- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Allianz Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Allianz Travel Insurance cover?

Allianz single trip plans, allianz annual/multi-trip plans, which allianz travel insurance plan is best for me, can you buy allianz travel insurance online, what isn't covered by allianz travel insurance, is allianz travel insurance worth it.

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards , Allianz Global Assistance offers plenty of options.

Allianz trip insurance plans fall into two categories: single trip and annual/multi-trip plans. We evaluated several single trip and annual/multi-trip plans to help you figure out which policy makes sense for you.

Depending on what type of coverage you’re looking for, Allianz offers several different travel insurance options. Allianz’s plan choices fall under single trip or annual/multi-trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

Annual/multi-trip plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Because the coverage period is longer, these plans are more expensive.

Some of these plans include medical coverage only while others also provide more comprehensive travel insurance perks. There’s coverage for business equipment as these plans are geared toward work travelers.

Allianz offers five travel insurance plans for single trips, including a plan that's mainly focused on emergency medical coverage.

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don't need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Allianz single-trip plan cost

Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs of 4%-8%, according to the U.S. Travel Insurance Association.

» Learn more: How to find the best travel insurance

Allianz offers four different annual/multi-trip plans.

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

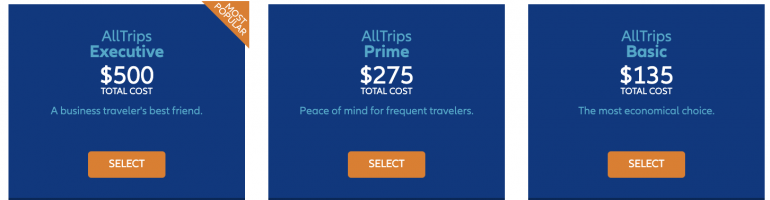

Allianz annual/multi-trip plans cost

Let's look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan's price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re abroad.

If you have a premium travel card (e.g., the Chase Sapphire Reserve® ): These cards often offer some trip cancellation and trip interruption coverage, so you may not need a plan that offers all the same coverage. In this case, getting the OneTrip Medical plan might be enough.

If you’re going on a trip and returning home: OneTrip Prime, Basic or Premier are good options to choose from while offering different levels of coverage.

If you’ll be going on multiple and longer trips: the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length. The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card: In these instances, it's best to choose a comprehensive plan depending on how much coverage you need and for how long. Consider one of the single trip or multi-trip plans.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

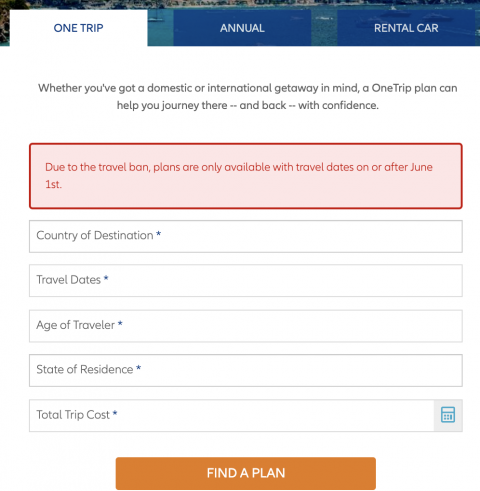

Yes, head over to AllianzTravelInsurance.com and choose "Find a Plan" from the menu on the top.

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the "Get a Quote" option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

» Learn more: Is travel insurance worth it?

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different needs.

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

No, Allianz doesn't offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel isn't.

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Allianz Global Assistance offers several good travel insurance plans to choose from. If you’re looking for a travel insurance plan for a vacation, a single-trip plan is your best bet.

If you’re a frequent traveler or take lots of business trips, a multi-trip plan could be the way to go. If you have a travel credit card, look at what travel insurance benefits you may already have so you don’t duplicate your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

AllTrips Premier

Frequent travelers rely on the AllTrips Premier Plan to smooth all the bumps in the road. AllTrips Premier can make travel less stressful for you and everyone in your household by providing benefits for covered emergency medical care and emergency transportation, lost/stolen or delayed baggage, and rental car damage and theft coverage (available to residents of most states). Trip cancellation and interruption benefits can reimburse your prepaid, non-refundable expenses — such as transportation costs, vacation rental costs, resort fees, even campground reservations — if you must cancel or cut your trip short due to a covered reason.

