembership fee of £250 7

To access the On Business benefits, your company must not be a travel agency, ticket brokerage firm or consolidator AND your company does not have an existing corporate incentive agreement with British Airways, Iberia or American Airlines. When enrolling into the On Business programme through this British Airways American Express® Accelerating Business Card application progress, there is no requirement for your business to be VAT registered. (Visit ba.com/onbusiness for more information).

A Companion Voucher makes your Avios go further

You can get away for fewer Avios than you might think with a British Airways American Express Companion Voucher.

Use your Companion Voucher to either take someone with you on your Reward Flight for no additional Avios or reduce the amount Avios needed for a Reward Flight by 50% as a solo traveller.

How would you use yours?

10,000 avios.

Enjoy the freedom of a solo getaway to one of 25 exciting European destinations for only 9,250 Avios + £1 return.

20,000 Avios

Escape the everyday with a continental city break for two. Return flights to Europe for two people start at just 18,500 Avios + £2.

50,000 Avios

Jet off with that special someone to see the bright lights of New York or Dubai for just 50,000 Avios + £200 all in.

*Applies to off-peak return Reward Flight Saver flights paid in full with Avios.

Service like no other

Enjoy refund protection on all eligible items you buy using your Card in the UK.

We cover items up to 90 days and will replace or refund items up to a maximum of £200 on the British Airways American Express® Credit Card and £300 on the Premium Plus Card and the Accelerating Business Card, even if the retailer won’t.

Collect up to 90,000 Avios by inviting your friends

You can collect up to 90,000 Avios per calendar year when you refer friends to take out a personal BA Amex Card and as soon as they’re approved. We’ll also welcome them with bonus Avios too. Terms apply. See link for full details.

Pay off your purchases with Instalment Plans

With Plan It from American Express, you can spread the cost of your purchases on your BA Amex Card into instalments over 3, 6 or 12 months. Subject to eligibility. Minimum transaction amount of £100.

Find out more

Collecting avios, spending avios, buying avios.

Updates to the Companion Voucher

From 1 November 2024, the required spend to qualify for a Companion Voucher will increase from £10,000 (British Airways American Express® Premium Plus Card) or £12,000 (British Airways American Express® Credit Card) to £15,000 within a membership year. This change will be relevant to the Amex Cardmembership year applicable on 1 November 2024 and thereafter.

Until 31 October 2024, existing Cardmembers can obtain their Companion Voucher by reaching the current spend target of £12,000 (Credit Card) or £10,000 (Premium Plus). From 1 November 2024, Cardmembers will need to reach the new £15,000 target, regardless of which Card type is held, before their membership year ends to earn their Companion Voucher. Purchases already made in the current membership year count towards the new target.

- Terms, taxes, fees and carrier charges apply per person. For the Credit Card Terms and Conditions apply. Introductory offers are not available if you currently hold or have held any personal American Express Card product in the past 24 months. Applicants must be UK residents aged 18 years old or over and are subject to approval. For the Credit Card, 5,000 bonus Avios will be awarded onto your Account once you have been approved and you have spent and charged a minimum of £2,000 on goods and services to the Account within three months of Account opening. For the Credit Card, you will be awarded 1 Avios for every £1 spent and charged per transaction. Avios are not earned on Balance Transfers, Cash Withdrawals, American Express Travellers Cheques purchases, Foreign Exchange, interest, any spending in excess of your credit limit, charges for returned payments, late payment or referral charges and American Express Credit Card finance charges. Written details available on request. Please note, it can take up to one month for the bonus Avios to be awarded to your Account once you have met the required spend. New Cardmembers only. Please note this offer is subject to change.