All benefits are per insured, per trip unless otherwise noted. Trip Cancellation and Trip Interruption are per travel insurance plan. Trips longer than 90 days are excluded from coverage.

Benefits/Coverage

Benefits/Coverage may vary by state, and sublimits may apply. Please see your plan for full details.

Epidemic Coverage Endorsement

Adds certain epidemic-related covered reasons for Trip Cancellation/Interruption; Travel Delay; Emergency Medical Care; and Emergency Transportation benefits. For example, you may be reimbursed for prepaid, nonrefundable, unused trip costs if you must cancel your trip because you, a travel companion, or a family member are diagnosed with an epidemic disease such as COVID-19. For more information, look for the Epidemic Coverage Endorsement page within your plan details.

Not available in all jurisdictions. For plans without this endorsement, certain limited-time COVID-19 claim accommodations may be available. Read our Coverage Alert for details.

Trip Cancellation

$2,000 / $5,000 / $10,000 / $15,000

Reimburses your prepaid, non-refundable expenses if you must cancel your trip due to a covered reason. Multiple benefit levels available.

Benefit is per policy , per year.

Trip Interruption

Reimburses you for the unused, non-refundable portion of your trip and for the increased transportation costs it takes for you to return home due to a covered reason. Multiple benefit levels available.

Emergency Medical

Provides benefits for losses due to covered medical and dental emergencies that occur during your trip. Depending on your plan, there is a $500 or $750 maximum for all covered dental expenses.

Benefit is per insured , per trip .

Emergency Medical Transportation

Provides reimbursement for medically necessary transportation to the nearest hospital or appropriate facility following a covered illness or injury.

Baggage Loss/Damage

Covers loss, damage or theft of baggage and personal effects.

Baggage Delay

Reimburses the reasonable additional purchase of essential items during your trip if your baggage is delayed or misdirected by a common carrier for 12 hours or more. Receipts for emergency purchases are required.

Travel Delay

$1,500 (Daily Limit $300)

Reimburses additional eligible accommodation/travel expenses and lost prepaid expenses due to a covered departure delay of six or more hours.

Rental Car Damage and Theft Coverage*

Covers costs if a car you're renting is stolen or is damaged in an accident or while it's left unattended (not available to residents of KS, TX, and NY).

Benefit is for all insureds , per trip .

Travel Accident Coverage

Provides cash payment for covered losses due to death, loss of limb(s) or sight as a result of a covered travel accident.

Benefit is per insured , per trip.

24-Hr Hotline Assistance

With Allianz Global Assistance, you'll never travel alone. Our multilingual assistance team is available 24 hours a day to help you handle all kinds of travel emergencies. We can help you find local medical and legal professionals, arrange to send a message home, help with missed connections and lost/stolen travel documents, and much more.

Provides personalized information about your destination and assists you with obtaining restaurant reservations, tee times and tickets to events.

Pre-Existing Medical Condition

Your plan may provide Pre-Existing Medical Condition Coverage if you, a traveling companion, or family member has a Pre-Existing Medical Condition. A Pre-Existing Medical Condition is an injury, illness, or medical condition that, within the 120 days prior to and including the certificate purchase date: 1, Caused a person to seek medical examination, diagnosis, care, or treatment by a doctor; 2. Presented symptoms; or 3. Required a person to take medication prescribed by a doctor (unless the condition or symptoms are controlled by that prescription, and the prescription has not changed).

This plan waives the exclusion for pre-existing medical conditions if at least one of the following conditions are met:

- The trip was purchased during the coverage period;

- Your policy was purchased within 14 days of the date of the first trip payment or deposit; or

- You have continuous coverage. You have “continuous coverage” when the Coverage Effective Date of this policy is no later than seven days after the Coverage End Date of a previous annual policy issued to you by us.

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

Type the country where you will be spending the most amount of time.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

RELATED PRODUCTS

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Allianz Travel Insurance Review

- Coverage Options

Compare Allianz Travel Insurance

- Why You Should Trust Us

Allianz Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

While traveling can be a fun escape, it's an inherently risky activity with many variables to consider. So many worries can remove you from the joy of travel, which is where travel insurance can help.

Allianz Travel Insurance Global Assistance is a prominent leader in the travel insurance space that has been around in some form since 1890. Allianz offers a variety of travel insurance plans that can suit your individual needs. Read on to learn more about Allianz.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz is one of the leaders in the travel insurance industry, included in our guide on the best international travel insurance . With 10 plans split between single trip, annual, and rental car insurance, Allianz has its bases covered. It also provides specific insurance for particular needs, such as annual policies for business travelers and sports equipment coverage for athletes.

While Allianz is one of the best international travel insurance providers, it also has great CFAR coverage for its Prime and Premier single trip plans, covering 80% of nonrefundable travel expenses when most policies usually offer 75%. It's also great for families, with coverage for kids 17 and under in its OneTrip Prime and Premier plan.

Allianz is well reviewed among customers, receiving an average of 4.3 stars out of five across nearly 70,000 reviews on Trustpilot. Its Better Business Bureau page fares a little worse, receiving 3.64 stars out of five across 1,600 reviews. Positive reviews mentioned an easy and quick claims process with a responsive customer service team. However, negative reviews often mentioned difficulty specifically with claims for ticketed events.

Allianz also has a highly rated mobile app called Allyz TravelSmart through which you can contact customer service, view your plan, and file a claim. It received an average rating of 4.4 out of five stars on the Google Play store across over 2,600 reviews and 4.8 out of five stars from over 22,000 reviews on the Apple app store.

Coverage Options Offered by Allianz

Allianz travel insurance offers different policies, grouped under two types: single trips and annual multi-trip insurance .

The company's travel insurance policies can include the following coverage types:

- Trip interruption coverage , which can help recoup costs if you leave a trip early.

- Travel delay , which can cover some costs if you need additional accommodations due to a delay in travel.

- Emergency medical transportation , which covers transportation to a hospital for eligible illnesses and injuries.

- Emergency medical expenses in case of a dental or medical emergency.

- Baggage delay , which can cover some costs if you need to purchase required items due to your bags being delayed by a certain period of time. Must have receipts for this.

- Baggage loss or damage , which can help recoup some costs if your bag is lost, stolen, or damaged.

- Epidemic coverage endorsement, which can help recoup costs if you must cancel a nonrefundable trip due to an epidemic. It's important to note that there may be limitations and this isn't an option everywhere.

- Travel accident coverage , which can cover costs related to an injury that results in loss of vision, your hands or feet, as well as loss of life.

- Support via a 24-hour hotline

Single-Trip Plans

The general budget option is OneTrip Basic, which can offer various protections should something happen, if you file a claim for a qualified reason.

One step up is the OneTrip Prime policy, one of the most popular plans Allianz offers. It has higher coverage limits than the Basic plan, along with some additional perks.

A more complete option is OneTrip Premier, which includes more comprehensive protections should you need them. This policy is for more extensive, longer trips and includes extras like SmartBenefits—which up to $100 per day for a covered travel or baggage delay with no receipts necessary, only proof of delay—and sports equipment loss coverage.

The coverage limits available vary by plan. Here's an overview of what each policy covers:

Other OneTrip Premier benefits not mentioned in the table above include:

- Sports Traveler, reimbursement up to $1,000 in the event of a missed sports event for a qualified reason

- Sports Equipment Loss, reimbursement up to $1,000 to cover damaged or lost sports equipment

- Sports Equipment Rental, reimbursement up to $1,000 for the cost to rent sports equipment if your equipment is damaged or lost

- Vehicle return, up to $750 reimbursement to return your vehicle to your home if you can't drive it for a qualified reason

- Adventure and sports exclusions changes, which allows you to waive some losses in the event you participate in high-risk activities like free diving at 30 ft, scuba diving at 100 ft, caving, and more

There are two additional single-trip plans from Allianz that offer more specialized coverage: One Trip Emergency and OneTrip Cancellation Plus.