- Terms, taxes, fees and carrier changes apply per person. For the Premium Plus Card Terms and Conditions apply. Introductory offers are not available if you currently hold or have held any personal British Airways American Express Card product in the past 24 months. Applicants must be UK residents aged 18 years old or over and are subject to approval. For the Premium Plus Card, 30,000 bonus Avios will be awarded onto your Account once you have been approved and you have spent and charged a minimum of £6,000 on goods and services to the Account within three months of Account opening. For the Premium Plus Card, you will be awarded 1.5 Avios for every £1 spent and charged per transaction. Avios are not earned on Balance Transfers, Cash Withdrawals, American Express Travellers Cheques purchases, Foreign Exchange, interest, any spending in excess of your credit limit, charges for returned payments, late payment or referral charges and American Express Credit Card finance charges. Written details available on request. Please note, it can take up to one month for the bonus Avios to be awarded to your Account once you have met the required spend. New Cardmembers only. Please note this offer is subject to change.

- Supplementary Cards allow you to share the benefits of your American Express Card with others close to you. You will be the main Cardmember and will be liable for all charges made on the Supplementary Card(s). Additional Cardmembers must be 18 years or over. Written details available on request.

- BA American Express Credit Card Terms and Conditions apply to Avios redemptions. Reward Flights and Companion Voucher bookings are subject to availability and taxes, fees and carrier charges apply per person. Companion Vouchers can only be used when redeeming Avios for a British Airways Reward Flight seat in economy only, paid with Avios. Detailed information on Companion Vouchers can be found here or by calling 0344 493 0750 (calls charged at local rate). Companion Vouchers earned from 1 September 2021 can be used on bookings departing from outside of the UK as well as allowing the Companion Voucher holder to benefit from a 50% reduction in Avios when making a Reward flight booking with their Companion Voucher as a solo traveller. Only vouchers earned after 1 September 2021 can be used on Iberia and Aer Lingus. Visit here for full Companion Voucher Terms and Conditions .

- BA American Express Premium Plus Card Terms and Conditions apply to Avios redemptions. Reward Flights and Companion Voucher bookings are subject to availability and taxes, fees and carrier charges apply per person. Companion Vouchers can only be used when redeeming Avios for a British Airways Reward Flight seat in any cabin, paid with Avios. Detailed information on Companion Vouchers can be found here or by calling 0344 493 0750 (calls charged at local rate). Companion Vouchers earned from 1 September 2021 can be used on bookings departing from outside of the UK, as well as allowing the Companion Voucher holder to benefit from a 50% reduction in Avios when making a Reward Flight booking with their Companion Voucher as a solo traveller. Access to Reward Flight seats within Club World (business class) is available for British Airways Premium Plus Companion Vouchers earned from 1 September 2021. Only vouchers earned after 1 September 2021 can be used on Iberia and Aer Lingus. Visit here for full Companion Voucher Terms and Conditions .

- Reward Flights are available to any Executive Club Members with an Avios balance. In addition to your Avios, the only cash amount required for Reward Flights is to cover the taxes, fees and carrier charges. Reward Flights are subject to availability. To find out more about Reward Flights and/or Reward Flight Saver visit here .

- Terms and Conditions apply to the British Airways American Express credit card insurance. Please see the Insurance Terms and Conditions . Please read this to understand the limits and exclusions that may apply. Terms and Conditions apply to the British Airways American Express Premium Plus Card insurance. Please see the insurance Terms and Conditions for full details. Please read this to understand the limits and exclusions that may apply.

Applicants must be 18 years old or over. Approval subject to status and Terms and Conditions apply.

The information relating to the financial benefits and services of the Card is the responsibility of American Express Services Europe Limited and British Airways accepts no responsibility for inaccuracies.

British Airways Plc registered in England and Wales company no.1777777 of Waterside, PO Box 365, Harmondsworth, West Drayton, Middlesex UB7 0GB, is an introducer appointed representative, for insurance mediation activities only, of American Express Insurance Services Europe Limited.

American Express Services Europe Limited has its registered office at Belgrave House, 76 Buckingham Palace Road, London, SW1W 9AX, United Kingdom. It is registered in England and Wales with Company Number 1833139 and authorised and regulated by the Financial Conduct Authority.