OneTrip Emergency Medical

OneTrip Emergency Medical is a budget option that exclusively offers post-departure benefits to cover you while you're on your trip. As such, the plan doesn't include pre-departure benefits such as trip cancellation or interruption.

- Travel delay, up to $200 per day per person for a maximum of $1000 for delays of six hours and beyond

- Travel accident coverage, up to $10,000

- Emergency medical transportation, up to $250,000

- Emergency medical expenses, up to $50,000 though dental emergencies have a maximum of $750

- Baggage delay, up to $750 with a delay of 12 hours or more

- Baggage loss or damage, up to $2000

- Epidemic coverage endorsement

- Concierge services included

OneTrip Cancellation Plus

The OneTrip Cancellation Plus policy by Allianz is its economical back-to-basics option that can recoup costs in the event of a travel delay, interruption, or cancellation for a qualified reason. This policy includes:

- Travel interruption coverage, up to $5,000

- Trip cancellation coverage, up to $5,000

- Travel delay, up to $150 with delays of six hours and beyond

Multi-Trip Plans

The aforementioned policies are for single trips, but with Allianz travel insurance it's possible to get an annual/multi-trip policy.

The starter annual plan is the AllTrips Basic policy which includes the most basic coverage, and it excludes both trip interruption and trip cancellation coverage.

The AllTrips Prime policy is geared toward travelers who take a minimum of three trips each year and comes with additional coverage compared to the basic plan.

Another annual plan is the AllTrips Premier policy, which is geared toward frequent travelers and includes higher coverage limits and choices.

AllTrips Executive

Additionally, there's the AllTrips Executive policy, which may be a good fit if you're a frequent business traveler. Under this plan, personal travel is also covered. This policy includes:

- Trip interruption coverage, up to $5,000, $7,500, or $10,000

- Trip cancellation coverage, up to $5,000, $7,500 or $10,000

- Travel delay, with a daily limit of $200 up to $1,600 for delays of six hours and beyond

- Travel accident coverage, up to $50,000

- Baggage delay, up to $1,000 with a delay of 12 hours or more

- Baggage loss or damage, up to $1,000

- Rental car damage and theft coverage, up to $45,000

- Business equipment coverage, up to $1,000 in the event your business equipment gets lost or damaged

- Business equipment rental coverage, up to $1,000 in the event you need to rent business equipment due to loss, damage, or theft

- Change fee coverage, up to $500 to recoup costs of changing a ticket for a qualified reason

- Loyalty program redeposit fee coverage, up to $500 to recover fees lost due to getting loyalty points back after a canceled trip

- Pre-existing condition coverage available when purchased within 15 days of first trip deposit

Additional Coverage Offered by Allianz

Aside from the travel insurance policies from Allianz listed above that help travelers prepare for interruptions and cancellations, there are additional add-ons that can cover more.

OneTrip Rental Car Protector

If you're looking for rental car coverage, Allianz offers the OneTrip Rental Car Protector policy for $11 per day. This policy includes:

- Trip interruption coverage, up to $1,000

- Collision damage waiver, up to $50,000 which helps cover costs in the event your rental car is damaged in an accident or stolen

On top of the rental car coverage plan, with the OneTrip Prime plan, there's an optional upgrade to get Required to Work coverage. If there is a work-related emergency and you need to cancel for a qualified reason, this coverage can help recover expenses.

Cancel For Any Reason

An optional upgrade for OneTrip Prime and OneTrip Premier, Allianz cancel for any reason policy covers 80% of nonrefundable costs when canceling a trip for any reason. Allianz stands out compared to the best CFAR travel insurance as most policies only offer 75% coverage.

What's Not Included with Allianz Travel Insurance?

Allianz travel insurance covers the basics and more and has some high-risk activity exclusions in the OneTrip Premier plan. Aside from that, Allianz travel insurance excludes the following:

- Acts of violence, such as war, terrorism, and civil unrest

- Risky adventure sports

- Unexpected natural disasters (OneTrip Premier allows cancellation due to hurricane warnings)

- Any travel alerts or government regulations and more

If you're interested in coverage for activities like scuba diving, skiing, and more, consider World Nomads, which covers more than 200 activities.

Allianz Travel Insurance Cost

Allianz single trip travel insurance estimates.

How much travel insurance costs with Allianz will depend on a variety of factors, including the type of policy you purchase. To get a quote with Allianz, you'll need to provide the following:

- Your destination

- Travel dates

- The state you live in

- The total cost of the trip

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following Allianz travel insurance quotes:

- $102 for OneTrip Basic

- $151 for OneTrip Prime

- $184 for OneTrip Premier

A 30-year-old traveler from California is heading to Japan for two weeks, costing $4,000. The Allianz travel insurance quotes are:

- $153 for OneTrip Basic

- $195 for OneTrip Prime

- $270 for OneTrip Premier

A couple of 65-years of age looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following Allianz travel insurance quotes:

- $298 for OneTrip Basic (total for two travelers)

- $400 for OneTrip Prime (total for two travelers)

- $540 for OneTrip Premier (total for two travelers)

Allianz travel insurance premiums generally stack up favorably against the average cost of travel insurance which is $248 per trip, but again, the specifics of your trip will largely determine how much you'll pay to insure it.

Allianz Annual Multi-Trip Estimates

To receive a quote on Allianz annual plans, you don't need nearly as much information. You just need the following:

- Insurance start date

- Your state of residence

A 30-year-old New York resident looking for travel insurance will pay the following prices for annual travel insurance with Allianz:

- Allianz Basic: $125

- Allianz Premier: $249

- Allianz Executive: $459

A 60-year-old couple from Texas will pay the following:

- Allianz Basic: $63 per traveler, $126 total

- Allianz Premier: $217.50 per traveler, $435 total

- Allianz Executive: $485 per traveler, $970 total

Filing A Claim with Allianz Travel Insurance

If you purchase a travel insurance policy through Allianz and experience a qualifying event, you can file a claim on the company's website or via its TravelSmart app.

To file a claim with Allianz, you'll need to submit information on their website or app about the type of claim and provide supporting documentation, as well as payment information to get reimbursed. You'll need to select the plan and include your email or policy number as well as your departure date.

If you need assistance when filing a claim with Allianz, you can reach the company at 1-866-884-3556. To reach out to Allianz online, you can submit your request via its contact form.

The Allianz mailing address is:

Allianz Global Assistance

P.O. Box 71533

Richmond, VA 23255-1533

See how Allianz stacks up against the competition.

Allianz Travel Insurance vs. AXA Travel Insurance

Competitor AXA travel insurance covers 75% of your nonrefundable costs if you choose to cancel, for any reason (as the name suggests) if you choose that as an upgrade and buy it two weeks before your first trip deposit. Allianz's CFAR policy covers 80% of nonrefundable costs.

That said, if we look at the travel insurance quotes based on a 30-year-old traveler from California going to Japan in the first two weeks of October paying a total of $4,000 for the trip, AXA travel insurance is more affordable. It's $97 for its Silver plan, which covers 100% trip cancellation and interruption. Compare this to $153 for the OneTrip Basic Plan through Allianz.

Read our AXA travel insurance review here.

Allianz Travel Insurance vs. HTH Travel Insurance

Allianz is a good travel insurance option if you're looking for a variety of customized choices. Another competitor, HTH Worldwide Travel Insurance , has three trip protection options.

TripProtector Economy is HTH's budget option and may be a good fit if you're looking for higher medical coverage limits. This policy covers up to $75,000 in accident and sick benefits and $500 in dental benefits.

Plus, the policy covers up to $500,000 for an emergency evacuation. The OneTrip Basic policy from Allianz covers the same dental benefits but offers just $10,000 in medical expenses.

Read our HTH travel insurance review here.

Allianz vs. Credit Card Travel Insurance

A travel insurance policy can offer robust protections, but if you're looking for something basic for trip interruption or cancellation and rental car coverage, check your travel rewards credit card. If you experience illness, weather, or cancellations that affect your trip, you may be able to recoup costs.

Credit card travel insurance coverage may be a good fit for short trips where you don't have a ton of upfront prepaid costs. However, if you're going to be away for a while, have many prepaid expenses, and are concerned about medical coverage, traditional travel insurance may be your best bet.

Read our guide on the best credit cards with travel insurance here.

Allianz Travel Insurance Frequently Asked Questions

Allianz is a reputable and well-established travel insurance provider. The company offers various travel insurance policies for individual trips as well as annual plans. Coverage options may include trip interruption, trip cancellation, trip delay, emergency medical, and more. The company has mixed reviews from consumers but has an A+ rating with the Better Business Bureau.

Nearly all travel insurance policies offered by Allianz cover COVID-19, aside from the OneTrip Rental Car Protector Plan. Through the Allianz Epidemic Coverage Endorsement, policyholders receive additional protections if they need to cancel a trip due to COVID. Unfortunately, while it's available in most plans it's not available in all jurisdictions, so be sure to read the fine print.

While the best plan is one best suited to your needs, Allianz's OneTrip Premier is the most robust policy, with high cancellation and interruption coverage. Additionally, kids 17 and under are included in coverage. This policy also includes unique benefits for athletes and adventurers thanks to sports equipment coverage.

If you need to file a claim, Allianz may require proof of incident in order to receive benefits. In cases of medical issues, you may need to provide a medical receipt or document. In other cases, you may need to provide other documentation for trip cancellation or trip interruption such as a death certificate, police report, or employment letter.

Allianz doesn't cover missed flights exactly but can help cover costs due to trip delays depending on your policy. So if you missed a connecting flight, you may be able to receive funds to recoup costs related to accommodations and transportation.

Why You Should Trust Us: How We Reviewed Allianz Travel Insurance

As part of this Allianz travel insurance review, we looked at the top travel insurance providers in the space. We reviewed the variety of options offered, coverage limits, benefits, add-ons, flexibility, protocols, claims process, and affordability.

Allianz succeeds in offering many different policies aimed at everyday travelers, business travelers, and athletes. To find the best travel insurance option for you, check out several companies, review the benefits, and compare quotes.

Read more about our travel insurance methodology here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

IMAGES

COMMENTS

Get a quote, compare plans and buy Allianz travel insurance online. Trip protection for cancellations, emergency medical & more. Over 70M policies sold.

Whether you're traveling for leisure or business, you'll appreciate the benefits and coverage Allianz Travel Insurance plans can provide. With 24/7 support from our travel professionals around the world, we helped over 70 million people last year to protect themselves from the unpredictable.

you can rely on Allianz Travel Insurance to help make things right. SINGLE TRIP. ANNUAL. RENTAL CAR. Whether you're planning a road trip, camping getaway or vacation rental, a OneTrip plan can help you journey there — and back — with confidence. Destination (Country) Travel Dates. Age of Traveler. State of Residence. Total Trip Cost.

Allianz offers several different plans that can help you cover trip delays or medical emergencies. Check out our full Allianz Travel Insurance review.

Wherever your adventure takes you, international travel insurance can help you travel with peace of mind. If you become sick or injured while traveling; or if circumstances cause you to cancel or interrupt your trip, international travel insurance is there to help you.

Purchase a Travel Insurance Policy - Step 1 | Allianz Global Assistance. Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply. GET A QUOTE.

Travel insurance is a plan you purchase that protects you from certain financial risks and losses that can occur while traveling. These losses can be minor, like a delayed suitcase, or significant, like a last-minute trip cancellation or a medical emergency overseas.

Allianz has a robust selection of travel insurance policies for all types of trips, travelers and budgets. Vacationers with a sports-focused itinerary should take a look at the perks in...

AllTrips Premier can make travel less stressful for you and everyone in your household by providing benefits for covered emergency medical care and emergency transportation, lost/stolen or delayed baggage, and rental car damage and theft coverage (available to residents of most states).

Allianz travel insurance offers different policies, grouped under two types: single trips and annual multi-trip insurance. The company's travel insurance policies can include the...